Guess what lessons Wall Street learned from 2008?

Hedge-fund manager David Einhorn explained that the value of an answer depends on the quality of the question.

“Have we learned our lesson? It depends what the lesson was,” Einhorn, the co-founder of New York-based Greenlight Capital, said at the Oxford Union in England on Wednesday.

..“If you took all of the obvious problems from the financial crisis, we kind of solved none of them,” Einhorn said to a packed room at Oxford University’s 194-year-old debating society. Instead, the world “went the bailout route.”

“We sweep as much under the rug as we can and move on as quickly as we can,” he said.

Just like a junkie, Wall Street won't admit there is a problem until it can no longer avoid it.

Two weeks ago I pointed out that not only has Wall Street brought back such products as synthetic collateralized debt obligations, they have created a new product, synthetic collateralised default swaps (i.e. 'derivatives of derivatives').

Synthetic collateralised default swaps isn't the only new Wall Street creation.

The financial industry has also created a new way to make predatory loans.

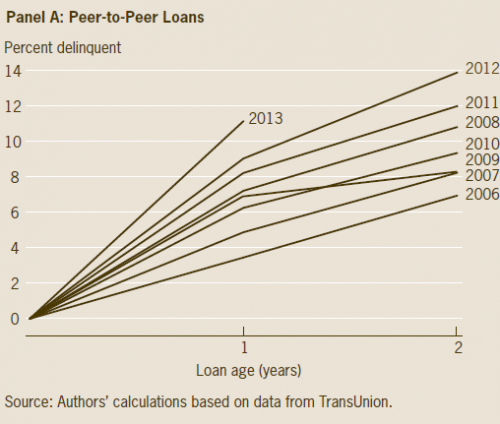

Peer-to-peer lending commenced in the US a decade ago when investors – now mostly hedge funds, banks, insurers, etc. – could lend directly to consumers via online platforms....Now the Cleveland Fed came out with an analysis that focused on the consumer end of the business, called the loans “predatory,” compared them to pre-Financial-Crisis subprime mortgages because they’re now showing very similar delinquency characteristics, and fretted what these P2P loans, given their double-digit growth rates, could mean for financial stability:Based on our findings, one can argue that P2P loans resemble predatory loans in terms of the segment of the consumer market they serve and their effect on individual borrowers’ financial stability. The 2007 financial crisis illustrated the importance of consumer finance and the stability of consumer balance sheets.

Loan balances outstanding have soared 84% in four years, from $55 billion in 2013 to $101 billion in 2016, according to the study. Nearly 16 million US consumers had personal loans via P2P lenders at the end of 2016.

P2P loans can carry 30% interest rates.

Predatory P2P loans isn't the only subprime 2007ish trend. There is also auto loans.

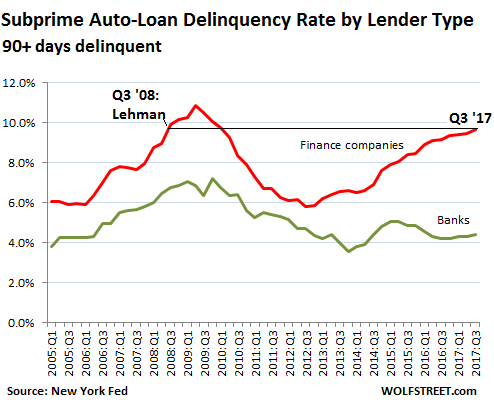

Of the $282 billion in subprime auto loans outstanding, finance companies originated 74%, according to today’s data from the New York Fed. Banks and credit unions granted the remaining 26%.

The 90+ day delinquency rate for subprime auto loans originated by banks dropped after the Financial Crisis and has since remained fairly steady. In Q3, it was 4.4%, down from 7.1% at the peak of the Financial Crisis. So the subprime auto-loan fiasco is not going to topple the banks.

In contrast, the 90+ day delinquency rate for loans originated by auto finance companies has been soaring since 2013. In Q3 2017, it hit 9.7%.

This 9.7% is the highest delinquency rate since Q1 of 2010. And it first hit that rate on the way up during the Great Recession in Q3 2008, during the Lehman moment. A year later, it peaked at 10.9%

Let's be aware that these numbers and products are happening near the end of a credit cycle, with low unemployment, with the yield curve flattening, and record high stock, bond, and home prices.

What happens when the music stops?

Comments

Never enough chairs to go around

when the music stops.

Or life boats either.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Won't admit there is a problem

or doing things deliberately and setting up the next economic crisis? I'm going with the second one.

The 2008 crisis was a huge transfer of wealth from the lower classes. This has set up the high rents, no houses available for younger people to buy and the massive losses of jobs.

People lost their retirement savings and some have had to go back to work in the low paying jobs that you have written about.

The tax cuts are a blatant transfer of wealth again and republicans aren't even trying to hide this. Two of them have come right out and told us that they were threatened by their donors that if they didn't get this passed, they wouldn't receive anymore donations to their campaigns.

Welcome back to the robber baron days. Some analysts are saying that the next economic crisis is just around the corner and congress is rolling back the weak banking restrictions that they put on the banks during the Obama administration. This is on top of the Bush tax cuts that congress voted on.

I saw a comment that said there are telephone polls from California to DC that would be great for crucifixion

It's treason.

Hang 'em all.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Talk to ‘em, sd! We tell ‘em what you tole us ! Good stuff.

..... Crucify

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

The clip I saw was very much more gentle

Gillabrand went to great lengths to say that in the 1990's environment the Bil Clinton's response was OK, but in 2010's environment it was not, giving a gaping hole in which the Clintons can survive.

Gilibrannd is as shitty as the Clintons.

Compensated Spokes Model for Big Poor.

Umm, oops. Chuckle.

This comment was supposed to go in another thread, but anyone reading it probably already figured that out.

Compensated Spokes Model for Big Poor.

Wall Street learned that

only the Fed can save them from ice nine. We won't crash until oil goes well over 100 dollars a barrel. It could happen in 15 minutes if KSA and Iran close the straights in some kinetic dust up. Until then watch the price if oil , watch China markets, and Japan.

So, can I cash out my 401k?

I don't understand any of this.

I tried to cash out when I left the job with which I participated, but the guy in India said I had to call back in 2 weeks. Wtf?

It's been 8 mos now. They send me stuff in the mail I don't understand. My son said, 8 mos ago to leave it. It was only like $900, then. Can I just pull it?

Also, can I just have them penalize me up front, instead of at tax time? Maybe leave me with $500 after it's all done?

This shit is weird, too. You put in a certain amount, and if you pull it, you pay for participating. Fuck that!

Found this, wonder if this could get you started?

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Thanks, DO

I'll go have a look.

when the music stops

[video:https://youtu.be/vV6DC5tpU44]

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Party Like It's 2009

It's Déjà Foobar all over again.

Don't worry when the bubble bursts they will just lower interest rates to stimulate the economy -- like they always do. Oh wait, interest rates are still close to virtual 0% and we are at full employment.

And the world's most powerful nation is in debt to the tune of $20 Trillion. Keep printing.

This Pooch is Soooo Screwed.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Trump, Hillary, Obama

They never have anything to worry about. BIG RUGS

"Religion is what keeps the poor from murdering the rich."--Napoleon

The oligarchy/Congress just don’t cayuh about the 99...

... and when the music stops, they hang us out to dry? They have plenty of stashed cash?

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.