That's not supposed to happen

Earlier this year the Federal Reserve committed itself to the rate hiking cycle.

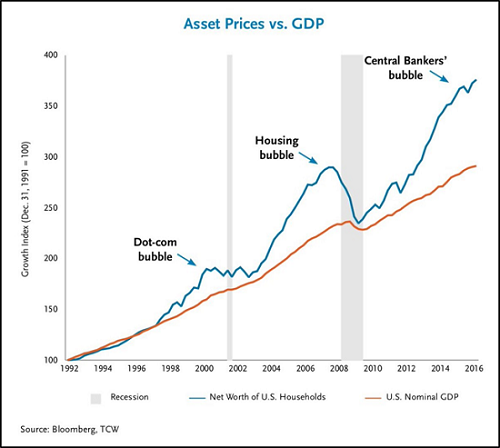

The reasoning was that the Fed wanted to deflate the asset bubbles and keep down price inflation.

The recent rise in the Fed funds rate will likely cause a ripple effect on the borrowing costs for consumers and businesses that want to access credit based on the U.S. dollar.

They've slowly raised rates from zero (ZIRP) to just 1.25%. Still historically low, but enough to make an impact. Right?

Treasury yields slip to fresh 10-month low after ECB news conference

Not only is the long-end of the curve not turning up as the Fed raises rates on the short end of the curve, but yields are actually dropping.

If bond traders were really convinced that the economy was getting stronger, then demand for the super safe assets should soften. Here's something else: the yield curve, or the difference between short- and long-term rates, is shrinking. That typically happens when confidence in the economy is low, because traders don't expect growth to be strong enough to generate faster inflation that would erode the value of fixed payments over time. Indeed, a government report Thursday showed that the Federal Reserve's preferred measure of inflation -- the core personal consumption expenditure index -- rose just 1.4 percent in July from a year earlier, the smallest increase since 2015.

..."Any back up in rates should be viewed as a buying opportunity," Michael Collins, the senior investment officer for fixed income at PGIM, said in an interview with Bloomberg Television. Going forward, 10-year Treasury yields will probably "spend more time below 2 percent than above 3 percent," he said, adding that late cycle economic indicators are starting to build while price wars are breaking out across most all industries.

What happened?

The first problem is that there is no real price inflation. In fact, despite the asset bubbles, there is a danger of deflation.

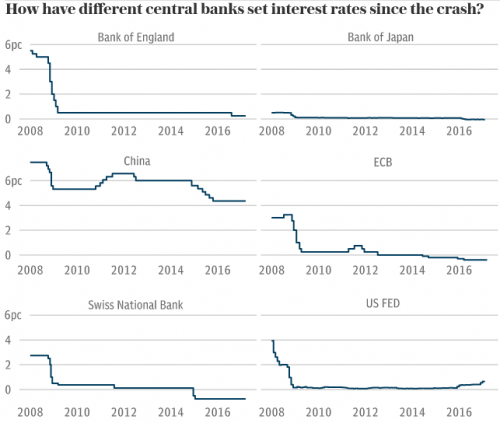

The key takeaway: negative and near-zero interest rates show central banks’ desperation to avoid deflation. More important, they highlight the bleak state of the global economy.

In theory, low- and negative interest rates were supposed to reduce savings and stimulate spending. In practice, the opposite has happened: The savings rate has gone up. As interest rates on their deposits declined, consumers felt that now they had to save more to earn the same income. Go figure.

Kenneth Rogoff, economist and all-around asshole, says:

"It makes sense not to wait until the next financial crisis to develop plans and, in any event, it is time for economists to stop pretending that implementing effective negative rates is as difficult today as it seemed in Keynes’ time," he said, citing the growth of cashless transactions as a reason to think that negative rates could be implemented more easily in future.

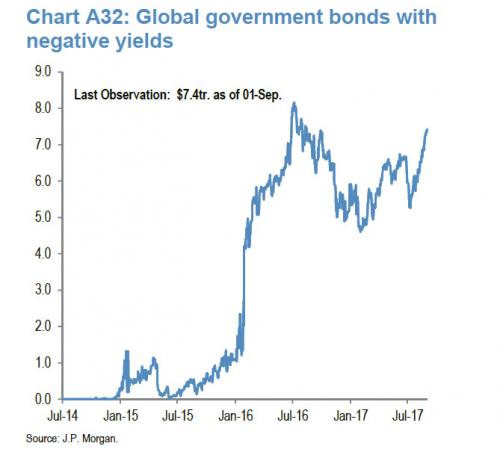

Rogoff is obviously wrong about one thing - negative interest rates (NIRP) are already here. They never left.

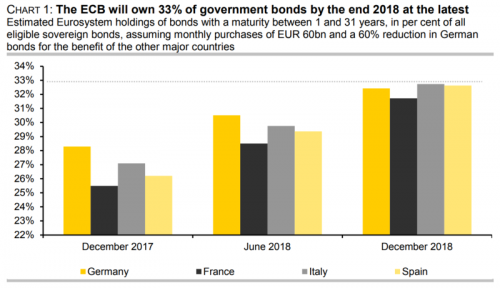

What's more, global central banks are running out of QE as well.

“Bond scarcity is increasing in more and more countries,” says Louis Harreau, an ECB strategist at Credit Agricole CIB in Paris. “The ECB will be forced to reduce its QE regardless of economic conditions, simply because it has no more bonds to purchase.”

The ECB is running into the same problem that the BoJ ran into last year.

One long-running concern about the BOJ's quantitative and qualitative (QQE) easing program had been that the central bank, which already owns around 40 percent of all JGBs, would eventually run out of bonds to buy.

In both Europe and Japan, government bonds sometimes don't trade for days. The markets are broken because one buyer dominates the market, and never sells.

What appears likely to happen is one of the most frequent leading indicators of a recession - an inverted yield curve, where short-term borrowing costs are higher than long-term costs.

However, never do yield curves invert at such a low level.

So what we have is an extremely dangerous situation indeed. While record high stock prices have become more detached from economic reality than ever before, the Fed has encouraged debt levels to surge to a record as well. And because robust growth has been absent, the level of the U.S. 10-year Note can't seem to get above 2.5 percent.

...Therefore, unless President Trump can pass his aggressive fiscal stimulus plan imminently, it is likely that the yield curve will flatten out much quicker than at any other time in history due to that current tight spread.

The truth is it will probably only take a handful of rate hikes to cause the yield curve to resemble a very flat pancake. Why is that important? A flat or inverted yield curve has most often led to a recession and carnage in the stock market; just as it did prior to the huge collapse in equities during 2000 and 2008.

Only this go around, when short-term rates rise to meet long-term borrowing costs the ensuing recession will occur with record-low interest rates, unrivaled debt levels, unparalleled real estate prices and unprecedented stock prices.

Bond yields are, historically speaking, "in the basement" and the public and private sectors are already saturated in debt. Therefore, there just isn't much the government can do to encourage another round of debt accumulation to pull the economy out of a death spiral as it did in the wake of the Great Recession.

It matters that the global central banks never exited crisis mode after 2008.

Comments

Time

I think it is time for the unthinkable to the Conservative-reps and corporate-dens. That one word that is the worst curse word ever to them.......Taxes! Tax the rich at a more appropriate fair share, and do not let them make it sound like they will also hit the middle class making under X-000,000 bucks per year so they don't panic. Corporate and billionaire tax dodgers need to be made to stop dodging, and made to realize it is actually their patriotic duty to help save the nation they were born to, and got their fortunes from.

Those that want to not do their fair share and avoid the crippling of the nation via burdening the middle class of lower means and poor instead of the wealthy who can still live like kings after taxation should be punished to the full extent as possible under the rules. Not likely to happen, but that is my thinking.

So long, and thanks for all the fish

Too bad we are likely to end up with a tax deal

that screws over anyone making less than $100,000 and benefits corporations and the rich while increasing our debt instead of using taxes and reducing military spending.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

True,

Sadly our Parasite class(my term for the greedy billionaires), want all flowing to their coffers while the poor and working class shoulder the burdens of the nation. Used to be the taxes were higher on the wealthy for good reason,

A) they could still live very comfortably after taxed to help maintain our nation infrastructure as well as socially and militarily(although that too has gone out of control).

B) it kept them from overwhelming politics for years, now they support the "think tanks" and similar projects that make people think that their parasite lifestyle is acceptable and desirable for themselves.

Now look at us, back to the bad old days of monopolies, corporate yellow journalism, and the overfed MIC and Big Corporates ruling us all. Pretense used that we have a "democracy" with the horse and pony show we call "elections"

This is why I call America, "The Corporate States of Oligarchia" they own it, we just live and slave here.

So long, and thanks for all the fish

BOHICA

Maybe it's a good time to go long on canned goods and shotguns.

"Obama promised transparency, but Assange is the one who brought it."

Pay down debt, cut expenses

Increase savings if possible.

Economies crash without societies collapsing all the time.

My go-to line...

...is to stockpile cigarettes and whisky for the coming prison economy...

I want my two dollars!

In common parlance...

We're fucked.

At 1.25 percent our reserve currency cleanest dirty shirt bonds are good to go. In fact it seems like anything, even Puerto Rico bonds seem popular. negative rate bonds can't get enough of those.

On another note No doubt Trump is looking for a couple of Chicago Friedmanite Austrians to fill the vacancies at the FED. Part of the problem with inflation is that the Fed has been fighting a monster deflationary swoon for almost a decade. At the same time they had the money printing on white hot , QE (now taken over by BOJ and Eurozone banks to the tune of 160 billion a month.) Along with the Bernanke Put backed up by the plunge protection team at 33 Liberty the stock market and the real estate market on both coasts have gone bubblicious. (Asset inflation for the rich). Oh oh! Bubbles gonna pop. New York real estate market turning over, San Francisco, Portland, Seattle. Next. Canada gone bonkers still in ever crazy bubble time. Miami real estate may be wiped out, after Mother Nature went all evil fae on Houston. Double trouble. Events are out running both the Fed and Trumps nitwittery. Ice Nine out over on the event horizon coming to shore after the trade winds play whack-a-mole on the coastlines. Ack! Phew!!! Can't keep up. Buy Bitcoin? Somehow doesn't appeal to me. Stock up on ammo? maybe. But I think a good surf fishing pole might be more serviceable out here on the coast. And I don't want to hear anymore about the 4000 earthquake swarm up on the Yellowstone caldera. Are you back to typing 2 handed.

No need for worry.

Somewhere out there, I assume Bonddad is asserting that the fundamentals are sound.

La di da, la di da.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Heh!

I'm pretty sure Bonddad lives just not at TOP. Saw his name turn up on a blog roll somewhere. Used to like those fights with Bobswern and others.

Actual money means nothing

unless it's in your pocket.

We may yet see how much the banks are really worth. I'll bet, using my make believe money, that there is no there there.

Binary code for zero:

01111010 01100101 01110010 01101111

Regardless of the path in life I chose, I realize it's always forward, never straight.

China's Debt Bubble

So I went looking for economic news and found this:

https://wolfstreet.com/2017/08/17/so-when-will-chinas-debt-bubble-finall...

And this:

Long story short, there was a "draft of a 92-page civil complaint that Benjamin B. Wagner, the then U.S. attorney in the Eastern District of California, and his colleagues were prepared to file in federal court."

The well concealed complaint has finally surfaced and:

https://www.vanityfair.com/news/2017/09/jamie-dimon-billion-dollar-secre...

Isn't that special! I was laid off from GreenPoint Mortgage around August of 2005, just before the shit hit the fan. Way to go Obama! Congratulations Kamala! Can't wait to hear more whining about Trump and promises of economic reform!

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

"Authorities have many tools to control it..."

Maybe they do, but unfortunately the authorities seem to be preoccupied with robbing us all blind.

native

Now is it time for

Jubilee? Trick question: it was time years ago; nothing improves without it.

Orwell: Where's the omelette?

Are you ready

?

[video:https://www.youtube.com/watch?v=kj3e2iL6vvo]

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

Debts that can't be paid won't be. - Michael Hudson

Cool tune.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Question

Has there ever been a similar situation in our economic history? It looks as if the Federal Reserve has no more rabbits to pull out of the hat to correct the mess. All this reminds me of a song by Ray Charles.

The Fed must raise rates.

I'm convinced of this. Who does a Zero Interest Rate Policy favor ? What has been the result ? Why has it gone on for so long ?

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Condeelezza Rice to the rescue!!!

"no one could have known"

I looked her up on wikipedia and got the exact quotation

I am not trying to hack this article by bringing in such an illustrious person

But, how dare you claim that the servants of the economic God are fallible?

Just to show how off base you are (and before you say that I am being mean to a woman) here is a quick update to her statement

Since I have the wikipedia page up, you might be interested in some of her greatest hits. I started at the top and most have to do with war but I found this down the list

It is making me sick to go through the list, including denying torture, black sites, etc, but this fits what has happened ....