Corporate Cannibalization

The stock market has been on an incredible run, gaining $4 Trillion just since the election.

So stocks are rising because every Tom, Dick, and Harry has been buying equities, right?

Wrong.

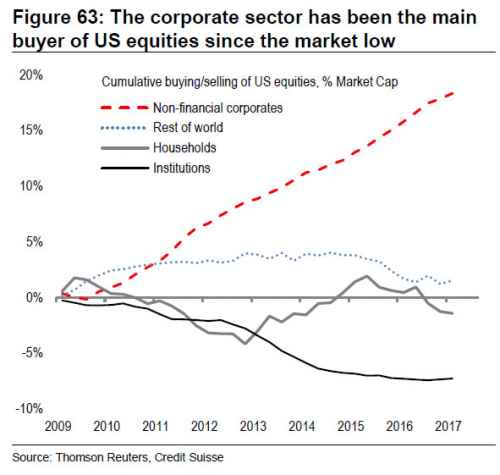

As Credit Suisse's strategist Andrew Garthwaite writes, "one of the major features of the US equity market since the low in 2009 is that the US corporate sector has bought 18% of market cap, while institutions have sold 7% of market cap."

The stunning post-2008 stock bull market has been accomplished almost entirely through corporate buybacks.

In November 2016, Goldman Sachs’ chief equity strategist David Kostin estimated that, in 2017, S&P 500 companies will spend $780 billion on buybacks — a new record.

That’s crazy.

For most of the 20th century, stock buybacks were deemed illegal because they were thought to be a form of stock market manipulation.

By several measurements, stocks have gotten extremely expensive.

So the fact that stocks are now trading at a P/S ratio that matches the Tech Bubble (the single largest stock bubble in history) tells us that we’re truly trading at astronomical levels: levels associated with staggering levels of excess.

OK. What business is it of yours if corporations are using more and more of their profits to boost stock price rather than invest in the long-term health of their companies? That's freedom, and such.

Except that isn't what's going on.

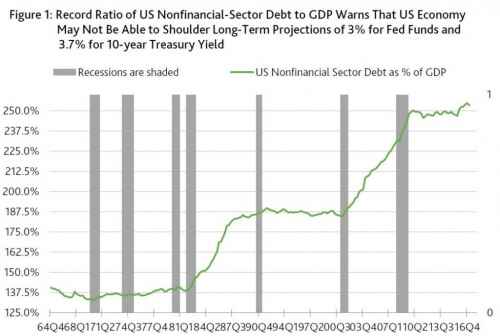

The leverage of the US nonfinancial sector has reached unprecedented heights according to the US’s never before seen ratio of nonfinancial-sector debt to GDP. Nonfinancial-sector debt includes the credit obligations of households, nonfinancial businesses, state and local governments, and the US government. Though the ratio of US nonfinancial-sector debt to GDP’s moving yearlong average dipped slightly from Q4-2016’s record 255% to Q1-2017’s 253%, the latter was considerably higher than year-end 2007’s 230% that immediately preceded the Great Recession.

Record amounts of borrowing + Record amounts of buybacks = Record amounts of borrowing to buy their own stocks.

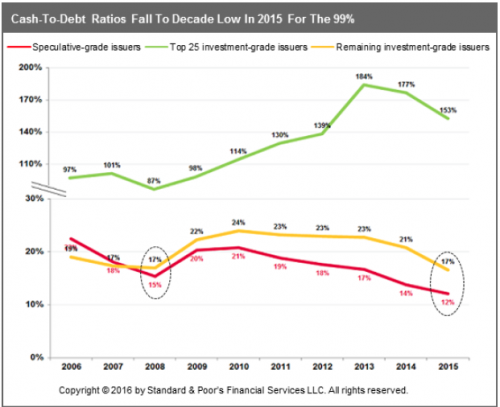

What's more, outside of the top couple dozen companies, cash on-hand has never been more rare.

Well, it's a free market and blah, blah, blah, and who are you to say what is the best way to spend their money, you commie, etc.

Right. Maybe, just maybe, corporate executive America is sick.

As corporate America engages in an unprecedented buyback binge, soaring CEO pay tied to short-term performance measures like EPS is prompting criticism that executives are using stock repurchases to enrich themselves at the expense of long-term corporate health, capital investment and employment.

...A Reuters analysis of 3,300 non-financial companies found that together, buybacks and dividends have surpassed total capital expenditures and are more than double research and development spending.

Lately, the sheer volume of buybacks has prompted complaints among academics, politicians and investors that massive stock repurchases are stifling innovation and hurting U.S. competitiveness -- and contributing to widening income inequality by rewarding executives with ever higher pay, often divorced from a company’s underlying performance.

It is long-past time that people start using the terms "mismanagement" and "fraud" to describe corporate America. The system isn't going to fix itself.

Comments

Using debt to buy back stock

So they can write the debt off their taxes. Then they can use their overseas cash to pay back the debt at a lower rate than they would be taxed to repatriate it...

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

Amen brother

It seems capitalism is choking on it own excesses...all the while screaming for more deregulation. Pop goes the weasel!

“Until justice rolls down like water and righteousness like a mighty stream.”

Thanks again.

We are fortunate to have you writing here. Even when some of the topics you write about are over my head.

Many people say that Obama was a great president because just look at how the stock market is doing. But don't talk about how income inequality has gone up so much during his tenure.

Are shareholders upset with the amount that CEOs are being paid and if so, is there anything they can do about it? Or are they happy that their stock is doing well?

The message echoes from Gaza back to the US. “Starving people is fine.”

Shareholders are often not happy with CEO pay

but shareholders have even fewer rights than minority voters in Florida.

It's not a democracy. Hell, it's not even a one-share one-vote system.

It's extremely rare for shareholders to even seriously threaten a board decision, much less overturn it.

Gee, I wonder who's going to stuck with the bill for this.

The real SparkyGump has passed. It was an honor being your human.

It's not a bug,

it's a feature.

There is no such thing as TMI. It can always be held in reserve for extortion.

Most of the Corporate Kool-Aid

shit we are forced to watch brags about our stock price and how great that is for shareholders.... Yeah, we all know where most of their pay comes from, it is disgusting. And insulting. And we too have taken out debt to do it. I no longer bother to look close anymore, some of the things that go on I don't want to see. A co-worker feels the same way - just hang on until you can retire and try not to rock the boat too hard. And if you do, you'll be warned about doing so. Go Team!

Only a fool lets someone else tell him who his enemy is. Assata Shakur

I hope you get paid for your writing and analysis somewhere.

Your voice is definitely deserving of a large audience.

Stop Dissing The Job Creators!! ;-)

I didn't realize the buybacks were this huge. Stock PEs are looking Bubblicious. The company stockholders are prolly luvin it -- all the way until their company goes bankrupt. And these POS CEOs see the financials months before the market does, so the rats know when it's time to jump ship ahead of the crash, leaving Joe Mainstreet holding the bag full of worthless stawks.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

2 companies ago

I once had options and they really were seriously in the money for a while. God, we all watched fascinated as they split, went up, and split again. We had spreadsheets.... The one thing we didn't do is watch what the big dogs in our company were selling. We rode that puppy all the way into the ground, being greedy fools who would not sell out, believing all the hype about this just being a blip, it would go up again. The late 90s, early 2000, telecomm.

The only "gain" I got for all that was a loss carryover from an employee purchase plan. The implications of the greed hadn't hit me then, and it was fun to think about being able to not worry about retirement. Yes, I am that conservative I would have saved most of it had it ever vested. One woman put her entire 401K into that company's stock and rode that all the way down. But the big dogs walked away rich, many of them barely competent at the jobs they had. No options for me anymore and the lesson learned there, cash out as soon as they're in the money. Don't be greedy, take their money and move along.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

I never had Options

Sorry to hear that sad story Lizzy. Apparently, It was a carrot hanging from the end of a stick.

I worked at one of the big US Techs for 25 years. The first 15 years were great. Then they hired a CEO, known for his corporate raider credentials, to come in an raise the company stawk price. He proceeded to gut the pension plan, cutting employees pensions by two thirds. Then rewarded himself and a handful of top execs with bonuses for doing it. That was the end of employee loyalty.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Anyone that believes the markit is truly a markit

might want to think again.

https://jessescrossroadscafe.blogspot.com/

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

BOJ (Bank of Japan)

ECB (European Central Bank) BoE (Bank of England) all have QE on going which is an effective put holding the market from losses. Over here stateside we have the plunge protection team bringing their levitation to the DOW, S&P.

legalized gov funded (QE) pump and dump.

Solidarity forever

Obviously unsustainable.

I'd say simply let the whole thing collapse on itself and burn the remains, but we all know it would take Main Street with it. The way the Ubers and Filthys (rich / 1% / Oligarchs) treat this country it's amazing it still stands.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

My nephew was just visiting

and talking about how much his 401k has gained under Herr Drumpf. I believe he's in for a very rude and sad awakening.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11