Bubble Watching

History doesn't repeat itself, but it does rhyme.

- Mark Twain

At some point we are going to have another economic bubble burst.

It's inevitable. It's what we do.

So to stay in practice, let's play Spot The Bubble.

Lee Camp gets several things right.

The value of American subprime mortgages was estimated at $1.3 trillion as of March 2007.

Outstanding student loan balances amounted to a whopping $1.31 trillion as of Dec. 31, 2016.

The current student loan delinquency or default rate is a staggering 11.2%.

Delinquency rates for ALL mortgages across the country peaked at 11.5% in 2010.

It looks exactly alike.

However, Lee does one thing wrong in this comparison: the owners of the debt are different.

A huge percentage of the subprime mortgages were owned by the banks, mortgage lenders and insurance companies. Thus the crash was a financial crisis.

Student loans, OTOH, are owned by the taxpayer. Thus, this crisis is a fiscal one, not a financial one.

As of July 8, 2016, the federal government owned approximately $1 trillion in outstanding consumer debt, per data compiled by the Federal Reserve Bank of St. Louis. That figure was up from less than $150 billion in January 2009, representing a nearly 600% increase over that time span. The main culprit is student loans, which the federal government effectively monopolized in 2010 when the Affordable Care Act was signed into law.

Prior to the Affordable Care Act, a majority of student loans originated with a private lender but were guaranteed by the government, meaning taxpayers foot the bill if student borrowers default. In 2010, the Congressional Budget Office (CBO) estimated 55% of loans fell into this category. Between 2011 and 2016, the share of privately originated student loans fell by nearly 90%.

Prior to the administration of Bill Clinton, the federal government owned zero student loans, although it had been in the business of guaranteeing loans since at least 1965. Between the first year of the Clinton presidency and the last year of George W. Bush's administration, the government slowly accumulated about $140 billion in student debt. Those figures have exploded since 2009. In February 2016, the U.S. Treasury Department revealed in its annual report that student loans account for 31% of all U.S. government assets.

One really sucky part of the ACA that people have forgotten about.

So basically a third of ALL government assets are student loans, and those loans are going bad at an increasing rate (an implied delinquency rate of 27.3 percent). The student loan crisis is no longer a crisis for just students. It's now much, much bigger than that.

This won't blow up Wall Street like last time, but it will bankrupt the nation unless something is done quick.

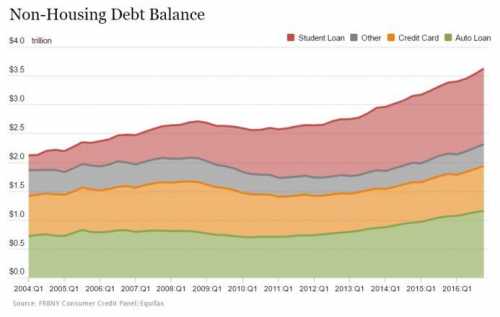

What Lee missed for some reason was a different bubble that also has all the same qualities of the student loan bubble, but isn't backed by taxpayers - the auto loan bubble.

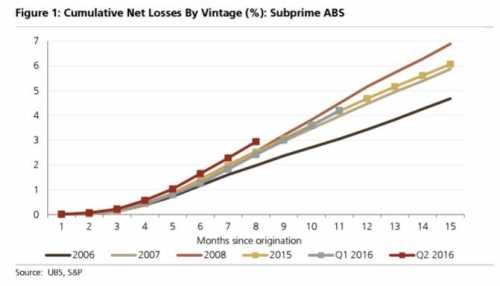

Subprime auto-loan default rates match those seen just before the 2007-2009 recession. It’s a red flag that’s been flapping for some time for analysts worried it could pose risks to the broader credit market, bank health and, ultimately, the consumer-driven economy...

Credit-rating firms and market participants have been scrambling to explain subprime default rates for recent vintages (loans made in 2015, 2016) that have now reached levels consistent with those originated just before the 2007-09 recession

Not only that, but the overall trend, of lending to increasingly suspect borrowers, is following the same pattern as we saw in 2004-2007 with subprime mortgages.

The percentage of subprime auto-loan securitizations considered deep subprime has risen to 32.5 percent from 5.1 percent since 2010, Morgan Stanley said. The researchers define deep subprime as lenders with consumer credit grades known as FICO scores below 550.

Steve Eisman, of “The Big Short” fame, has his eyes on this sector.

Subprime auto loans constitute roughly $200 Billion, and more than one million people are in default on their auto loans.

While subprime auto loans are considerably smaller than the subprime mortgage market, a crash in auto loans will also rock the entire auto industry.

Comments

This is just stupid

can you spot the bubble?

Yeah agree,

And remember though that part of this valuation probably has to do with the Solar Roof story. Some are betting on Tesla's sales team I guess.

I don't get how putting solar $hingles everywhere when the south-facing ones are doing most of the work is going to sell in my area of the USofA.

...and if there is a collapse?

A study has found that the majority of Americans could be financially destroyed over an unexpected $500 expense, as only 41 percent of US citizens have that much money in their savings. https://sputniknews.com/us/201701141049581964-majority-americans-lack-sa...

Debts are the new chains of slavery!

“Until justice rolls down like water and righteousness like a mighty stream.”

Actually they are the old chains of slavery

Proverbs 22:7 (NIV), “The rich rule over the poor, and the borrower is slave to the lender.”

in history

we've been trained

Deuteronomy 15:16 But suppose a male slave says to you, “I don’t want to leave you,” because he loves you and your family and is happy with you.

How true...

Thanks for the reminder! Some methods of oppression are timeless.

“Until justice rolls down like water and righteousness like a mighty stream.”

Worst part about the auto loans are the collectors.

Doesn't matter what the reason for the default is, if they hear about the location of a car, they'll be there within minutes to snatch it. They'll break locks, trespass, and anything else they have to do in order to get it.

Instead of vilified, the MSM lauds those assholes, and gives them reality shows where they take back the property of the banks from the snidely whiplash white trash who spend all their money on frivolous things like... food.

[video:https://www.youtube.com/watch?v=yLA28umt9iw]

I do not pretend I know what I do not know.

Years ago, my sister had her

car repo'ed. I was there at the time, over Thanksgiving day weekend. Her car was in the garage but we gave it to him, she was 5 payments behind and he couldn't do anything for her there. She later tried telling me we shouldn't have given in. Yeah. They call the local cops before they ever take your car, and if he needed LEO help I'm quite sure he would have gotten it.

Sadly, her excuse wasn't food but horrible money habits. We rescued that car so her kids wouldn't find out, and man, they don't mess around there. Did it at the very last minute with a loan in my name and automatic payroll deductions from her. You only have days to retrieve the thing before they sell it, for less than you owed originally, naturally.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

It seems to me that these bubbles all have one thing

…in common:

The are firmly rooted in income inequality, compounded by the asset stripping of the American People. It is triggered when the People try to get ahead. (With the Federal Government holding the bag.)

Well done, capitalist predators!