"Worst since Great Recession"

That's what a lot of the economic headlines say today.

Empire Fed report: worst since Lehman

Retail Sales: worst since 2009

Corporate earnings downgrades: worst in seven years

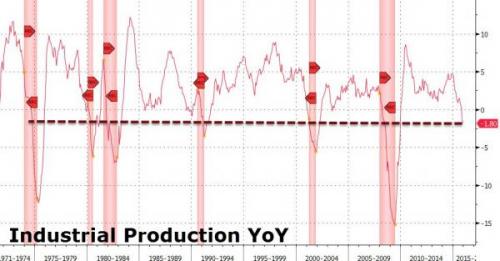

Industrial Production: revised down

And then there is the stock market. It is still way, way up from 2009, but it's having a very bad 2016 so far.

China's stock market is down 20% just since December.

Meanwhile, the U.S. stock market is testing important support levels.

Stocks fell around the world, with U.S. equities headed for the lowest since August, and bonds jumped as oil’s plunge past $30 sent markets reeling. Treasuries extended gains as U.S. data did little to calm nerves frayed by concern that global growth is slowing.The Dow Jones Industrial Average sank more than 300 points, European stocks fell to the precipice of a bear market and the Shanghai Composite Index wiped out gains from an unprecedented state-rescue campaign. Oil plunged past $30 a barrel as Iran prepares to export into a global supply glut. A measure of default risk for junk-rated U.S. companies surged to the highest three years. Yields on 10-year Treasury notes dipped under 2 percent, while the dollar extended a rally. Gold surged with the yen on haven demand.

“Markets have to go through several stages and right now they’re just holding their head and crying,” Krishna Memani, chief investment officer at Oppenheimer Funds Inc. in New York, said by phone.

[Update: DOW now down over 500 points and still sinking; technical support levels are now broken]

Comments

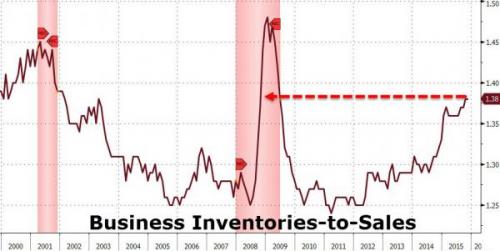

More charts

Consumption is up

Prices are steady to down a bit.

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will be lonely often, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. - Friedrich Nietzsche -

Puerto Rico "in midst of economic collapse"

Lew says

One more headline

Corporate bonds