Housing Bubble 2.0

There is an old saying on Wall Street: "No one rings a bell at the top."

Guess what? The bell, like in 2006, isn't ringing.

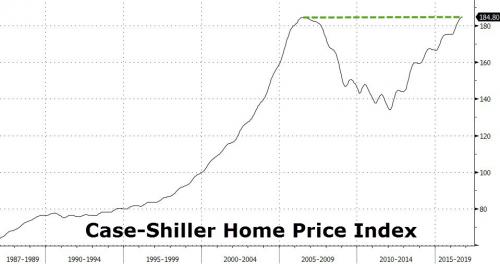

The S&P Case-Shiller index of US home prices rose in September to the highest level since July 2006, when the most recent housing boom topped out.

"Boom" is an interesting word. A few years ago they used a different "b" word for the exact same home prices.

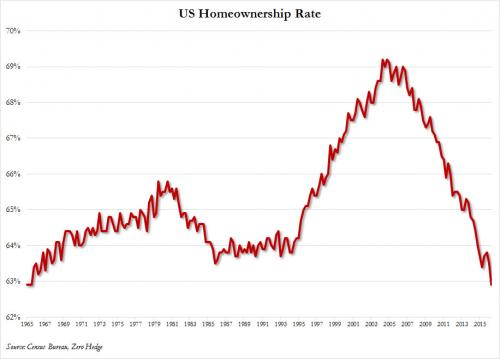

House prices have been rising as a healthy jobs market and historically low mortgage rates have made homeownership more appealing.

"Healthy" is another I wouldn't use. For instance, does this chart look healthy?

"The new peak set by the S&P Case-Shiller CoreLogic National Index will be seen as marking a shift from the housing recovery to the hoped-for start of a new advance," David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in the release.

"Recovery" is yet another word I wouldn't use.

I was thinking "re-inflate".

Consider this chart to fill in the gaps.

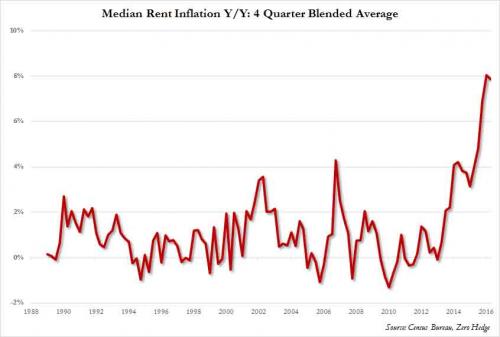

Home prices have spilled over into rent prices.

A new study by three economists, published by the National Bureau of Economic Research, establishes a few facts that may be useful in helping to assure you that no, you’re not crazy—it really is getting harder to pay for a roof over your head. Try dropping these in your next argument with your landlord:

- Since 1970, “the price of housing (or shelter) services has risen almost 40 percent relative to other goods.”

- During the same time period, “the percentage of households facing ‘extreme’ [costing more than 50 percent of their income] housing affordability burdens rose from 16 to 28 percent, while the share facing ‘moderate’ [costing more than 30 percent of their income] burdens rose from 30 to 53 percent.”

- In 1970, the median renter spent a fifth of their income on rent; now, that number has risen to nearly a third of their income.

- Income and wealth inequality have risen drastically since 1970, and renters as a group have seen smaller gains than homeowners. And households today have fewer people on average than they used to (they “have shrunk in size by almost 30 percent”)—which raises housing demand and exacerbates the affordability crisis for renters even more.

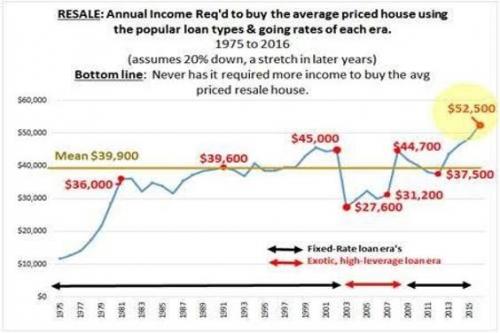

Housing Bubble 2.0 does not have the excess of cheap debt that Housing Bubble 1.0 had, but it does have the unaffordable price-wage dynamic.

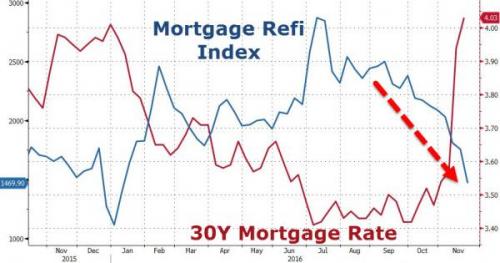

One last thing to consider is what the recent hike in interest rates since the election has done.

The fast rise in rates has spurred homeowners to pull back from refinancing their mortgages. Applications dropped 3% in the week ended Nov. 18 from the prior one, the seventh consecutive weekly decline, and the second since Election Day, according to data released Wednesday by the Mortgage Bankers Association.The MBA estimates refinances will fall 46% next year, to $484 billion, which will hurt Americans’ ability to free up cash by reducing the cost of their monthly mortgages. The fall in refinances also will hit an important area of consumer-loan growth for banks. To slow the possible damage, banks already are pitching riskier loans that come with adjustable interest rates or allow borrowers to pull more equity out of their homes.

“The increase in rate has shocked consumers…I didn’t expect it either,” said Dave Norris, chief revenue officer at LoanDepot, the 10th largest mortgage lender in the U.S. by loan volume.

This month’s rate increase has eliminated a large share of borrowers for whom refinancing would make financial sense. Before the election, 70% of all borrowers with a 30-year fixed-rate conforming mortgage stood to incur at least a half a percentage point in savings by refinancing. Now only 35% of borrowers are eligible for such savings, said Walter Schmidt, who tracks mortgage-backed securities at FTN Financial

At what point do these insane prices burst the bubble?

Comments

Last chance to grab what they can...

Price is reflective, IMHO, of rich folks realizing that the only thing left of value they can grab with their stolen money is LAND.

And they will NEVER sell it. The only guaranteed income when the stock market crashes next time will be rents.

Because thanks to the nice laws, landlords have much more power than they used to, and can GUARANTEE payments through nice little bullshit like "Housing Debt" which will ensure that any tenants who try to call them out on it will have to pay or ruin their chances of getting ANYWHERE else in the entire country.

It's a racket.

I do not pretend I know what I do not know.

The ownership of residential real estate by the market

is a new unknown and may provide additional bubble support.

All the indicators are yelling bubble, and some for quite a long time. Not just in housing, but every aspect of the global economies. Apparently not even Trump can rupture it.

Maybe the OPEC output cut will do it... Isn't this exciting? Global Economic Jenga!

I think the election stock market rally is borrowing from the

1st & 2nd quarters of 2017 and a rout will ensue.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Heh. I think it's stealing energy from neighbouring dimensions!

you can bank on that

at .02 % they give us serfs

Zionism is a social disease

The next four years

Are going to see the greatest land grab since the 19th century. Say goodbye to the National Parks and all that public land out west...

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

Here's an honest question: I am led to believe that many

people with mortgages were unable to refinance during the period of historically low interest rates because of the fees involved. Now, many of these mortgages are poised to rise because of mortgage contract provisos known to the buyer at the time of purchase. If this is true, then we will be seeing a wave of foreclosures of nearly 50% of what occurred in the bankster fraud heyday. I think it's also true that over 20% of mortgages are still under water.

I am also under the impression that there is a glut of single occupancy housing vacancies and that most of the building permits are for multiple family units, apartments in other words. Rents are going up at a rapid pace but I don't think it's sustainable given the precariousness of employment Americans are suffering.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

As a mortgage broker, on fees...

On average, all the third party fees for a refinance should total about $3,000 including the appraisal (for at least a small to moderate size loan). There are plenty of ways to structure this so a client would not come in out of pocket (either by a credit from a lender or rolling fees into a new loan). Given the large difference in rates pre-crash versus the lows, the only reason fees would have been limiting is if the loan was too small compared to the fees.

In regards to rates rising, I would expect that many of them will be rising by about 0.5% to 1% next time they increase (depending on what index they are tied to. 1 Year Treasury bonds will be closer to 0.5% right now, 1 Year Libor will be closer to 1%). The other issue will be rolling second mortgages where people will need to start paying principal and interest. I do wonder if those were tied to the recent uptick in foreclosures.

Thank you very much for taking the time to reply. I do

appreciate it and I am trying to understand the situation, not only to separate out the comments that are not based on the facts, but to learn how the system works..

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

This essay pairs nicely with you essay on the differences

between the rich and the rest of us. They're out to suck us dry.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Two Questions

In the "Resale: Annual income" chart, are the amounts adjusted for inflation?

Also -- housing prices in Europe, Central America and elsewhere equal or exceed US prices. Can a case be made that we're climbing toward global parity rather than experiencing a new bubble?

Re:

yes, it's inflation adjusted

Boom or Bust!

They are both four letter words.

Let's keep in mind that in our Glorious, Shiny and New Global

Enslavement SchemaEconomy, that among our most esteemedlabor colonytrading partners are busily looking for places to put their money as the looming GlobalRecessionmarket adjustment suggests anyplace but the stock or bond market. U.S. real estate is a perfect way to stash money while artificially driving up the price in ourdecrepitEsteemed Land of America who's fearless leaders will be sure to ameliorate this problem after they crawl out from under their desks or pause from practicing theirenfeeblementeloquence lessons, once again proving that we are not a nation of patsies. Home of the Grave Mis-consideration of Consequences. We are not worthy of their mental masturbations!'"Recovery" is yet another word I wouldn't use.' Recovery is better used by those pensioners who are gaining a five percent increase in their checks AFTER they took a 15 or 20% cut five years ago. A slow and painful recovery. Like convalescing after being in a minor train accident. You may actually walk again!

Thanks gjohn.

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

I'm hanging on for dear life.

Only five more years to pay off my house. Will I make it or lose it? Don't know but giving it everything I have.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

That is indeed a worthy goal.

I hope you make it.

Life is strong. I'm weak, but Life is strong.

Thanks, featheredsprite.

I'm sick and tired of debt.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

In 1999, I sold my house and paid off my sailboat

I've been living aboard the boat, debt free for over 15 years now. And as an added bonus, I can take my house with me where ever I want to go. I can't find the words to tell you how wonderful it is to live debt free. The only regular payment I make is insurance on the boat once a year. No monthly electricity, water, garbage, sewage, cable TV, ridiculous cell phone plans, car insurance, registration fees or any of the things typical of life in the US. I pay in other ways, but no monthly fixed payments and pay far less for phone, internet etc. than I would in the US. I do occasionally incur marina fees if we decide to stay in a marina for a few months, but that's our decision and I don't have to sign a contract.

After living debt free, I can't even imagine going back to the stack of monthly bills I once had. To me, this is truly living in freedom. Sadly, it seems the intent of the government and TPTB is two-fold. First, get you into debt. Second, keep you there! I feel so sad for our young people. They will likely never know, nor have the chance to ever live debt free. They exit college with more debt than I had when I purchased my first house.

“Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.”

George W. Bush

I taught a class on

Personal Finance and used a story about a couple who decided to do exactly what you are doing. I would show their expenses, show how they downsized to pay it off and afford their life on the boat. It was true financial freedom. Did you write a book about it? I think it's wonderful that you found a way.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

No book yet, but I've considered it

We are still hoping to sail on to Africa and across the Atlantic to the Caribbean. Once we transit the Panama Canal and exit on the Pacific side, we'll have completed a circumnavigation. After that, I'll probably sit down to write the story. Provided I'm still able. This lifestyle isn't for everyone, but it is a truly an affordable and incredible way to enjoy life.

“Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.”

George W. Bush

You have my admiration for being able to do this.

Raggedy Andy and I were trying to sell our house and live in our RV for a few years just to live a bit free and have no debt. Alas, the house did not sell, so we've decided to make the best of it. Now, we only have five years left to own it - if nothing happens, but that's sketchy in this environment, as well. But, if we lose it, we have 17 acres free and clear and we can pitch a tent, or buy that RV and get the heck out of Dodge!

Good luck to you. I hope to read your book, someday!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Thanks Raggedy Ann!

There are lots of sailors out here who don't want to commit to doing this forever so they rent their house, take off for a couple years and make a decision on whether they want to continue on. You could do the same. If you're still generating an income, you could rent the house, buy the RV and pay it off with the income or, just take off! You can get some great deals on used RV's and sued sailboats.

Once you pull the plug, it's amazing the things you find that you can happily live without! Of all the things I'm glad I no longer have, it has to be a car. You can't live without one in the US, but it's an albatross around your neck. Insurance, maintenance, registration fees and parking tickets. When we need one, we rent one for a day. Here in Malaysia we can rent a car for the day for about $10. Sadly, I've still paid a couple parking tickets, but only about $6 each and I still haven't quite figured out why I got them. LOL!

“Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.”

George W. Bush

You have no idea how much my car is an albatross

around my neck. I get panic attacks driving, anymore, because I have a 50 mile (one-way) commute. It's also the reason my house won't sell and probably won't rent. I live in a very depressed, rural area. We are a bedroom community to Albuquerque. As much as they have tried to bring industry to the area, it continually fails. For goodness sake, Google located a plant here - built a 60,000 sq.ft. building and left in 6 months. We put the house up when they were building the plant, thinking workers would be moving in that could afford housing. We were three months into the real estate contract when they left. When the state cried foul and said, "you have to pay us $1million for leaving!" Google paid it like it's a $10 bill.

Once the house is paid off, we'll have the freedom we seek and can then do as we please. In the meantime, I'm working like a slave to make extra payments to get that particular albatross off my neck.

Great talking to you, reflections!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

You too RA!!

Keep at it! With only 5 years to go you're almost there!!

“Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.”

George W. Bush

Since r > g, the difference has to come from somewhere

Since businesses are using borrowed cash to prop up their valuations instead of producing anything, the return on capital has to come from somewhere else. Rents are all that is left.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg