IMF: A quarter of the banks won't make it

Submitted by gjohnsit on Mon, 10/10/2016 - 6:40pm

It's amazing just how little was fixed after the 2008 financial crisis that the big banks caused.

Last week's IMF meeting couldn't have made that any more clear.

A global economic recovery would still leave about a quarter of banks in developed countries too weak to support further growth and susceptible to future shocks, the International Monetary Fund said.

Banks controlling about $12 trillion of assets would remain vulnerable during a rosy economic environment marked by faster economic activity, rising interest rates and declining defaults, the IMF said Wednesday in its semiannual report on financial stability. Most of those banks, with $8.5 trillion in assets, are in Europe, according to the report.

So even a best-vase scenario would leave these huge banks on the brink of failure.

Why is that? In one word: debt.

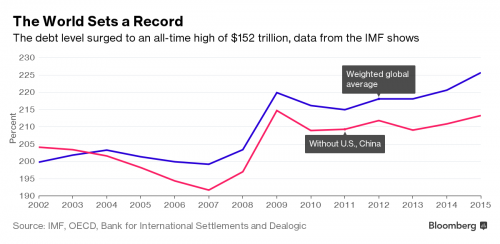

Gross debt in the non-financial sector has more than doubled in nominal terms since the turn of the century, reaching $152 trillion last year, and it’s still rising, the International Monetary Fund said. The figure includes debt held by governments, non-financial firms and households.

Current debt levels now sit at a record 225 percent of world gross domestic product, the IMF said Wednesday in its semi-annual Fiscal Monitor, noting that about two-thirds of the liabilities reside in the private sector. The rest of it is public debt, which has increased to 85 percent of GDP last year from below 70 percent.

Slow global growth is making it difficult to pay off the obligations, “setting the stage for a vicious feedback loop in which lower growth hampers deleveraging and the debt overhang exacerbates the slowdown,” said the Washington-based fund.

“Excessive private debt is a major headwind against the global recovery and a risk to financial stability,” IMF fiscal chief Vitor Gaspar said in prepared remarks. “History has taught us that it is very easy to underestimate the risks associated with private debt during the upswing.”

The problem, as always, is the debt. But the monkey wrench in this situation is that the central banks won't be there to bail out the banks this next time.

Worse is the spreading realization that the central banks have little fuel left in their tanks. Recessions come intermittently and unpredictably. Containing them generally requires 5 percentage points of rate cuts. Nowhere in the industrial world do central banks have anything like this kind of room, even allowing for the effects of unconventional policies such as quantitative easing. Market expectations suggest that it is unlikely they will gain much room for years.

Comments

Anyone want to buy my Deutsche Bank stock?

Time to re-watch The Big Short.

Gëzuar!!

from a reasonably stable genius.

Jill's QE for student debt?

Now that the idea is out there, maybe the Fed will be forced to do it when the next recession hits.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

What part of

"it's a big club and you (we) ain't in it" didn't you get?

glitterscale

Arguably, the previous (= the “Great”) recession never ended.

Economic ‘recovery’ feels weak because the Great Recession hasn’t really ended

Better Have Good Relations With The Neighbors!

Otherwise, the neocons will give the NRA their wet-dream world of violence and weaponry.

Vowing To Oppose Everything Trump Attempts.

Solution same as always --

working-class revolution, debt jubilee, take back the government.

"The Resistance will be patchwork at first, but we’ll find each other

quickly, a constellation flickering to life.." -- Malcolm Harris

Mr.

Robot.

It's too late to take it back.

It's toast.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Debt jubilee actually works

If you clear out excess debt and excess wealth then the economy recovers. Excess wealth becomes unproductive because debt service keeps consumers from consuming. Your debt is their wealth. Jubilee will never happen in Western economies because the purpose of government in the West is to protect the interests of private property. Doing this would be repugnant to the ruling class and their kept politicians. They would scream class warfare and moral hazard.

Capitalism is the perfect system since it not only generates extreme wealth for a few, but also allows them to guard that wealth by owning the politicians.

Cassiodorus is 100% right in his solution.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

You reminded me of the Cataline conspiracy

And then I found this CounterPunch article that mentions it as a single case in all the debt problems of antiquity.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

gjonhsit?

Does that name reverberate with those around you, who who are awed by your desire, to research and understand that which surrounds you? And yet, they wish you would sit down and shut up?

"Best-vase". A place you put flowers to die.

Thanks as always.

Regardless of the path in life I chose, I realize it's always forward, never straight.

“Best-vase” scenario

http://tvtropes.org/pmwiki/pmwiki.php/Main/PricelessMingVase

We be just riffin’ on a typo — seriously though, thanks, gjohnsit, for the steady stream of economics information.

That made me check my household cash-at-home supply.

I have more than I thought. Stash in a safe place, easily forgotten, and it's a wonderful surprise to re-discover. Good thing I don't eat bread. My cash can go to one other item.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.