This isn't capitalism

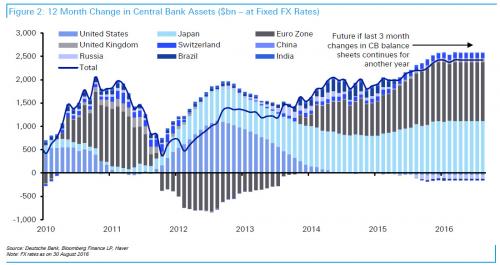

Eight years ago the central banks of the world embarked on a bold experiment. They approached the economic crisis with the assumption that it could be fixed with monetary policy alone. Their primary weapon was quantitative easing (QE).

Now, in 2016, experimental monetary policy has run up against reality. The reason is something simple to understand, and yet hard to believe:

central banks are running out of things to buy.

It's happening all over the world.

In Japan.

In Sweden.

In England.

There simply aren't enough bonds to sell to meet the central bank demand.

In the huge Eurozone the inability to find enough bonds to buy has created a bizarre feedback loop.

The European Central Bank may be buying bonds from itself as it runs out of debt to sate its massive quantitative easing program.

To put that another way, it's virtually the same as taking a dollar out of your left pocket and putting it into your right pocket.

Central bank QE has gotten so extreme that Bank of America's Barnaby Martin calculates "around 45% of the global fixed income market is now “compromised” by central bank buying."

Consider that nearly half of the bond buyers in the world don't care about price, because they print money out of nothing.

This immense, unprecedented, asset buying binge has created distortions in markets all over the globe.

They have managed to push a mind-boggling amount of bonds into negative yield.

The value of negative-yielding bonds swelled to $13.4tn this week, as negative interest rates and central bank bond buying ripple through the debt market.

“It’s surreal,” said Gregory Peters, senior investment officer at Prudential Fixed Income. “It’s clear that central banks are dominating markets. There’s a race to the bottom. Central banks are the main drivers of this, it’s not fundamental.”

The lack of fundamentals is the most alarming point.

It also means, that the markets lack economic fundamentals by definition. It's a condition that prompted the WSJ to say, "One answer to these disparities is that the markets have become so distorted by central bank activity that they are no longer transmitting very useful information about the economy at all."

Say goodbye to "market efficiency". People now mostly trade based on what they think the central banks will do next.

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back”

- John Maynard Keynes

Let's consider for a moment the $13.4 Trillion number.

Already a third of all sovereign debt yields a negative interest rate. That means that investors are effectively paying governments to lend to them.

In spite of global central banks rewriting the rules for the global markets, they've been unable to create sustainable growth or inflation. This has left them trapped.

"The problem is rising debt and monetary easing comes with many collateral effects. One is the distortion of asset prices, leading to asset bubbles," Gallo explained on his website.

"Asset price distortion also has a ripple effect on wealth distribution, increasing inequality by benefitting the already-wealthy who are more likely to hold financial assets. Over time, low rates and QE can also encourage misallocation of resources to leverage-sensitive sectors, including real estate and construction."

With the global credit markets hopelessly distorted, you might think that central bankers would take a moment and contemplate the situation. Instead they are starting to dive into the equity markets, led by Japan again.

Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings.

Once again, instead of being discouraged by Japan's example, the ECB is ready to follow.

The European Central Bank could run out of eligible bonds for its 1.7 trillion euro bond-buying scheme, meaning alternative options are on the table should it decide to loosen policy further to lift growth and inflation across the bloc.

Analysts say these could include large-scale share buying, a policy that the BOJ has already adopted after it started purchasing equity exchange traded funds (ETFs) for its own quantitative easing scheme six years ago.

All the major global central banks are buying up financial assets to the point that global liquidity is drying up. In other words, the central banks are becoming the markets.

Which means that it is unlikely that the central banks will ever be able to sell those assets.

Tiny Switzerland is setting the pace for Europe.

Switzerland’s central bank now owns more publicly-traded shares in Facebook than Mark Zuckerberg, part of a mushrooming stock portfolio that is likely to grow yet further.

It is now the world’s eighth-biggest public investor, data from the Official Monetary and Financial Institutions Forum show....In the last 12 months the SNB’s equity holdings have surged 41 percent to around 127 billion francs, according to Reuters calculations.

Forget the economic questions of this trend.

Has anyone considered the moral and political consequences of having a central bank control basically all the financial assets of a major nation?

Has anyone considered the moral and political consequences of having a central banks control basically all the financial assets of every major nation?

How can this situation NOT lead to a government-corporate partnership in both the economy and the political system on a global scale?

Don't let yourself get distracted with sleight-of-hand arguments and rhetoric. When you buy stocks in a company, your personal interests and the companies interests become entwine. Why should governments buying stocks in companies be any different?

Has anyone really considered the implications here?

"The first stage of fascism should more appropriately be called Corporatism because it is a merger of State and corporate power"

--Benito Mussolini

As Nicholas Smith, an analyst at CLSA, recently pointed out, the "BOJ is partially nationalizing the Japanese stock market". Not one company, or even one industry, but nationalizing an entire market.

That's a radical step, and its happening all over the globe.

The United States is different though. We haven't nationalized an entire industry.

No one would dream of doing something like that. Right?

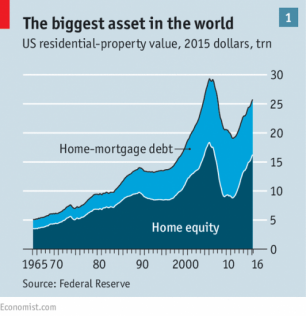

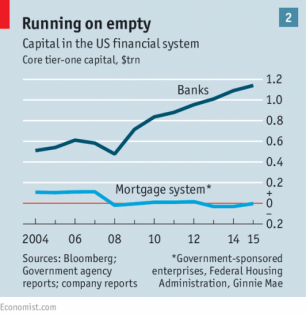

The trouble is that, in America, the banks are only part of the picture. There is a huge, parallel structure that exists outside the banks and which creates almost as much credit as they do: the mortgage system. In stark contrast to the banks it is very badly capitalised (see chart 2). It is also barely profitable, largely nationalised and subject to administrative control.

That matters. At $26 trillion America’s housing stock is the largest asset class in the world, worth a little more than the country’s stockmarket. America’s mortgage-finance system, with $11 trillion of debt, is probably the biggest concentration of financial risk to be found anywhere....

The strange path the mortgage machine has taken has implications for ordinary people, as well as for financiers. The supply of mortgages in America has an air of distinctly socialist command-and-control about it. Some 65-80% of all new home loans are repackaged by organs of the state. The structure of these loans, their volume and the risks they entail are controlled not by markets but by administrative fiat.

One week before Lehman Brothers failed, Fannie Mae and Freddie Mac failed, an event that most likely pushed Lehman Brothers over the edge. The resulting $189 billion taxpayer bailout is still the largest in American history. No executive at Fannie and Freddie was punished.

Yet eight years later Fannie and Freddie still dominate the mortgage market, still unreformed. Why is that?

The GSEs themselves have not demonstrated any serious interest in significant reforms. They continue to impose guarantee fees and price adjustments far in excess of real credit risk. Since profits go straight to the Treasury, the GSEs have no incentive to control costs. To the contrary, expenses have increased by more than $1.1 billion, or 36 percent, since 2012.

On the other side of the coin, the government is fully aware that it is in the mortgage business, and thus will do whatever it takes to make sure the real estate market stays afloat.

No one is keen to make transparent the subsidies and dangers involved, the risks of which are in effect borne by taxpayers. But an analysis by The Economist suggests that the subsidy for housing debt is running at about $150 billion a year, or roughly 1% of GDP. A crisis as bad as last time would cost taxpayers 2-4% of GDP, not far off the bail-out of the banks in 2008-12.

Of course this isn't the only way that public-private/government-corporate partnerships are happening.

The oldest and most popular method is the sovereign wealth fund. On a global scale they control well over $7 Trillion in assets and have access to $20 Trillion more.

Many of these funds are under control of their central banks.

What we are witnessing is what The Economist called The rise of state capitalism. Also known in many circles as crony capitalism.

And everywhere state capitalism favours well-connected insiders over innovative outsiders.

The Economist only criticizes the economics of the system. My concern is the politics of the system.

What happens if the public opposes and protests the system? More importantly, what happens when the system starts to break down, like it is now? What interests of the public will the governments sacrifice to protect their fiefdoms?

Comments

This is the companion essay

to this one I wrote two weeks ago.

Might as well have

been written in greek. Or is it Greek? Not to blame the author. Hardly. But, most of us are clueless about "central banks" and The Fed and... and... and most anything to do with "The Economy."

Here's the simple way to cure what ails The Economy™ (in my uneducated opinion)...

Pay workers. Hire more workers. Done.

Most companies do not have enough employees to keep their business going. They run on a skeleton crew - and their business looks it. Looks like hell. Wally World? I'm looking at you. But, you ain't nearly alone.

Pay workers $12 an hour. Minimum. With $15 an hour 3, 4 years down the road.

The days of paying workers $10 an hour are bull$h!t. And should be over.

More money in peoples pockets means more money circulating in The Economy™.

More money circulating in The Economy™ creates "economic activity."

(as opposed to negative economic activity today).

And, "economic activity" evenyually creates more jobs.

It's pretty simple.

Dump money into The Economy™- by paying workers more money - and that economy grows. On its own.

Take it away - Austerity - and it doesn't.

But RW asshats don't want Bottom Feeders enjoying a better life in an Economy™ they didn't create. Damn "takers!" So... no raise for them/ us!

What they didn't figure, apparently, is they eventually fuck themselves.

Somewhere it says you eventually reap what you sow. Karma's a bitch.

Welcome to Austerity, mofos!

Want more money in your pocket? Pay me more money.

Simple as that.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Your solution is not incompatible with Keynsean doctrine

I wrote an essay a while back that tries to explain some of the mumbo jumbo in common parlance. It's really not all that mysterious, but the financial industry has a vested interest in making it seem so. See The Big Short for further elaboration.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

His solution is the only one that makes any damned sense

the rest of this shit is highway robbery. We're literally being robbed--when I say "we", I mean "entire sovereign nations".

Who is going to stop it? Why don't we ask someone who is FILTHY RICH and get them on the record? Like, someone named Rothschild, maybe. One of them seems to be quite chummy with Hillary Clinton, apparently...

Thanks! This needs to

be run in every senior H.S. class and every economics 101 college course. What kills "our" Economy™ as much as anything is most of us buying into it without questioning it. An entire generation has grown up under Reaganomics. They know no other system, including the system before Reagan. Before Trickle Down b.s. So, the under 40 crowd looks at Boomers talking about the good ol' days and believe we're blowing smoke or still smoking something. They see no evidence of a time when workers actually got by using collective bargaining, of a time when the corporates actually paid their taxes (including a chunk going towards the local public schools). They only see corporate greed and the results thereof. But there was an America, before Reagan, when the avg. Joe Blow worker could work an entry level job (or McJob, even) and take home enough pay on Friday to pay the rent and still go bowling, enjoy a beer or three. I know! Who knew? It's been a long time since those days, and an entire generation missed it.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

also keep in mind ...

... people of that age have never seen a functioning government. Much becomes clearer.

nice job

difficult to comprehend as the oligarchy wants it to be.....perfect example of a complex self organizing system using human agents to make "decisions".

An idea is not responsible for who happens to be carrying it at the time. It stands or it falls on its own merits.

To take your last point first, the Economist is not leveling

with its readers because markets are creations of the state and can't exist without state support. There is no "economics" - there is, and always has been under capitalism, political economy and those with the wealth are usually able to move governments in the direction that will benefit them.

The central banks started buying bonds because those who control the political economy were besotted by the foolishness of austerity as a response to a crisis induced by the financial industry. Governments would not respond with even a Keynesian fiscal policy and the central banks, which have only monetary policy to work with, did what they could to keep a semblance of stability. The result has been to inflate the price of stocks and many financial instruments while helping to ensure that wages are suppressed and increases in productivity are captured by the 1% and not the 99%. Also important is to keep a large number of workers unemployed and underemployed to keep the precariousness of employment in workers' minds.

As for the notion that innovation has been displaced by the large firms, this doesn't give a true picture because large transnational corporation spend a large part of their excess profits in buying smaller firms and milking them for ideas.

Why are corporations headquartered in the global north able to supplant local capitalists in the global south when the local businesses are more attuned to what their areas need and want? The answer in my view is that intervention and threats of intervention allow them to exercise imperial power when they feel it will benefit them. Only 8% of the jobs in the USA are manufacturing jobs these days. It's a testament to the clout of global capital that it is able to have its tentacles reach worldwide and exploit the wage differentials (that are rapidly narrowing).

Monopoly capital tends to stagnation - secular stagnation - and lacking investment opportunities in productive enterprise has forced the capitalists into the financialization of the system which, though profitable, is unproductive and is suited for transferring wealth from the middle and lower income groups to those who control the corporations.

Thanks for this fine essay - I hope to digest it soon and no doubt will learn somethings - as I usually do from you - and maybe find out some of what I've written here needs correcting. This is top information and needs serious thought.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Outstanding reply, as usual, duckpin. Thank you.

Thank you HW. How different, and better in my view, if FDR had

kept Henry Wallace as Vice President instead of replacing him with Harry Truman.

Wallace was an environmentalist; pro-peace in a post WW2 world; an ardent advocate of desegregation; and fully supportive of FDR's Workers Bill of Rights. Often the right person in the right place makes a lasting difference and this unwarranted change at #2 made a huge, and hugely negative, difference.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

I hope the economy crashes after Nov 7

The crash seems inevitable.

Am I wrong?

The political revolution continues

One side effect to your unpleasant facts, gjohnsit:

The facts you bring up, unpleasant as they may be (and are) have an effect that needs to be discussed:

MMT is pure crap.

The maximum value of any particular piece of currency is the sum total value of the issuing nation's economy divided by the number of pieces of that currency in existence. This is a law of nature, no more subject to any form of human "sovereignty" than the law of gravity is.

When central banks create ginormous amounts of currency and plumb it straight into the financial system with no intervening real-world economic involvement such as government spending would provide, the value of that currency tends to become what its real-world involvement is: zero. When the liquidity is injected via government spending programs, the money actually acquires meaning and value by way of being involved in the real economy (read: non-FIRE); witness the inflation of the US Dollar between defacto de-metallization in the 1960s (end of precious metal circulating coinage) and the Clinton Administration (1993 - 2001).

Therefore, it is not only possible, but easy, for a supposedly "currency sovereign" government to run out of meaningful money. "But Zimbabwe" indeed! (Or "But Weimar Germany 1928", for that matter!)

Even Bitcoin needs to have some inherent controls on issuance of new Bitcoins. The Bitcoin "mining" process was designed to insure this control would continue to exist (although it will eventually force Bitcoins to deflate out of existence unless the current system is eventually fixed).

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

boy, you're gonna get some push-back on that.

my opinion differs from yours mainly in a couple of particulars.

for example, i would not say that MMT is "pure" crap, quite the contrary, it is a very diligently reformulated and adulterated crap, such that is very difficult to pin down the exact nature of its crap content.

similarly, i'm not sure your formula for the inherent value of the currency ("value of economy"/"total quantity of currency") really holds up to scrutiny, not least because i cannot even define "total value of the economy". at any rate, curious phenomena like the velocity of money come into play ...

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

definitions

Actually, it's moderately easy to determine the size of an economy at any given time. Were that not so, it would be impossible to render oranges-to-oranges comparisons using "constant money" over time. For a smaller-scale example, in order to compare the actual debt load of modern Millennials to the debt load I would have faced had I been able to borrow enough cash to stay in school, I render "constant money" by comparing the price of commercial shelter rent between now and then. The result is that today's dollar comes out to effectively 25 - 40 cents in 1977 money; the 12 - 15 thousand dollars I would have ended up owing in 1980 has pretty much the same value as the roughly 40,000 dollars a typical Millennial owes on a new Bachelor's degree.

Also, when all dollars had to come out of the ground before they became dollars (at least in theory), we could count on each dollar having at least some minimum value, because it cost something to create each one. Hence, the parallel to the Bitcoin world, where the actual physical cost of maintaining the Bitcoin blockchain (which is substantial) does for Bitcoin what the cost of mining and milling precious metals used to do for the dollar.

Bottom line: you can either have an unlimited supply of money at the cost of it being nearly worthless or you can have a finite supply of money which actually has value. Remember, John Maynard Keynes advocated governments borrow and spend the latter sort of money, not play with the former sort. He was alive and an adult during the Weimar hyperinflation, and he would instantly recognize the Zimbabwean and Venezuelan hyperinflations as the same thing,

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

OK, after however many years of austerity

probably the last thing I am afraid of right now is the Weimer hyperinflation.

Bottom line: you can either have an unlimited supply of money at the cost of it being nearly worthless or you can have a finite supply of money which actually has value.

And yet, the bankers seem to have a near-unlimited supply of money, and it sure as shit isn't worthless. Prices are high, yes, but a much greater problem is that wages/salaries are low. I don't see a situation with tons of people having tons of money and the cost of goods and services being through the roof. I'm not having to pay 60,000 dollars for a hotdog--I'm not like an Italian from the 80s or something.

Not to be rude, but why the hell would I be running scared from Weimer now, when people running scared from Weimer have essentially been running our economy into the ground for years? This feels like the economic version of talking about McGovern.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

and that's, I think,

what the MMTers would say. Running scared of hyperinflation is precisely the wrong thing to do. Central banks can create all the money they want, but unless people want / can afford to borrow it to do things, it has no effect on the real economy.

Well, but ...

... it is impossible to do this. Economists do their best, which they know in their hearts is hopelessly inadequate, and then foist the results on the rest of us, because if they admitted just how inadequate their techniques are, nobody would give them the time of day, nevermind the keys to the kingdom.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Re: Inflation

Whenever I hear of observers wringing their hands over inflation, I like to point out a few things about the topic that most people aren't aware of.

Whether or not a depreciating asset (like paper money in an inflationary environment) really has any 'value' depends on what is happening in the real economy at such times. If people continue to accept fiat money for payment, and continue to be able to offer it to others for real goods and services, then it has value, period.

The only thing that matters in these discussions is what happens in the real economy when inflation is driving economic transactions. If everybody is working and producing things of value and trading what they have for things they don't have, then an economy simply can't do any better.

If that is happening at the same time that robust levels of price inflation are occurring, there there really is no problem whatsoever, no matter how much savers might be disappointed in fact that their money accumulations are gradually depreciating.

It is also important to note that, contrary to popular perceptions, inflation is not some kind of mysterious ‘effect’ that spreads out evenly over all of the economy’s participants, like a rising tide. The actual truth is that members of different income brackets can---and do---experience different rates of inflation.

It is indeed quite possible for the members of one income bracket to experience a period of high inflation at the same time that another income group is experiencing low inflation, disinflation, or even deflation.

Something very close to that is precisely what has been happening in America over the past 35 years or so. During this period, the income tax’s top rates were reduced in the 1980’s and again in 2001 & 2003. This simply threw large amounts of disposable dollars at all rich people, which they then threw at the asset markets, setting off a very robust level of inflation within the upper class.

At the same time, working class incomes were being squeezed by outsourcing, de-unionization, and the exporting of good-paying jobs to China and other low wage countries. This generated the very low levels of inflation that we've seen in the CPI.

You see, rich people don't really mind inflation, as long as it is occurring within their own class, and not in the class that generally represents their costs.

A final point, it is important to understand that inflation is always and everywhere harmless when it comes to its impact on the purchasing power of most of those who endure it.

Yes, prices are always going up, but disposable incomes are also going up at the same time, enough to cover the higher prices being charged. We know this because, if they weren't going up sufficiently, the price increases would not occur, but would begin to drop, instead.

So even though nominal gains during a period of inflation do not necessarily mean that any real gains are being made (that depends on what's happening to the real economy), it is also generally true that no one loses during periods of inflation, at least in terms of purchasing power. (The one notable exception that everyone always points out---those on fixed incomes---is ridiculously easy to fix.)

Inflation just isn't the bogeyman that a lot of casual observers believe it is.

Having said all that, I tend to agree with you that MMT is not the ideal solution that so many of its adherents seem to believe it is.

James Kroeger

If your MMT non sequitur were valid

then we would surely already expect the currencies involved to be worthless, and massive inflation to be obvious, such that real items cost large amounts of currency. This is clearly not the case. We don't need shopping carts full of currency to buy a loaf of bread.

Your 'law' of nature is also intriguing, but remains an unsupported assertion hiding behind the tautological expression 'value of the economy'. The value of the economy is the consensus of what those trading currency believe it to be at any moment.

Nope.

This isn't happening because the wealthy are not turning the money loose into the general economy. Indeed, they quite clearly don't know what the hell to do with it all -- though, per gjohnsit's analysis, one thing that they're doing in running up stock prices. Effectively, we have at least two almost-orthogonal economies in play.

Another thing that the wealthy are doing with some of that money is buying up residential real estate, to be rented back out to the proles at inflationary rates.

As long as they keep all of that quantitative easing to themselves, we'll see rising prices in only a few realms of consumer spending, as average consumers won't have any more money than before. Some things -- like tuition at top-tier public universities -- will continue to rise, as the elites will pay ever higher rates while simultaneously cutting public subsidies; the result will be to effectively exclude 95% of students from those institutions (UIUC is already unaffordable for most Illinois residents).

In the long run, all of those trillions of dollars of issued credit will demand to be served --and the people holding those trillions of dollars of issued credit will be competing with each other in order to buy everything that has a price attached to it. I leave it to your speculation to explain what is probable and improbable in that circumstance.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Not pure crap.

Though I agree with you about putting money in the real economy, I don't know why you're taking it out on MMT. The fact is, we're in an MMT system right now in the sense of a few years ago they invented 16 trillion out of their asses to save themselves. Where we aren't in an MMT system is in the sense of the banks get to invent the money, not the governments, and then they get to lend that money to governments and others and charge people and institutions for the privilege of using the thing they just magicked out of their ass. And to put the cherry on the top of this shit sundae, we're spending all that Magically Created (But Only By Bankers, You Plebe) Money on all the wrong things, which is the source of the problem--assuming you want the world to remain capitalist at all, which I'm no longer sure is a good idea. But if you DO want the world to remain capitalist, vampire squid capitalism ain't gonna cut it, chickie-boo--Y'all need functioning real economies.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Why are we, the U.S., not the 99% not investing in its people?

As is beautifully detailed in this essay, Central Bank meddling just inflates currency without any impact on production, economies of scale, and only short-term enhancement of new ideas (innovation). I get that. What I don't understand is why "the Smart People" don't realized that we are on a monetary path to nowhere? Please enlighten me as to the rationale for this elitist idiocy--seriously, how can this be happening?

I have an answer to that

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back”

- John Maynard Keynes

Your point is well-made, just as in the essay.

I just needed it to be pounded into my head one more time.

Also, it's not up to central banks

to take the money they create and spend it in the economy. That's up to you and I, and governments spending money on our behalf. The Fed did their job. It's the fiscal side where action is lacking, for a variety of reasons.

The short, fair answer?

"Morality". Those 'smart' believe that the 1% earned their money and deserve it. The other 99%? Lazy and undeserving. Never mind that the statement is nonsensical from a purely mathematical standpoint. It's how they look at themselves in the mirror, I guess. It also helps that all of those 'smart' people are making money off the deal.

Democrats, we tried to warn you. How is that guilt and shame working out?

I don't usually pimp my past essays, but

this one was up before most folks came to caucus99. It gets at the morality you're describing. Check out the similarity between Randian thought and apocalyptic Christian thought:

http://caucus99percent.com/content/very-long-way-galts-gulch

In fact, I'm gonna see if I can re-publish it; think it's actually relevant to now.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Those in control of the world's largest corporations, which do

not have meaningful competition, don't want to invest in the USA when countries with cheaper labor and no environmental laws are available. When corporations are in this position - that of administering prices rather than having prices established through competition - they can be said to be monopolies. This does not mean that there is only one entity in a certain area of commerce, it means that there is no meaningful market(in the old sense of competing through prices of goods) and that these global corporations can act without risk(other than a political risk).

Japan has 16% of its workforce in manufacturing jobs; Germany has 19% of its workforce in manufacturing. The USA is down to 8% since 57,000 factories have been closed due to NAFTA, CAFTA, and other pacts. Japan and Germany are supporting their manufacturing sectors, the USA under Clinton, Bush and Obama are not.

As an aside, monopoly capital often does not invest in factories abroad - they work through contractors who build and own the factories and hire(or enslave) the workers. So when Vietnam returns less profit than, say, Burma, then the global capitalists will move to Burma and leave the contractor to deal with his own empty factory and the state to deal with the unemployed workers.

Not only products flow from south to north but the profits also flow from south to north leaving the exploited regions poorer than before. Capital moves in an instant; starving unemployed workers don't move that fast if they are allowed to move at all.

The "smart people" are beholden to the rich people and the rich people are getting richer and richer under this system.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Into the shadowlands we go...

Into the shadowlands we go... There be dragons there!

Asset Price Distortion and Inflation... What's the Difference?

Let me guess.

"Asset price distortion" doesn't lead to reduced returns on extended credit while "inflation" does?

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

Nationalized Like the ACA --

Sounds like it's nationalized like the ACA or like Fannie Mae with that "capitalistic socialism", you know, privatize the profits and socialize the losses? Putting government, and it's people's pocketbooks, on equal footing and in the same boat with global conglomerates and financial markets.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

nope

Nationalization means actually owning the industry.

ACA just mandates participation and subsidizes it.

Big difference

Is the BoJ an Institution Like Fannie Mae or the FED, or is it

like an actual institution of Government?

My short surf didn't yield any clear results, but it did lead to clear delineation of Japanese public policy and the BoJ.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

Is it Really State Capitalism or is it Capitalistic Socialism?

I guess it depends on who is running the show and whom the show is trying to entertain...

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

good question

I wouldn't use the term "socialism". But what is it?

It's Socialism For the Capitalists...

I mean, you can't expect a capitalist to be on it all the time -- to be successful all the time.

We really need a padded landing for our "job creators", because what happens when they miss the hurdle?

Are we supposed to completely stop the race? Life is a fast moving river and there ain't no stopping it. Maybe we could slow it down a bit with some collective responsibility.

Socialism for the capitalist, for the good of the Nation.

ACA -- QED.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

It's corporatism, aka fascism.

Like I think you said?

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Corporations are People Too, My Friend... ;-) nt

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

why not? The mortgage market / Fannie Mae

... IS essentially socialism.

All Wars Are Banksters Wars!

[video:https://www.youtube.com/watch?v=5hfEBupAeo4 width:640 height:480]

Thanks for the essay. This monetary stuff makes my brain hurt.

It seems that the safest place to put your cash is in your mattress.

"Those who make peaceful revolution impossible will make violent revolution inevitable." - JFK | "The more I see of the moneyed peoples, the more I understand the guillotine." - G. B. Shaw Bernie/Tulsi 2020

unfortunately it's become important

Regular people shouldn't have to worry about this stuff

ironically, that would make things worse ...

... because the contents of your bank account in part determine how much money your bank can loan to others to grow the real economy.

I think the scariest thing in that diagram...

Is the productivity section. QE is supposed to spur investment and get money flowing - and lead to hiring and productivity gains. It has the exact opposite effect. I have often said that lower taxes also has the same effect - it leads to MORE greed and MORE hoarding and MORE cost cutting. Having the exact opposite effect that is advocated by the Neolibs. The central banks would be more successful if they just printed money, went into lower class neighborhoods and dropped it from helicopters. Instead, we get state governments and the federal government cutting food stamps - which have been shown to have an 8 for 1 stimulus margin. The scary thing is - I saw the last collapse coming and I was able to manage my assets. I have no fucking clue what to do now.

Democrats, we tried to warn you. How is that guilt and shame working out?

I'm feeling you

It shouldn't be this hard.

They've screwed tthe pooch and regular people will pay for it.

Saw it in '07, too. Now though...

I keep watching these numbers and it simply makes no sense. As far as I can tell, the '07-08 depression has not only continued, but it seems as though the banks are simply kicking the can down the road to the umpteenth-zillion power. We can see trouble coming, but this time even the end result is not so clear, not to mention what the average John and Jane can possibly do to protect ourselves and our families. Maybe I shouldn't even say, "... this time." It's never really ended.

As we went into 2007, the danger signs were there and I heeded them. People thought I was nuts. I wasn't nuts, as my detractors found. Many - no, most - of my coworkers and friends lost at least 60% of their retirement funds; a fair number lost close to 80%. A few lost their homes. I took some losses, but nothing like that. Since 2008, most have claimed they've made it back, but damn few have come close to making it all back. Not many understand how badly they were fleeced.

Now, it appears to be shearing time once more. I know they're coming with the shears, but I'm short on ideas on how to save our butts. Perhaps the best thinking is to realize that the '07-08 depression has not ended. Going into bonds doesn't seem to be an escape however.

This is basically what Stein is advocating

Buying up all outstanding student debt via QE would do exactly this.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

QE was only ever meant to save the banks

Had TARP gone to the people instead of the banks the money would've flowed thru the banks eventually but the banks got greedy and wanted it all for themselves rather than have the people get their hands on it.

Like you I haven't a clue what happens next, but I believe only a reset or

debt jubilee solves the problem now. My best guess is to own some physical PM's.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Wouldn't this eventually have a deflationary effect?

For the moment the Central banks can push money back into the economy via buying more bonds and stocks, when they run out of things to buy, or it becomes politically unsustainable... What happens to all of those interest payments/dividends, how do they keep money flowing back into the economy at that point given the practical devotion to the economic austerity religion most governments hold themselves to?

Or what happens when they start selling their holdings off, If ever such a thing becomes possible.

Impossible to sell?

I'm thinking the same thing, luminous. How can you possibly sell the stuff? ...except to another bank? It's Ponzi of the money gods or something. Insane.

The Buck Stops Where? We, the People, Will Be on the Hook.nt

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

My bet is deflation comes first

This massive market price distortion is causing investors to search for yield by overpaying in stupid places (junk bonds, emerging markets, subprime, etc.)

In Wall Street parlance its called "picking up nickels in front of a bulldozer."

Eventually one or more of these are going to implode, which means a huge destruction of money - deflation.

After that...????

After that there will be political decisions made.

Clearly Europe shows the deflation aspect of it,...

I am watching for further deflation in Europe, if savings their keep going further negative, I image the slow moving bank run their will turn into something less slow.

Price deflation/inflation rate will likely stay behind the currency deflation rate as is also happening in Europe, Prices will be kept sticky by interest on bonds issued prior to negative rates, The un inflation adjusted costs of that debt will stay the same even as deflation increases the burden of those same dollar/euro amount bonds.

I am very curious if its possible for a currency to deflate into value-less-ness.

As far as I know in modern economic history their has never been a deflation crisis.

I wonder what tools would a central bank/government even have in theory. Mass debt forgiveness would be a double edged heri keri knife, Even interest rate adjustments to that debt would be a massively problematic issue. When they run out of debt/stocks to buy the majority of the market will still be privately held, And I can't image that forgiving just corporate bonds or even beyond that, just the ones held by the central bank would be a sane political stunt to pull, that is the stuff of bloody revolutions. Even nationalizing the banks might not give them the room to pull that one.

It's capitalism all right.

They're still exploiting wage labor for the surplus. If it were feudalism, there would be direct appropriation of the surplus produced by peasants, rather than wage labor.

What type of capitalism we have today is another question.

"Our Left is out to lunch" -- Richard Wolff

I think gjohnsit thinks it's corporatism, aka fascism

But for me, it's hard to draw lines between corporatism/fascism, late-stage capitalism, disaster capitalism, crony capitalism, straight-up corruption....

[video:https://www.youtube.com/watch?v=zZ3fjQa5Hls]

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Corporatism is capitalism --

and thus just as susceptible to class struggle as any other form of capitalism. I am not interested in libertarian hokum about "true capitalism," in which the forces are ostensibly in perfect competition and the stars are aligned.

"Our Left is out to lunch" -- Richard Wolff

As an academic, I can see the obvious differences

between Gilded Age capitalism, New Deal/Keynesian capitalism, and the insane Suicide Capitalism we're involved in now (as well as the other versions of capitalism from earlier) There's obvious differences--legal, cultural, economic. That said, your point is well taken--capitalism has basically shown that, if it can take over government, it will, and that basically puts paid to any notion that capitalism can function as anything except, at best, a new kind of aristocracy, and at worst, a death cult.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

And They think WE Are Stupid?

I read somewhere once that economics students at come colleges used to play Monopoly and actually follow all the rules most of us ignore. It would take days to play a game, but the results had to have been very different in some respects. It should have, for instance, taken a whole lot longer for someone to have all the money and all the property.

I propose that all Economics majors MUST play in a Monopoly tournament, following ALL of the rules, and will be denied their degrees UNLESS they are the winner of their tournaments. This would severely reduce the number of incompetents who are destroying the economies we all need to survive.

Based on what they have produced -and I use that term very loosely- they have way too much idle time on their hands, so they turn to serving Balaam and causing bedlam.

Vowing To Oppose Everything Trump Attempts.

Real Monopoly games are fast

One of my kids is fascinated by Monopoly so I've played a lot of it. The reason most games take so long is that people naturally modify the rules to be less brutal. If you follow the rules exactly (housing shortages, 10% mortgage repayments, no free parking money, etc.) a game of 3-4 players usually takes an hour. About the same as Catan really (another interesting that economics game, but one that requires a strange mix of competition and cooperation).

The real back story on Monopoly was the subject of the recent book The Monopolists which it documented how the original game was a tool designed to teach a progressive 19th century tax system ("single tax"). It then got stolen by Darrow and sold to Parker Brothers, even though The Landlords Game was patented and college students had been playing the derived Monopoly game for decades (Darrow even stole the misspelling of Marven Gardens...) PB then spent 50 years trying to bury the truth until a counter-lawsuit dragged the whole stinking carcass out into the light.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

I was given the recent reissue of Anti-Monopoly

(of which i think there have been at least 2 and perhaps more completely different games from different creators).

In this game, each player chooses whether to play as a competitor or as a monopolist. The rules for each are type are significantly different; most significantly, competitors can build a house on any property they own, regardless of who owns other properties in the same color group, BUT the rents they receive are MUCH lower than what the monopolists receive (fixed at 10% of the cost of the property plus the improvements, so there isn't that killer jump that monopolists get with a 3rd house).

What's interesting is that, due to a couple of seemingly minor design elements, money is in constant short supply, particularly for the competitors. Basically, they end up paying lots and lots of taxes, which strangles their ability to improve their properties. I strongly suspect the game designer was of libertarian ideology.

BTW, playing Monopoly "to the rules" can take longer than you suppose, because there are very few things that rules explicitly prohibit. Tournament Monopoly often involves a wide range of rather byzantine deals between players.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Uh...THEY'RE trapped?

In spite of global central banks rewriting the rules for the global markets, they've been unable to create sustainable growth or inflation. This has left them trapped.

OK, I'm no economist, and I know far less than you about these things. But wouldn't one way of creating inflation and growth be to SPEND money, through a series of new New Deals around the globe, and put money into the real economies of the world and into the pockets of tens of millions of people who would then SPEND MORE MONEY?

OK, now tell me why that's the wrong answer. Fire away.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

THEY aren't trapped.

We are trapped. Of course a series of New Deals would do a lot of good. But a New Deal requires fiscal policy, government spending. The people we elect, including a lot of Democrats, are wedded to austerity. (The Democrats may be a little less wedded, but are unwilling to undertake the expenditures on the necessary scale even if the Republicans would let them.)

Central banks do monetary policy. They've worked out a scheme where the money they create when they buy paper from banks stays in the finance sector. In my opinion the huge amounts of new money sloshing around the financial sector have resulted in overvalued stocks and bonds. Meanwhile ordinary investors (You can't be a saver with negative real interest rates. We need a pithy term for letting someone charge you to hold your money.) buy overvalued stocks, overvalued bonds, or short duration credit with virtually no interest or negative interest.

A number of economists including Jamie Galbraith, Stiglitz, and Krugman before he entered the tank, have suggested ways that monetary policy could be used to get newly created money out of the financial sector. Dramatic interest rate cuts on student loans and cram downs where mortgage holders were forced to reduce principal come to mind. Central banks would come closer to using monetary policy as an alternative to fiscal policy.

But hey, do you really want to encourage the lower 99%. If they deserved it they'd be in the 1%.

I Think Creating Inflation is Mechanically Simple. Ideologically

it's a bit more complex.

Are the wealthy after money or power? If it's just money, then inflation would be the smart play. It's not about money, though. Big Corporate & the Oligarchs are into Power -- money is just a tool.

I really wish Big Corporate & the Oligarchs were just into making money. It would make things so much easier.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

The central banks don't spend the money

When I say "trapped" I mean unable to exit QE (see the chart above).

This is why there is talk about helicopter money. When that eventuality gets closer I'll write about it.

OK, I could have sworn you quoted Mussolini's

definition of fascism. I must be hallucinating.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Great essay, explains a lot

There are a few mysteries in the current economy. First is the ridiculous market cap, given a moribund economy and demographics favoring a large correction. Clearly the Fed has been putting large capital sums into investments in bonds and indirectly into stocks with zero interest rates and QE. This is a one way street, as it's unsustainable and eventually creates an enormous stress on the market for a massive correction.

Second, is the question of why we don't have inflation with the Fed creating so much money out of thin air. Clearly their perception is that it is OK because they are buying something of value, that is, bonds, or in the case of loans they are secured by something, if not directly then by the corporations themselves. If you follow the money, though, you find that it eventually pours into the cash-out spigot of the markets, and that's the oligarchs and the petite-oligharchs income stream. So why doesn't it create inflation. That's because the economy is so moribund that it is incapable of creating buying pressure. Another way to look at this is that if you take out the cash infusion from the Fed that the economy has been in a depression since 2008.

And the third question is: what is the mechanism that finally leads to a massive correction? I think that the essay has the answer, the central banks run out of paper investments to infuse cash, after all this mechanism is a one way street.

What I hear from more and more rational thinkers is that the economy needs a reset badly. That there are structural problems and economic management problems that just will not go away. We really have to rethink how we put a saddle on the thing called Capitalism. The free market cannot function without the government setting rules and creating mechanisms that make is productive and stable. To me, that includes Glass-Steagall and a highly progressive income tax. If the market can't come up with a fair distribution of income then the only choice is for government to compensate.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Great comment

In general I agree with you. But we don't have general inflation because the money central banks create stays in the financial sector. We have asset inflation.

It took me a long time to figure this one out

I eventually realized that QE wasn't creating "money" per se. QE was creating "credit", which looks like money but doesn't act like it.

Does one need money if one has credit?

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

I'm a little surprised

that no one commented about how the mortgage industry in America had been nationalized, will stay nationalized, and how much of a danger it is to the economy.

But then hardly anyone noticed that Fannie and Freddie, trillion dollar companies, went under right before Lehman did.

It's like people have a blind spot.

For me--the distinction between the public and private sector

is extremely shaky right now. (The craziest version of this phenomenon is happening in national security.)

IOW, the government doesn't appear to me to be as separate from the private sector as it used to be. So the shock value--or any other value--of the government nationalizing something isn't the same as it used to be for me. I generally assume any nationalization is just one more kind of bailout--one more way that the "public" sector is funneling money toward the favorite business interests of rich financiers, so that they can continue their ridiculously risky behavior without consequences.

That is almost certainly way too reductive, but you can understand why it's a tempting form of intellectual laziness. Fundamentally, I no longer think of the government as having an independent existence, authority, or power. They look like the legal arm of some really unsavory business venture.

The nationalizing that I wish the government would do is not the nationalizing they have done, nor that they will do, and apparently they can nationalize a whole piece of the financial industry--more or less-without gaining any power whatsoever over the people who run the financial industry. It used to be that nationalizing was something that the government could threaten to do to an industry if it got too far out of line--Theodore Roosevelt famously threatened to do it to the steel industry--and what was implied was that the government, not the steel maganates/robber barons, would have control over it.

But are you saying that Wall St no longer has control over the mortgage industry? Isn't it more like the government is running it for them (and subsidizing it heavily?)

If so, it's not really shocking. If not, well, maybe that's surprising, but I'm sure that if they've taken over the mortgage industry, it's because Wall St wants them to.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Any and all:

"What interests of the public will the governments sacrifice to protect their fiefdoms?"

Orwell: Where's the omelette?