Warning! Paradigm Shift Ahead

Kozo Yamamoto, a new member of the cabinet of Japan's Prime Minister Shinzo Abe, made a statement on his first day that should give you an idea of just completely conventional neoclassical economics have failed.

"I think it might be necessary to encourage a discussion throughout all ministries about a wage target policy," Yamamoto told reporters in Tokyo on Thursday morning.

Since NeoKeynesianism failed in the 70's, central banks have targeted the money supply, money velocity, inflation, and all sorts of other measurements, but never people's wages.

According to neoclassical economics, rising wages are "bad" because they reduce "competitiveness". Kozo Yamamoto is telling his peers that they have it backwards.

In pushing the notion of targeting specific increases in wages, Yamamoto, 67, is taking on one the key failings of Abenomics to date. Stagnation in wages is holding back household spending in Japan and undercutting efforts to generate the kind of steady gains in consumer prices needed for a healthy and expanding economy.

Coming out of the 2008 crash, economists all over the world freaked out over rising government deficits. This led to austerity in both the U.S. and Europe.

Now economists are having second thoughts.

According to JPMorgan’s Joseph Lupton, fiscal tightening has subtracted nearly half a point annualized from global GDP growth for the last five years.

Yet Lupton is joined by other economists in an expectation that fiscal policy will provide a boost to GDP growth this year.

“This would mark the first time in seven years that fiscal policy has bolstered growth,” Lupton said in a recent note.

“Given the strong private sector desire for savings and resulting record-low sovereign borrowing costs, the world has gone from needing a lender of last resort to needing a spend[er] of last resort,” he wrote.

So what has caused economists of the world to question their long-cherished beliefs? The utter failure of their policies.

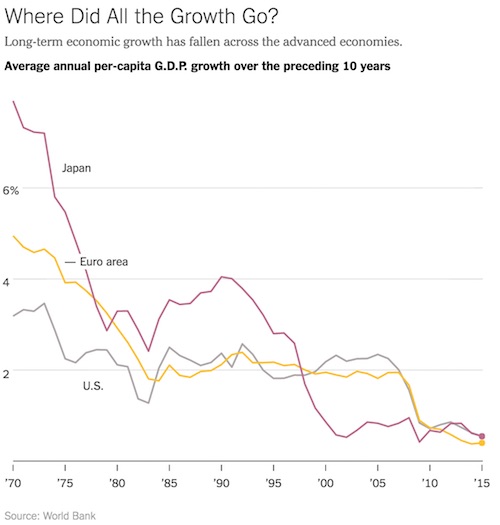

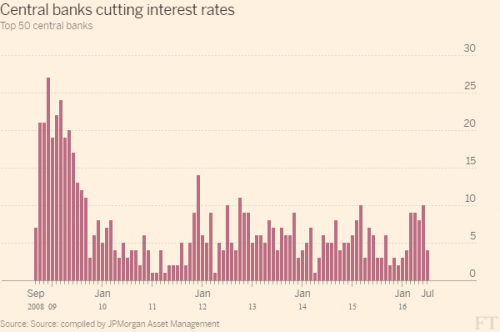

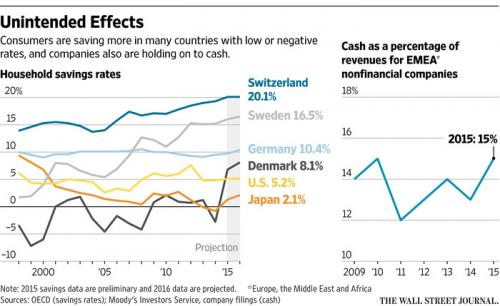

It isn't just the fact that global growth has stagnated on their watch. It's that lately the opposite of what they intend to happen is happening.

For instance, cutting interest rates is supposed to get people to borrow more and save less.

So what happened?

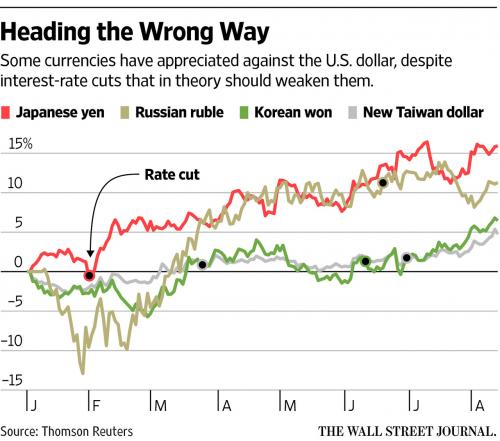

It isn't just consumers that aren't cooperating. It's also the most important market in the world - the currency market.

In theory, loosening monetary policy should lower a currency’s value. However, all this year the opposite has been happening.

The Reserve Bank of New Zealand became the latest victim of this phenomenon on Thursday. Despite a 0.25% cut in interest rates to a record low of 2%, the New Zealand dollar, also known as the kiwi, immediately strengthened to the highest levels in a month

It isn’t just the smaller economies in Asia: The Bank of Japan has had the same problem. A rate cut that took interest rates negative for some deposits at the start of the year has prompted a surge of yen buying and a 15.9% rally in the currency.

And globally, the same phenomenon is occurring. Rate cuts in Indonesia, Russia, Hungary, South Korea and Taiwan in the past year have all done little to weaken surging currencies.

Basically central bankers of the world are recognizing that they have no more bullets. Their economic theories are bankrupt.

The question is: what happens when investors wake up to this new reality?

the European Central Bank and the BOJ are reaching the limits of the policies they have used so far.

"Given the tools that they are using right now, which is negative rates and quantitative easing, those tools are reaching their limits,” Jaime said.

Comments

The world is slow to learn these lessons

Let's hope it chooses to take heed now and respond accordingly.

'What we are left with is an agency mandated to ensure transparency and disclosure that is actually working to keep the public in the dark' - Ann M. Ravel, former FEC member

love this, this makes me smile

Love your work explaining complex economics to us too gjohnsit. Keep it coming, please.

So what's the new

paradigm? I can't imagine Real Economies doing their job -- allowing communities to live decently -- without a Jubilee (wiping out debt), plus relegating all swaps and derivatives and maybe futures trading to the status of casinos. (With massive taxation at that.)

If think the winners of the current game would rather humanity and all of nature go up in flames before they willingly took that route.

Orwell: Where's the omelette?

yep. I don't expect

any paradigm shift in economic policy. Don't confuse them with the facts, Conservo Economists KNOW their policy is right - and will ride it out another 20 years to prove it. Besides... even if they're "wrong" they still win by turning communities into Detroit. "If only Libruls had followed our policies they wouldn't be living in the $h!tholes they're living in!"

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

The new paradigm

Is understanding that everyone in the world has a right to live. That providing the basics (food, shelter, healthcare, education) as a right to everyone on the planet creates a world where trust and cooperation can be built and war/terrorism becomes a bad dream of the past. The new economics revolves around how countries can create an international pool of resources from excess production from which other countries can draw to take care of their people. It is a world where sufficiency for everyone becomes more important that the mantra 'the one with the most toys wins'.

If I knew the answer

to your question I would soon be very wealthy.

Unfortunately, I don't know the answer. I only recognize that a significant change is upon us because this road is out of pavement.

How many years has Japan's economy been in the flusher?

I don't know, but my guess is that it is at least 20 years

When will the brilliant economists realize what has happened around the world

And by the way, now that the presidential race is about a couple of politicians, and the latest flaps, issues like poverty have gone away from main stream coverage

With the environment becoming less and less able to

sustain human life, the poor become more and more invisible, especially those not fit enough to be the working poor. Politicians mouths concern for "hard working" people, the "working poor" and the (snort) "middle class." The infirm due to disability or age, not so much, especially if said infirm are not military veterans, but even if they are.

It imploded early 1990s

"The present economic systems are crumbling. The Japanese economy has cracks in it; it will soon come to an end. It is clear now that pure capitalism has come to an end. It has no future whatsoever. The economy, education, the environment — everything — will be placed within the context of global social democracy in which everyone participates."

- The World Teacher Maitreya's analysis as relayed on March 6 1990 by an associate

We're still getting it wrong

High spending = low savings = high vulnerability = poverty and misery. Also, high consumption = greater wealth disparity = social dissolution, and most importantly ecological devastation.

The world's consumer/worker classes are trying to tell us something - that "growth" is counterproductive. We need low spending, high saving, negative growth. We just aren't listening, because that would mean rethinking too many things. The paradigm that needs to change is not how to manage capitalism, it is capitalism itself.

On to Biden since 1973

The term 'Capitalism' itself

was a scholarly invention, valid enough a view for someone trapped in the System of the day. But it's real name is 'Plunderism' and that game is 'take as much as you can safely get, by any means necessary.'

Orwell: Where's the omelette?

Well Regulated Capitalism

works just fine. For everyone. Alas... that's NOT the way real Ayn Rand capitalism is supposed to work. It's NOT supposed to benefit the workers, too. It's supposed to only benefit the "risk takers" at the expense of workers and consumers. "Risk Takers" reap the rewards while workers and consumers take it in the shorts.

Since Reagan (if not before) Repubs and their masters have been all about rolling back those "anti-business" regulations, if not totally erasing them from the books, retaking the profits they've lost since FDR. The Capitalistas have done a damn fine job! Cutting and slashing all those FDR / Dem regulations have put more money back in their portfolios - while keeping more money out of the pockets of their workers. American workers haven't gotten a real raise in 20 years - and if left up to the Capitalistas, will be another 20 years before they see another nickel.

Well regulated capitalism works just fine! The best system there is. The problem is the under 40 crowd has never experienced it. And that crowd grows bigger yearly.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Your savings comes from someone else spending.

We need to spend like crazy to save the planet, then we can talk about a 0 growth economy.

The planet is more important than money tokens.

If we were smart, we'd realize that savings (hoarding) makes sense when it comes to saving up the environment but not so much when it comes to saving up money tokens - which we create out of thin air and can always create more.

Interesting idea

Save the world by burying it in garbage.

Save the world by eating the seed corn.

(actually we might as well - Monsanto sterilized it anyway)

The gospel according to Saint Grasshopper.

On to Biden since 1973

We need low spending, high

You must've loved 2008. The Great Depression, even better. They fit exactly your prescription.

actually

I paid off my mortgage in 2004 and use a credit card once a year just to keep the bank off my back. Granted, I was very lucky to have kept my job, but other than that I barely noticed the Great Recession.

On to Biden since 1973

Again, however, your income (and thus savings)

comes from someone else spending.

Want to save an extra $10? Then someone has to spend an extra $10, either someone in the private sector by going into private bank debt or the government can go into $10 deficit.

You gotta begin by thinking about where your money originates from: Either from bank lending or government spending.

What are we facing then with flat interest rates

and a currency bounce from abroad? Are all currencies in some sort of deflationary spiral, a "race to the top", as it were (with none wanting that position)? For a few years now, I've wondered if the end game will be inflation or deflation.

"Obama promised transparency, but Assange is the one who brought it."

Inflation or Deflation?

I've wondered the same thing and have concluded that the "little guy's" assets and wages will deflate, but the things he needs (like food, medical, shelter) will inflate. One would think with all the quantitative easing by the Federal Reserve, there would be inflation. However, inflation has been low except in some products. Right now I think the Federal Reserve is just hoping to keep things stable, since there are so many underlying problems.

Fuggeddaboutit!

Want to look at Japan? Look at Shinzo Abe! That man is so corrupt, it is taking the Japanese emperor Akihito to stand against the rising militarism Abe stands for. Abe wants to resume picking up where Hirohito's Japan began, and run the same gangster scam, only this time under the US nuclear umbrella. TPP will be used to justify growing Japan's military and unleashing it from its Constitutional prohibition of going to war.

TPP: Bringing Pacific War II to an ocean near you. THAT is your paradigm shift.

edited for typos

Vowing To Oppose Everything Trump Attempts.

I can't figure "economics" out.

On bad news the stock market goes up. On good news the stock market goes down.

It had been my admittedly simplistic thinking that if consumers had more to spend, then more goods and services would be purchased. Because of the multiplier effect of having more money in circulation, not in megabanks, the economy would have productive growth to everyone's benefit, except perhaps the wealth-hoarders. Help me out on this one.

Middle Class is Shrinking & Poorer

The problem is that consumers don't have enough money to spend on goods and services because the middle class is shrinking. Also, the prices of necessities (food, medical, shelter, etc.) have increased, so people have less to spend. There are jobs, but many of them don't pay well anymore. Unions have declined and companies squeeze their employees so that their profits are greater.

"Marketplace calculated that the typical middle class life has gotten 30 percent more expensive in the past twenty years, and Pate says overall wages have been flat since the 1970s. She shared more of her thoughts on how our economy has changed fundamentally in the past several decades and what it means to have a disappearing middle class."

http://www.marketplace.org/2016/06/08/world/middle-class-less-money-and-...

K.P., thanks for the useful link

But it still doesn't help me understand this.

This illustrates the "fallacy of the commons" when applied to economic growth. I do not disagree that for each individual employer, fleecing their employees makes the company more profitable. But when this same unbridled capitalist mantra is applied by all (or most) companies, we get the continuing shrinkage of the middle class. Hence shrinking economic growth.

Each Man for Himself Doesn't Work

You are correct and that is why this unbridled capitalism could likely go the way of the dodo bird. I have seen various economists warn that a different economic theory is necessary since current economic principles are failing miserably. Going back to the era of progressive regulation and legislation would solve a lot of the problems, but the forces are strong to keep going in the wrong direction. It will be interesting to see if there are big changes after another financial bubble bursts.

The only regulation which

The only regulation which will be permitted under the off-shored corporate law to unanswerably rule under the TPP and other corporate coup 'trade agreements' will be involved corporations/billionaires, through 'trade court' corporate lawyers creating law, directly controlling The People to maximize their anticipated profits, for as long as The People survive and have anything to be drained of.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Exactly right.

More money in the pockets of workers and consumers puts that money directly back into The Economy,™ spurring more economic growth.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Stocks react to interest rates

more than to the economy.

Bad economic news means the Fed will cut rates. Maybe even more QE buying.

Good economic news means the opposite.

This is all very gloomy and distressing.

But here's a random question although important question: As a working person, where should one go to get reliable information on what to do with their meager retirement savings in a ROTH IRA trading account? or even if they have a small sum of cash, say around $10K. Buy gold? Keep it in US currency bank accounts? Buy Bit Coin? Dump all stocks? Where should a lay person go to get reliable financial investment information so that their life's savings is not deflated and wasted and defrauded away from them by the scheming wealthy powerful criminals?

Love is my religion.

I never got the logic of the elites firing their customers

and wondering why no one is buying their stuff. It's all a race to the bottom for consumers now. We HAVE to seek out the lowest price for everything we buy because our wages have fallen and we simply can't afford to shop brick and mortar retail anymore.

The real SparkyGump has passed. It was an honor being your human.

About those savings ...

I've just finished Michael Hudson's Killing the Host, a book I highly recommend. He says we're entering a period of Debt Deflation. He explains that, in national accounting, money used to pay down debt is counted as "savings." Every now and then some MSM shill will tell us that consumers are saving a lot and not spending. The truth is that 63% of Americans don't have enough actual savings to cover an unexpected $500 expense. Here's Hudson on Debt Deflation:

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.