News Dump Friday: $10 Trillion in Negative Yield Bonds

Submitted by gjohnsit on Fri, 06/03/2016 - 3:00pm

Negative-yielding government debt has risen above $10tn for the first time, enveloping an increasingly large part of the financial markets after being fuelled by central bank stimulus and a voracious investor appetite for sovereign paper.

The amount of sovereign debt trading with a sub-zero yield climbed 5 per cent in May from a month earlier to $10.4tn, buoyed by rising bond prices in Italy, Japan, Germany and France, according to rating agency Fitch.

The ascent of the negative yield, which first affected only the shortest maturing notes from highly rated sovereigns, has encompassed seven-year German Bunds and 10-year Japanese government bonds as both the European Central Bank and Bank of Japan have cut benchmark interest rates and launched bond-buying programmes.

...

Negative rates have not been confined to the sovereign debt market. Corporate bonds with a negative yield have climbed to $380bn, according to Tradeweb.

“You have central banks which have gone through the looking glass and gone through . . . zero that many people thought was unbreakable,” said Sameer Samana, a strategist with Wells Fargo Investment Institute.

U.S. is an island in a sea of negative

the US accounts for almost 60% of all positive yielding debt and 89% of the positive yielding debt which has a tenor less than 1YR (Figure 4). Also, US debt accounts for 74% of the positive yielding G10 debt in the 1 – 5YR sector.

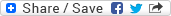

The probability of a recession occuring within the next 12 months has never been higher during the current economic recovery. This is according to the economists at JPMorgan.

"Our preferred macroeconomic indicator of the probability that a recession begins within 12 months has moved up from 30% on May 5 to 34% last week to 36% today," JPMorgan's Jesse Edgerton wrote. "This marks the second consecutive week that the tracker has reached a new high for the expansion."

An audit report published on Thursday suggests that debt-laden Puerto Rico may be able to void some of its borrowing because politicians exceeded constitutional debt limits and their own authority.

The report, shared with MarketWatch, states that some of Puerto Rico’s debt may have been issued illegally, allowing the government to potentially declare the bonds invalid and courts to then decide that creditors’ claims are unenforceable. The scope of the audit report, issued by the island’s Public Credit Comprehensive Audit Commission, covers the two most recent full-faith-and-credit debt issues of the commonwealth: Puerto Rico’s 2014 $3.5 billion general-obligation bond offering and a $900 million issuance in 2015 of Tax Refund Anticipation Notes to a syndicate of banks led by J.P Morgan JPM, -1.49% .

Money for those debt payments is not in the commonwealth’s proposed budget, either. On Tuesday Puerto Rico’s governor, Alejandro García Padilla, sent a proposed 2016-17 budget to the island’s legislature that provides for only $209 million of the $ 1.4 billion of current debt-service cost. As García Padilla told reporters at a news conference: “This is simple: either we pay Wall Street or we pay Puerto Ricans. If the legislature decides we pay Wall Street more, well, each has his responsibility. I will continue defending Puerto Ricans. Money I send to Wall Street, I do not have to provide services here.”

Japan for years has been renowned for having the world’s largest government debt load. No longer. That’s if you consider how the effective public borrowing burden is plunging – by one estimate as much as the equivalent of 15 percentage points of GDP a year, putting it on track toward a more manageable level. Accounting for the Bank of Japan’s unprecedented government bond buying from private investors, which some economists call “monetization” of the debt, alters the picture. Though the bond liabilities remain on the government’s balance sheet, because they aren’t held by the private sector any more they’re effectively irrelevant, according to a number of analysts looking at the shift. “Japan is the country where public debt in private hands is falling the fastest anywhere,” said Martin Schulz at Fujitsu Research Institute in Tokyo.

While Japan’s estimated gross government debt is now over twice the size of the economy, according to Schulz’s calculations using BOJ data, the shuffle of holdings from private actors like banks and households to the central bank is having a big impact. It means debt in private hands will fall to about 100% of GDP in two to three years, from 177% just before Prime Minister Shinzo Abe took power in late 2012, he estimates. It’s not like Japan is slowing down on borrowing. Abe’s administration is now laying the groundwork for another burst of fiscal stimulus, which could be funded by selling bonds. He also announced Wednesday a delay to a sales tax hike planned for April 2017, rebuffing fiscal hawks who argued it was vital to raise revenue.

In the United States, nearly one-third of adults, about 76 million people, are either “struggling to get by” or “just getting by,” according to the third annual survey of households by the Federal Reserve Board....

Nearly 70 percent of adults said they were “living comfortably” or “doing O.K.” — up a bit from previous years — but nearly half of all respondents said they could not cover an unexpected expense of $400, or could do so only by selling something or borrowing money.

Americans seeking a path upward through education are staggering under a load of debt. The median debt load for someone with a bachelor’s degree was $19,162. For a master’s, it was $36,000, and for a professional degree, $100,000.

Hundreds lined up Friday for a Donald Trump rally in far Northern California, but the atmosphere in the city of Redding was far calmer than in San Jose the night before when protesters pounced on Trump supporters, throwing punches and eggs.

In San Jose, a dozen or more people were hit and car windows were broken Thursday night. Trump hats grabbed from supporters were set on fire on the ground. At least one woman was pelted with an egg.

Police stood their ground at first but after about 90 minutes moved into the remaining crowd to break it up and make arrests. At least four people were taken into custody, though police didn’t release total arrest figures Thursday night. One officer was assaulted, police Sgt. Enrique Garcia said.

There were no immediate reports of serious injuries and no major property damage, police said.

Thursday night’s crowd, which had numbered over 300 just after the rally, thinned significantly as the night went on, but those who remained near the San Jose Convention Center were rowdy and angry.

Some banged on the cars of Trump supporters as they left the rally and chased after those on foot.

Comments

If we think the country is divided now,

just wait till HRC and Trump finish tearing it apart.

Peace out, tmp.

Your comment flashed an image into my head ...

HRC and Trump are like two hyenas fighting over the carcass of the American people.

An apt analogy!

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

This can't end well

For one thing, people have been told to save for retirement and with yields on bank CDs - a preferred investment for the unsophisticated - microscopic, people have to spend their principle.

For another, American debt from all sources forty years ago was $1Trillion. Today, it's approx. $50Trillion.

For a third, pension funds are used to - and need - a return of about 7% to fund their liabilities: It's impossible to get that yield safely now so pensions will either be cut or the fund will buy exotic financial instruments, and we've seen how that turns out.

Regarding Puerto Rico: The island is a colony and is governed by Article IV, Section 3 of the US Constitution and cannot declare bankruptcy and is at the mercy of the US Congress and president. If there has been a slip-up in the issuing of some bonds, then the banks who put the bonds up for sale are insured. However, if Congress sees fit, they can make Puerto Rico responsible for all the debt because of the island's colonial status.(Congress can set PR free or even give the island to another country.)

My money would be on Congressional relief for the bond holders at the expense of the citizens of Puerto Rico who have a per capita income only 50% that of the citizens of Mississippi.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Won't somebody think of the insurers?

They are also substantially fucked by ZIRP.

Get ready to pay for it again, once every 10-12 years or so

Wait, so now I can make money by going into debt?

I'm being facetious - but seriously, they are paying people to take out loans? How does that work?

I actually can't wrap my head around what possible purpose that could serve financially. If I pay a percentage more for money I borrow, so say I borrow 10K, but in the end once I've paid it off I have actually paid back 12K - would I now borrow 10K but only pay back 9K? Am I misunderstanding this?

And if I'm not, why wouldn't people take out loans - keep the negative interest, and give back the rest? (Granted, for us peons, that wouldn't amount to much - but for rich people who can borrow huge sums of money.... wouldn't it work?)

How it works

link

In theory it enables economic growth

by making holding onto cash less lucrative than investing it in new businesses. In practice, of course, it does what you say and encourages borrowing to start bubbles. Land, for example, or other scarce but low risk commodities.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

is this time different?

we've had 8 years of ultra low interest rates, the zerohedgies predicted zimbabwe levels of hyperinflation, which obviously hasn't occurred. China tried to hedge their dollar investments by cornering rare earths and other commodities, just in time to see prices crash through the floor. Oil is headed for a slow, steady decline as renewables change the energy equation. Witness the Saudis planning for a post petro world ...

You can invest in land if you want, but who, including millennials, have the wherewithal to buy it from you?

Maybe we're rapidly reaching the tipping point where the pool of greater fools that you need to take investments off your hands at a profit has shrunk enough?

Certainly feels to me like we're breaking some new ground here. Deflationary forces almost anywhere you look.

The negative interest rates are really

designed for people who have more cash than they know what to do with. e.g. maybe they don't see enough good investments, they think the economy is going into a recession soon, or they just want to make sure that they have the money available in the most liquid form possible when they need it.

In the U.S. if you had $250K or less, you could park the money in an FDIC insured account. If the Bank failed, you'd still get your money back. Anything above that amount, you would risk losing in the event of a bank failure. However, you could protect yourself by buying insurance. If the insurance costs more than the rate of interest, then it's the same thing as paying someone the privilege of charging you a negative interest rate.

So for large institutional investors or foreign governments paying the negative interest rate on safe government debt might still be a cheaper alternative when you need to find a safe place for hundreds of millions or billions of dollars than parking the funds with a private institution and paying a private insurer to hedge against a bank failure.

Japan is also doing it as a way of discouraging governments like China from buying up Yen denominated assets. e.g. because when China does that, it increases the value of the Yen, which drives up the cost of Japanese exports to foreign markets, which reduces the amount of Japanese exports that other countries buy, which hurts growth inside Japan.

That's an educated guess at least.

Not to defend Trump or his supporters in any way but

this is messed up (from your last link):

Trump holds a rally. His supporters show up. Protesters attack the supporters. Trump needs to take responsibility? Maybe, just maybe, if the police had been doing their job, there would have been fewer problems? When Sanders' supporters stage a peaceful demonstration, they are cordoned off. These unidentified protesters were allowed free rein. There is no indication in the article of what the "protesters" were protesting. Is it possible that Brock has extended his operations from online to physical attacks?

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

There were a lot of Latinos in one video.

There's some genuine anger at Trump for his hate speech. Not that that justifies violence.

I'm going to say something politically incorrect

I have no problem with political violence by the public.

In fact, I think the country would be well served with more of it.

What I have a problem with is STUPID political violence.

And working-class latinos carrying a Mexican flag, beating up working-class whites is just stupid.

If you are gonna commit violence, make it count. Do it against the rulers of this country.

Know thine enemy.

Who brings eggs to a peaceful rally?

I watched a number of videos and read several reports. The violence seems all too planned, and the way police handled the whole protest was abysmal at best.

There were also Latinx in attendance as Trump supporters. In fact, Trump has a lot more Latinx support than most people understand. The majority of it is in Texas, Arizona and Colorado, but since the other candidates have dropped out, he will probably also pick up the Republican and those avoiding HRC Latinx in states such as Florida. I expect if HRC is nominated, it will grow as more people become aware of her actions in Latin America.

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

More than likely IMO

Spontaneous political violence very rarely happens spontaneously.

There is almost always a provocateur organizer, and the mayor of any city is typically a prime suspect - and especially when he displays such a confrontational attitude afterward.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

Agreed, but off target

I think pro-wrestling impresario and scam-master Trump probably brings in his own protesters, to keep headlines hot and his base fired up.

Where were the cops?

A Trump rally and no police presence to break up a street fight?

That's on the mayor plain and simple.

He let it happen because he wanted it to happen.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

Maybe the mayor was assured by Trump's campaign

that the protesters and violence was all kayfabe. Is that more plausible than the mayor just ignoring the possibility of violence?

Economic repression combined with threats of physical violence

are being perpetrated by the Trumpeters. This country has a long history of this behavior towards low income people and especially p.o.c. I don't condone violence but there is a case to be made that the protesters are acting in self defense.

It's only a matter of time before guns are brought into the mix. This election of and by elitists will bear the its poisonous fruit.

Gosh. Unhappy news abounds.

And it's Saturday, I hear/read. I have Bachelor's buttons blooming blue with hot pink tradescantia (invasive monster!!) and painted daisies in pre-bloom burst. I need yellow in the flower bed, time to plan for next year or buy some marigolds. Or wait until fall to have goldenrod and mentally transport into a mind image. California poppies would be nice...

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.