It's the beginning of the end for the biggest bond market bubble in history

Something that a lot of regular people don't know is that the global bond market is roughly 2.5 times the size of the global stock market.

To put it another way, a stock market crash causes recessions. A bond market crash causes governments to fall. That's why you need to pay attention to the growing bond market crash.

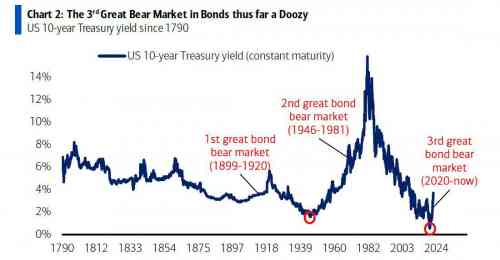

(Reuters) - Global government bond losses are on course for the worst year since 1949 and investor sentiment has plummeted to its lowest since the financial crisis, BofA Global Research said in a note on Friday...

Bond funds recorded outflows of $6.9 billion during the week to Wednesday, while $7.8 billion was removed from equity funds and investors plowed $30.3 billion into cash, BofA said in a research note citing EPFR data.

Investor sentiment is the worst it has been since the 2008 global financial crash, the note said.

It's not like you couldn't see this one coming from a mile away.

Back in June I posted: "What you see instead are bond yields that are waaayyy behind the curve. Who in his right mind would buy a bond that yields 3% in a time when price inflation is running at 8.6%?

...At some point gravity will win. When that happens the correction will likely be violent."

In late July I posted Reality will soon smack the financial markets:"So the yields on inflation-adjusted Treasury bonds is going up (disclaimer: I bought these for myself), while the yields on non-inflation-adjusted Treasury bonds is dropping to less than a third of those yields.

Someone on Wall Street is very wrong on this bet."

Well now we know for a fact that Wall Street was wrong, as they rush to unwind billions of dollars in bond and equity positions.

Government bonds have racked up losses of 20% so far in 2022, as of Thursday, according to BofA. They are on course this year for one of their worst performances since the Treaty of Versailles, which was signed in 1919 and went into effect in 1920, establishing the terms for peace at the end of World War I.

...Government bonds are the world’s most liquid asset so “if the bond market does not function, then no other market functions, really,” said Ben Emons, managing director of global macro strategy at Medley Global Advisors in New York.“Rising yields continue to dry up credit and are going to hit the global economy hard,” Emons said via phone on Friday. “There’s a risk of a ‘sell-everything market’ that would resemble March 2020, as people withdraw from markets amid greater volatility and find they cannot actually trade.”

For 40 years Wall Street has counted on the Federal Reserve backstopping their trades. Inflation was kept low because Wall Street was crushing the buying power of the working class. That left the Fed free to pump inflation directly at the financial markets.

The M2 money supply is the broadest measure of the amount of money in the economy. The large and unnatural spike in the M2 during 2020 is hard to miss. Anyone familiar with supply and demand could tell you that if you massively increase the amount of money in an economy that prices will rise.

So did that come from giving poor people money? Hardly. First of all, the spike is much larger than the $260 Billion spent on extra unemployment benefits in the CARES Act. More significantly, just look at what happened to money velocity in the economy.

Money velocity dropped off a cliff even while a mountain of money was shoved into the economy.

That may seem like a contradiction, but it isn't. It's a clue to who got all that money.

According to the Congressional Budget Office, each dollar of UI benefits raises aggregate economic activity by $1.10. In other words, when you give poor people money they spend it. Every dollar spent on SNAP benefits (i.e. food stamps) generates $1.67 in economic activity.

The poorer the people getting the money the more likely they will spend it. Wealthy people are more likely to save or invest it. This isn't a controversial statement.

The game plan was that if inflation ever did pop up then the Fed would raise interest rates and crush the working class even more. The problem is that the Fed pumped so much inflation into Wall Street that it began leaking out into the real economy, despite it never reaching the working class.

The Fed has no business buying $2.7+ TRILLION RESIDENTIAL Mortgage-Backed Securities (RMBS). The Fed recklessly pumped the housing bubble for Wall St's benefit. Result?

Out-of-control housing inflation - for both home prices AND rent. It's like they WANT a homelessness crisis! pic.twitter.com/dNiVfP6dAn

— Occupy The Fed Movement (@OccupytheFeds) March 25, 2022

This means that crushing the working class again will not solve the inflation problem.

Anyone holding Treasuries is guaranteed to lose money to inflation. Big investors, such as our overseas creditors, aren't going to tolerate that for long.

Eventually interest rates must rise on a nation that is absolutely saturated in debt on every level.

Just to bring real interest rates back to positive values requires doubling the current rates. Imagine what that would do to mortgage rates, credit card rates, corporations that already hold record amounts of debt, and our national budget.

Comments

2022 worse than 2008?

It's realistically possible.

What stage of capitalism is this?

It's the...

swirling down the crapper stage.

Change the Taco Bell label to a Federal Reserve label and change the white paper sheets to a 12-pack of rolled dollar bills. The greedy could then hoard money and toilet paper at the same time.

I always wondered

what those who ate at the mexican phone company used for wipe.

I only go there when I'm constipated.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I LOL'd

Your economics lessons are always impressive, but I'm glad to see you be funny for once!

That said, I've never seen any evidence that "so-and-so cuisine/fast-food derivative thereof gives you the runs" claims have much basis in reality....

Changing Subject: Bonds are blowing up, Emperor Satoshi is naked - what do you think would be good to invest in right now (were one of a mind)?

Also, do you follow r/WallStreetBets? How About r/WallStreetSilver? What do you think of them if so?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

There is evidence

I can tell you from experience that Jack In The Box has earned that reputation with me. Although I must admit that it never reached "Fiesta Strength".

My doctor says drain some blood

Doctors used to use blood letting to treat sick patients. They would carry around leeches in a jar and apply them to the skin. I liken that to raising interest rates to high levels to cure inflation.

The solution to inflation is difficult in that it requires wisdom and self control on the part of government. Firstly inflation is in a self reinforcing positive feedback mechanism. As prices go up you need more pay and your products need higher prices. Secondly inflation is fueled by sectors competing for a bigger piece of the economic pie. Thirdly, politicians in power need a growing economy to stay in power. If you print more money then more goods and services are bought.

Paul Volcker got us out of an inflation spiral in the 1970s with the application of a huge jar of leeches. It just about killed the economy, with mortgages at 18% and higher. I know because I had one. But in a sick economy demand plummets and inflation abates eventually.

So how would I do it?

1.Stop printing money.

2.Increase productivity.

3.Implement useful social programs, which will move economic spending away from inefficient wealth concentrated sectors to broad based efficient sectors, and in general redistribute income to the lower economic sectors.

Increasing productivity is the most important solution, as you are countering the basic cause "more money chasing fewer goods". Could we produce a quality living unit for $50,000? Of course we could. Could we produce a transportation system the moves people at 1/4 the current cost? Could we decrease energy cost to 1/4 per capita and maintain the current quality of life? Of course. But we need vision and application of capital for development and deployment. Also we would be attacking the basic socio economic system that fuels the careers of our vastly corrupt politicians. Also we would understand the extreme drain on our economy from war and endlessly preparing and promoting war. I calculated that in my city if we gave the portion of our federal taxes that goes to the war department to the city then the budget could increase 3 fold. Imagine what great cities we would live in if we just doubled the budget.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Bloodletting

is actually a qualifying medical remedy.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Replying late but...

I just wanted to say thank you for your very informative comment.

If you're poor now, my friend, then you'll stay poor.

These days, only the rich get given more. -- Martial book 5:81, c. AD 100 or so

Nothing ever changes -- Sima, c. AD 2020 or so