We are approaching a National Minsky Moment

I consider Hyman Minsky to be the last, great economist. His most significant discovery is that "stability breeds instability". To paraphrase, the longer a market is stable, the more unstable elements accumulate.

He went on to describe the three phases of a market as such:

1. Hedge Phase

The hedge phase is the most stable phase, where borrowers have enough cash flow from investments to cover both the principal and interest payments.2. Speculative Borrowing Phase

In the speculative borrowing phase, cash flows from investments cover only the borrower’s interest payments, not the principal. Investors are speculating that the value of their investments will continue to increase, and the interest rates will not rise.3. Ponzi Phase

The Ponzi phase is the riskiest in the cycle. The borrowers’ cash flows from their investments are not enough to cover the interest and principal payments. Investors borrow, believing that the rising asset value will allow them to sell the assets at higher prices, enabling them to pay off or refinance their debt.

We could debate whether if we've reached the Ponzi Phase of our economic cycle. To me it's beyond obvious that we have.

There is the anecdotal evidence, such as retail trading has exploded. A huge influx in IPOs. A record increase in SPACs.

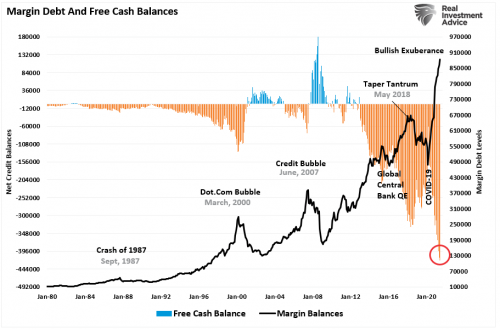

Then there is the more measurable evidence, such as investors paying record multiples and prices for money-losing companies, and margin debt at new highs and near-record annual increases.

However, I'm going to push right on past that point and look at the balance sheet of the U.S. government in the context of Minsky. First of all, let's look at the two big numbers - deficit and revenue.

Other than WWII, at no time in American history did the national deficit ever approach the nation's overall tax revenue before.

I don't know about you, but I think that is alarming because by some measures we are pushing the national budget into a Minsky Phase 2.

Fortunately, because of unprecedented asset buying by the Federal Reserve, interest rates have remained abnormally low. This has allowed interest payments on the enormous national debt to remain manageable, at somewhere in the $550 Billion a year range.

However, there's a very big catch to that fact - it's entirely unsustainable.

Anyone holding Treasuries is guaranteed to lose money to inflation. Big investors, such as our overseas creditors, aren't going to tolerate that for long.

If real interest rate remain negative they are going to start selling Treasuries, and when that happens the dollar is going to drop, and the Fed won't be able to stop that.

That will push inflation higher, which will cause overseas creditors to sell more dollars, and will probably cause the Fed to lose control of the long-end of the rates curve (i.e. interest rate on long-term bonds).

Eventually interest rates must rise on a nation that is absolutely saturated in debt on every level.

Just to bring real interest rates back to positive values requires tripling the current rates. Imagine what that would do to mortgage rates, credit card rates, corporations that already hold record amounts of debt, and our national budget.

Comments

Gloom and Doom

Sorry for the bummer, but my essay on American Empire got me thinking about this.

The two essays compliment each other.

All your coverage lately has been really outstanding

...and engaging. You really shine in the midst of a collapse of Western Empires, not to mention a concurrent global pandemic, rapid-fire climate change upheavals, and general ratfucking mayhem that is breaking out in places like Haiti and Kabul.

All kidding aside, these are excellent contributions. You have your finger on the pulse of the times. You keep it succinct and deliver it in coherent gulps. Keep the insights coming, please.

As to economic predictions:

What could be more obvious? Right? So this would be obvious to the Fed, as well — unless we are looking at another Greenspan senior moment where the Fed goes blank and misses the financial collapse of the century, circa 2006-2008. So, we must assume that what you describe :: international loss of confidence in the Dollar, a financial flight to safety somewhere other than the US Dollar, front-loaded risk, high interest rates, and massive losses for most American savers, who are forever in denial about dollar failure. They still believe the US is exceptional. And we must assume that all of this is part of the Fed's economic policies, and what they have planned all along.

I can't make this work, logically. Yes, they are driving the car. And yes, they are aiming for the ditch. But catastrophic financial failure is not in their own self interest.

One must consider, however, the meticulous, century-long effort to remove all hints of economic knowledge from US public education. Anyone who completes K-12 in the US knows absolutely nothing about money (or about factual American history). They went to a lot of trouble to sanitize the working knowledge of the American People. This has been a great benefit to the financial industry....

general ratfucking mayhem

I like that term I'm going to steal it.

The Fed's monetary policy left traditional central bank policy and commonly understood economic theory behind back in 2009. It's went down the rabbit hole into Alice In Wonderland economic/acid monetary experimentation and hasn't looked back.

The thing is, no one is calling them out on it because the political establishment is so immensely corrupt that it is completely unable to do its most basic job. Thus the two things the economy needs - fiscal and structural reforms - are off the table.

The only group that is still free to do anything substantial in order to keep the corrupt and rigged game going, is the Fed. But the Fed only has one tool - monetary policy.

Monetary policy can keep things liquid, but they can't actually fix anything. Plus, even the Fed is so corrupt that it has completely abandoned 50% of it's mandated job - to regulate Wall Street banks.

So what we end up with is some anonymous blogger yelling that no one is behind the wheel of the speeding bus and a cliff is approaching.

While everyone is squabbling over mask mandates, taking horse pills, and cancel culture. If I wasn't on this bus too, I would gladly watch it crash with a "good riddance" attitude.

This makes perfect sense.

It's the corrective lens through which to view even my own comments.

I had not factored in the endemic corruption of the financial establishment, which is actually a vast social abuse.

.

So..... this looks like the pivotal error that sent the US careening down the path of the policy psychopaths. The beginning of the ruinous neglect of regulations and oversight in finance, I would tie to the early Reagan years. That's when the mentally incapacitated President made his boldest moves, such as slashing forever the taxes required to maintain a modern nation, which kicked off the dystopian present. Top that with Reagan's asinine revocation of the Fairness Doctrine, which forever muffled the voice of public concern — a voice that could challenge and correct blatant misinformation on broadcast news. Cutting off the public's voice led directly to the evolution of the present-day media, in all its mendacious splendor.

By design, gj, by design.

I propose that it was understood by all parties ab initio that regulation would be a sham, though regs that benefit the banks would, of course, be promulgated and implemented. Of the bankers, by the bankers and for the bankers, and bankers are, for the record, fungible. Self regulation, the ultimate fraud. Just think how bad Frank James would've been had Jesse not been there to rein him in, bwahahaha.

be well and have a good one

That, in its essence, is fascism--ownership of government by an individual, by a group, or by any other controlling private power. -- Franklin D. Roosevelt --

Good pair of postings

We look at capitalism is a logical system when, today, it is really a collection of rules (or lack of) with the sole goal of enhancing profit. Buying politicians and creating a movement solely to benefit the 1%, while gas lighting the 99% into believing the system of democracy/ capitalism is to everyone's gain seems to be the only goal.

Whatever "our" government does, there is a well monied entity who is lined up to benefit handsomely at our expense. Obamacare and the insurance companies come to mind. Either way if there is no system to take over from 1%-ism were're dead. Even fleeing to Mars won't save us.

A Minsky moment and an Ibn Khaldun moment

both coming together now.

GJohnsit, are you familiar with Ibn's work?

https://www.mindattic.org/muqaddimah/

My own philosophy that echoes Minsky and Ibn is this:

when something becomes obviously true it is about to be proven false.

examples

USA is obviously the worlds superpower.

buy gold, you never go wrong with gold

buying a house is the best decision you could ever make

Thanks for your great posts.

No I hadn't heard of him

Thank you. I'll read up on him

Minsky moment

This is an important and informative post, Gjohnsit. I would add this, derived from Minsky, the only economics professor I wish I'd learned from when I had the chance.

Capitalism is inherently unstable because of the behavior of private investors and their markets. Successful investing sows the seeds of its own downfall, as investors come to expect that an investment boom will continue. To the degree corporations capture the government, the government's responses to the instability make it worse, all acting to serve private, not public, interest.

Further, to the extent finance dominates and real production recedes, corporations depend on stability less and less and often prefer instability. Speculation requires some minimum of disorder, otherwise there is less to gain from speculative investment.

The inherent instability of the institution is due to the nature of financing investments in capital assets. A capitalist economy is inherently dynamic, and changes through time disturb the possibility of stability. Uncertainty is a crucial component of the capitalist economy because investment is time-consuming and because expectations of future profit always rest on uncertainty. The instability also comes from the psychology of capitalist investors and the inevitable role of speculation.