Our Rentier Economy

One thing that has always frustrated me about discussions about economics by liberals is that the discussion rarely progresses past the topic of taxes. As if simply raising taxes on the rich would cure society's ills.

An economy is run on incentives and rewards. So if you want to fix an economy then you must look at what action is being rewarded.

This basic idea is why the field of economics was developed, and why all the great economists hated the rentier class - people who gather wealth to themselves while producing nothing.

“As soon as the land of any country has all become private property, the landlords, like all other men, love to reap where they never sowed and demand a rent even for its natural produce.”

-Adam Smith

"..yet it would mean the euthanasia of the rentier, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity-value of capital. Interest today rewards no genuine sacrifice, any more than does the rent of land."

- John Maynard Keynes

With that in mind, consider this news.

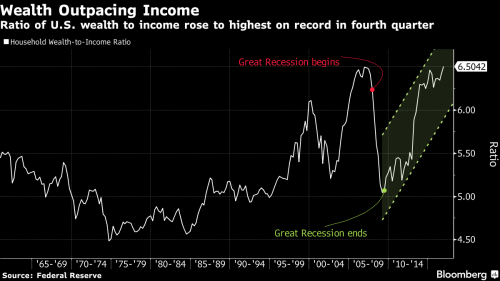

The ratio of American households’ net worth to inflation-adjusted disposable income jumped to a record 6.5 at the end of 2016, reflecting higher stock prices and property values, according to Federal Reserve data. Previous records were set around the Internet-driven stock bubble of the late 1990s and the housing boom of the mid-2000s. “Economic and financial history do not always repeat, but sometimes they do,” Joe Carson, an economist at AllianceBernstein, said in a note.

Does stock prices and real estate produce goods? No, they do not. Income from actual work does.

However, the high price of land and financial assets does produce something - inequality.

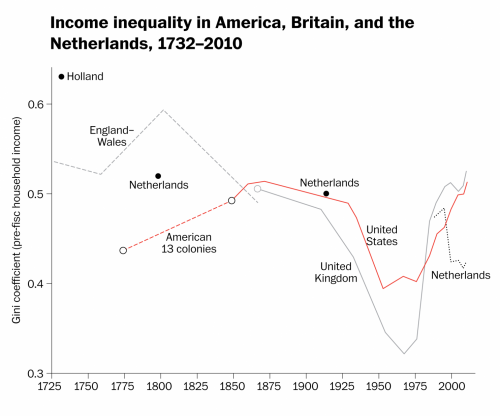

According to Lindert and Williamson’s calculations, today’s income inequality may be the highest the nation has ever known.

“We went from one of the most egalitarian places in the world to one of the least,” Williamson said. “What happened?”

What happened is that we evolved into a rentier economy, where moving money and speculating is paid well while actual work isn't.

Don't believe me? Then listen to Nobel-winning economist Angus Deaton.

“What is not OK is for rent-seekers to get rich,” Deaton said in a luncheon speech to the National Association for Business Economics.

Rent seekers lobby and persuade governments to give them special favors.

Bankers during the financial crisis, and much of the health-care system, are two prime examples, Deaton said.

Rent-seeking is not only does not generate new product, it actually slows down economic growth, Deaton said.

“All that talent is devoted to stealing things, instead of making things,” he said.

...

Deaton said he favors a single-payer health system only because our current part-private and part-public system is exquisitely designed to give opportunities for rent-seeking.

“So I, who do not believe in socialized health-care, would advocate a single-payment system...because it will get this monster that we’ve created out of the economy and allow the rest of capitalism to flourish without the awful things that healthcare is doing to us,” he said.

Comments

The other day, Morning Joe showed a video clip of, of all

people, Tucker Carlson. When Carlson had a show on MSNBC, I could not abide the sight of him. I was no fan of Scarborough either, but Carlson was the worst.

In the clip, the subject was repeal of the so called Obamacare taxes. Carlson challenged that, saying that the problem with the economy is not that wealthy people need a tax cut, but that the rest of us do not have enough money. And Scarborough agreed. Carlson and Scarborough.

(Side snark: Tell me again how Occupy and Sanders's run accomplished nothing.)

@HenryAWallace Given how horrible the

Given how horrible the situation is, I'd go for both.

Rearrange the economy AND tax the rich.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

I keep telling people

that many on the right think the same way we do, but they simply refuse to think otherwise.

My dad lives with me now, and he likes conservative channels, so I'm stuck hearing them. I was very surprised to notice that there is quite a bit of overlap between the right and left.

dfarrah

So much time and effort

is spent focusing on tiny differences between us rather than all of our basic similarities.

I am not at all surprised. People are people.

We all want the best for our children. This means jobs and good-paying ones. It means safe workplaces. It means breathable air and drinkable water. It means affordable housing and good, affordable educations. What has obscured all that is the intention disruption of those obvious truths by the plutocrats. The last thing they want to see is Democrats and Republicans divided against them. So they demonize and divide us. I don't think it's any coincidence that the issues each party (and media) focuses on are the most divisive and the most intractable--the positions people, mostly on the right, think God wants them to take. If you believe in God and believe God wants X of you, changing your mind about that issue is going to be difficult. Not impossible, but difficult.

And the way to try to change minds on those issues, IMO, is not to try to turn people into atheists, but to try to convince them of what the Bible actually says: Don't judge anyone else. And, it's up to God to do what he wants to do, not you or your government or even your pastor. Unfortunately, the religious right churches are making as much hay out of teaching things contrary to what the Bible says as the political right is making out of pandering to them and as both Democrats and Republicans are making out of keeping us divided.

I am not sure if it's already too late or not. If it is not too late, then the only shot we have is finding ways uniting with the right, at least on an issue-by-issue basis. We may never agree on something like reproductive choice, but maybe we can agree on things like relatively clean air and water and good, affordable education. It's not ideal, but it's better than nothing.

We don't have to agree on everything

but focusing and obsessing on those things isn't healthy.

I would say that focusing on them to the exclusion of everything

else is not healthy. If I were a member of the GLBT community or a woman desperate for birth control or an abortion, I would have a hard time focusing on anything else, unless I am also homeless or living in Flint or in some other dire strait that is even more emergent.

But, again, if we seek union with other Americans issue by issue, we don't have to cast away any issue.

The MSM reports that

18 corporations did not pay any taxes for 2015 ( iirc ) but leave out the fact that they actully got refunds, billions in some cases.

When I try to explain to Mr. Typical Taxpayer they are not only NOT paying their fair share, but taking taxpayer money away from revenues. Not only are we picking up their share, but giving them our tax money.

It is then I see their eyes glaze over and a palpable vibe they are looking, desperately, for a way to change or mitigate the subject at hand so as not to show their total ignorance.

It's crazy so many people have no clue regarding basic economics.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

socialized healthcare

I just love how Deaton, who claims not to advocate socialized healthcare, presents the case for socialized healthcare so very well......

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Exactly

'Something I don't believe in, is essential for the rest of my belief system to work.....'

How about, unfettered capitalism isn't the answer to everything.

Gëzuar!!

from a reasonably stable genius.

I wish people would say Medicare for All, rather than

single payer. First, many Americans probably have a zero to vague clue what single payer means, but most sure know what Medicare is and they either have it or want it. If they are not receiving it, someone they know is, a parent, or a grandparent or a neighbor.

Second, single payer is not accurate, anyway. Very often three payers are involved in one claim, the patient, who has to cough up a co-pay, the government (in the case of Medicare) and a co-insurer, such as Medigap or the insurer who covered the patient while the patient was working.

Every year for I don't know how long--until Obamacare, anyway, John Conyers introduced HR 676, entitled the Medicare for All Act. In 2008, it had 100 co-sponsors, every House member of the Progressive Caucus, but the number has dwindled, as has the number of members of the Progressive Caucus. Maybe there is a correlation between the two "dwindles." https://en.wikipedia.org/wiki/United_States_National_Health_Care_Act

I just googled and saw that Conyers has introduced another one for 2017-18, only now it's entitled the Expanded and Improved Medicare for All Act. I am a little leery of the expansion, but it has to be better than either Obamacare or Ayn Ryancare.

A good example

real estate speculation

You can't fix stupid greed.

From 2004 to 2006, I was a construction manager for a homebuilder near Ann Arbor Michigan. The realty company that sold the homes was telling everyone that the sky was the limit on home prices. Many of the buyers were rolling in their furniture, appliances, pool tables, you name it, on 30 year loans with the expectation to roll it into the profit they would make by flipping in a couple of years. Needless to say, of the more than 45 homes I constructed in two years, over half of them were in foreclosure by 2009.

The banks and the wealthy were more than happy to snap them up and turn them into rentals.

People are just too greedy to see a setup.

I left the construction business in 2006. The writing was on the wall.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Another way to say it

“No warning can save people determined to grow suddenly rich.”

- Lord Overstone.

Well, you can grow suddenly rich if you have plenty of money

to invest and can afford to lose it if you miscalculate. For example, People who bought homes to flip or rent in California, say 2010 to 2012 or 2015 probably did well, especially if they had a modicum of taste when they chose renovations. I followed that pretty closely. Investors were buying relatively modest homes with large yards that had not been re-done in years, maybe out of estates. They brought the interiors up to date, maybe added a pool or some kind of outdoor feature and raked it in.

Actually, local homeowners are not wealthy. You can sell

your home for 5 times what you paid for it, but where will you live next? You pocket money only if you are moving to less expensive area or state or if you are willing to downgrade or rent. Otherwise, you just plow your real estate "riches" right back into your next home. And, if upgraded, your mortgage is bigger, too. Empty nesters going to a smaller home or a condo or a senior living situation may make out, but probably not the majority.

@HenryAWallace

Thank you for making the point which invariably first pops into my mind the instant this meme of homeowners making out like bandits from high housing costs pops up!

The people who make money on this seem to be generally wealthy investors/members (and CEOs) of investment groups, not homeowners simply moving into some other house - and often spending far more on upgrades (unless professionals doing the work themselves) than they make back in 'profit' to pay down for their next home, especially after the legal and moving expenses are taken into account.

This following seems to be NY-centric and several years old, and typically referencing those handling luxury and large properties but the amounts given to those at the top relative to those at the bottom seem consistent with other (edit: such institutions, including) investment groups - and all come out of the amount the property sells for. Seems almost as though a real estate bubble was needed to maintain this.

And now there are vast tracts of high-priced housing standing empty across America and being bought at high prices by, at long last, people who want homes; I expect that once enough have made their packet off these home-owners, the (disaster-created) bubble will burst, perhaps just in time for the market bubble also to burst? Will we see a replay of repossessed over-priced homes while financial institutions are again bailed, again hitting the American public coming and going, in the private and public purse, while Wall St is propped up to go forth and sin again and America starves on the neglected streets?

https://therealdeal.com/issues_articles/paycheck-confidential/

Edit: just to mention, like a lot of my posts, this contains stuff directed more at potential 'drive-by readers' who, like myself, may not understand economics in the manner of so many here, but who can figure out when they're being suckered, once they have enough 'ground level' details on who's profiting off their efforts and properties. So I wanted to indicate that much of the money being made from high house prices may not be theirs or their real estate agents, while rather too much of the price of whatever they purchase will likely wind up in the hands of the few, one way or another.

That, and this smells like a set-up, with recent posts here indicating that now, homeowners are buying while big investors are pulling out...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

We need Tony Stark (Iron Man) , Industrialist

I remember growing up, there were many "industrialists", people who built things. That word no longer describes anybody who is rich nor even has much of a meaning anymore except in a few cases. The last time I heard that term was the cartoon character Tony Stark.

I am not sure I would extend that word even to some software companies such as Microsoft which was built on the innovations of other people, and through monopolistic practices.The wealth of Microsoft management was built by the rentiers who threw their money in the stock market.

A lot of the behavior of startups was driven not by profits off their products, but from rewards they expected from the rentier class mostly the stock market. No executive in America gets rich off their wages/salary--they rely on bonuses and other tools such as stock options which are denied workers in the company. Although at one time, at least in the South Bay area, the real home of Silicon Valley and not SF, companies were egalitarian about spreading the wealth of their labors by giving workers at every level stock options. As far as I can tell, that practice has come and gone in most cases, and only executive management gets those rewards.

Uber and Amazon are perfect examples

as neither one of them make profits worthy of their markit cap.

WS/NYC needs to be occupied forever

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Excellent point. (nm)

Beyond all efforts to complexify this problem

…the answer has always been profoundly simple:

To keep the GINI Index low, excessive income is captured and released as government investments inside the economy. A high Gini Index results in severe inequality of economic opportunity and individual gains in earnings. When nations want economic growth, social mobility (economic opportunity for everyone), improved infrastructure, social harmony, and liberty (personal empowerment for all individuals) — they systematically capture excessive earnings and invest them in improving the nation and the people.

It works like a law of physics.

Here's what that looks like in practice:

Historical chart of income inequality from above.

The Blue Circle shows a period where the Gini Index was low and society flourished. Individuals achieved liberty; infrastructure was world class; education was accessible to all, private and public debt moved lower, and hard work resulted in great achievements.

Historical chart of tax rates showing lowest and highest earners.

The Purple Circle shows how excessive and destructive concentrations of individual earnings were surgically captured using tax rates as high as 90 percent at the very highest margins. This revenue was poured back into the general economy, which resulted in decades of year-over-year income gains for workers at all levels. It was a time when the US was considered "great." The tax rates allowed for the existence of a "Great Society."

::

This is presented as a "proof." Both circles encompass the same years. If you match those years with leaders and their policies, you will pierce the veil of economic noise and understand everything you need to know about the mechanism of real-economics.

Keep in mind: People are not taxed; income is taxed.

US politicians will always try to convince you of the opposite. Don't let the propaganda flow unchallenged. The reason we tax excessive income is not to bully high earners, but to prevent them from bullying the rest of society and turning it into a dystopia of dispair.

The political activist, Albert Einstein, saw this occurring and wrote about it to warn the American people. The tax and spend mechanism is a staple of economic rebalancing in the interest of liberty and justice, and it has been a known-known from the birth of economic science. This is the principle that drives the systems used by those nations that provide the highest quality of life for all their citizens.

::

Note: The economic policy changes you would like to see cannot come from inside the US political system, because the people who now own and operate it do not wish to earn less than half of what they currently do. National health care cannot come from inside the government for the same reason. Nor can criminal justice reform or immigration reform or election reform or environmental reform or war reform or education reform. These areas of responsible government have been privatized around the edges to richly reward the free market capitalists, and they hold a veto over the will of the people. That also cannot be changed from inside the system.

Just to be clear and remove the last illusion:

(from )

The United States is not one of the "nations that provide the highest quality of life for all their citizens," mentioned above.

The United States is heavily engaged in asset-stripping its population of throwaway people by denying them the human right to health care, and then forcing them to spend an ever increasing share of their earnings on the world's most expensive medical care, to stay alive.

But it is to no avail, as the life expectancy continues to sag inside the US. Behold the streamlined eugenics of Empire's internal depopulation movement. But you knew that.

The "tax and spend" nations that provide the highest quality of life for their citizens are depicted on the chart in black.

We went through reforming capitalism in the 1930's

with FDR and the New Deal. Capital obstructed as best it could and then set about undermining the reforms until we are at the sorry state we find ourselves in.

Monopoly capital went global in the 1960's(at the latest estimate) and when areas for profitable exploitation became scarcer, the process of financialization kicked in. In the USA the % of GDP generated by manufacturing and the % generated by finance reversed so the non-productive sector now is much larger than the sector that actually produces things. Wealth begets wealth which is way Bill Gates(for one) has garnered more wealth to himself since leaving Microsoft than he amassed while running the company.

What the world needs is to displace this system with one which promotes sustainability for future generations and that takes respecting the biosphere. As Engels said, "For each such victory, nature takes its revenge on us." The global military/financial/industrial complex is literally killing us and we should not go quietly when regional models of economic activity still exist and give testimony to how it can be done.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

@duckpin I want to point to

I want to point to something that is usually overlooked: the role of European oligarchs. At no point in the past two and a half centuries have the European oligarchs reconciled themselves to the continued existence of the American republic. There is always news about big money center banks laundering money for criminals. Hardly ever mentioned is that this is merely a continuation of the role played by certain Europeans institutions in the slave trade and the opium trade. Today, for example, a former head of British intelligence sits on the board of HSBC, aka the HongShang, aka Hong Kong and Shanghai Bank.

Yes, the ideas and policies of the New Deal came under attack. A key organization in that attack was the Mont Pelerin Society. I highly recommend Mirowski and Plewhe's book on the MPS. But they completely failed to follow one of the most interesting lines of inquiry: the general secretary of Mont Pelerin for almost two decades was Max Thurn, of the very rich and very reactionary Thurn und Taxis royal family.

See the graph of income inequality, showing the USA beginning so much better than UK and Netherlands, and then becoming worse since the 1930s - which fully coincides with the active life of MPS - reminded me of this crucial angle.

- Tony Wikrent

Nation Builder Books(nbbooks)

Mebane, NC 27302

2nbbooks@gmail.com

Mont Pelerin Society and European Oligarchs

Interestingly, 8 past presidents of the Mont Pelerin Society have won the Nobel Prize in Economics, including F.A. Hayek (father of neoliberalism), Milton Friedman and George Stigler. I didn't realize that the Nobel Prize for Economics was not in Alfred Nobel's will. From Wiki:

The Riksbank prize "in memory of Nobel" is awarded

to prominent apologists for capitalism. To call it a Nobel prize is simply wrong and those who go along with being "Nobel Prize Winners" are scammers.

Referring to the Swedish central bank's award as a Nobel prize gives a veneer of unearned respectability and acceptance and the for-profit press gladly goes along with the charade.

The winners this year did their work in "showing" that the exhorbinate compensation given to CEO's is justifiable and generally a good thing to do. In the USA CEO pay has gone from 30X the average worker to over 300X the average worker in two generations. Worth it? Of course not.

The scandal lies with the Boards of Directors who OK these enormous sums while they themselves vote themselves 6-figure pay for attending a few meetings a year. They are also complicit in keeping stockholders from demanding accountability from the company bosses even though it's they who own the company.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

What you say is probably true but I think it more germane

that capitalism and imperialism both arose in England and spread to NW Europe. Throwing people off their land; confiscating the commons; making wage slaves of former farmers; and taking the fruits of exploitation is how capitalism works and perpetuates itself.

Today with global financial capitalism commanding the military and diplomatic power of the rich nations, the system is more entrenched than ever. It's entrenched even though it's a planet killer.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

The concept of 'unearned income' has been disappeared

Michael Hudson has great insights on this:

The Inversion of Classical Economics

[video:https://youtu.be/m4ylSG54i-A width:400 height:300]

And

Rentier Capitalism – Veblen in the 21st century

America is a stupid country. And this is deliberate.

I say it all the time. After all, we rely on 15th century economics, 18th century governance and 19th century energy production because any attempt to move away from those is a grave sin against the almighty Constitution, dontcha know.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

Recently found work by Karl Polanyi

Karl is rightly famous for "The Great Transformation" first published in 1944

From wikipedia

Karl gave a series of lectures at Bennington College in 1040 - before the US entered the war. They are short, just a few pages each.

The Present Age of Transformation

Thanks for the excellent comments on this article. I have to go back later and read them more carefully