Oh, Snap! We've seen this before

Submitted by gjohnsit on Fri, 03/03/2017 - 11:39am

You've probably heard of Snapchat, the photo sharing and messaging app so popular with millennial America.

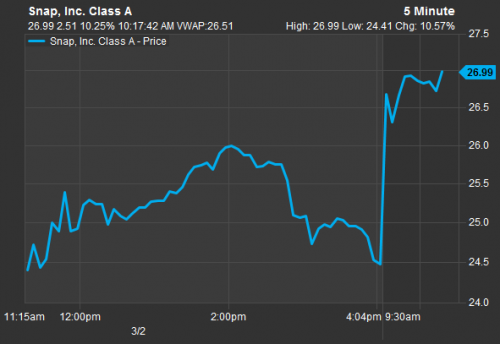

Yesterday. Snap Inc. had it's IPO. The offering price was $17.

Shares of Snap's stock extended their IPO gains on Friday morning, rising about 12 percent.

Snapchat's parent company hit the public markets in a much-anticipated IPO on Thursday. The stock surged 44 percent on its first day, trading in heavy volume.

Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management, told CNBC the positive reaction to the Snap IPO may be a reflection of the so-called animal spirits reawakening in the stock market.

Yea. "Animal spirits" is one phrase you could use.

It's not the phrase I would use.

There’s no point in comparing Snap’s profits to any of those companies, since Snap doesn’t have any. The company lost $514.6 million in 2016 and $372.9 million the year before, according to the prospectus it filed in February. It has lost money every year since it began commercial operation in 2011 and has warned it may never earn a profit.

"May never earn a profit".

Now that's a catchy phrase I can understand!

Especially for a company now valued higher than Sony, HP, eBay and Sprint.

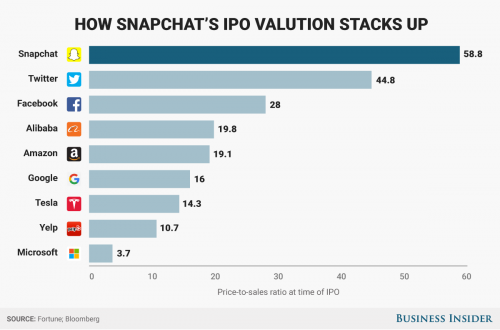

Twitter is an interesting comparison.

Twitter has struggled to add users and generate advertising revenue, even though it claims a user base of 319 million. It went public in 2013 at $26 a share. This week it was trading below $16 a share...

As Mr. Nathanson and his fellow research analyst Perry Gold put it in a recent note to clients: “There is something brilliant about going public after only a few years of generating any revenue at all. The sky’s the limit and history is not a guide.”

"History is not a guide".

Funny. I've always heard something very different.

Comments

The last time that I read that it didn't matter

if a company ever made a profit was just before the dotcom crash.

Be warned!

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Considering 100% of that value was created...

by unpaid users and the US Government...

IMHO, creating a platform is useless if nobody uses it. As a result, without constant attention subsidies from the MSM and other tech companies, the value would be less than zero.

So, it's a socialized profit based off the UNPAID work of thousands.

And they say Corporate Slime don't like socialism.

I do not pretend I know what I do not know.

Infinite Bubbles

A bubble for you and a bubble for you and a bubble for you, bubbles for everyone!

A bubble for you and a bubble for you! Everybody gets

a bubble! Oprah 2020! /s

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Morgan and Goldman should hang their heads in shame

link

Perhaps you have never heard of Churning

Churning

I think we have evolved to cavitation economics now

How it is still all going is a mystery, is it the 14 trillion pumped into the MIIC? The unlimited printing press of QE inflating stock markets?

They all seem to have enough stupid money to keep it going. Last time Goldman Sachs spotted a great wheeze where they made massive profits by bringing the house down. Only a matter of time in the current regulatory environment before one of the players pulls a repeat.

There are many themes and variations

and the only commodity is confidence. All you need to do is instill confidence and you can pocket quite a large sum of money. And the good thing about the system now (as opposed to the 1950s) is that you do not even need to have currency to run the con. They weren't called confidence artists (back in the day) for nothing.

Harold Lloyd economics writ 21st century.

Maybe we can sell land in Florida? Key Largo or Key West in a centenary deal!

China problems are coming to a serious boil. Who is going to continue to buy US debt if they can't? Until then I guess the party can continue and perhaps reading Letters to the Editor from 1927 on might be interesting. There is always someone pointing out the impending disaster, usually they are ridiculed.

High school makes $24 million from Snap IPO

Private catholic school, because they need it so much. California pile on.

And you get NBC, and Comcast having Vox

beat that drum like a dead horse...Wow

Take a look at Salesforce for jebbus sake

Profitless companies are no barrier to success in Silicon Valley.

If you don't watch the TV show I highly recommend it, it's only a slightly exaggerated parody of reality. Slightly.

There is a slight difference, though...

between profitless companies like Salesforce, which have existential value providing business services that companies willingly pay for, and companies like Snapchat, which lack intrinsic value altogether.

There is a truth to your point but

intrinsic value and monetization are not the same thing. If Snapchat did not have value it would not be used.

You can tell people

till you're blue in the face........that there is no there there.

If they forced all companies to pay out what the stock is worth there would be little to nothing.

It's mostly speculation.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Abstract on top of abstract on top of yet more abstractions

This is the world we live in. The only way to monetize sites like snapchat is through advertising. Who would pay a subscription fee for such a service? Perhaps a lot of people may pay out of pocket had not the culture of the internet been born of free services. I do hope the owners of snapchat are as left as left can be and remain that way.

I'm not really going anywhere with this other than it just boggles my mind on how much money is spent on advertising and promotions. I doubt that the real value of advertising is more than 1/10 in terms of return on investment compared to what the ad men will tell us it is. Ah, vanities.

I cut the cable twenty years ago, before anyone coined the catchphrase "cable cutters". Waking up sleepess at two in the morning, turning on the tv with nothing on but infomercials to watch was a rip off. My life now is as commercial free as possible and it makes an astounding difference in the general quality of life. NPR calling itself public radio is a misnomer. National Private Radio. Nazi Propaganda Radio. The Hillary Station!

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

Are people really that stupid now? I saw a

picture of the young con artist who 'founded' the site. He's supposedly the latest dot.com billionaire. Rec'd!!

Inner and Outer Space: the Final Frontiers.

Amazon changed my thinking

Regarding the new stock market reality. They were in the red for years; people kept pumping money into them; now they rule.

1999 vs 2017

Guess which stock market is which

@gjohnsit

https://www.youtube.com/watch?v=4vuW6tQ0218

Monty Python - Dead Parrot

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.