The next financial crisis?

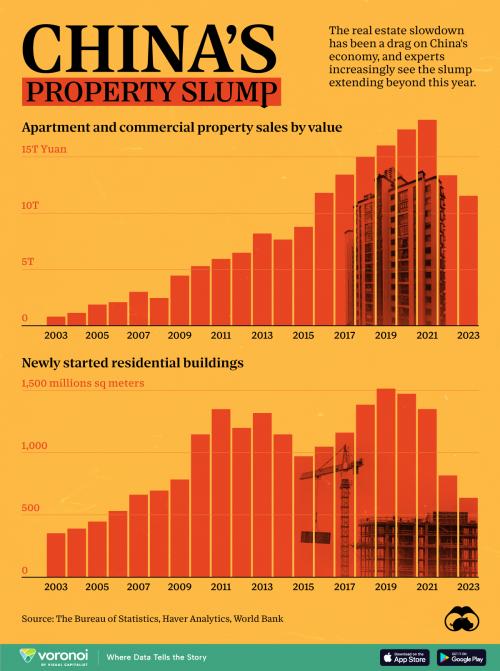

The Chinese economy has been too reliant on real estate for decades. As the chinese economy grew, this real estate bubble expanded globally. So when the government moved to bust this bubble there was going to be collateral damage.

"This is just like the US financial crisis on steroids," the Hayman Capital founder said. "They have 3 ½ times more banking leverage than we did going into the crisis, and they've only been at this banking thing for a couple of decades."

Bass said the years of economic growth China enjoyed prior to the pandemic were made possible by an unregulated real-estate market, which leaned too heavily on debt to expand.

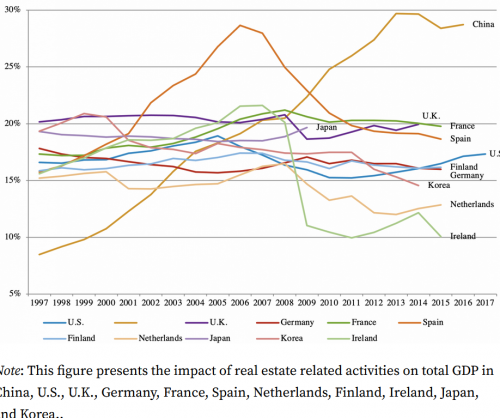

The only advanced economy in recent history with a similar share of real estate plus infrastructure investment in GDP was Spain during the run-up to the 2008 crash. Local government debt has climbed relentlessly from around 5 per cent in 2006 to 30 per cent in 2018, even by conservative estimates, and regional private banks are also exposed.

So why should you care? Because Chinese real estate investors didn't just invest domestically.

A unit of China Aoyuan Group, for example, which is in the middle of a US$6 billion debt restructuring plan, sold a plot in Toronto at about a 45 per cent discount to the 2021 purchase price late in 2023, according to data provider Altus Group.

Just this week, distressed developer Guangzhou R&F Properties agreed to sell its stake in a £1.34 billion (S$2.28 billion) property project in London’s Nine Elms district in return for some of its dollar bonds and 10 pence, while an office block in Canary Wharf is selling for 60 per cent less than it was sold for in 2017 after it was seized by lenders from a Chinese investor.

In the midst of this Chinese real estate crash is a domestic commercial real estate crash.

The commercial real estate sector is at risk of seeing its biggest crash since 2008, and that could slam US banks with up to $160 billion in losses.

Comments

one would think these casino banks could learn by

-

-

their previous losses in the long term but

apparently short term gains are better

for the bottom line

as long as the central banks pull their

assesassets out of the fire?

Zionism is a social disease