News Dump Wednesday: Recession Storm Warning Edition

Submitted by gjohnsit on Wed, 03/23/2016 - 3:02pm

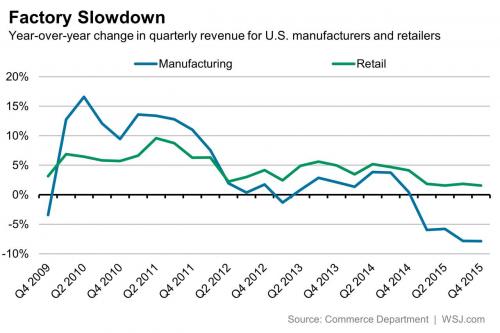

Yes, everything points toward recession, but we still aren't predicting a recession.

Pre-tax earnings probably fell 9.5 percent in the fourth quarter from a year earlier, after dropping 5.1 percent in the third, according to economists at JPMorgan Chase & Co. in New York. That would be the biggest decline since the 31 percent free fall in the closing months of 2008 during the height of the financial crisis.

Why is that important? Well, history shows that when profits fall, the economy often follows them downwards. An earnings hit of the size that JPMorgan says is taking place has led to a recession within three years about 90 percent of the time.

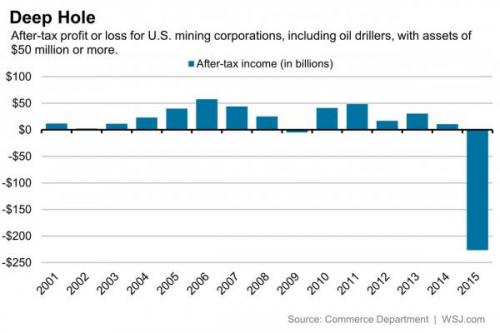

It's not just energy getting wiped out

The U.S. mining industry—a sector that includes oil drillers—lost more money last year than it made in the previous eight.

Mining corporations with assets of $50 million or more recorded a collective $227 billion after-tax loss last year, according to Commerce Department data released Monday. That loss essentially wipes out all the profits the industry had made since 2007.

NIRP: It's no longer just for governments

Sanofi and Royal Dutch Shell Plc bond yields have dropped below zero, highlighting how European Central Bank stimulus is distorting the region’s credit markets.

Traders are quoting yields of minus 0.016 percent on the French pharmaceutical company’s 1.5 billion euros ($1.7 billion) of bonds maturing in May, according to data compiled by Bloomberg. That’s the first time the yield has dropped below zero. The same happened for Shell’s May 2018 bonds earlier this week.

About 16 billion euros of highly rated corporate bonds are trading with yields below zero as negative deposit rates spur money managers to look for alternative safe places to park cash. Bond prices have also been bolstered by the ECB’s plan to start buying non-bank corporate notes, as policy makers seek to drive investors into riskier or longer-dated debt.

Brazil's state-controlled oil company Petrobras posted its biggest-ever quarterly loss on Monday after booking a large writedown for oil fields and other assets as oil prices slumped and refinery projects faltered.

Petróleo Brasileiro SA (PETR4.SA), as the company at the epicenter of Brazil's massive corruption scandal is commonly known, had a consolidated net loss of 36.9 billion reais ($10.2 billion) in the fourth quarter, according to a securities filing.

The bigger-than-expected shortfall was 48 percent larger than the 26.6 billion-real loss a year earlier, the previous record.

Imagine if Ted Cruz or Donald Trump proposed a policy to monitor thousands of Muslim citizens even if they had no specific ties to terrorist groups. Then, for good measure, they called for a new law to allow the police to search the homes of suspected terrorists without a warrant and to place terror suspects under house arrest without a court order.

Sounds like a nightmare. One can imagine the indignation. Pundits and politicians of good conscience would intone against the politics of fear. Some on the right would respond that political correctness should not be a barrier to counterterrorism.

But what I have just described is not a Republican sound bite. Rather, it is the current counterterrorism posture of France.

The Gun Rights association says it aggressively fights “gun grabbers” in state capitals and Washington. The group has raised millions of dollars in part by depicting the better-known National Rifle Association as too “inside the Beltway" and “more interested in having access to politicians and ‘getting something done.’ ”

“We believe in absolutely 100% no compromise,” the association says on its website.

Comments

Weren't you just saying

Just the other day you were talking about O&G being down in the toidy, but grabbing the handle for leverage.

Tell me again... if they've lost that much money, why are they coming back to frack wells that they walked away from a year ago? That happened around here. They had pads in and wells started. Then everybody packed their stuff and went back to Texas and wherever else they came from. Now I've heard rumors that a couple outfits are back to finish the well.

This makes no sense. Does it?

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

There is so much cheap money being pushed by the Fed

that normal business investment and business cycles are unpredictable these days. I don't pretend to be able to wrap my mind around all of it.

One of the things I learned

I got super interested in O&G drilling when I heard that Aubrey McClendon had bought all the leases held by Enervest in a three county area of southern Ohio. Since my lease is held by Enervest, and I was in one of those counties, I thought it wise to take a crash course on what this might possibly mean to me and my land.

One thing I learned from several sources was that the O&G industry operates almost entirely on borrowed money. They said these outfits don't ever really make a profit - it's all on paper. In truth, as long as they can make enough to pay their bills, loan payments, and salaries, they're satisfied.

What caused the sudden stoppage - which actually began a couple years ago - was that they were no longer making enough to do that. The banks have these things called revolver loans that renew in March and October. Apparently a year ago this month many banks didn't renew the cash for a lot of the smaller outfits. Last October, they did it again, only with the bigger outfits.

This was from many people who had worked in the industry for decades, and it reminded me of something a vendor of mine used to have on the bottom of his invoices. "Please Pay Me, So I Can pay Him, And He can Pay You."

Can that honestly be called an economy?

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

The California housing market

Yes, it's that bad

True or False?

We'll know soon