News Dump Thursday: Deutsche Bank Saga Edition

Submitted by gjohnsit on Thu, 09/29/2016 - 12:31pm

Only a bailout can save Deutsche Bank

Only a substantial intervention by the German government can stop the collapse of the country's largest lender, Deutsche Bank, according to Stefan Müller, the CEO of Frankfurt-based boutique research company DGAW.

"Deutsche Bank doesn't realize that something serious needs to happen," he told CNBC via telephone on Thursday morning. "(CEO John) Cryan clearly showed that he has no idea how to survive."

Some creditors backing away from DB

While the vast majority of Deutsche Bank’s more than 200 derivatives-clearing clients have made no changes, some funds that use the bank’s prime brokerage service have moved part of their listed derivatives holdings to other firms this week, according to an internal bank document seen by Bloomberg News....

Credit-default swaps protecting Deutsche Bank bonds surged to a six-month high earlier this week, according to data compiled by CMA, while the stock hit a record intraday low of 10.18 euros.

The financial pressure on the lender is also spilling over into German politics, stirring speculation Chancellor Angela Merkel’s government might be forced to offer support. Chief Executive Officer John Cryan told Bild newspaper this week that government aid was “out of the question.” Any taxpayer-funded solution for the bank’s troubles would be Merkel’s downfall, according to the leader of Germany’s biggest opposition party.

Germany's second largest bank by assets, Commerzbank, announced an overhaul of its structure on Thursday following what it called "current market rumors."

The lender said Thursday that it would make a net reduction of 7,300 jobs at the company and will stop paying dividends for the time being amid a drive to sustainably increase its profitability by 2020. The cost of the restructure would be in the region of 1.1 billion euros ($1.2 billion), it said in a statement, and the plans would be ratified by its supervisory board on Friday.

The announcement comes as its rival Deutsche Bank has fiercely defended its capital position amid a rout in the stock markets for financial firms. Deutsche Bank's stock has slid over 50 percent so far this year and the cost of insuring exposure to its debt has risen sharply. It has come under pressure from aggressive short-selling, notably from some large hedge funds.

Meanwhile, Commerzbank shares have fallen 38 percent year-to-date and were down 1.25 percent Thursday with news of the dividend being cut.

Health care costs ate your pay raise

Real, or inflation-adjusted, compensation has risen 61 percent since 1970; wages, on the other hand, have increased less than 3 percent in real terms in that period.

During the same 46-plus years, this rose 61 percent. Total comp includes wages, various worker benefits such as matching 401(k) contributions, health insurance, disability insurance, paid vacation and leave plus any employer-paid taxes. “These benefits are now a substantial part of the cost of an employee – and they appear to be growing,” according to the Federal Reserve Bank of St. Louis, which compiled the data.

It isn't a stretch to surmise that most employees don't really appreciate how substantial this non-wage compensation is; nor do they realize how much health-care costs, the biggest part of their non-wage compensation, have risen.

The political and policy ramifications of this are significant. Workers are unhappy with their salaries; employers are unhappy with their costs. It isn't a big leap to conclude that so long as either health-care costs keep rising or employers are responsible for paying them that wages will be competing with compensation.

For more than 40 years, wages have lost that battle.

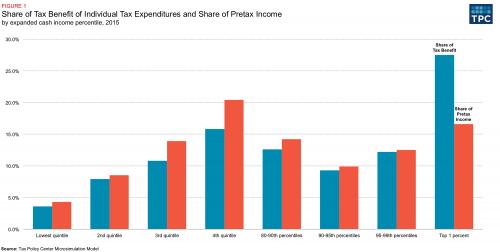

The top 1% also get the tax breaks

The top 1 percent of Americans as measured by income rake in 17 percent of all U.S. income on an annual basis—before taxes, of course. And that caveat is important, according to a new analysis by the Tax Policy Center (TPC),1 because that select group of citizens gets 27 percent of the tax breaks doled out by the federal government.

The TPC’s calculations show an estimated $1.17 trillion in federal revenue last year going to individual tax expenditures (a fancy way of saying taxes we didn’t have to pay because of deductions, like for giving old clothes to the Salvation Army—or, in this case, collections to the Metropolitan Museum of Art). While the wealthy see an outsize benefit compared with their share, the lowest-income households get just about 4 percent of federal tax breaks, close to their portion of all pretax income. That same trend holds for taxpayers in middle- and upper-middle-income households.

Among the biggest of these givebacks, courtesy of the Internal Revenue Service (well, really Congress), are capital gains and dividends—these are the biggest way the wealthiest benefit. Characterizing capital gains and dividends as government spending is somewhat controversial, noted Gleckman. “The IRS considers them a tax expenditure, but there is a question of whether they really are. There are tax-preferential rates, but are those preferential rates really a government spending program?” The terminology does sound like it’s already government money, and only if your accountant finds the appropriate deduction can you have some back.

Using the IRS nomenclature, the top 1 percent got more than 60 percent of the benefit from a basket of subsidies including the preferential tax rates on capital gains and dividends, the step-up basis for inherited assets, and the exemption of most gains from the sale of a primary residence. The top 1 percent also gets a big serving of benefits from itemized deductions, which include gifts to charitable organizations, gobbling up 32 percent of that category. That’s a lot of old Chanel suits.

The United States is expected to tell Russia on Thursday it is suspending their diplomatic engagement on Syria following the Russian-backed Syrian government's intense attacks on Aleppo, U.S. officials said on condition of anonymity.

Obama considers military response

Obama administration officials have begun considering tougher responses to the Russian-backed Syrian government assault on Aleppo, including military options, as rising tensions with Moscow diminish hopes for diplomatic solutions from the Middle East to Ukraine and cyberspace, U.S. officials said on Wednesday.

The new discussions were being held at "staff level," and have yet to produce any recommendations to President Barack Obama, who has resisted ordering military action against Syrian President Bashar al-Assad in the country's multisided civil war.

But the deliberations coincide with Secretary of State John Kerry threatening to halt diplomacy with Russia on Syria and holding Moscow responsible for dropping incendiary bombs on rebel areas of Aleppo, Syria’s largest city. It was the stiffest U.S. warning to the Russians since the Sept. 19 collapse of a truce they jointly brokered.

Meanwhile, two other nuclear powers are shooting at each other

Two Pakistani soldiers were killed after clashes with Indian troops in the disputed region of Kashmir, Pakistan's military said.

The Indian army said it had conducted "surgical attacks" across the de-facto border between the two countries to foil a "terrorist attack," according to India's Director General of Military Operations...

The incident comes less than two weeks after 18 Indian soldiers were killed in an attack by armed militants on an army base in Uri, about 63 miles (102 kilometers) from Srinagar, the summer capital of Indian-administered Jammu and Kashmir.

It was one of the deadliest attacks to take place on an army base in Kashmir since militant attacks began in the late 1980s, and sparked a furious war of words between India and Pakistan.

Another day, another bunch of dead civilians

The United Nations in Afghanistan said on Thursday that an airstrike in the eastern province of Nangarhar near the Pakistan border killed at least 15 civilians and injured another 13.

In a statement, the U.N. Assistance Mission in Afghanistan called for an independent investigation into the incident, which took place in the Achin district early Wednesday.

It said that all the dead were men, and one of the injured is a boy. They were part of a crowd that gathered at the home of a tribal elder to welcome him back from his pilgrimage to Saudi Arabia to perform the Hajj ritual

Afghan President Ashraf Ghani has formalised a peace treaty with Hezb-i-Islami, an armed group led by Gulbuddin Hekmatyar, a deal the government hopes will lead to more agreements with other fighters....

Ghani also pledged to lobby the US and the UN for the lifting of international sanctions on Hekmatyar, who was designated a "global terrorist" by the Washington for his suspected ties to al-Qaeda and the Taliban.

Comments

Deutsche Bank has a worth of approx. $18.6Billion according to

one way of assessing such entities. The US government has filed a paper claiming $14Billion DB owes the US Treasury for multiple transgressions including failure to pay what is alleged to be owed to the Treasury.

Banks earn more money on loans when interest rates are substantially higher than the are now. Much of Germany has negative rates and no bank has yet to figure out how to earn as much money in this environment as with rates at (say) 5%.

This is a bank is trouble. Sure they can count on Obama meeting DB at less than half way, they aren't some mook with a mortgage after all, but DB is still going to be on the hook for substantial dollars.

Merkel won't do the (probably) proper thing and let DB fail and then nationalize it; her financial road atlas doesn't cover that turnpike.

A lot of smart well-connected people are predicting a bailout.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

DB will be bailed out. DB is a client, they use our trading

platform on their Autoban (DMA) desk. They haven't paid their invoices in months and today we had a meeting with a few members of their legal team.

I doubt you will believe what they requested but here goes -

They asked us for an amendment to our contract providing a "Living Will" which would require us to provide our software and services free of charge IF they had to declare bankruptcy.

DB has so many vendors and creditors that need to get paid and those CEO's will convince the politicians that work for them that they need DB to be bailed out.

Expect the bail out soon.

I bet a few jaws hit the floor on that one

indeed, after the meeting I made the suggestion to

my ceo that we should agree but we require them to agree to pay an additional 15% a month for the next 3 years.

He said to me " and if they go bankrupt?"

I replied "lets buy the swaps to cover" :).

Oh the 'free market"

Financial stocks are starting to crash

This is starting to look a lot like late-2007, early-2008.

We are a long ways from a Lehman moment, but DB has $75 Trillion in derivatives.

When counter trade clients get outta' dodge...

Would like to see if the the derivative clients cash out of Deutsche Bank but then place those SAME trades with a more capitalized bank... Might be 2007 all over again. But I'm sure their will delaying moves over the pond there in Germany - like a rumored public bailout and so forth. There will still be ups and downs, I'm sure, so that the trading in-crowd can make some money on this event.

Peace

FN

"Democracy is technique and the ability of power not to be understood as oppressor. Capitalism is the boss and democracy is its spokesperson." Peace - FN

Let's not forget Italy's banks

clock is ticking

$75Trillion in derivitives: breathtaking fact in light of 2007.

There are people who know what to do, and there are people who have the power to do things, and they are not the same people.

At the very core of this looming crisis, we are dealing with capitalist waste: These financial products, along with financialization of the global economy in general, are non-productive and to the extent they demand, and get, government bailouts, they are parasitical.

At minimum, the truth needs to be continually told - like you are doing - in the hopes it will sink in - little by little - with the electorate.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Note the volumes in this chart

DB is in serious trouble.

Liquidity in Europe's banking sector will dry up in a matter of days if this keeps up.

This is the heart of the matter

Here:

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

It's just a bet like gambling...

What insurance company in their right mind would let YOU take out insurance on your NEIGHBOR'S house burning down??? That is just what these banks are selling as a product. You (they) are betting that someone else will go bust even though you (they) have NO financial interest in the original transaction - only in the outcome. This is nuts, just like we've gone back in time to 2007. Derivatives should be available ONLY to the principles involved in a financial transaction and not be sold as a bet on the "come line" crap table of Wall Street. The only bugaboo this time around is that the derivative gamblers winnings will be paid out in the event of a bank going bust BEFORE the little guy who has an actual savings account gets anything. They have nothing to lose here but we do...

Peace

FN

"Democracy is technique and the ability of power not to be understood as oppressor. Capitalism is the boss and democracy is its spokesperson." Peace - FN

That's an "Oh Wow" chart! Oh Wow as in I didn't realize it was

that dire. Thanks.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Live video from Wall Street today

Looks like Obama

is setting the table nicely for Hillary to have that big clash with Russia she's been itching for. Syria here we come. Got an unpopular President and restive public, what do you do? Start a war, of course. Everybody will start singing the National Anthem again, no problem. It works every time.

native

All Wars are Banker's Wars

Written and spoken by Michael Rivero. The written version is here: http://whatreallyhappened.com/WRHARTI...

What Really Happened Radio Show

[video:https://www.youtube.com/watch?v=SKnF1HEUwuo width:300 height:300]

Peace

FN

"Democracy is technique and the ability of power not to be understood as oppressor. Capitalism is the boss and democracy is its spokesperson." Peace - FN

Some months ago

Christine Lagarde, head of the IMF was on BBC saying that the IMF was on "alert" due to the instability of the European banks. And here we are.

It won't be long and we'll have to revert to the barter system as the banking system is quickly making money devoid of value.

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

So the good news is that we'll probably nuke ourselves to

death before global warming can finish us off.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

We'll cancel out global warming

with nuclear winter.

But you'll have to stand in the right spot.

Maybe irradiation will restart the evolutionary procees.

As if.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Christian Bale and Steve Carrell in...

The Even Bigger Short.

Gëzuar!!

from a reasonably stable genius.