The massive real estate bubble that no one is talking about

The real estate bubble was so 2007.

It burst and a lot of people lost their homes, the banks went bust, and the financial system nearly collapsed, but home prices came down, right?

What if I was to tell you that the real estate bubble has not only been re-inflated, but is now bigger than ever before?

You might find it hard to believe because practically no one in the media is talking about it. Yet the information is out there and readily available.

That's not to say the current property bubble is exactly the same. In fact, there important, fundamental differences that completely change the dynamics of this bubble and need to be recognized.

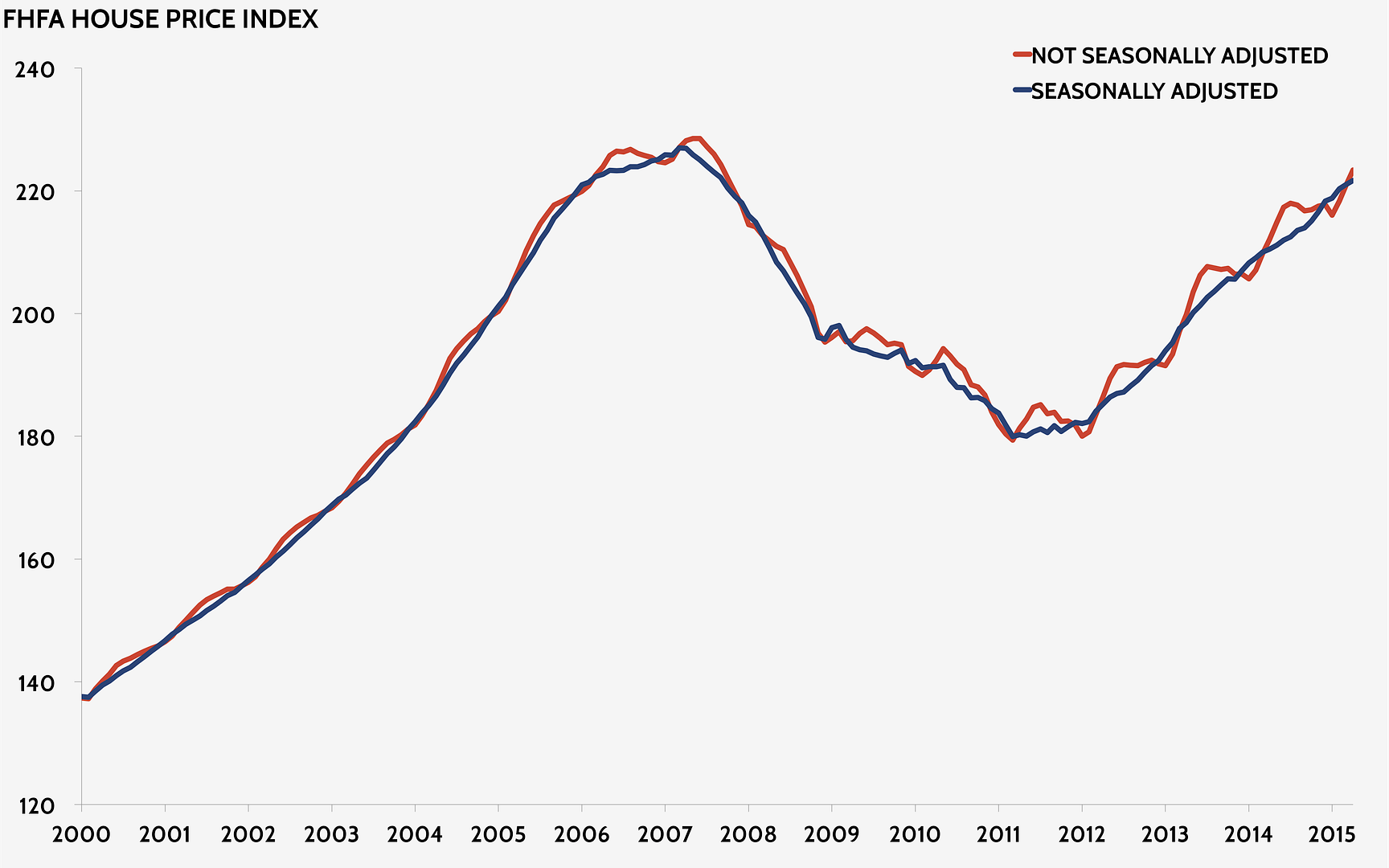

This first chart shows that even by official numbers, housing prices have already near the peak insanity prices of 2006-2007, and they are still accelerating.

Why no one is talking about that is a mystery to me.

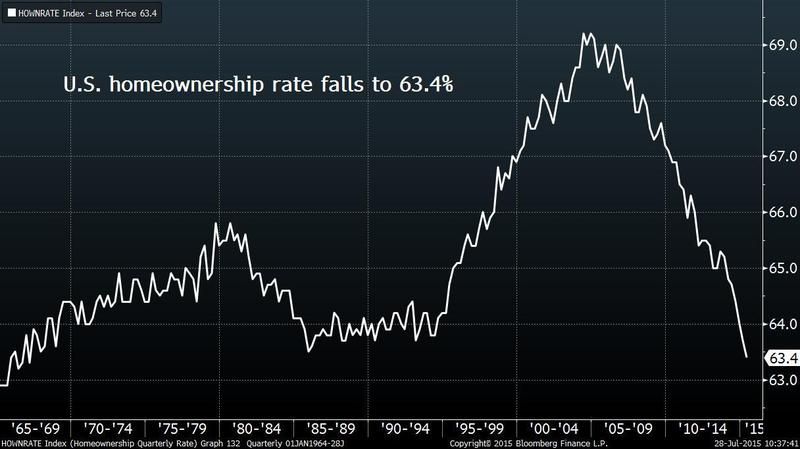

Yet even while housing prices are through the roof, homeownership rates have dropped through the floor.

This chart speaks of a serious crisis.

It also show that this 'echo bubble' in housing is very, very different than the one 2004-2008.

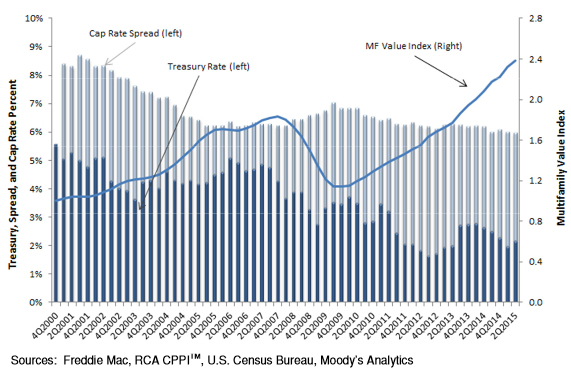

For instance, while everyone is looking at single-family homes as the benchmark for housing, multifamily unit prices have already left the 2007 peak in the dust.

U.S. multifamily-building prices are 33 percent higher than they were at the prior peak in 2007, according to Moody’s Investors Service and Real Capital Analytics Inc., a jump stoked partly by the abundant financing from Fannie Mae and Freddie Mac. That’s raised concerns that a bubble is forming that might pop when interest rates rise, according to Levy, the investment banker. Taxpayers could be on the hook for losses incurred by the mortgage companies if apartment values were to fall sharply.

Multifamily property prices have increased on average of 15% per year since 2010.

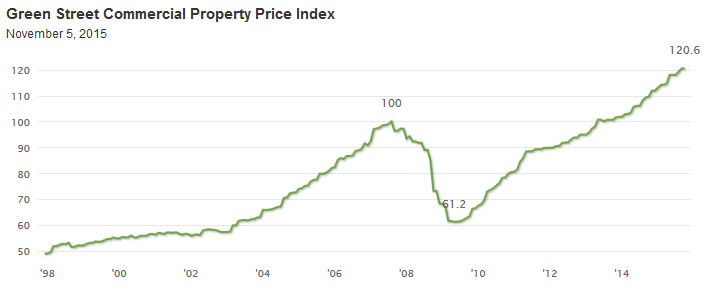

For a better clue, let's look at the commercial real estate market.

The value of the commercial real estate market is roughly equal to the value of the entire stock market, so this is serious.

It seems bizarre that we can find ourselves in this position just seven years after the last enormous property bubble burst. It's even more bizarre that everyone is pretending it doesn't exist...again.

If I was to guess, this mass delusion stems from the fact that the bubble is being created by the deep-pocketed, cash-flush rich, and the people suffering from it are working poor.

Real-estate-data firm Black Knight Financial Services said that in August 21% of mortgages to buy homes–as opposed to refinances–went to borrowers with credit scores below 700. That was down from 24% in August 2014 and from 40% in August 2005.

Some might be incline to think that this means its a stronger housing market because the poor aren't involved. But that would be wrong for two reasons:

1) Most bubbles are caused by the rich, not the poor.

2) A healthy housing market requires the working class to not be priced out of it.

It also shows the weak base underpinning today’s housing market. While the upper echelon of mortgage borrowers has piled into the market with home purchases and refinances at rock-bottom rates, borrowers with any sort of tarnish on their credit reports continue to be shut out or stay away.

First-time home buyers are just 30% of the single-family housing market, instead of the historic 40%.

Home values have jumped 34 percent since reaching a bottom in early 2012.

Home prices are increasing at 13 times the rate of wages. The Housing Affordability Index dropped 12% in just the first five months of 2015.

Looking at this housing bubble from a more comprehensive perspective, housing is vastly less affordable now than in 2007.

So why aren't people calling these homes massively overpriced like they are? Because the way people traditionally measure whether a home is overpriced is by how much you can rent it for, and rental prices are going nuts as well.

Nearly 21 million rental household, or about half of all rental households, spent 30% or more of their income on rent in 2013.

11 million households spent at least half of their income on rent and utilities, up 37 percent from 2003.

These cities aren't always very expensive cities. Miami and New Orleans rank near the top in percentage of income going to rent simply because wages are so low.

To make matters worse, rents rose last year at their fastest rate since 2008 and are "set to accelerate" at "the fastest rate...since the 1980s.".

In December 2013, Shaun Donovan, U.S. Secretary of Housing and Urban Development, gave this warning: "We are in the midst of the worst rental affordability crisis that this country has known."

And its only gotten worse. A recent report came out showing that the most likely future scenario means difficult times are in store for renters.

The number of U.S. households that spend at least half their income on rent—the "severely cost-burdened," in the lingo of housing experts—could increase 25 percent to 14.8 million over the next decade. More than 1 million households headed by Hispanics and more than 1 million headed by the elderly could pass into those ranks...

They've been able to hide this massive real estate bubble by only comparing it to a massive rental bubble.

The question is, does anyone care that we've set up the financial system to collapse again? Or are the sheeple so enamored by the political horse-race that we are going to ignore it until it blows up again?

Comments

Interesting response on DKos

There were dozens of people that said basically "yep, I'm seeing it happen around me"

And then there was a few people who responded with either "Don't believe this guy. He's always wrong" or "It isn't happening in exactly the same way as the last bubble, so therefore it can't be a bubble."

A lot of

free market screw or get screwed responses also. Nothing like an economic diary that doesn't laud the inevitable world as we find to bring all the casino players out of the woodwork. BBB is disgusting he's sitting pretty and could give a shit about affordable housing. Glad to see brul1 back and posting.

This subject is close to home for me literally. It was very interesting to see the wildly varying opinions which had a lot to do with locale. I'm hanging on to my house and not selling even though my property taxes have tripled in the last 3 years and I can't afford major upgrades needed. We have quite a lot of equity as we paid refinanced our disaster in the making mortgage with a credit union. We used our savings to pay it down and depleted the rest of it weathering the meltdown years. Why am I not selling? Because of the vulture investments real estate and 'development' in Portland for what I pay for property taxes, insurance and mortgage combined I could barely afford to rent a broom closet.

Throw in the fact that we're self employed a sole proprietorship btob it would be hard to get decent financing for a new house. We could move to someplace that is as the Realtor's say not as desirable as this hot urban city. We have put a lot of both sweat equity and money into this house for the last 23 years it serves not just as our home but our office space. I also feel that if we sold it the developers and investors would bulldoze it and build 'infill' housing or flip it faster then you could blink. I love my neighborhood and I don't think I could do this.

One question, you seem to be saying that single family house prices are going down. In Portland's case they seem to skyrocketing and are artificially being pumped up. Is this because of a local artificial gentrification bubble or is it because as the many letters we get with cash offers from investment/ realtor's that a lovely young couple is interested buying your home.

How is buying up at inflated prices and wrecking a city legal? Ask me the city government is complicit with these vultures. The residents in our once mixed income demographic city are paying for their own demise with increased property taxes and by the corrupt city services who in turn charge us for the costs of putting in new sewers, fixing the streets, putting in transformers/wiring etc. infrastructure to support the gigantic apt complex's and tall skinny infill Mc Mansions.

The demolishing,defoliating and rebuilding is proceeding at and break neck speed. so if I sell and make a tidy profit I'm still, as screwed as the under water home owners are. I couldn't afford the rent anything decent and if I bought a house it would eat the profit. I'm staying and working on building up our business so we can at least afford to pay for maintenance. This is like musical chairs and I think I'll just stay on the chair I landed in. Meanwhile I need a new roof that's going to cost 16,000$. time to quit screwing off online and get to marketing online as our business is all electronic. My son said the other day 'Mom your a spammer'. Here i go off to find some hot new leads. Our business is picking up so maybe the spamming works.

The Commercial real estate bubble

link