Krugman and Greece's Moment of Truth

There's a lot of economic rubbish being printed about the Greek Crisis, most of it coming from the creditors and bankers. The story they are selling is that Greeks are lazy and they won't reform their economy, so they have no one to blame but themselves.

They think that you are too lazy to find the actual facts before the clock runs out on June 30th. By reading this essay you will prove them wrong.

Paul Krugman cut through the cr*p with this article.

In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology.

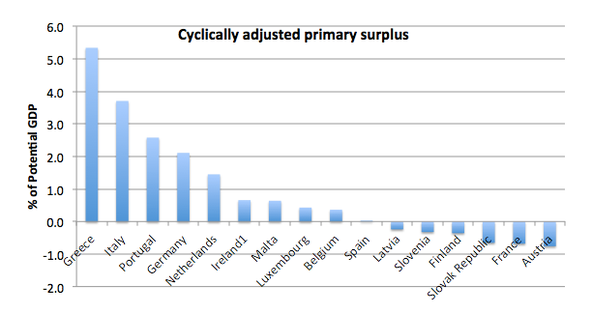

Krugman then shares this chart showing the budget of the Greek government before interest rate payments.

Achieving a large primary surplus in midst of a 25% collapse in the economy of Greece is a massive achievement of austerity, and stands as proof that Greece has been reforming their economy.

How did they do that? With increadibly painful cuts. Greece has cut 25% of its public employees since 2009. Greece has cut its fiscal deficit from 15.6% in 2009 to 2.5% in 2014, one of the largest reductions in the world.

The biggest lies about the lack of Greek reforms involves pensions (note: in the United States that would be called Social Security).

I've seen wild claims about how Greeks can retire with a full pension at 50 years old and other such bull.

Here are the facts:

Greece has cut their pension payments by an average of 40% in five years.

Because of those pension cuts, 45% of retirees in Greece live below the poverty line

Because of the economic Depression, pensions are the main source of income for 49% of Greek families

Before they will release €7.2bn in aid that Greece needs to pay public-sector salaries and pensions and repay €1.6bn in IMF loans, those lenders want further reforms to the pensions system, including penalties to put people off taking early retirement and more cuts to even the lowest pensions.

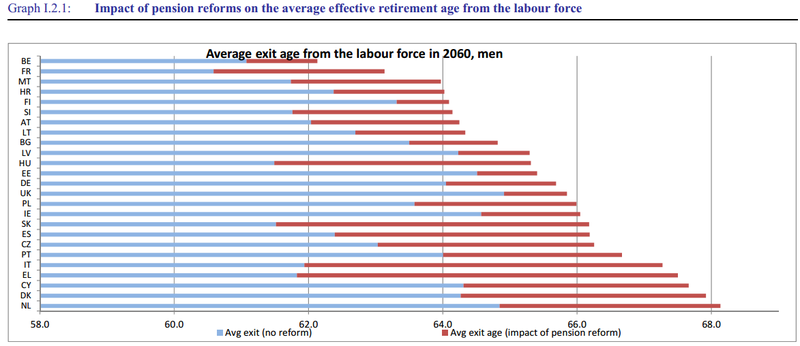

Finally there is the rediculous claims about Greeks retiring early. Here is a chart showing the truth (note: Greece is under 'EL').

Yes, Greece had needed to reform their pension age, but that's been done already. The average pension is now less an $1,000 a month.

Because of all these cuts, 20%of Greeks 'no longer have enough money to cover daily food expenses'.

That's a crisis in my book. But the bankers and creditors want blood from a stone, and they are willing to lie in order to get it.

There are two other lies about Greece that must also be addressed.

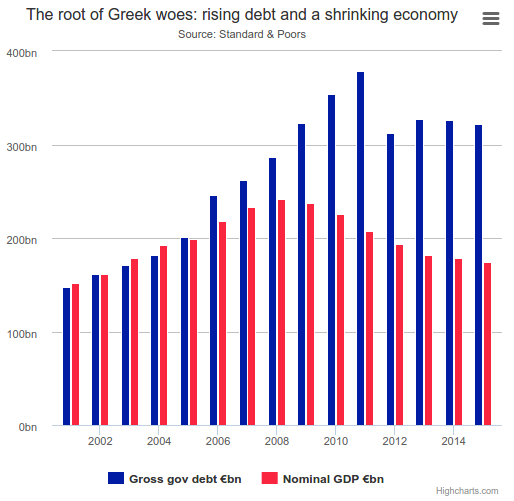

First of all, was the massive 2010 bailout. The thinking goes that Greece got the largest bailout in history, so if they are trouble now it's all on them.

However, the 2010 bailout was a farce. More than 90% of the bailout was for French and German private banks, which simply moved Greek debt from private hands to public hands at the IMF, ECB, and other central banks in Europe.

The mountain of debt remained almost the same as far as Greece is concerned. The IMF has since admitted that was a farce.

The other lie that needs to be addressed is that this is Germany vs. Greece.

Admittedly, Germany has taken a hard line with Greece, so that much is true. However, the group that has taken the hardest line in these negotiation is the IMF, and the United States has the most clout of any nation in the IMF.

In fact, the IMF walked out of the talks a week ago. That means that even if Germany reached an agreement with Greece this week, the IMF could still veto it if they don't come to the talks. The IMF has already killed at least one deal.

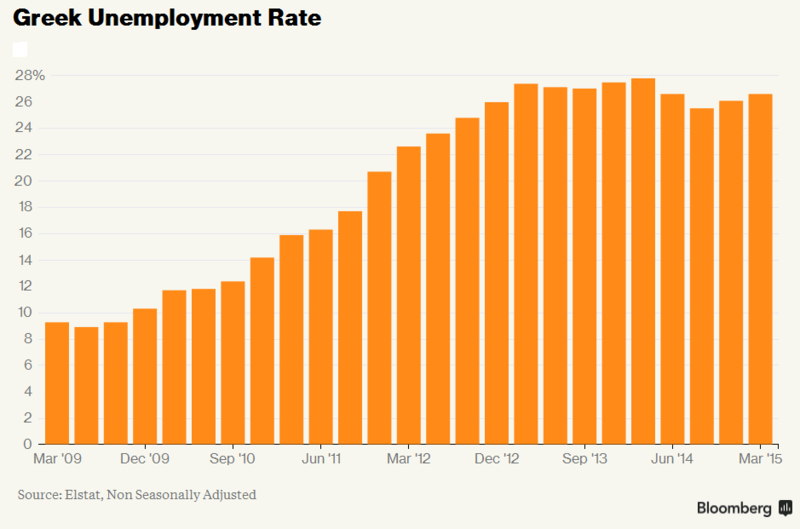

Greece is in a Depression equal to the worst the United States experienced in the 1930's, and the financial leaders in Washington and Europe seem determined to make sure that things continue to get worse.

Is it any wonder that the Greek government has accused them of plotting regime change.

Comments

Aha! Economics!

Seriously though, this is the real agenda of the Austerians -- and yes, that is spelled correctly (although it does indeed look a bit like Austrian, the economic school of thought that has much in common with the neoliberal austerity approach now being taken with Greece): To shift from social needs to private gain. And those who can and will gain are those with the oligopoly on capital, i.e. the global .01%, through the means of a massive redistribution and transfer of -- or rather continued and redoubling of efforts to redistribute and transfer -- the wealth and worth of the working class to the owning class and its handmaidens in the financial elite.

And it is and has been through finance, from interest charged on credit cards, mortgage refinancing, and payday loans (a.k.a. loan sharking), and a whole host of ways designed to suck you into a yawning abyss of debt.

Class warfare? You bet. And it's past time we started firing back.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon