If the economy is so great why is everyone broke?

For years we've been bombarded with stories about how wonderful the economy and the labor market is doing.

For example, take a look at these recent news articles:

Goldman sees unemployment below 4%, job market getting so good it could 'overshoot'

The Job Market Is Having A ‘Goldilocks’ Moment

Wow! Everything is wonderful for the working class.

Except when you actually talk to working people. Then you come away with an entirely different story.

Almost 8 out of 10 American workers say they live paycheck to paycheck to make ends meet, according to a new survey from CareerBuilder. That can force people to take on debt or otherwise struggle when an unexpected bill arises...

A year ago, about 75 percent of U.S. workers said they were living from payday to payday, a number that has grown to 78 percent this year.

The first thing that stands out here is that we are talking about more than 3/4 of all workers.

The next thing that jumps out is that things are getting worse when we are already at so-called "full employment".

If this was just one study, that would be one thing.

But this is just the latest study that shows the same alarming condition of household finances.

About 57 million Americans have no emergency savings

Nearly 7 in 10 Americans have less than $1,000 in savings

As for things getting worse for working class households, there are several other trends that back that up.

One of those trends is the falling savings rate.

The personal savings rate was 3.6 percent in the fourth quarter of 2016, down from a previously published 4.9 percent, according to annual revisions to gross domestic product and related data, released Friday by the Commerce Department. That’s the lowest reading since a 2.8 percent rate in the final three months of 2007, just as the U.S. was entering a recession.

The figures suggest that consumers were saving less to maintain their spending entering 2017.

The other trend is consumer debt.

The average American is so deeply in debt that they may as well stop pretending that they are free.

Some 40% of Americans with debt are spending up to half of their monthly income paying it back. And that may not even be enough to cover how much they owe....

The survey found that nearly half of Americans are carrying at least $25,000 in debt, with an average debt of $37,000, excluding mortgage payments. About one in 10 surveyed said their debt was more than $100,000.

When you are that deeply in debt there are a lot of things you can't do, such as quit your job and pursue your dream.

However, there is one thing you can still do - you can fall behind.

More than one in three Americans are living with debt in collections, according to a newly released study from the Urban Institute. The credit of 77 million Americans could be severely impacted, preventing them from reaching their financial goals.

The national average of debt reported in collections is $5,187; held by 35% of the population with credit files. This debt does not include delinquent mortgage payments, but is instead made up of debt like unpaid medical bills, overdue credit card balances and even outstanding utility statements.

One in three means chances are that more than one person you know is in over their head right now.

If I sound like a broken record, there is a reason for it: because you've heard it all before.

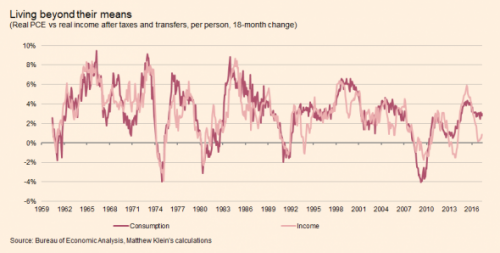

Not since the beginning of 2008 have Americans saved so little — and that’s before accounting for inflation. It could be a sign of trouble ahead.

...The current gap between growth in consumption and disposable income is among the widest since the data begin.

Today’s situation is one where consumption would have slowed into recessionary territory if not for the collapse in the savings rate. The one parallel is 2004-2007.

There is another debt record being set by American consumers right now - credit card debt.

Credit-card debt in the US rose in June, surpassing the peak set just before the 2008 financial crisis....

"We simply can't keep taking on credit card debt forever without it causing major problems," said Matt Schulz, the senior analyst at CreditCards.com. "This record probably won't be a major tipping point, but it likely isn't too far off."

"It's worrisome that we are starting to see delinquency rates now begin to rise even with the unemployment rate at a cycle low," David Rosenberg, the chief economist at Gluskin Sheff, said in a note on Tuesday.

The story here is unmistakable: the working class household is under immense financial stress, and it is taking on debt that it can't handle in an attempt to keep from sinking into bankruptcy.

The consequences of this on a personal level are obvious.

The "major problems", on the other hand, are somewhat less obvious, but no less severe.

For instance, the cost of higher education has outpaced wages for a generation. This eventually creates "major problems".

Across the state, University of Hawaii college enrollment has plummeted by 15 percent in just six years, from a high of 60,300 students in 2012 to 51,300 as of 2017.

Trying to explain this decline, university President David Lassner pointed to the fact that college enrollment has been declining around the country.

...As we all know, the cost of a college education has been increasing for years, so it was only a matter of time before potential students began weighing the costs and benefits of substantial debt and asking whether it’s really worth it.

Another example is home prices, which have once again entered bubble territory. What "major problems" might that cause?

Newly built homes are more expensive than they've ever been before. They are also more expensive when compared to similar existing homes than they've ever been before. And that is why sales are suffering, dropping an unexpected 9.4 percent in July compared to June, according to the U.S. Census.

They are simply out of reach for too many potential buyers.

... Last December, the median price hit the highest of any month on record.

In addition, the price premium for newly built homes compared to comparable existing homes has more than doubled since 2011, according to John Burns Real Estate Consulting.

No matter how you look at it, virtually all working class households are in trouble and it is starting to bleed into the generally economy.

Which begs the question of how this could be happening after more than 10 million jobs had been created since the end of the recession? Why isn't this showing up in wages?

Economists come up with complicated and hard to understand answers to that question. When in fact the real answer might be a lot simpler.

Maybe, just maybe, those jobs never existed.

Allow me to introduce you to the concept of the Birth/Death Model.

There is an unavoidable lag between an establishment opening for business and its appearance on the sample frame making it available for sampling. Because new firm births generate a portion of employment growth each month, non-sampling methods must be used to estimate this growth.

Earlier research indicated that while both the business birth and death portions of total employment are generally significant, the net contribution is relatively small and stable. To account for this net birth/death portion of total employment, BLS uses an estimation procedure with two components..

There is one truth and one lie in that statement.

The business birth and death portions of total employment is indeed significant.

However, the net contribution is NOT small and stable.

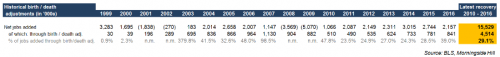

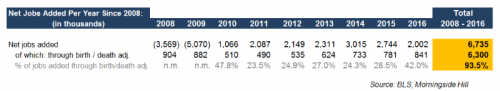

Morningside Hill did this breakdown of the BLS numbers.

In 1999 the Birth/Death Model added 0.9% of jobs created.

In 2003 it added 379.8% of jobs created.

In 2009, when more than 5 million jobs were being destroyed according to BLS surveys, the Birth/Death Model created 882,000 jobs.

Last year the Birth/Death Model accounted for 39% of jobs created.

A full 30% of jobs created since 2010 or 4.5 million out of 15 million jobs were added via the birth/death adjustment.

That's not small OR stable.

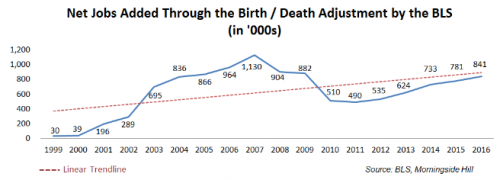

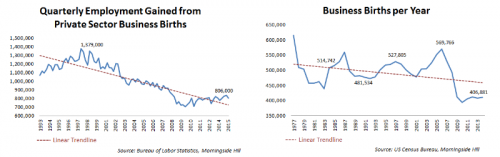

What's more, the BLS trend is to say that more and more jobs are being created through new businesses.

Which is a perfectly fine assumption to make...assuming it is true.

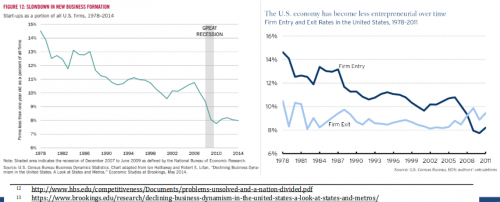

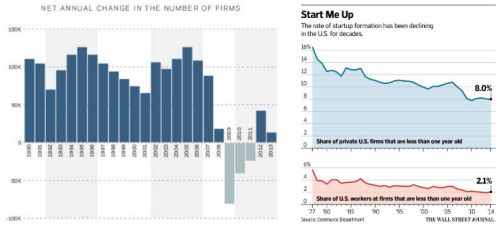

Is there any evidence that more and more businesses are being created in the U.S. to employ more and more people?

No, it's not true!

Even by the BLS' own measurements, new business creation is in a Depression.

Therefore 93.5% of those jobs supposedly created since 2008 are at the very least questionable, if not an outright lie!

Comments

What are you talking about? Nobody's broke!

And the Democrats know because everybody they listen to has plenty of money.

Clearly everybody else in the world is just a lazy slacker who doesn't understand the concept of self sacrifice or asking their friends and family for help. I'm sure that they'd be happy to help with a small loan of a million or so, if people just ASKED...

Sorry, just laughing because I got a small sum from my folks for my kids to go school shopping, and it feels like a fortune, just because it isn't spoken for already.

But then, I've been broke for so long, I'm not sure I know what it's actually like to have money. Acting in LA was a great prep for the way the rest of the American Economy does business. Beg, and pray that you get lucky.

I do not pretend I know what I do not know.

The game of numbers

Our model of the economy is nothing more than an abstraction, a delusion we feed ourselves simply because we don't take a few extra minutes to understand the numbers themselves.

How many times do we hear that the economy is doing great because of the stock market? OK, let's look at that. From data I found (if I'm wrong please correct me):

http://www2.ucsc.edu/whorulesamerica/power/wealth.html

So, when we hear that the stock market is doing wonderful therefore the economy is doing great...no. Doctors, lawyers, business owners, investors, etc. they are doing fantastic, but the rest of America? Nope.

Regarding things like unemployment numbers...that doesn't tell us anything about the state of the economy itself. If unemployment numbers are high, yes, we see that as a problem for the economy. But if unemployment numbers are low, it is a false sense of security. It doesn't state anything about the work itself, just that people are working.

If you're working min. wage, you are employed.

Can you barely survive working 2 jobs? You're employed.

You about to foreclose on your house? Still employed.

I've always been skeptical of GDP

In fact, I've been skeptical of any economic number which includes the contributions of capital. I've always wished there was somewhere simple to go to get the non-capital GDP of the US (Or any other country). I have two issues with capital.

1) It isn't really anything but pushing numbers around. There is no concrete reality underneath it. It doesn't enable anything. It doesn't support anything. It's just a game rich guys (and me) play with other rich guys.

2) As I noted, whatever is going on there is not relevant to the vast majority of Americans. Sure, for me it rocks. But for everyone else... not so much.

I feel like there'd be a much more accurate assessment of our economy if you simply took out Wall Street before looking.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

Let's also mention the fact that....

unemployment for people with disabilities is more than double the rate for the neuro-typical and able-bodied. That number would be far higher if you factor in that most folks with disabilities are part-time workers. Oh, and just for good measure:

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

You can say that again.

Unemployment among the blind is at least as bad as the usual unemployment rate among members of the Actors’ Equity labor union, said to be 90%.

http://www.huffingtonpost.com/brendan-mcmahon/unemployment-is-a-lifesty_...

And many who do have jobs are employed at tasks far below their qualifications and potential.

Jobwise, the blind are disadvantaged even in European countries that otherwise have excellent social safety nets. Spain is something of an exception in that the blind can be hired by their own big, influential organization O.N.C.E. that runs the national lottery.

https://en.wikipedia.org/wiki/ONCE

Well at least there'll be

some entertainment value in watching -- after the sure to happen (and soon) crash, and the automation eating whatever minimum wage jobs are out there (as well as better paying work)...

watching the Dem Party STILL try to make it that they'll win votes by continuing to pretend that nobody gives a crap about anything but which tribe they belong to.

Orwell: Where's the omelette?

That reality check

keeps bouncing, because no one wants to admit they may be doing worse than all those they know. Something to do with, even if they have nothing, they have their pride and what dignity they can hang onto, and, yes, it must be someone else's fault.

Then the Ds keep adding insult to injury. It is a wonder why the working class don't just get over it: Rs & Ds not so much into you.

Fighting for democratic principles,... well, since forever

Thank you GJohnsit

This is a perfect example of your stereotypical writing quality and it's a large part of why I come back here and even occasionally put in a donation.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

Interesting NPR story on Advertising Down

So here we are, 8 years into a recovery (very, very late in the cycle by historical standards) and the patient (working class) is still laying on the table gasping for air.

It's time for the Monied Class to admit they have rigged the game way too far in their favor. If people have no money to buy the economy doesn't function. All facilitated by the corporate whores in congress.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.