The Housing Bust Never Ended!

It just changed into something even worse.

Home prices have returned to bubble-level prices, but millions of former homeowners remain permanently damaged from the bust.

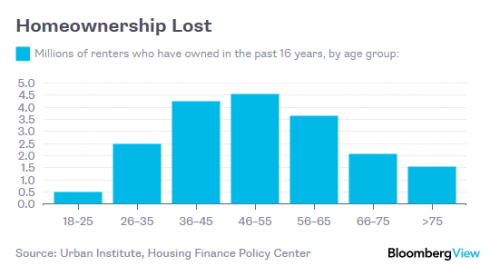

A new report from the Urban Institute's Housing Finance Policy Center offers a valuable glimpse at what has happened to the U.S. population's housing and credit status since the turn of the century. Of particular interest: A group of about 19 million renters who, at some point in the past 16 years, used to be homeowners.

People can become renters for various reasons, such as moving for a job or downsizing in retirement. The data, though, suggest that this group consists largely of people who lost their homes because of unaffordable loans, the housing bust and the subsequent economic slump. They are mostly middle-aged, unusually likely to have foreclosures or other black marks on their credit records, and are concentrated in bubble states such as Arizona, California and Florida.

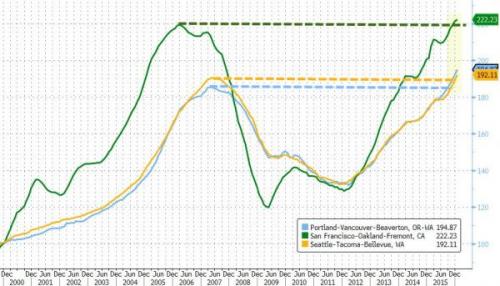

The Housing Bust grinds on year after year, yet the news media and political establishment have long since moved on and forgotten it. Why? Because home prices have returned to unaffordable rates, especially on the West Coast.

It's a testament to how slanted the economic system is.

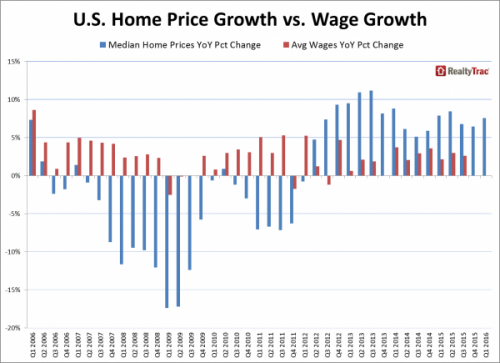

The recovery in home prices, while celebrated by existing homeowners and investors, is not based on the economic health of the general population.

The disparity is so obvious, that Lawrence Yun, NAR chief economist, the same group that has never witnessed a bad time to buy a house in all of human history, had this to say:

"Home prices ascending near or above double-digit appreciation aren't healthy – especially considering the fact that household income and wages are barely rising."

This spectacular rise in housing prices, in spite of stagnant wages, caused an unusual milestone late last year.

For the first time in recent memory, wealthy all-cash home purchases were a larger percentage of the housing market (38%), than first time homebuyers (32%, and the lowest percentage since 1987).

While also unsustainable, this is also the opposite dynamic as the recent housing bubble. There is no mountain of debt with subprime borrowers this time, so there is nothing to pop. On the other hand, Boomers will one day want to sell their homes in order to retire, and Millenials will simply be unable to pay those inflated prices because they never had a chance to build up equity.

Unlike the news media and politicians, let's not forget the former homeowners who are now barely scratching by as renters. Their situation is increasingly bleak.

While high-rise apartments, $100 million houses, and luxury condos continue to pop up in major metropolises all over the United States, millions of poor Americans are living in housing that they can’t afford. The National Low-Income Housing Coalition states that about three-quarters of them are spending more than half their incomes on rent and utilities, a much greater share than what experts say should go to housing to ensure financial stability. People generally shouldn’t spend more than 30 percent of their income on rent, according to Fortune.

When so much of their income goes to rent, those with low incomes face the possibility of homelessness if an unexpected health expense or job loss, or even something as basic as car repairs, busts their budget for the month.

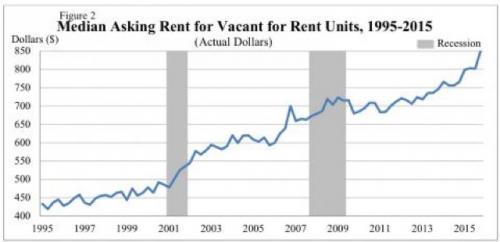

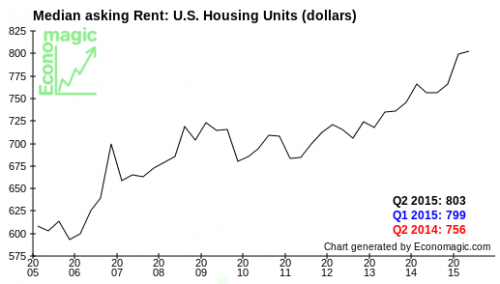

Rents have risen faster than the rate of inflation, and double the rate of wage growth for several years now. What's more, things are expected to keep getting worse for renters.

“Rents are insanely unaffordable on a historical basis in the United States right now.”

- Stan Humphries, chief economist at Zillow

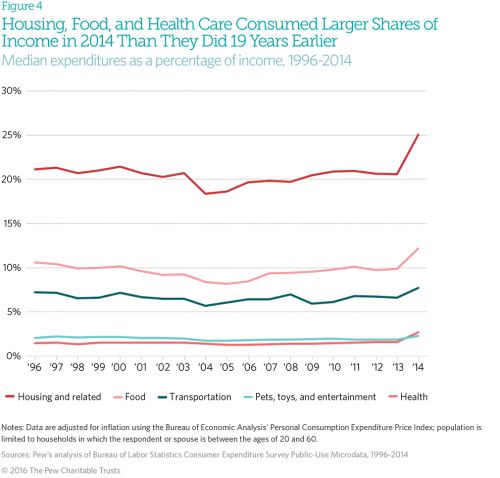

While the problem today is primarily housing affordability and wages that are increasingly falling behind, the problems of living expenses in America today isn't limited to just that.

A recent report by Pew Charitable Trusts is so bleak it is bracing.

Here are some of the findings:

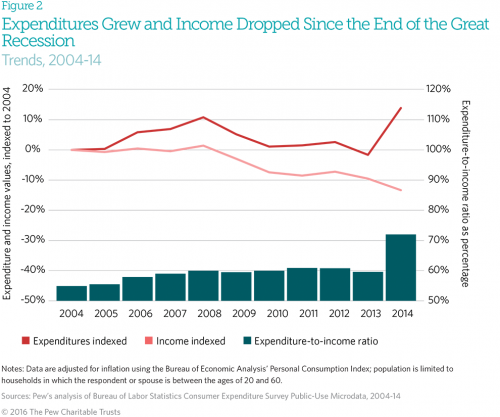

As the recovery began, median household expenditures returned to pre-crisis levels, but median household income continued to contract. By 2014, median income had fallen by 13 percent from 2004 levels, while expenditures had increased by nearly 14 percent.In 2004, typical households at the bottom had $1,500 of income left over after expenses. By 2014, this figure had decreased by $3,800, putting them $2,300 in the red. The lack of financial flexibility threatens low-income households’ financial security in the short term and their economic mobility in the long term.

"Typical households at the bottom" in the case of this study are the bottom third of households.

In America today, 63% of Americans are one paycheck away from homelessness.

“Savings are depleted for many households after the recession,” it found. Among those who had savings prior to 2008, 57% said they’d used up some or all of their savings in the Great Recession and its aftermath.

Savings rates have actually dropped by half (11% to 5.5%) between 2012 and 2015.

In America today, 40% of workers have contingent jobs, up from 30% in 2005.

That's a far cry from President Obama's recent statement that "America is pretty darn great right now."

Comments

Let's take a break from rox/sux battle

and consider something that is deeply important - the state of the working class in America today.

I'm going to drop this on TOP tomorrow morning. Please give a tip if you can.

Maybe they'll actually talk about something of substance for a change.

The battle was won by "sux" long ago.

A third of Orange, however, is interested in engineering a "victory" the old-fashioned second-grade way, by telling on teacher. This is what keeps everyone fixated on that "debate" as such. Take away the "rox" people, as we've done here, and you actually have a topic.

"To watch the leader of the most powerful nation on earth endorse and finance a genocide prompts not a passing kind of disgust or anger, but a severance." -- Omar el Akkad

Thanks GJ!

Great content as always. Friday Open Thread is ready and is a call for content.

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will be lonely often, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. - Friedrich Nietzsche -

No one will pay attention I expect

But I will look for it.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

You may be right

but I'm still going to try to insert something that matters anyway. You never know.

One last chart.

Put together these charts ...

Falling home ownership

+

(somewhat) stabilized house-ownership prices

+

rising rental rates

This is totally expected given the huge, repeated, hits savings have taken.

People that could afford mortgage payments don't buy a house, because they lack the savings to handle the up-front costs.

Just one more nasty effect of driving down wages.

Yeah, I've been saying this a along time

Housing prices have been at elevated prices for a long time. Some of the problem initially were people buying homes, with the intent to sell higher. Banks helped inflate prices and were too willing to extend credit. It was unsustainable.

TARP was awful and terribly flawed. It gave money to banks to give them ability to extend credit. But it didn't address the underlying problem of people whose credit was damaged and being damaged and thus could get credit. The money should have gone directly to making payments on people's mortgages. That would have maintained home ownership. Maintained people's credit scores, and still got money to the banks.

So, instead we got banks foreclosing on homes. Leaving entire residential districts empty. Lower revenues from property taxes. Homes empty, inviting crime, lowering property values. Local governments are strapped for money. State governments losing revenue and with balanced budget requirements, even more money taken from local governments. Infrastructure crumbles. Schools strapped and unable to maintain quality (plus other pressures on them.)

Banks, however, want to maintain high level values on homes. So, the foreclosed homes aren't on the market at the same time. They are dribbled out into the market - raising values because the so-called "supply" is limited. They were able to do this because, guess what, they got all the money from TARP, giving them lots of money and able to hold onto properties for long periods of time and if somes homes had to be demolished, no big deal. They got money for that too. And keeping home prices rising makes up for it even more.

-9.75, -8.21

Who is buying houses for cash?

Is it mostly the banks that have bought up the houses that they foreclosed on or wealthy foreign investors? Maybe both.

Another thing to keep an eye on is the subprime auto loans. Many of the people who lost their houses during the subprime mortgage scandal have such poor credit that they are paying huge interest rates to buy cars and the banks are bundling the subprime auto loans just like they did housing loans. And Dodd Frank, which Hillary states that Obama has strengthened the banking laws, has been watered down by the banks and congress so much that it's basically worthless.

The link to the article about the subprime auto loans problem

http://www.counterpunch.org/2016/03/18/80774/

“Rising odds asteroid that briefly threatened Earth will hit moon”

Is it too late to knock it back on course?

House flippers.

I've been watching what's going on on our street on my walks to work. There's been 3-4 houses for sale or rent at any given time since I started walking last fall. There was a small crappy duplex for sale, they were asking $375k for it. Someone bought it and put it up for rent; I called to see what they were asking for rent, $1300/month for four bedrooms, he said. (I don't think that's how duplexes work?) A couple days later there was a sign up by it saying "I buy houses, all cash! Call ______ ".

There was another small house being completely remodeled. I kept thinking, I bet they're going to put it up for sale as soon as they're done remodeling it. Sure enough, a month or so ago there was a FOR SALE sign up. I'm pretty sure someone already bought it as the sign is no longer there. Unless they took it off the market again because they're still working on landscaping stuff.

I think a lot of them just get bought by investors who then put them up for rent at inflated prices.

We're moving back in with my MIL next week because they jacked our rent up too much. We're living on just my income right now while hubby is going to school, and it would be over half of my income, for a tiny one-bedroom. And all of the appliances are old except the dishwasher, and the washer and dryer that FIL bought us for a wedding gift. We tried to negotiate but they basically said we can't do anything, it's corporate that sets the prices. Bah. I know rental prices are more reasonable in your area Snoopy, but that's too far for us and I don't have my own vehicle.

I don't know how long they think it can keep going like this. Pretty soon no one is going to be able to afford to rent OR buy. And we shouldn't have to all be doubling and tripling up on roommates or living with family into our 30s. At least moving in with MIL is also saying Fuck you, I refuse to play your bullshit games! to the rental market.

This is the main problem right here:

We simply aren't being paid enough. After rent, car payments, student loan payments, bills and groceries and health care there's nothing left. Something has got to give, hopefully sooner rather than later.

/rant

This shit is bananas.

I'm sorry that you have to move

But am glad you have some where you can move to. I'm one house payment away from losing my house, but have no where I can move to. And I am afraid that I will lose most of the things in my house because I don't think I have the money to move them in to a storage facility.

I'm so disgusted with our government that didn't put any restrictions on the banks before they gave them trillions of our fucking taxes after they deliberately crashed the global economy.

I'm trying to make extra money by selling my photos so I can keep my house. I'm on so many websites that sell photos, but so are a lot of people.

Are you in SLC?

Rents in my area might be cheaper, but they are still very high.

“Rising odds asteroid that briefly threatened Earth will hit moon”

Is it too late to knock it back on course?

I'm sorry your situation is so precarious too.

Yeah, we're in Murray right now; we'll be moving to Taylorsville.

This shit is bananas.

People in Silicon Valley are buying for cash

and the situation is exacerbated by flippers.

I will look for it as well

I'll tell you what though, this post scares the daylights out of me. I'm one of those 19 million people.

I'm scared of how many tens of millions of Americans

who are so close to not making it, and who's employment is so fragile.

I'm scared because I know that we are probably just months away from another recession.

I'm scared what these people will do when they lose everything.

We're being priced out of Silly Con Valley

We're on the waiting list for a senior apartment complex that's geared to those on fixed-incomes -- since our only income is Mr. Scribe's pension, we qualify. We're currently borrowing money from his mom to keep us from living in our car. Hoping that something opens up by May (April's already out of the question). If we didn't have family responsibilities for his mom (laundry, errands, doctor's appointments et al) we'd be looking to move inland; Sacramento is still reasonably affordable and has a decent transit system.

turning 60 this year, and not feeling stable at all

from economic view, at least. i consider the source of my problems to be corrupt republican stranglehold on the political economy of my state. but that is just me. it is a gravy train for them.

you can see me in front of home in my profile, i pooled income with my mother to purchase it over 10 years ago, the year before the spike of florida multiple hurricanes of 2004 in florida. then a weird real estate spike of 2006, price of house doubled practically overnight. 80k to 160k, then shortly after, it crashed to 'normal' again. never figured that one out. maybe haarp weather manipulation and then corrupt real estate manipulation. who knows.

though mom passed away about 5 years ago, and my 2010 marriage to vilma didn't bring the stability i expected, she has been a real cuban tempest in my life, the real crisis was when i lost main employment last oct 2015 for reasons which are a much longer story. i suspected internal corruption and i was actually ostracised as a state whistle-blower. rethugs again. no surprises here.

i always had two jobs, one for about 10 years in a school in grounds maint., the other a second part-time business for myself, essentially mowing lawns and irrigation fixes with a helper when work got too overwhelming.

which means, as i get older, nothing is getting any easier and now i'm finding i have to work harder and have less money to pay the same bills, car payment, mortgage, ect. i can't work 2 jobs now because who is gonna hire you at 60. so i keep pushing my old lawnmowers.

and scramble every month to find enough money to avoid living under scenic florida interstate highway bridges.

It was the perfect crime

Create a bubble, break it, buy up everything at greatly reduced prices, rent it out.

The next one will be even worse.

Great post!

Regardless of the path in life I chose, I realize it's always forward, never straight.

Well done, as always.

It's up at TOP

I hope you can somehow get it some attention.

as opposed to the endless rox/sux battles.

This post hits close to home

GenXer here on the late-ish side. Had the distinct honor of being at the beginning of the runaway tuition costs that Millenials also enjoy. Yay, debt! Also went to buy my first home a couple years later than my dual income friends and --as I found out later-- at the height of the bubble. Didn't happen. Almost signed my name but chickened out when I did the math and realized they were taking insane* risks to approve someone at my income for that size mortgage (450sqft condo even). Ramen would have cost too much. I'd have been eating air. And that's when I knew we were in trouble. Actually, I'd had an inkling before, when my ex got approved for a $450k mortgage double my almost mortgage all while making less than me. Now, again single income because my partner is sick, rents are sky high and owning is a fantasy. Slap a fresh coat of paint on a hovel and call it home.

* Not being flippant. Predatory lenders were/are insane as in DMS code for name your personality disorder.

"Intelligence is the ability to adapt to change." Stephen Hawking

NEW: http://www.twitter.com/trueblueinwdc

This is a very important essay

because it really speaks to just how dire the financial situation is for the majority of Americans.

Extremely well done, gjohnsit!

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

My area

Down here in the hills of Ohio, we got slapped with a double whammy a few years ago. Great Recession hit hard and I saw a ton of foreclosures and Sheriff's Sales.

The subprime thing at least answered a question about how a neighbor from hell managed to build a $365K house (he says), on an income of about $40K a year. Multiple refinancing has enabled him to hang on to it through the years, but the last appraisal on it came in at $125K (the property is a dump with piles of crap and junk cars everywhere).

A friend of mine lost a house that had been in her family since the early 1900s, then her husband's pay was cut. They searched for over a year and a half before finding a rental they could barely afford.

I was doing a dispute on my property taxes a few years ago and had to come up with five comparable properties. While searching for them, I noticed something odd. Some ridiculous number (that I can't recall now) of houses that had sold around here in recent months. This is a rural place, few jobs, and houses simply don't sell at that rate around here. But there they all were. Then I noticed something else. Over half of them had been bought by investment groups, hedge funds and banks - all from out of state.

A few months later, I thought I'd discovered why. We had us a full blown fracking boom!

Oh yeah! Thousands of kids flooding the county offices doing title searches. Landmen from every O&G outfit you could name calling, knocking on doors, waving a gas lease and smilin' like Billy-Bob the used car salesman. Wuz he gonna make you a deal? HooWee! You wuz gonna be reech beyond your wildest dreams. Drillers, pipeliners, seismic surveyors, support services, you name it, they were like cockroaches everywhere. And, of course they would all need a place to stay.

That's when I found out rents had gone to $1000 per bedroom per month. And figured out why everywhere you looked hotels were sprouting like dandelions.

The frack boom fizzled in 2014 of course, but house prices and rents haven't seemed to have caught on to that fact yet. Now I understand why. Now I understand why one place on my north end sold last year for $265K. Dinky little house, but on twenty-five acres. Last year, a place behind me sold for $125K - ten acres of grass with a 2 bdrm trailer on it.

Both of these are why everybody's property taxes went up... again, btw. Because everybody knows what some urbanite with more bucks than brains pays for a place automatically makes YOUR place worth more too. If you sold it that is, and if you could find a buyer as stoopid as the other guy did.

And, if history is any guide, that will be the next thing to put people in a bind. Property taxes. This is right in line with an old script I watched play out decades ago in N/E Ohio. Beautiful, rural area full of longtime residents whose ancestors settled the place in the 1800s. Cleveland Real Estate Inc. spotted it and wanted it immediately. Farms were parceled up. Lots sold. New roads, new schools, gas lines, water lines, sewer lines. Taxes went up to pay for it all. This was before CAUV (current agricultural use value), so the native population could no longer afford to pay them. They scattered to the winds. Population went from around 80,000 to 227,000 in twelve years flat. Welcome to the Chem-lawned treated, pyrethrin and malathion drenched Exurbs.

We have got to stop this shit. It's insane, and anyone who can't figure that out has no business being in charge of anything.

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

yep

I see the same thing in Oregon and Washington state. A house we had in Oregon and had bought in 2001 for $169k was recently put up for sale for ~$740k.... built in 1958 and sold then for $11k (or so they say). I work with people in Washington state that earn about $65k a year and bought houses that cost $250k plus and there is no guarantee that they can stay in that area (around Seattle) for their career... they frequently have to move for the job. We bought a cheap place in the country with some land too far to commute for work but the price was low enough that I could afford to pay rent somewhere to live close for work... but now I am in California then have to bounce to a couple other states and out of the country for a little while. My rent in the home state for work needs is $250 more than my mortgage payment for the house so I split the rent with a roommate and go home on weekends (when still in the state)...

Many would consider the job I do fantastic because it pays very well and is somewhat unconventional with lots of 'free' travel but it is nothing of the sort. It is unstable for the long term and I work insane hours fighting sleep deprivation on a weekly basis with a huge dose of high stress at times which adds to the sleep deprivation...

I fully expect another housing and financial system crash. In the LA area where I currently being a wage slave, it has more of a third world characteristic to it with hot rodding and basically unpredictable behavior from people living in the area... can't wait to leave this area to a little more relaxed area (more rural) in another state.

I think we have 3rd world quality leadership in this country and I don't care what people think about Obama, I think he sucks just as bad as bush did... he just speaks like he's normal and has a great smile but his 'fixing' the economy is a huge lie... in my book, he did the opposite.... just kicked the can down the road until the next crisis hits. The key is interest rates which I don't believe will regain normal rates till we're on a new and sound currency system (backed by something real instead of the lies and deception of politicians. The path to a sound currency is fraught with much pain and suffering for 100's of millions of people and it is a dreadful prospect but the utter lack of courage and ethics demonstrated by the politicians makes it seem so much worse than it could have been if we'd just taken the hit 2008 and let the fraud die a natural death instead of a fraudulently induced 'life'. My employer just got bought out by a private equity fund last year which doesn't bode well at all for a bright future.

Another permanently maimed ex-homeowner here.

Had to sell off our home of 10+ years at a loss, due to business contraction in the recession. Couldn't keep it, so it went down the road. Now renting, and just signed a two-year extension to the lease to maintain the current rent levels for that long, anyway. Getting close to retirement age, and am now making my peace with the reality that I will in fact die penniless (at my desk, while working).

Will be a cold day in hell before I talk to a realtor again. Fuck real estate, and the horse it rode in on. That is all...

Seconded! eom

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

It's terrible just how many people here on C99P

this topic applies directly too.

It tells you how under-reported this stuff is.

the 'economy'

is just a wrecking ball swinging on an end of a frayed steel cable. I actually understand completely your views on Trump on your other diary. A lot of people have listened way too much to what 'others' have written about Trump rather than exactly what Trump has actually said. I actually listen to he says rather than what people write about him ... he is far less of a war monger than hillary but he does say things that are not politically correct but are not much different than what I have heard a million times said by guys when talking amongst ourselves. He and Sanders are the only ones who are non-globalists which is the main reason so many have come out of the wood work to destroy both of them (IMHO). I prefer Sanders but really am worried he will be crushed by the clinton juggernaut which I find far more disturbing than Trump who is left of Clinton in many, many ways including economics, trade, immigration (sane policies please) and war.

I, too, am one paycheck away from losing my home.

If either me or Raggedy Andy lose our job, we are in deep shit. It infuriates me. At 63, you'd think I'd be in a better financial situation, but no! Let's keep wages low! No raises for the working people! Let's raise insurance premiums so their take-home pay goes down! These things are happening to me, as well.

We have 21 acres. Luckily, only the house and three acres are mortgaged. If we lose it, we still have 18 acres - free and clear - to live on, so we're lucky. Of course, that would take money to get ourselves going, but we could buy an RV and live there, no problem - it's the only thing we've got going for us. In the meantime, we struggle everyday. This is why I give to Bernie - not much - why I give to c99 - not much - but these are the two most important things, to me, right now.

Something's gotta give. I just hope it's the good side of things to come.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

It is hard to watch it go.

We had our piece (35 acres- raised llamas) on the market for almost two years, trying to get a decent price for it, so that we could perhaps try to get into something much smaller to retrench while looking for new gigs. Tried to save it: burned through savings, burned through 401Ks, burned through everything, until we simply had to take what was offered and move back into town. If we could have unloaded it somehow earlier, we'd be in better shape, I guess, but it was not to be- there were no buyers, since it wasn't an in-town McMansion. Realtor had both sides of the deal, so she made out like a freakin' bandit, and we came away in the hole. In retrospect, we probably should have just left the keys in the mailbox years before- we would have been in no worse shape. C'est la guerre.

I do have to say that i'm starting to kind of like the asset-free lifestyle in one respect, though: when people threaten legal action these days, I can just laugh at them. Good *luck*, Bucko.

Somehow I missed this yesterday

Coincidental timing for an article.

sorry - reply just below posted as new comment

newbie

That's intense.

Always enjoy your work and look forward to every article.

Thanks

Want to mention

For those of you who are of the older persuasion (65+). Check into Homestead Exemption.

Every state has it, with varying rules. Basically, if you're over 65 and own the house you live in (only one to a customer), the exemption knocks the first $25,000 off your property's value. You don't pay taxes on that amount, and it shows up as a credit.

In Ohio they recently put an income test on it... Thank You Goobinor "I'm for the poor folks" Kasich. If you earn more than $31 K a year, you can't get the exemption now. Fortunately I have no problem meeting this requirement.

Not much I know, but it'll save you a few bucks.

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

watch

when the next crash happens all the krugman types will come out of the wood work telling everyone this or that reason for it... instead of the truth that Obama and the subservient senate and congress to wall street REFUSED to do the right thing and instead bailed them out and allowed all the fraud and corruption to continue unabated and they'll have the "Solution" which is hand monetary authority to the World Bank, WTO and IMF via SDRs. It is all corrupt, all the time