Friday is Meme Day

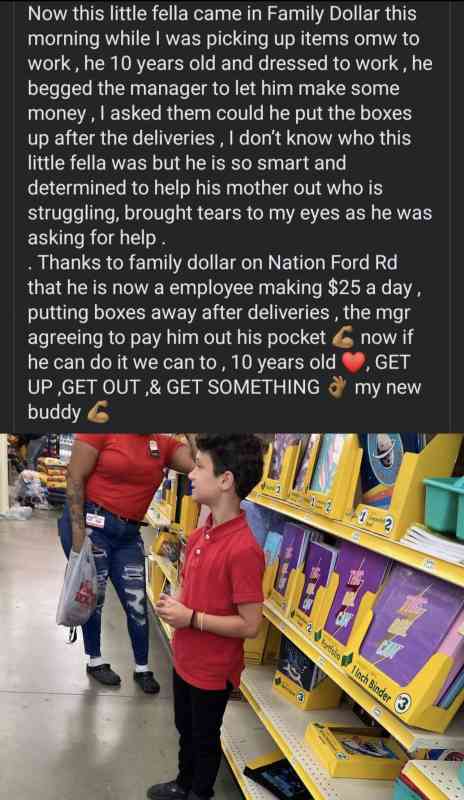

Let's all rejoice in this "uplifting" story below.

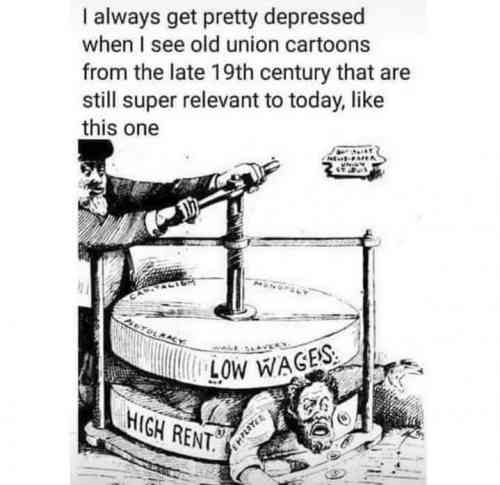

I'll finish off with this topper.

This recent, unusual moment of worker leverage made Bank of America quite anxious. The memo expresses distress about “a record tight labor market,” stating that “wage pressures are … going to be hard to reverse. While there may have been some one-off increases in some pockets of the labor market, the upward pressure extends to virtually every industry, income and skill level.”

The memo recalls a previous Bank of America memo in 2021, which it says warned of “very strong momentum in the labor market, suggesting the economy would not just hit but blow through full employment. Fast forward to today, and these trends have been worse than expected.”

The memo is an uncanny demonstration that the economist Adam Smith was right when he described the politics of inflation in his famed 1776 work, “The Wealth of Nations.”

“High profits tend much more to raise the price of work than high wages,” Smith argued. “Our merchants and master-manufacturers complain much of the bad effects of high wages in raising the price. … They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains. They complain only of those of other people.”

Thus, exactly as Smith would have predicted, Bank of America complains loudly about the bad effects of high wages in raising prices, but appears to be silent about the pernicious effects of high profits.

...

Most interesting of all is that in Bank of America’s enthusiasm for the Fed going on the attack against working people, it gets the basic facts wrong: Wage pressures have turned out not to be, as its memo claims, “hard to reverse.”“If you did see continually accelerating wage-growth, it would be a problem,” Dean Baker, senior economist at the Center for Economic and Policy Research, a liberal Washington, D.C., think tank, told The Intercept in an email. “That would almost certainly mean a wage-price spiral with ever higher inflation. However, [nominal] wage growth has slowed sharply from around a 6.0 percent annual rate to just over 4.0 percent in recent months. … So, [Bank of America wants] the Fed to raise rates (and unemployment) to attack a problem (accelerating wage growth) that doesn’t exist in the world.”

The memo therefore tells us what we suspected all along: The most powerful economic actors in the U.S. — entities like Bank of America and its clients — do not like working people to have power. But it’s nice to have it in their own words. Harris, the author, was not available for comment.