Fracking and tar sands industry facing ruin

The price of Brent crude oil dropped below $28 today, a price that few would have predicted two years ago. While the shake-up in the industry (i.e. defaults and bankruptcies) from these low prices are on everyone's mind, it should be noted that sub-$28 is the price for high-grade crude oil.

What comes out of Canadian tar sands is not high-grade.

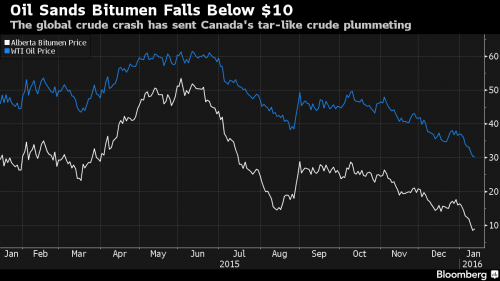

Think oil in the $20s is bad? In Canada they’d be happy to sell it for $10.

Canadian oil sands producers are feeling pain as bitumen -- the thick, sticky substance at the center of the heated debate over TransCanada Corp.’s Keystone XL pipeline -- hit a low of $8.35 on Tuesday, down from as much as $80 less than two years ago.

Producers are all losing money at current prices, First Energy Capital’s Martin King said Tuesday at a conference in Calgary.

Which doesn’t mean they’ll stop. Since most of the spending for bitumen extraction comes upfront, and thus is a sunk cost, production will continue and grow.

$8 oil for what takes probably $40 or more to produce is bad (for tar sand miners), but there are some frackers in North Dakota that envy the tar sand miners.

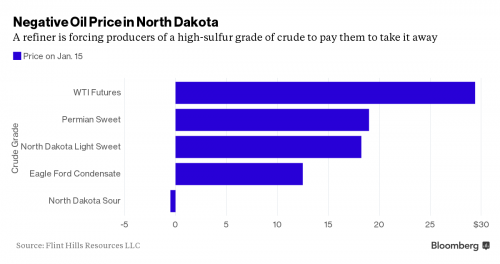

Flint Hills Resources LLC, the refining arm of billionaire brothers Charles and David Koch’s industrial empire, said it would pay -$0.50 a barrel Friday for North Dakota Sour, a high-sulfur grade of crude, according to a list price posted on its website. That’s down from $13.50 a barrel a year ago and $47.60 in January 2014.

While the negative price is due to the lack of pipeline capacity for a particular variety of ultra low quality crude, it underscores how dire things are in the U.S. oil patch.

This particular crude is a minority of shale oil production, but like subprime housing in 2007, it's the canary in the coal mine.

At $35 virtually every fracker is cash flow negative and we've broken well below that.

Banks that lent the frackers all this money are bracing for massive losses. How big will these losses be? Maybe more than you think.

Here are a few more gauges of the crisis to come: Since 2006, an additional $1 trillion of capital expenditures by just 59 companies has been spent on shale drilling and operations, according to oil-and-gas industry site OilPro.com. And another $1 trillion of energy-bond debt has gone on the books, according to the Bank for International Settlements. Energy-company bonds will sell off and create a pall of risk avoidance across all industries.

A staggering $2 trillion of debt was meant to generate a 3-to-1 increase in value. That value today is definitively less than half of what was spent. Overinflated year-end 2015 reserve values and hard-defaulted credit facilities will combine with an absence of private and public equity markets. The contagion through the expanding and loosely regulated derivative market is surely destined for surprises. Leases will be forfeited and meaningful plugging and abandonment liabilities will build. If the company cannot pay, the banks will be forced to do so.