Central Banks are leading the global economy off a cliff

Central banks are increasingly turning to experimental monetary policy to deal with stagnant economic growth and the danger of deflation. If things keep going in the same direction, it'll soon come to America.

After the Bank of Japan cut some rates below zero last month to spur growth and inflation, strategists are weighing the Federal Reserve’s options in case of a crisis. If the world’s biggest economy weakens enough that traditional policy measures don’t help, the Fed may consider pushing rates below zero, according to Bank of America Corp. and JPMorgan Chase & Co.

In 2012, New York Fed researchers said negative rates could prompt individuals to avoid depositing money in banks, potentially weakening the financial system.

“They’re still concerned, but not as much as they once were,” said Mark Cabana, a New York-based interest-rate strategist at Bank of America. “They’ve seen how successful they were in other countries, where there haven’t been adverse impacts on market functioning.”

OK, sure. NIRP directly punishes savers, which isn't fair or just, but as long as it is "successful", right?

But is it successful? Consider Japan.

As a result of the BoJ’s decision, banks are now more attractive to savers than money market funds, which have begun closing funds to new money. Brokers described the decisions by 10 fund providers following last month’s decision by the BoJ to close its doors to new money as “contagion”.

The finance ministry also suspended a sale due in March of 10-year bonds to retail investors. With the yield on such bonds now almost zero, but no negative rates on bank accounts, private investors have little incentive to buy.

The direct cost of negative interest rates would be just 0.2-0.3 per cent of profits at the three biggest banks, said Deutsche Bank analyst Yoshinobu Yamada. But banks will suffer when they have to reinvest maturing Japanese government bond (JGBs) at lower rates, he warned. “In an extreme case, the megabanks could end up with almost no JGB holdings,” said Mr Yamada.

So the short-term effects of NIRP in Japan are 1) the money market industry froze up, 2) the long-dated bond auction failed, and 3) the major banks will lose money and will stop buying government bonds.

Sounds like a success to me! No, wait. I mean the opposite of success.

Complete and total failure.

However, Japan's experience with NIRP is new. What about a nation that's had NIRP for years? What about Sweden?

The verdict is in.

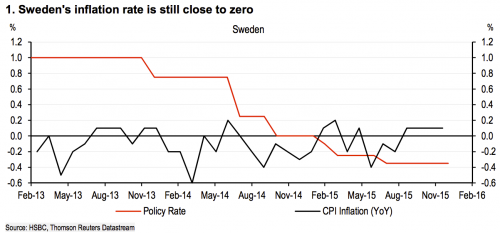

Sweden's extreme negative interest rate policy has failed, serving only to inflate a housing bubble.

The country's central bank, the Riksbank, has had an interest rate of -0.35 since the beginning of 2015 in an effort to boost inflation. That requires banks to charge a deposit rate of -1.1%, because Swedish interest rates move in a lock-step "corridor."

Even with a -1.1% deposit rate - the lowest in the world - inflation hasn't budged at a measly 0.1% and is still miles away from the central bank's 2% inflation target.

The Riksbank also missed the mark on its other objective to make exports cheaper and more competitive through a weaker currency. The krona weakened for a few months but is on the way up again.

It's important that negative interest rates haven't worked in Sweden, because if the policy would work anywhere, it would work there.

Sounds like a success? Nope. Complete and total failure here too.

Since the negative effects are so obviously a failure, I guess success has been redefined to meaning "not causing a complete collapse". Sort of like how the GWOT has gone.

One thing NIRP has done is cause huge real estate bubbles, and those always turn out well.

Everyone pretty much agrees that that housing in Sweden is in a bubble. With interest rates so low they are negative, Swedes are getting mortgages and putting the cash into stocks and bonds rather than paying down the debt. Economists worry that if the economy takes a downturn, Swedes will be forced to liquidate their stocks and bonds at the same time they sell their houses — and that could cause an economic death spiral.

An economic death spiral. Now where have I heard that before? Oh yeah. Citicorp mentioned it the other day.

"The world appears to be trapped in a circular reference death spiral," Citi strategists led by Jonathan Stubbs said in a report on Thursday.

"Stronger U.S. dollar, weaker oil/commodity prices, weaker world trade/petrodollar liquidity, weaker EM (and global growth)... and repeat. Ad infinitum, this would lead to Oilmageddon, a 'significant and synchronized' global recession and a proper modern-day equity bear market."

In fact, the home of NIRP, Europe, is where the finance industry is having the most problems.

The stocks of giant banks, Deutsche Bank AG and Credit Suisse Group, were already lower than it was in the depths of the financial crisis in 2009. And that was before today's bank stock rout.

In the end, NIRP discourages banks from making loans and taking deposits. Which brings up a big question.

The state of affairs does raise some difficult questions for banks. If banks aren't there to make loans and earn a margin, what is it that they do?

Comments

well...yes

Looks like I called this one too

Japan

Europe's in trouble, China is in trouble, Japan is in trouble, South America is in trouble, OPEC is in trouble. Even Canada is in trouble.

How long do people think America can fly above all this?

til they crash, that's how long ... /nt

https://www.euronews.com/live

One last update

Negative yield pile tops $7 Trillion

I can't help but wonder when this breaks