News Dump Wednesday: Failing Fed Edition

Submitted by gjohnsit on Wed, 06/01/2016 - 12:24pm

Federal Reserve hacked 50 times

The U.S. Federal Reserve detected more than 50 cyber breaches between 2011 and 2015, with several incidents described internally as "espionage," according to Fed records.

The central bank's staff suspected hackers or spies in many of the incidents, the records show. The Fed's computer systems play a critical role in global banking and hold confidential information on discussions about monetary policy that drives financial markets....

The records represent only a slice of all cyber attacks on the Fed because they include only cases involving the Washington-based Board of Governors, a federal agency that is subject to public records laws. Reuters did not have access to reports by local cybersecurity teams at the central bank's 12 privately owned regional branches.

Even Congress has gotten curious what is going on

A congressional committee has launched an investigation into the Federal Reserve Bank of New York's handling of the heist of more than $80 million from accounts it maintains for the central bank of Bangladesh, CNBC has learned.

In a letter to New York Fed President William Dudley on Tuesday, House Science Committee Chairman Lamar Smith, R-Texas, asked for "all documents and communications" related to the cyberheist from the Bank of Bangladesh account. The committee also wants to know what oversight the Fed has conducted of the SWIFT system, an international electronic messaging system used by banks worldwide to authorize billions of dollars a day in money transfers.

At a private equity conference this week, Drew Bowden, a senior SEC official, told private equity fund managers and their investors in considerable detail about how the agency had found widespread stealing and other serious infractions in its audits of private equity firms.

In the years that I’ve been reading speeches from regulators, I’ve never seen anything remotely like Bowden’s talk. I’ve embedded it at the end of this post and strongly encourage you to read it in full.

Despite the at times disconcertingly polite tone, the SEC has now announced that more than 50 percent of private equity firms it has audited have engaged in serious infractions of securities laws. These abuses were detected thanks to to Dodd Frank. Private equity general partners had been unregulated until early 2012, when they were required to SEC regulation as investment advisers.

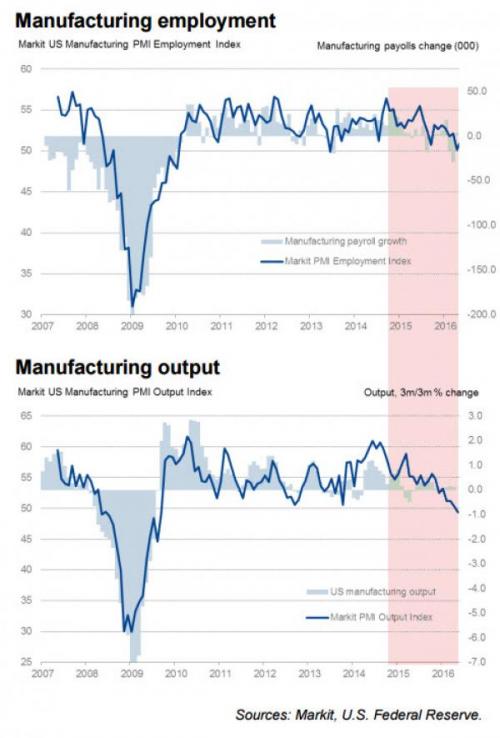

The JPMorgan global manufacturing purchasing managers index (PMI), slipped to 50.0 in May from 50.1 in April. Any reading above 50 signals expansion, and any reading below signals contraction. This reading of 50.0 signals stagnation.

"Rates of expansion in production and new orders also eased to a near-stagnation, while the pace of contraction in new export business was one of the steepest during the past three years," Markit said in its report. "The muted performance of manufacturing was also reflected in the labour market, as staffing levels fell for the fourth straight month."

How to lose $4.5 Billion in a day

Last year, Elizabeth Holmes topped the FORBES list of America’s Richest Self-Made Women with a net worth of $4.5 billion. Today, FORBES is lowering our estimate of her net worth to nothing. Theranos had no comment.

Our estimate of Holmes’ wealth is based entirely on her 50% stake in Theranos, the blood-testing company she founded in 2003 with plans of revolutionizing the diagnostic test market. Theranos shares are not traded on any stock market; private investors purchased stakes in 2014 at a price that implied a $9 billion valuation for the company.

Since then, Theranos has been hit with allegations that its tests are inaccurate and is being investigated by an alphabet soup of federal agencies. That, plus new information indicating Theranos’ annual revenues are less than $100 million, has led FORBES to come up with a new, lower estimate of Theranos’ value.

A day after announcing their “final assault” on the ISIS-held city of Fallujah, Iraqi troops have been stalled at the southern gates, in the face of major resistance from ISIS forces. Unlike previous defenses, there was no word of ISIS using suicide attacks, and rather faced the Iraqi military heavily armed in a gun-battle....

US officials have conceded that they believe Fallujah will not only be a long, difficult fight for the Iraqi military, but that the troops will likely face hostility from the civilian population as well, as the overwhelmingly Sunni Arab city is averse to being “liberated” by the Shi’ite-dominated military.

Comments

1,000 migrants drowned last week

did anyone notice?

And they're on those unsafe boats because

we and our European allies, after turning their home countries into smoking ruins, refuse to do anything to help the victims of our policies.

Ooh! Scary Muslims! Some of them might be mad at us! No shit! So let them drown.

China debt bubble bigger than Subprime bubble

Nothing to see here

Are those deaths on the candidate who made Libya a failed state?

(Hint: not Sanders and not Trump)

MPAA lobbyist / SOPA sponsor to draft Democratic party platform

https://torrentfreak.com/mpaa-lobbyist-sopa-sponsor-to-draft-democratic-...

Low interest rates are poison for pension funds

a single downturn and they are finished

How do I extricate myself from TIAA and AXA?

This is getting serious for my long-term. They will go down, too, and swallow my assets. I know, all about me.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Wishing you the best, riverlover eom

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

The Fed could be a force for good again.

There is this little phrase they invented.. 'Quantum Easing'.

The Fed used it to bailout banks by buying up 'distressed' assets.

If you can bailout banks, you could bailout Puerto Rico...or heaven forbid...

buy up student loans and reset the interest to Fed Fund's rate.

The Fed has that authority to intervene.

I want a Pony!

45 million trapped in modern slavery

Up 28% in two years

The TPP should stabilize that boom

to a nice sustainable 99%.

Well, I feel so much

better now after reading this diary and comments.....ugh.

Thank you for these informative diaries, gjohnsit.

dfarrah

On the other hand ...

The Fed only has monetary policy to deal with downturns. My own opinion is that they've mostly done us a great service. For all complaining about low returns, also remember: those same rates apply when you want to refinance your mortgage or buy cars. As far as Main Street goes, that's not a bad thing.

If we want to level our cannons at someone, level them at Congress, whose fiscal policy acts as an anchor on what the Fed tried and mostly succeeded at doing. Also, be thankful we're not in great depression 2.0.

thanks, janet!