Three indicators of how much millennials are struggling

Just to be clear, these economic indicators will include Gen Z as well.

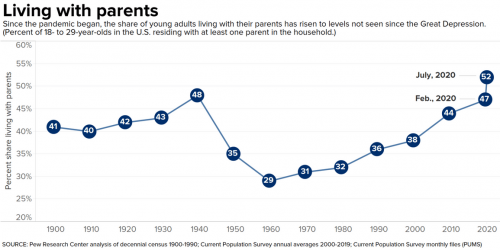

Nearly a third of millennials and Gen Zers, over the age of 18, get financial support from their parents, according to a new survey by personal finance site Credit Karma. The site polled more than 1,000 adults in October.More than half of parents with adult children said their kids are living with them. Another 48% said they pay for their kids’ cell phone plan, car payments or other monthly bills. Nearly a quarter also said they provide their adult children with a regular allowance, pay some or all of their rent or have them as an authorized user on their credit card, the report found.

...

Finances are the No. 1 reason families are doubling up, Pew found, due in part to ballooning student debt and housing costs.

With limited financial resources, lower wages and shorter credit histories, young adults are struggling to manage high-interest debt more than other age group, according to a new report by Urban Institute. Nearly one in five adults between the ages 18 and 24 with a credit record in the U.S. currently have debt in collections.“Young adults are particularly vulnerable,” the authors of the report wrote. “The high cost of borrowing coupled with limited income makes it difficult to manage debt in this stage of life.”

Overall, credit card balances are surging, up 15% in the most recent quarter, the largest annual jump in more than 20 years. At the same time, credit card rates are now over 19%, on average — an all-time high — and still rising.

But for new applicants for credit, APRs are typically even higher, as much as 30%, according to Ted Rossman, senior industry analyst at Bankrate and CreditCards.com.

This last indicator involves much more than just millennials and Gen Z, but I think that it's an easy guess to say that those groups are over-represented in this trend.

Nearly 2/3rd of workers live paycheck to paycheck:

As of November, 63% of Americans were living paycheck to paycheck, according to a monthly LendingClub report — up from 60% the previous month and near the 64% historic high hit in March.

...

Compared with a year ago, 32% of all consumers are saving less than they were before, LendingClub found. Among those who said they are struggling financially, half are unable to save and have no savings at all.One-third of working adults — 33% — feel somewhat or very uncomfortable about their ability to pay an emergency $400 expense, a separate survey by the Bipartisan Policy Center also found. Nearly 8% wouldn’t be able to afford it at all.

What does this add up to? A third of millennials are not dating because they have no money.

According to the data, financial instability is hampering their ability to find 'the one' because it's forcing them to budget, instead.

...This information follows a separate study, also by Match.com, which said that the average single American spends about $60 (£49) per month on dating - but, unfortunately, it's still men who fork-out most of the costs.

Fifty-one per cent of men spend more than $100 (£82) a month on dates, while 29 per cent spend more than $150 (£124) a month.In contrast, 66 per cent of women spend less than $50 (£41) a month on dates, while their average amount spent on Valentine’s Day is just $51 (£42).

The shift in economic reality, where male-dominated jobs vanished in the U.S. and got shipped over-seas, while female-dominated jobs have flourished, has gotten far ahead of our culture.

The fact that men are still expected to pay for the date, is just the most modest of example. It's much more built into our culture than that.

Many social scientists think they have found it: The declining "marriageability" of men in the eyes of women. The bottom line is that young women are beginning to outperform young men on many measures of and educational and professional attainment and salary. This matters, because even in today's progressive cultural environment, both men and women (in every educational and racial group) overwhelmingly deem high status and the ability to "provide financially for a family" to be more important for a husband than for a wife. Matching these attitudes is the fact that women in all demos tend to marry "up" in terms of education and income. And the fact that low-income women (who today are the least likely to marry) are far more likely than high-income women to cite unavailability of financially stable men as a reason not to get married.

It isn't just dating. Nor is it limited to just getting married. It goes all the way to the ability to stay married.

The laments she has heard are backed up by data, according to Mona Chalabi of fivethirtyeight.com. She summarized University of Chicago Booth School of Business findings for NPR, saying that, in their sample, dissatisfaction increased, and could lead to divorce, “once a woman started to earn more than her husband.”And the amount didn’t appear to be relevant: “Whether the wife earns a little bit more or a lot more doesn’t actually make much of a difference,” says Chalabi.

The University of Chicago found that a wife making even $5,000 a year more than her husband was associated with a greater risk of divorce.

Comments

So it isn't just millennials.

One stat from the silly geese at CNBC caught my eye. Of course they (and, I might add, we) are "saving less than they were before." Inflation is eating into those paychecks. Remember that the next step, with the Fed's "help," is creating a situation when nobody can buy a home unless they pay cash. So it creates a class of lifelong renters. Who cares? Oh, that's right, everyone who isn't paid not to care.

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa

Sometimes decisions by the ruling elites make no economic sense

So you might be incline to be confused.

When that happens it helps to remember that there is one thing even more important than profits:

Power.

Impoverishing the working class is not smart economically. But it makes total sense when you look at it from the point of view of the power dynamic of a feudal system.

Well when you have a dictatorship, or an oligarchy,

or any sort of government that isn't in a genuine sense a democracy ("democracy" being an over-used word to promote things which aren't democratic), most of the collective agenda goes toward activities which have to be pursued to keep the people on top in power and the people on the bottom out of power.

This is, also, why democracy (contra the ancients) is the most stable form of government.

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa

And the reason we can't own our own homes....?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

What a fink!

That word was long gone from my memory until I watched the video. Come to think of it, ‘fink’ doesn’t even come close to describing Larry Fink’s character. It’s all pretty scary.

Funny coincidence, isn't it?

But you're right; no, it's hardly sufficient.

Somebody needs to kill this man already. I can think of no persuasive logical, moral, or strategic justification not to. He's as mortal as anyone else, and The Proper Legal Channels(TM) are worthless.

There's no point in being Good if it just makes you a dupe and a slave for Evil.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Thanks for the break down

When our sons graduated from college they lived with us for awhile saving their money. Both got jobs immediately upon graduation. We did not pay their own personal bills but they lived rent and food free. They both needed a jump start as without one, they would be in a financial hole probably for years.

And oh, the youngest who lived off campus said that many students were getting SNAP benefits. Lucky it seemed local social workers understood what was going on and helped the students good food aid.

When my sons were starting in high school

my wife and I made a promise to them. They could graduate college debt free as long as the school was reasonable, like in state. We would cover it all (well, actually mom gave up her pay for 7 years) and be given what we could to start them out in life.

I grew up believing in the adage that every father pays the debt to his father to his son. Pay it forward.

My wife skipped college to go to work, but that was mid-60s. Later she used the tuition incentives in her job to add the college courses necessary to move into a better job at work. Hers was a labor of love for our sons.

One semi-humerous exchange with my older son during xmas break his senior year... ya know dad, some of the students are taking a lighter load and adding a year or two. My response: That sounds pretty good, let me know how it works out for you. My promise was for 4 years. You agreed then. Your mom and I are looking forward to some folding money.

I'm afraid I don't have a lot of sympathy

for the millenial plight and even less for the Gen-Z crowd.

I see too much of the attitude that socializing means more to them than a real quality of life.

Eat drink and be merry, the MasterCard bill isn't until next month.

If they know who and what a neoliberal is --

they have at least some respect from me.

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa

Do you know any millennials?

The ones I've known have been hard-working and smarter than I was at their age.

I think you're losing me here

Just what does working harder have to do with overspending their income? What does that have to do with high interest debt? It isn't a matter of working harder, it's a matter of working smarter. Of getting the most out of their income.

In a couple of other threads I pointed out some of the hidden inflationary overheads. Like a fee that I would have to pay to cover what I consider to be an item that the business should pay. And I would have to pay it twice.

For example, each apartment I've lived in during the past few years wanted me to have renter's insurance. And they went out of their way to push their subcontractor. And that insurance must cover liability for an item that the property should cover as a part of doing business. Their sub charges a fee of $2.75 as the overhead to the insurer (the sub is just a middleman) as well as a $.50 processing fee each month -- and it must be monthly. That 50 cents covers his automatic charge against the tenant's credit card -- automatic. So the insurance that shouldn't be my responsibility ends up being over 25%.

How about taking that pile of coins to the CoinStar? They take over 12%.

The whole place is rigged. And those really smart people you're talking about just sit there and take it. Along with their cootie shot.

Let's go Brandon.

If you have ever taken on any debt,

you have overspent your income. You have, I have, we all have. The difference is that the sub-10% interest you and I enjoyed is now 30+%. I ran up to the $100k+ federal student loan cap of the time in college, and paid it off over 10 years, on time- at 4%.

I took on a mortgage on our dream ranch in the early 2000s, and ended up losing the place in 2015 when my industry crashed. Blew through my 401k trying not to lose it- should have left the keys in the mailbox and simply walked away a year earlier, but I still wanted my dream. I’m still paying that off, and I will never be able to retire: as I’ve said many times, my retirement plan is to die at my desk. Dreams will kill you.

The younger folks now know better than to even bother, as I had to learn the hard way. I’m a late boomer (Gen Jones), and the last thing I will ever do is to slag off the millennials: they have no chance. And they know it. Of course they “take it”: what the fuck are they supposed to do about it, precisely?

I know that I will never buy another property. I doubt that I will ever buy another car. I hope to pay off my current debts (including the ones I have been forced to accrue since our rental home burned this past March) in 4-5 more years, but the jury’s out on whether or not I have enough heartbeats left to do so.

Even so, I’m very glad that I’m not 25. Please extend a kind thought towards those young folks whose only role in society will be to pay more and more interest to their Owners for less and less benefit for themselves. They will literally never know what we have known, and have even taken for granted.

Peace.

Twice bitten, permanently shy.

Exactly right

We didn’t grow up in a rentier society like the young of today are. We got to invest in housing and savings and felt like we were building a future. Everything they need today is to extract as much money from them as possible and give it to the parasites. They don’t get to buy homes and build equities for their future like we oldsters did.

Trump got the feds to reduce interest rates to zero for the banks to borrow money at will whilst we lowly peons got zilch for our savings and 30% interest rates for our credit cards. I apologize every time I speak to young people who are bitching about their lives because we kept voting for the people who did this to them.

The message echoes from Gaza back to the US. “Starving people is fine.”

Same here

This is exactly the thought I have every day, "...but the jury’s out on whether or not I have enough heartbeats left to do so."

Of course the jury's out on whether our financial condition or standard of living can ever be recovered. Let's just say I'm skeptical. I'm paying four times as much for housing now. So the budget we planned for years is a shambles as well as our lives. I've had no heat or ac for the entire holiday, and no work was done on my destroyed home because of the holiday. We're playing beat the clock. It won't be long, and we'll be getting the tax and insurance bills for a home that is unlivable. Do we give up?

After the house was flooded, one of the FEMA people told me I needed to calm down, he said he knew 80 and 90 year olds handling the loss of their home better than me. Maybe they made it to that age because they didn't suffer any catastrophic losses earlier in life.

Again, I don't think we're having a unique human experience. For us, it was a natural disaster. For others, it's a major health problem, disability, homelessness, war, etc. I actually appreciate the FEMA effort to mitigate our losses. In other respects, I'm observing the inadequacy of other institutions to provide services generally. Private parties almost invariably, with the exception of charities, seek to exploit our situation.

We've been screwed by interest rates and insurance companies our entire lives.

語必忠信 行必正直

If you have ever taken on any debt,

you have overspent your income.

I'm sorry but this statement is not logical. It equates debt to required payment on the debt. The active obligation. Debt is what you owe and as long as the amount owed on an asset is less than the value of that asset your balance sheet is in good shape. Ie, no bankruptcy time. You may lose money but that debt won't follow you forever.

We, the people, do not get bailouts. That is reserved for those who are not part of the deplorables, the great unwashed. If we blow an investment, we take the hit. I took a hit in 2008 also. The difference is that what I lost was a potential asset, a great big house inflation that never happened. But its value never fell below what I owed. At the end I ended up with a slight increase in what I had invested. Not the $400k that had me all starry eyed but $40k.

I guess that realization that we don't get saved by some superhero who comes in and with the swoop of a pen just makes all our bad decisions go away is what I'm trying to say. All those hollywood marvel comics stuff are nothing but comics. Part of the grift.

Millenials and gen-Zers are nothing more than rubes. They'll sign up for any immediate gratification and never kick the tires or read the contract. Every day in my soon to be ex-apartment the dumpster is full of Amazon boxes. Big tvs so they can be fully immersed in their latest brain candy.

I grew up in a place and time where iT wasn't surprising to see so many who built their dream house on their own with scrounged materials, living in a basement with no house above it. I helped build them. After doing a preliminary on our first house, the second house we built was a tiny 2 bedroom ranch with an unfinished upstairs. Nothing but studs and a roof. This was my bible at the time.

But I digress just a bit.

Income is what you have on hand to cover the obligation amount to service any debt (ie, make ongoing payments) after necesseties are satisfied.

Long ago when banks were part of our society they actively helped people understand that fact. No, Kyle, you cannot afford to go to Harvard. It's the local state U extension for you.

I have never in all my life ever overspent my income. Ever. When I sign the bottom line I make dam sure I can make that payment. Credit card companies hate me. I have never paid interest on a credit card. It is a convenience item.

Young people also hate boomers. They are such a buzz kill.

Oh well, got to get to work. Got boxes scattered all over as I do my 3 week move before the burly guys get here to do the big stuff. BTW, those boxes are the same ones I used on the move here. I just flattened them and set them aside cause I knew I'd need them again.

Be well, this too shall pass. Maybe sooner if the people get their come to jesus moment.

True enough,

if we were to accept a semantic difference- and a different set of assumptions.

The point that you made is entirely based on the assumption that you are somehow in control of your income: that you know to a certainty what income will be available at any point in time to service your debt. Once again, this was always a reasonable assumption for our generation. We had stable employment, and salaries that could be counted on to always monotonically increase every year. In the case of Something Happening, we could also count on walking right into a new gig that was equivalent or better.

That precious assumption is no longer correct, in general, and across all age groups. My business died when my industry was killed off *with no notice*, and I replaced it with a corporate job that pays less than 1/3 what I was reliably making. My new corporate job has not given me a raise in 7 years, and simply walking away to a new, better corporate job is no longer realistic, since I'm well into my 60s. Nobody hires old engineers- one recruiter told me, and I quote, "Why should we hire you? You'll just turn around and retire on us!" (which I know is illegal, but what am I going to do about it?).

The long and short of it is that I now realize that I do not control my income, and never have.

In the case of variable (and perhaps zero) income, *any* debt can easily exceed one's ability to service it- and in that case the semantic point no longer matters. I went to a good school, I paid for it myself, and I developed a business that should have seen me sail easily into retirement. My debt is now primarily to the IRS, incurred while trying to save my dream. I should have abandoned that dream long before, but I've always been a hopeless romantic.

Young folks today now do not have that opportunity, unless they have unearned wealth available. I didn't pick my parents well enough to enjoy any part of that. My wife's employer just went through a spate of layoffs, where essentially everyone dismissed had 20+ year tenures at the company (illegal, but what are they going to do about it?). My own employer could axemurder me tomorrow, or simply go out of business as well. I cannot assume *anything*. In this respect, I am also a millenial: I have gray hair and bad eyesight that makes it hard for me to trivially find a new gig, instead of piercings or tattoos or streetspeak. But we are in the same boat.

The realization of my fiscal mortality has taught me a very stark lesson: There but for the grace of Gawd go I. Everyone, and I do mean everyone, is now one fire/hurricane/earthquake/heart attack/cancer diagnosis/layoff/business closure away from really regretting buying that car/house/whatever, at best. It ain't just drugs and iPhones.

Well, perhaps not everyone. There are those who picked their parents better, and needn't be concerned about these trivialities at all. They are worthy of some disdain. But the rest of us mere mortals are trying our best- and the deck is stacked against us, and here lately it is particularly stacked against those of us who are too young to have gotten our foot in the door, or too old to completely start over after Something Happens.

Anyway, we agree on more than we disagree, I think. And, once again, peace- and good luck!

Twice bitten, permanently shy.

I feel badly for you, I really do

But I think that what we are trying to do here, especially here where we can openly discuss generational and societal problems is try to help find solutions to these problems. Or at least identify them.

Most certainly there are many, many individual circumstances where an act of god has overturned whatever good intentions a person may have. That very much applies to you.

But I am afraid that the act of god only applies in a very small percentage of cases. The vast majority of the cases involve individuals who did not do due diligence in their lifestyle. They overspent over diversions which did not further any future successes in their financial or living conditions.

In other words we as a society need to do some serious soul searching. That flooding in Florida was an absolute tragedy for many, many people and they are receiving no relief at the time when it is most needed. That same lack of foresight and planning on an individual level in the younger generations becomes a catastrophy at the governmental level.

The collective capability of everything that could have turned us into the true "Greatest Country" was thrown on the investment banker pyre.

Lets go Brandon! Vote Blue! Trump is scarier than poverty. Ukr as long as it takes.

What's on Netflix? /s

next up in the Netflix cue

some sub-genre about nazi affiliated

white supremacists groups

subjugating the intellectual class because

ignorance rules!

Zionism is a social disease

who's counting?

The breakdown by age looks like this:

Baby Boomers: Baby boomers were born between 1946 and 1964. They're currently between 57-75 years old (71.6 million in the U.S.)

Gen X: Gen X was born between 1965 and 1979/80 and is currently between 41-56 years old (65.2 million people in the U.S.)

Gen Y: Gen Y, or Millennials, were born between 1981 and 1994/6. They are currently between 25 and 40 years old (72.1 million in the U.S.)

Gen Y.1 = 25-29 years old (around 31 million people in the U.S.)

Gen Y.2 = 29-39 (around 42 million people in the U.S.)

Gen Z: Gen Z is the newest generation, born between 1997 and 2012. They are currently between 9 and 24 years old (nearly 68 million in the U.S.)

Gen A: Generation Alpha starts with children born in 2012 and will continue at least through 2025, maybe later (approximately 48 million people in the U.S.)

The term “Millennial” has become the popular way to reference both segments of Gen Y

Guess that makes me a "boomer" or boozer, as the case may be. Skipping a generation (Gen X),

that would bring us up to the so called millennials (Gen Y). Going by the (Gen A) definition, a

generation is now being plotted as 13 years. That is about half of what I would think a generation

would entail. Get born, grow-up, have babies and then the next generation comes along. 13 years

is a bit shy of that. On average, 18 may be more suitable.

So let's use their metric ..

1946 + 13 = 1959 + 13 = 1964 + 13 = 1977 + 13 = 1990 + 13 = 2003 + 13 = 2019;

then try average

1946 + 18 = 1962 + 18 = 1980 + 18 = 1998 + 18 = 2116

(sorta skips a demographic, no?)

B,X,Y Z,A

But reality tells us people are waiting longer to start families. Maybe average age 25.

just jump one in their numbering system ..

1964 +25 = 1989 + 25 = 2014 + 25 = 2039

oops, we lost another demographic

So that skews their logistics out of another letter designated "generation".

What gives?

Zionism is a social disease

"Gen A"?

LAAAAAAAME.

They ought to be 'Generation Yuzz' (which I use to spell 'Yuzz-a-ma-Tuzz') and you know it!

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!