When fortune no longer favors the brave

The global cryptocurrency market reached a value of US$ 1,782 billion in 2021.

Now 40% of all investments in cryptocurrencies are underwater. That's a lot of paper wealth that was incinerated.

Matt Damon doing a crypto ad. Jesus Christ does he not have enough money already pic.twitter.com/mS3tUgJ6HT

— Ken Klippenstein (@kenklippenstein) January 3, 2022

Unfortunately, it's not just wealthy speculators that are being hit hard. It's also hitting some of the poorest people on the planet.

El Salvador's president Nayib Bukele is a big Bitcoin enthusiast. However, his push into the cryptocurrency has left his country facing the spectre of default, a situation made worse by the famous digital currency's recent crash.

...

The current price of Bitcoin at $28,404 puts El Salvador's Bitcoin value at just over $65 million, but the country paid over $103 million for it in a series of purchases.

The drop of over $38 million is a fall of 37 percent.

...

The IMF executive board urged El Salvador to reverse track and remove Bitcoin's legal tender status, and expressed doubts about the plan for Bitcoin-backed bonds.In response, in February credit rating agency Fitch downgraded El Salvador's long-term debt rating from 'B-' to 'CCC,' putting it in the category where "default is a real possibility."

El Salvador's president, instead of being discouraged, has doubled down and purchased even more bitcoins.

The problem plaguing cryptocurrencies is not limited to just crypto.

What we are witnessing is the implosions of all of the most extremely speculative investments. For instance, meme stocks.

That’s because all the meme stocks that rode the popular wave during the pandemic have taken major hits. The index of 37 meme stocks compiled by Bloomberg has reached a record low in the last few days, down 63% from its peak in January 2021...

As for another player in the meme stock game, the zero-commission broker Robinhood Markets, through which many meme investors placed their orders, its price action points to the ebbing of the craze. Robinhood peaked at $85 on Aug. 4, shortly after its initial public offering. Wednesday it fell to $8.15.

It's interesting that Robinhood, the instrument of the meme stock bubble, is crashing along with meme stocks.

It's similar to the crash in bitcoin is coinciding with the collapse in stablecoins Terra and Luna.

That collapse in crypto has fallen on the market that you buy with crypto - NFTs.

An NFT of the first tweet posted by Twitter co-founder Jack Dorsey (it read: “just setting up my twttr”) was sold to a Malaysian business executive for $2.9 million in March 2021. The owner put it up for sale last month, hoping to collect $50 million. The highest bid was less than $14,000.

The one consistency in all of this is FinTech. Where Silicon Valley meets Wall Street.

SPACs, or special-purpose acquisition companies—sometimes called blank-check firms—begin as shell companies. They raise money from investors, then list on a stock exchange. Their sole purpose is to hunt for a private company to merge with and take public while skirting some of the other regulations associated with IPOs.

Losses top 60% from the peak about a year ago for many once-hot names like the sports-betting company DraftKings Inc. and space-tourism firm Virgin Galactic Holdings Inc., founded by British billionaire Richard Branson.

Comments

bitcoin has always been volatile

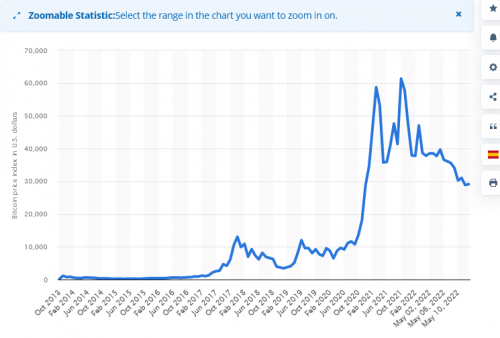

but has a good trajectory over time. I'm a proponent of holding bitcoin and gold if you have extra money. I bought my first bitcoin at $3k and first oz of gold at $1k. Bitcoin value is up 10x, gold not quite 2x.

With the collapsing US economy I think both have good potential.

Bitcoin the last decade

Gold over the decade

Bitcoin detractors are dancing a jig, but I think the hodlers will have the last laugh. YMMV.

“Until justice rolls down like water and righteousness like a mighty stream.”

What have you bought with your bitcoins?

I've been a detractor of bitcoin because I've been skeptical of the limited stuff of what you can buy with it. I could be wrong. This is where you can educate me.

A few things I am certain of is that the velocity of the cryptocurrency has dropped more and more. Meaning that people are holding onto it rather than spending it.

And let's be up front on this: any investment that you can't unload at any time is not profits that you can book. They are paper profits only.

As for gold, there's never ever been a time in history when you couldn't exchange gold for anything else.

bitcoin is much easier to convert to cash than gold

I could sell it today and have money in my bank account almost instantly. Of course, never sell in a dip.

I don't spent either gold nor bitcoin, I use them as a store of value. However, bitcoin is easy to use for purchasing items. Craigslist has a shop with bitcoin option. Florida is allowing payment of taxes with bitcoin. There's a small motor repairman in our little town that takes bitcoin payment. It is slowly becoming more accepted.

Now would be a good time to buy in the dip. I like Strike with no fees, but limits purchase to $1000/week.

I use a hardware wallet and store my own coins. I use a vault service (goldmoney.com) to hold my bit of gold. I figure both are better than a bank saving account. Again YMMV.

“Until justice rolls down like water and righteousness like a mighty stream.”

@Lookout

There were 8 stablecoins that I am aware of, and two of those just imploded. Liquidity could become a problem very soon.

Good luck with that.

You've never experienced a real bear market in crypto. You will.

OK. This is where I know you're wrong.

Nothing, and I mean NOTHING is a store of value that loses 50% of its value every couple years.

This I admit is a big deal. Historically, being able to pay taxes with a currency gives it legitimacy.

We'll see...

No need to argue, time will tell.

“Until justice rolls down like water and righteousness like a mighty stream.”

As a speculative investment you've already won

And that's what counts here. At least so far.

but as a store of value bitcoin has unquestionably failed.

Let me clarify what that means. Is the dollar the world's reserve currency because it keeps going up in value? No. It's the world's reserve currency because it's stable.

Rules of investing

There are a few hard and fast rules of investing of which this is one. Colloquially, it goes

Buy when they're crying,

Sell when they're yelling.

Crypto is gambling, and you never gamble more than you can afford to lose, nor do you use money that you know you're going to need.

Bulls make money,

Bears make money,

Pigs get slaughtered.

If you sell the dip because you got scared or you couldn't afford to lose your investment, then you're doing it all wrong.

“He may not have gotten the words out but the thoughts were great.”

That's true, but....

It's easier said then done.

However, the normal rules of investing that we've been living under for 40 years is ending.

Everyone looks like a genius in a bull market.

What can you buy with gold?

You can spend bitcoins at selected auto dealers, countless restaurants, and buy gift cards to Amazon, Best Buy and hundreds of others. You can pay for your hotel room through Expedia and book a flight through cheapair. Internationally, you'll find many small retailers who use it. You can't buy gas with it, but almost every gas station has a crypto ATM where you can cash in.

The only places you can spend gold are pawn shops and jewelers.

“He may not have gotten the words out but the thoughts were great.”

Really?

So if I offered to pay you in gold and silver, you would turn me down?

As I pointed out before, gold and silver have remained money for 5,000 years. It remained money during the collapse of civilization - twice.

Yes I would

No offense, but I really don't trust you enough not to be giving me a gold plated piece of lead. OTOH there is no fake bitcoin, it is all cryptographically verified.

“He may not have gotten the words out but the thoughts were great.”

LOL

People have known how to easily test coins for their gold and/or silver content for thousands of years.

As for bitcoin, the industry is littered with scams.

But hey, if you would actually turn down a gold coin, well, all I can say is if anyone offers you a gold coin then please reach out to me. I'll take it, and give you whatever equivalent bitcoins.

[edit] Terra

@bondibox Every city in the

Every city in the world has a Chinese gold shop that will buy for a 5% service charge, less if you are selling a lot. Turn it into any currency you want.

@ban nock OP complained about

OP complained about the limited places where you can spend bitcoin but there are many, many more places to spend bitcoin than gold. Giving me an example of a place where you can exchange gold for dollars is not a counter argument, especially when I can point to the preponderance of Bitcoin ATM's at almost every gas station, open 24 hours a day every day plus holidays. Large sums of bitcoin can be sold online and ACH transferred to your account and you don't have to expose yourself to carrying around thousands of dollars in gold or cash.

“He may not have gotten the words out but the thoughts were great.”

@bondibox

NBC News Crypto exchanges keep getting hacked, and there's little anyone can do

BBC Record-high seizure of $4bn in stolen Bitcoin

That's from a 2 minute google search.

When is the last time that you've heard of a large stash of gold being stolen?

Good though that

authorities have recovered most of that stolen in the second story. Re Bitmart, haven't heard of it. When I chose my brokerage 6 yrs ago, I went with a long-established one with good insurance against theft re the cryptocurrencies and cash amounts kept there. I accepted the downside of above-average fees per transaction to have more peace of mind with a brokerage with a well-regarded history (now 10 yrs old), good insurance backing (up to $255m total losses) and good track record for not having major hacks.

Recently though customers, in 10 states, have available additional personal insurance -- up to $1m -- for their crypto holdings through one insurance company. https://www.cnet.com/personal-finance/crypto/can-you-insure-bitcoin/. I might look into this myself if the premium is reasonable.

It would be an additional bonus if one day the FDIC could agree to provide customers on crypto brokerages with insurance comparable to what they offer for bank accounts.

Not your keys, not your coins

I have bought cryptocurrency on Coinbase, but I don't keep my coins at Coinbase. While a lot of people choose to keep their assets on an exchange, it is an accepted risk that your assets are only as secure as the exchange's IT department and policies.

When I owned gold I could choose a safe deposit box in the lobby with just one key, or one inside the vault protected by a 2 key system. And BTW it cost me $50 a year...

“He may not have gotten the words out but the thoughts were great.”

I bought a

house in SoCal last year with BTC, first converting it to cash of course, which is quite easy, when the price was in the $60k range. I also bought myself some satisfaction and peace of mind as I cashed out most of my BTC holdings while recouping all my investment $$ as I also replenished my bank account and added to my retirement account.

I bet far more on the coin than I expected to, mostly in 2016-17, a substantial % of my $ to invest, far more than the experts recommend and 100% more than my friends recommended, but it's paid off handsomely. I still have hopes for a rebound in the next year with my modest BTC holdings currently, but if it crashes completely, I still come out well ahead. Historically though, the coin has experienced 70-90% crashes in the past and has eventually snapped out of the dive.

However, I'm less confident of where it will be 3-5 yrs from now as it increasingly poses a threat to the bottom line and power of the big banks and that could mean a gov't crackdown might be in the offing.

I would have invested a chunk in gold, but as I was exploring the possibility I never was satisfied with the ways of holding it from what I saw at the time, and meanwhile I was in the middle of my BTC obsession.

That's very cool

As a speculative investment bitcoin has been a big winner. I've never been good at that sort of thing, but then I'm a horrible gambler.

That's the thing. No currency EVER behaves like that. Literally, no currency in history has ever done that. It's useless as a currency when it fluctuates like that.

But people have been trained to normalize a casino economy so that they see no problem with a casino currency.

Stability or lack

thereof, big crashes followed usually or eventually by major run ups, is why it's crazy to spend BTC on any small-ticket consumer item like food, clothing and the like. By the next week or month with a major uptick in BTC price, given the volatility, you could have bought 2x or 10x as many consumer goods. Buy and hold except for one-time truly major purchases.

But if BTC should begin to show much greater stability in price in the future, then you should see many more places accepting it as payment. Until then, it makes no sense, and that's why I am completely indifferent to its current limited use in the everyday consumer marketplace.

Another stablecoin implodes

That makes three out of eight stablecoins have imploded. When all the stablecoins are gone, then no one will be able to sell the idea that these are currencies.

SMH at NFT's

The problem with collectible NFT's is like the problem with many cryptocurrencies, they have no real utility, their value is solely based on what the next person will pay for them. They were hot and they were new but now we're seeing what the secondary market will fetch for them. NFT tech and smart contracts are incredibly powerful tools but they are being wasted on collectible NFT's and DeFi (decentralized finance).

LUNA was the darling of the DeFi world. Although it was self sufficient in how it paid stakeholders - funding exclusively from transaction fees - it was just another blockchain, there was nothing compelling for anyone to choose that chain for their smart contract applications. Some sharks found its achilles heel, but if you ask me it was just a matter of time before it failed or fell by the wayside to be replaced by the next hot thing.

IMO the best investments are the ones where devs are actually building something tangible with a UI/UX. Any project based only around tech will be the first to become outdated.

“He may not have gotten the words out but the thoughts were great.”

Tulips never were a great investment

but at least you had some flowers to look at. People talk about bitcoin like Beanie Babies. Like how much it goes up, not what use it provides. If a currency fluctuates wildly it serves no purpose. I can take a link from a 95% gold chain and walk into a Chinese market anywhere in the world and walk out with stuff. Dollar bills too. Inflation has hit hard, but the dollar has risen further against the Baht and the Kip, the only currencies that concern me. The market has taken a plunge, 25% on the NASDAQ, so what, it rose that much over the past year. The Market needs these things every once in a while to get rid of the chaff.