Housing affordability is about to become non-existent

Rising inflation, War in Ukraine, and central banks finally ready to raise interest rates, means that bonds are getting massacred.

The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt total returns, has fallen 11% from a high in January 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. It equates to a drop in the index market value of about $2.6 trillion, worse than about $2 trillion in 2008.

The bond massacre is extending beyond treasuries.

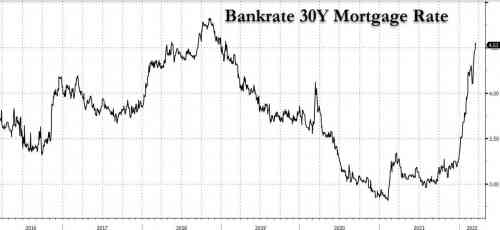

Where the average person will notice first is in mortgage rates.

The average rate on the popular 30-year fixed mortgage hit 4.72% on Tuesday, moving 26 basis points higher since just Friday, according to Mortgage News Daily.

...At this time in 2021, rates were about 3.45%

Naturally as mortgage rates have spiked, applications for refinancing have collapsed by 54% y-o-y. Less than 5% of U.S. homeowners can save money by refinancing their housing loans.

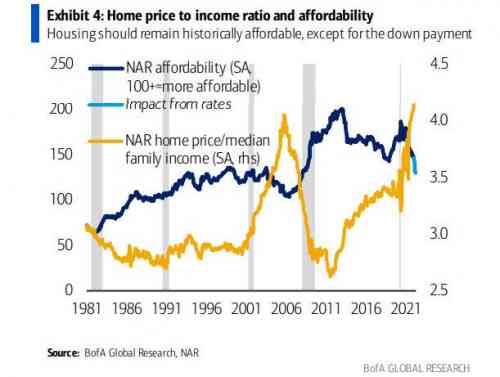

Housing affordability was already a crisis last year.

The National Association of Home Builders/Wells Fargo Housing Opportunity Index, which measures the ability of households to qualify for a 30-year mortgage without spending more than 25% of their income, fell from 63.2 in the fourth quarter of 2019 to 54.2 in the fourth quarter of 2021. Looking at the problem from a different angle is the NAHB’s 2022 Priced-Out Estimates, which concludes that 87.5 million households are not able to afford a median-priced home. That study assumes a 10% deposit, a 30-year mortgage at 3.5%, and a home payment to income ratio of 28%. Shockingly, this study means that almost 70% of American households have been priced out of a buying a home, and that is before reflecting rising mortgage rates that approached 4.0% earlier in February.

About 2/3rd of American households were priced out of buying a home LAST YEAR.

Then mortgage rates began to rise.

Economists have repeatedly and consistently underestimated inflation this past year, and thus have underestimated how much mortgage rates will rise.

Comments

I hope Blackrock

goes under for maintenance costs of the empty houses.

We are all one step away from living in RV parks and Tiny homes.

I built my home as I worked, and by the time I moved in, it was paid for, so I never experienced mortgage, but rent? I pad a lot back in the 70s.

The Ukrainians coming here can buy them. They will receive government $ you and I would never receive.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

I'm with Miss Katie...

Unoccupied houses bought on spec by hedge funds? Burn 'em. Most probably have unremediable death fungus growing in the walls by now because they didn't leave the heat at least turned to 55-60F. Those houses are less than worthless at this point; they are a liability. I'm hoping that someone keeps the speculators from offloading these death-traps on to innocent first-time home buyers...

I remember purchasing our home a long while ago and going through the hoops of showing to the mortgage company that NO, we really don't need to purchase flood insurance. While we are within half a mile of the river, we are way above the 100 year floodplain.

If I were an insurance company though, I would definitely have a very thorough mold inspection for all home transactions.

This is (perhaps slightly) independent of Katie's comment that they should be burned to the ground in principle. That too is correct in my opinion...

Yes, the global bond market is in trouble

worst since the 1940's

worst in 25 years