Why you can't afford a house: A bird's-eye view of our dysfunctional economy

This is going to be an over-simplified explanation of how we've got to this point. Some factors I'm going to ignore or dismiss because I believe they are minor factors. You are free to disagree.

Our story begins in 1998, with the collapse of the hedge fund Long-Term Capital Management. What made this an important milestone was that the Federal Reserve arranged a bailout of a non-bank financial institution. For the first time, our central bank bailed out what was clearly speculators.

In doing so the stock market, which was then correcting, exploded to new heights. The stock market then became a bubble, and imploded less than two years later. The Federal Reserve then dramatically cut interest rates, which was understandable. However, the Fed left interest rates too low for too long, and didn't begin raising them until almost three years after the recession had ended.

These abnormally low interest rates fueled the massive housing bubble, which began deflating in the fall of 2007. Washington responded to the faltering housing market by loosening borrowing requirements at Fannie Mae and Freddie Mac in early 2008, but that only made those agencies the bag-holders when everything collapsed in September 2008.

A lot of people forget that Fannie and Freddie collapsed a week before Lehman Brothers. It was the collapse of Fannie and Freddie that triggered the failure of trillions of dollars in derivatives.

That is the backstory for the ultimate policy failure, the consequences of which we see today.

Something you need to understand is that the financial system died in 2008.

It was not revived post-2008, it was merely put on life support, where it has been ever since.

The financial system could have been revived, but Washington decided not to. Dodd-Frank was not reform (i.e. changing the corrupt system). Dodd-Frank was only regulation (i.e. bringing the current system under the umbrella of regulation), and even that goal largely failed.

Because the political system was unable to reform the financial system due to its corruption, it had to be bailed out. The entity associated with the federal government that was capable of undertaking such a massive endevour was the Federal Reserve.

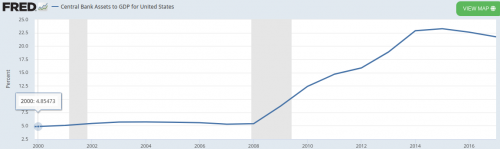

The Fed lowers interest rates by buying treasuries, but just cutting interest rates was not enough. The banks had to be bailed out directly. This meant taking trillions of dollars of those toxic mortgage-backed securities off their hands, at face-value prices.

Very quickly Wall Street was made whole again. In addition, because Wall Street was suddenly flush with cheap credit again, they went on a spending spree.

They bought bonds and corporate stock, until the prices of both assets exceeded the bubble peak prices.

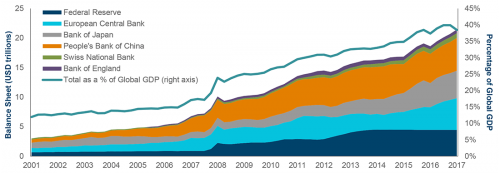

The second thing worth noting is that this was a global event. The Bank of Japan had been doing this to a lesser extent since the early 90's, although they accelerated their purchases after 2008.

The European Central Bank got into the act when the 2011 debt crisis hit. Before long the Fed wasn't even the largest player.

Even smaller central banks got into the asset buying frenzy, and they didn't limit themselves to just bonds. For example, at one point the largest holder of stock in Apple in the world was the Swiss National Bank.

So what you had was all of these entities all over the world, that could literally print money, buying financial assets by the trillions of dollars. This had never been done before in all of history, and it obviously benefited those who already held those assets - the wealthy.

The central bankers of the world are perfectly aware that what they are doing isn't healthy for the global economy, and they know that they are exacerbating inequality, but they are making all of their wealthy friends much wealthier. Plus every time that they even started to withdraw quantitative easing the financial system immediately began seizing up.

That's because the only reason that blood is moving through the corpse that is the global financial system is because the central banks continue to force blood into the corpse.

As you might imagine, this artificial life support has caused massive distortions after awhile.

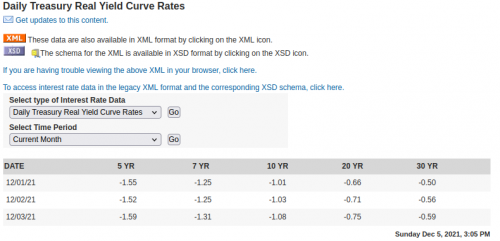

Negative yielding bonds would never exist in a healthy financial system, because why would anyone ever buy a bond that is guaranteed to lose the buyer money? Yet the world is saturated with these negative yielding bonds. At times even non-AAA rated bonds, and even junk bonds, have gone negative, which is bonkers.

With yield becoming almost impossible to find in the bond market, and stock prices hitting levels that have dwarfed every other bubble in history, wealthy people have had to look at unconventional places for a return on investment.

Which brings us to why you can't buy a house.

I saw this article today and it put things into perspective.

The wealthy aren't trying to force the working class back into feudalism. That's just a side-effect of an overinflated global asset bubble.

Some might try to blame the hyper-inflated housing market on not enough houses being for sale, but that's ridiculous.

Demographics, which are a better measure of housing demand historically, do not support more construction.

"There is a downward trajectory of population growth, household formation as well, that's really going to undermine the need for what's built," said McGill. "On the other side of that, you have the development community that's actually very optimistic about there being a housing shortage and actually very optimistic about how much needs to be built, and they're actually pressing the accelerator harder than we think they probably should be."McGill cited data from the latest Decennial Census from the U.S. Census showing household formation is about 24% below where it was in the prior four decades.

Household formation is far below trends partly because of obscene home prices. So it's logical to assume that household formation will continue to downtrend as the wealthy continue to buy up all of the real estate.

So what began as a political decision not to make needed reforms to a collapsed financial system is causing the slow breakdown in society in general.

Comments

excellent review -

Does that fit in here?-Hawaii housing crisis has Maui pushing to phase out 3,000 short-term rentals

We dreamt of having a piece of land on Maui. Now I am glad we haven't. I wished I were smarter. May be one day I will understand the whole shebang.

Thanks for all the effort you put in explaining things to dummies like me. I need a second life and a second retirement to read it all AND understand it.

Be well. Stay healthy and go on going on. Have a good day.

https://www.euronews.com/live

Astonishing

That said...

If this is true, and this ISN'T all driven by wanton malice...shouldn't there be some way this CAN still be fixed???

One point you're vague on (per your preface, I suppose): Why were the proper reforms not made when they should've been, if it was all just a "political" decision?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

You already know the answer to that question

Corruption. Plain and simple.

Sure, there's also a strong neoliberal ideology at the time of the 2008 crash, but corruption was the overriding reason.

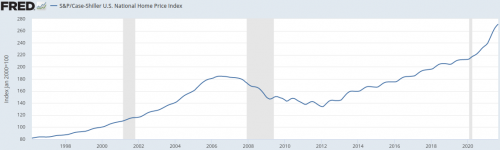

[edit:] adding charts for more context to the essay

Semantics, then

I suppose I didn't consider that, itself, to count as "political".

I've always been ambivalent about the word "corruption", too - in addition to possible metaphorical/metaphysical implications I disagree with (a lot of people talk about civic morality and its problems/solutions as though it were organic, I but I say it's more Platonic/Newtonian), and a history of not liking the sources/circumstances I usually heard it from/in, the term always reminds me of Claude Rains's character in Casablanca - he was by definition a corrupt cop, and gods bless him for it, right? Had he been an upstanding enforcer of the law, he'd have been a Nazi collaborator.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Some observations (anecdotal)

My county in western NC has the lowest inventory of houses available for sale (less than 1% of total housing stock) and highest median price per home. We are not Asheville which is experiencing similar outrageous price gains in housing, but not to the crisis level that we are seeing in our county.

As background, the income and poverty levels in this county fall directly into the median of the state, so we are not some wealthy and exclusive county, yet. The median age of the residents of this county now makes it the oldest county of 100 counties in NC. This was not the case in the past.

So what is happening in this county? Several things are driving prices to skyrocketing levels. First, this county is a very desirable place for people to vacation due to its natural beauty. Tourism is a major economic generator here. Second, a significant proportion of the land is tied up in one national forest and two state forests. Third, any affordable housing units never make it on to the open market but are instead being snapped up by investors and converted to Air B&B or VRBO units.

The housing shortage for work force housing and starter homes is so critical that it was the primary emphasis of the recent local election. Add to that, a severe shortage of rental units of any kind. What is happening is that our community is becoming older and wealthier with a lot of absentee landlords profiting from the short term rental business which is booming here. Young people and families cannot afford to move here unless they are willing to pay a very high price per square foot for what little housing is available.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Other factors

AirBNB is big in coastal cities, and this is killing the rental market.

I'll add in one other factor: overseas investors.

Americans often ignore the rest of the world, but the real estate craze/bubble is worldwide. Australia, Britain, Ireland, China, Canada, you name it. The United States isn't even the worst when it comes to insane housing prices.

A couple more charts