Could this finally be the peak in the housing bubble?

Big institutional investors have been spending billions and billions of dollars buying up single-family homes in order to rent them back to working class at elevated prices. Rents are up nationwide by a shocking and unsustainable 15% from last year.

Institutional investors made up about 20 percent of the home-buying market in 2020, which is an enormous chunk.

One of those big institutional investors is Zillow, and Zillow has a big problem.

Zillow is trying to offload around $2.8 billion worth of houses onto investors after it bought them with the intent of selling them to hopeful homeowners and landlords, according to a report by Bloomberg....Now, according to Bloomberg, Zillow is looking to offload around 7,000 of the homes it bought.

Two-thirds of the houses Zillow bought last year are worth less than what Zillow paid for. In places like Phoenix, 93% of Zillow's homes are underwater.

Of course, this isn't a housing bubble. Almost every economist and industry experts will tell you so.

The good news is that few economists believe that the current run-up in housing prices is a bubble that's about to burst, taking the economy down with it.The bad news is that practically no one was worried about the housing bubble in 2007, either.

Former Federal Reserve Chairman Alan Greenspan famously insisted in 2005 that there was no bubble.

...

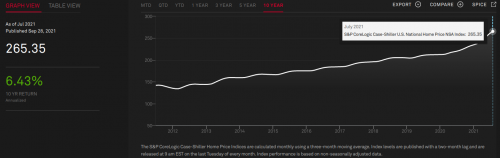

The previous record for rising home prices was a 14.4% year-over-year gain in the fall of 2005, according to Case-Shiller. The US housing market blew past that mark in April of this year, with a new record set every month since. Year-over-year prices increases now stand at 19.9%.

Sure things are different from 2007. The debt ratios are much smaller. On other hand, prices are much higher this time, around one-third higher than the last peak bubble prices. In order to get back to non-bubble levels prices would have to fall much further.

Zillow projects that national home price increases will slow but not start to decline. It sees 13.6% growth from September 2021 through September of 2022, a faster pace of increase than its previous forecast. Goldman Sachs forecast earlier this month that prices would rise another 16% by the end of 2022.

..."The housing market is out of whack. It's not sustainable. It is overvalued, stretched and vulnerable as [mortgage] rates rise, and affordability gets crushed," he said. "But I'm not concerned we're going to have a crash."

Just to keep things in context, home prices have never been higher and unaffordable.

At the same time, interest rates have never been so low, and thus have nowhere to go but up.

Meanwhile, supply chain problems and excessive Federal Reserve money printing is causing inflation to rise. This leaves historically low bond yields deep into negative territory after factoring in inflation. It's only a matter of time before people stop buying bonds because they lock in losses. When that happens bond prices will fall, which automatically will cause interest rates to rise, which will very rapidly cause already unaffordable home prices to become dramatically more unaffordable.

Comments

It's all been manufactured

Just like every other manufactured financial crisis since 1928.

At some point the blood letting will kill the host.

What do these billionaire genius sociopaths who have been blood letting the renter class have in mind for when the blood runs dry? Eat flesh?

The Road comes to mind. It may be a more prescient vision of what awaits us than we ever thought possible.

“Bubble” is much too pleasant a euphemism.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

The Zillow story is huge.

I was glad to see you covered it for us.

Thank you.

Talk about a canary in the coal mine.

Lots of canaries getting ready to sing these days.

NYCVG

This is even more absurd than the Vaccine Only Madness

The boom in prices while over ten percent of the housing units in the country are vacant makes no sense at all from an Economics 101 perspective. Anecdotal evidence confirms the reality of institutional buyers squeezing out people who want a place to live with ridiculous overbids, offered in cash, waiving inspection. I wanted to move to a cheaper dwelling when the pandemic started, but I saw that in spite of all the talk in the "news" about foreclosures and evictions, the rents in the Los Angeles area were going UP.

So either there is a unified intelligence driving some incomprehensible game plan, or, the central bankers of the world have just collectively said, "What the fuck?" and cranked up the printing press to print thousands of billion dollar bills in hopes of, against all logic, somehow a good result will come.

My money is on Somebody Has A Game Going.

I cried when I wrote this song. Sue me if I play too long.

It does in Economics 201 terms

All housing units are not equal. Extreme example: No one wants to live in certain city neighborhoods where guns crackle all nights and people sleep on the floor because it's safer.

Where are those vacant units? I'll bet they are not on 5th avenue in NYC or Rodeo drive. Nor in Chicago's "Gold Coast" near the Pritzker mansion. Nor the South Side Obama mansion, either.

The exurbs are cheaper than the suburbs. The suburbs (on average) are cheaper than the cities (on average).

Re Economics 101: if you only studied Physics 101 you would "know" that particles and waves are different. That atoms are immutable and electrons are fizzy green tennis balls.

Anything "101" is elementary and simplified. Exceptions and deeper analysis come in later courses, often numbered 500 or higher.

Not picking on you but sick of conservatives talking about supply and demand in a world of infinite buyers and sellers and ignoring the real world of monopoly and oligopoly. All wise "magic of the market" CEOs vs the reality of self-centered sociopaths that destroy century old businesses for their own gain.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The FED will start buying all sorts of debt

In an attempt to keep rates low, banks will sell mortgage bonds to the FED, making their money on "fees". States will delight in the increased property taxes. Until taxpayers default because they can't pay. Then the state/local governments will sell the properties to Berkshire Hathaway and others. The bubble can go much higher but the mess will be even bigger.

China is doing the right thing popping their bubble. Wall Street banks assure us that a collapse in China will have no effect in the USA. Uh Huh, Right!

I've seen lots of changes. What doesn't change is people. Same old hairless apes.