U.S. Dollar Crisis Directly Ahead

Today's news out of China is extremely alarming. Even if this was the only danger to the U.S. Dollar, which it isn't, this news alone should set off alarm bells.

(Reuters) - China should prepare for potential U.S. sanctions by increasing use of its own financial messaging network for cross-border transactions in the mainland, Hong Kong and Macau, according to a report from the investment banking unit of Bank of China...

The report said that if the United States were to take the extreme action of cutting off some Chinese banks’ access to dollar settlements, China should also consider stopping using the U.S. dollar as the anchor currency for its foreign exchange controls.

The central bank of the second largest economy in the world says to prepare to ditch the dollar. That is huge!

It also isn't an empty threat.

1) China has spent the last 10 years building the infrastructure to de-dollarize. Without this infrastructure they could only bluff.

2) Russia has mostly de-dollarized, thus proving it that it is possible without crashing the economy.

3) There is a growing customer base of nations locked out of the dollar system such as Iran, Venezuela and Cuba.

4) Europe is preparing to go outside the dollar system due to sanctions in response to Nord Stream 2.

If China de-dollarizes then the U.S. Dollar goes from the reserve currency, to a reserve currency.

Goldman Sachs Group Inc. put a spotlight on the suddenly growing concern over inflation in the U.S. by issuing a bold warning Tuesday that the dollar is in danger of losing its status as the world’s reserve currency.

This is why I have spent so much time writing about our tendency to sanction much of the rest of the world. It has consequences.

But being the reserve currency isn't only about politics. It's also about economics. And that is not good news either.

There's been a strong indicator in the world of finance over the past year or so that the dollar is in trouble. It's an indicator that few people pay attention to, but you should. It's the reason why I'm writing this essay today.

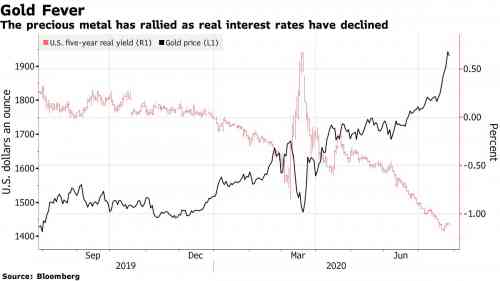

That indicator is gold.

Gold is a very small part of the investment world. So the recent all-time high is only significant because of what reality it reflects.

The virus has unleashed a torrent of forces that are conspiring to fuel relentless demand for the perceived safety from turmoil that gold provides. There’s the fear of further government-ordered lockdowns; and politicians’ decision to push through unprecedented stimulus packages; and central bankers’ decision to print money faster than they ever have before to finance that spending; and the plunge in inflation-adjusted bond yields into negative territory in the U.S.; and the dollar’s sudden decline against the euro and yen; and rising U.S.-China tensions.

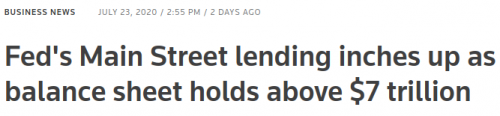

The primary economic danger to the US dollar is the trillions upon trillions of dollars the Fed has created, with no oversight, in order to bail out corporate America.

The Fed’s total balance sheet size rose by $6.1 billion to just over $7.01 trillion as of July 22.It was largely due to continued purchases of Treasuries and mortgage-backed securities aimed at keeping financial market conditions easy. These were nearly offset by a drop in foreign currency swaps with other central banks, which fell to their lowest since mid-March at just under $122 billion.

...

That powered a $3 trillion increase in the Fed’s total balance sheet between the beginning of March and early June.Despite the recent lull, analysts at TD Securities said in a note they still expect the total balance sheet to hit $9.4 trillion by year end and $11 trillion by the end of next year.

It seems amazing doesn't it? That the Fed could create so much money that it could endanger the dollar itself, and yet still do nothing for 90% of the population.

All this money printing for the wealthy has a side effect of forcing down interest rates so low that it makes gold an attractive investment, while making Treasuries a bad investment.

Comments

I'll be updating this essay throughout the day

Because I think that this subject deserves more eyes.

de-dollarization is already happening

Update:

It's interesting. This may be the most important essay that I've written all year, and it's gotten almost no attention on reddit.

Even here, no one has asked the two most obvious questions:

1) What's that you were saying about gold?

2) What can I do to protect my savings?

1a) Gold broke out to a new all-time historic high last week, and almost no one cares. Even the financial media is indifferent, despite gold being up 38% in the past year (better than stocks). That's usually a sign that the gold bull has further to run.

disclaimer: I'm a long-time gold investor.

2a) If you don't like gold (eventhough its a proven winner), then I suggest putting them in either 1) AAA-rated bonds priced in a high-quality foreign currency, or 2) overseas real estate in a stable country.

I heard that China bought a lot of U.S. 10-years c. 2008-10

@1

Supposedly they did this to help the U.S. economy out during that crash. As these are maturing they are not rolling them over, so effectively selling them off.

That's true. China isn't going to bail us out again,

not during this Administration, anyway. Besides, they have their own debt problems at this point to try and unwind before they arbitrage their risks by taking on another load of US Treasuries. More in a diary on that:

https://caucus99percent.com/content/active-shooter-capitalism-us-goes-po...

Scary territory

Not sure what the Fed balance sheet refers to.

Seems like it is a negative number if just holding debt.

(not an economist by any stretch but my room mate at university was)

Zionism is a social disease

this should help explain it

QMS has a point. All those items are debt, public and private

The Fed counts all the Treasuries on account as assets. That's only an accounting device, though, as both the Fed and the Treasury really act as two policy making agencies of the same US Government which issued the debt held in Fed accounts. The Treasury officially issued the Treasuries, but the Fed and its 15 or so member banks trade and manage it for their own purposes and profits. Treasuries are essentially public debt -- the taxpayers pay the principal with interest, which is the National Debt -- that's being managed by privately owned banks.

The difference between public and private character of the Fed, as I understand it, is mostly administrative and in the ability to hire and fire. The big member banks, to which the Fed lends money through the Repo markets and the Overnight Window, appoint the Governors of the Fed. Meanwhile, the Fed Chair is confirmed for a set term by the Senate. Functionally, though, it's really a distinction without a difference.

Perhaps, someone can put a sharper edge on this explanation?

From what I've seen foreign buyers have disappeared

from buying treasuries, IOW we are buying our own debt.

tRump, DC/SV/WS/ all wanting to monetize debt/stock price has resulted in GOLD being highly undervalued.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Monetizing our debt

The whole reason to have a private independent central bank was to not have this situation that we're in today.

Yet here we are. So if we're going to have a central bank why I nationalize it and help the people?

That way when they blow up the currency at least some good will be done.

Boy do I hate being this cynical

If you can see what sanctions are doing to the dollar and the future of it and the country don’t you think those who keep pushing for them know it too? Yet they keep doing it.

We all knew that the economy was in big trouble before COVID hit and now see how it was used as an excuse to bailout every bank and corporation that was in trouble before. Now congress is going to further destroy what’s left of the country by letting tens millions of people lose their homes and every damn thing they own. They know what it will do to the economy too if they don’t extend unemployment benefits. But what makes sense is the huge transfer of wealth while letting us go under.

I see the business and financial elite just taking everything they can before the plunge of the country into horrible poverty. More asset stripping by deregulation letting companies keep more of their money not spent on polluting.

Our window is closing fast to stop what’s happening. This is the event that the militia folks have been watching for and instead of them fighting against it they are cheering on the government that’s doing it. Dear gawd help me make sense of this.

The message echoes from Gaza back to the US. “Starving people is fine.”

You would think so, wouldn't you?

Yet they were all taken by surprise in 2007-2008.

Washington and Wall Street are consistently guilty of groupthink.

Plus there is a tendency of incompetence to rise to the top, especially in Washington.

I keep trying to sound the alarm for groupthink over the years

I'm autistic, therefore immune (people can still deceive or bully me into ruinous self-doubt, but I don't have the wetware USB port for the Human Hivemind, thank mercy) - given that there is awareness now that people like me exist, shouldn't people listen to me? Shouldn't communitarian minds be able to at least accept me for my utility in that role?

As is, nobody ever does; you can always be 'disabled', but better than the majority in even the most costly, difficult-to-exploit-for-personal-gain manner? The very thought is a crime.

If you'd asked me a year ago, I'd have said "Black Lives Matter" was the last thing in American politics that made sense; it certainly did in the context of the Trayvon Martin case. I loved it when I watched the 2016 primaries and ONLY Bernie Sanders got that call-in question about "Do Black Lives Matter, or do All Lives Matter?" "correct" (I don't remember, maybe Lincoln Chaffee did too? He was my second favorite up there after Bernie). Recently, though, I've grown increasingly alienated and antagonized toward it all, and the reason is simple enough:

Does MY life matter???

Apparently not; in a truly mind-melting failure of epistemology, "Respect My Existence or Expect My Resistance" only applies to entities whose existence has already been officially recognized (and hasn't been since rescinded, either!).

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Yes. Your life matters.

Your unique perspective is important and needed.

Your observations have a lot of value.

They retain innocence and are not bogged down in projections of motive, which is the dangerous way the US public thinks, which makes them extremely susceptible to propaganda.

Hang in there. Your time will come.

I am grateful to you both

That actually means a lot.

Incidentally, what does this even mean?:

It can help to know how one is different from others (e.g. I apparently have a borderline-eidetic memory, and I didn't know there was anything all that special about my memory until my father pointed it out only 6/7 years ago - the implications kind of terrify me). On the other hand, sometimes it can just pull the ground out from underneath your standards, and that frightens me too.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

See leveymg's essay for a big part of the answer.

Here's the essay I mean. It's long and covers a lot of our problem. Economic fallout is not covered, but it will be very hard on all of us.

TRUST US: Elite Lies, Self-Deception and American Failure

Submitted by leveymg on Wed, 07/29/2020 - 10:26am

See my taglines for my synopsis of our problem and probable outcome.

-Greed is not a virtue.

-Socialism: the radical idea of sharing.

-Those who make peaceful revolution impossible will make violent revolution inevitable.

John F. Kennedy, In a speech at the White House, 1962

I see these essays as companion pieces and thank gjohnsit

for his fine analysis of the economic side. Mine deals mainly with the psychology of the institutions that created these problems, and I conclude that the elites are neither inclined nor able to correct the consequences they created.

Sadly, I conclude, those in charge -- being prone to malignant narcissism -- lack the empathy and emotional intelligence to even want to fix things that don't immediately impact their own bottom line and privileges, so they are just going to take the rest of us down with them.

Worse, the plan is to stand on the shoulders of the bottom half and make us drown, which is what the system was designed to do.

On economics, I defer to to Mark Blyth's article, "The U.S. Economy is Uniquely Vulnerable to the Coronavirus: Why America’s Growth Model Suggests It Has Few Good Options", which concisely describes why the American model of dealing with the pandemic is proving to be a failure for the 99%:

Link to the leveymg essay you mention

(which I had missed earlier)

https://caucus99percent.com/content/trust-us-elite-lies-self-deception-a...

What, realistically, does that mean for the American 99%?

Is there going to be some point at which our buying power just goes up in smoke?

Are we heading into Wheelbarrow Territory?

Are the doomsday-preppers we shook our heads down at for decades (https://www.theguardian.com/us-news/2017/aug/02/preppers-survivalist-sum...) going to be demanding we lick their nipple-piercings before they grace us with our monthly seed ration?

Conversely, is this the sort of thing that's going to be functionally invisible to anyone outside of the finance industry?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

All good questions, and all hard to answer

There's only two things I can say for certain:

1) anything imported is going to increase in price

2) interest rates will be going up

While everyone will focus on #1, it's #2 that will have the most impact, because both real estate and the bond market are in enormous bubbles.

But exports should go up.

if it wasn't for all those countries that don't trade with us because of sanctions.

Orwell: Where's the omelette?

Yes, eventually

but since most of our factories are overseas, the export benefit will be lagging.

It'll be pain up front.

Our exports are raw materials and agricultural goods.

Right back to where we were as a colony in 1776. The corporate owners and CEO's have sold our industrial birthright along with the working class. May they rot in Hell.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Alright, follow-ups

How/where are they now? I get the sense that American interest rates are like American taxes: ridiculously, pathologically low compared to what's normal for a developed country.

High interest rates aren't all bad; people with money in the bank will start making more money. What will happen because of that? Is that good for wealth inequality, or bad (billionaires have billions in the bank, of course, but maybe more even of less money for more individuals might outweigh that, and if higher interest rates are good for plutocracy, why are America's are so low)?

Why? How will that work?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

They would go up in a free market

Fear and uncertainty cause lenders to raise rates in accordance with their estimate of the probability of loss.

But we don't have a free market, we have a Federal reserve controlled market. For the time being they have ceased to flirt with negative rates. That's about all you expect for now.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

That sounds like a good thing

The Fed confuses me; most government agencies I can figure out whether they're 'basically good guys' or 'basically bad guys' - the Fed...well, its origin story sounds reasonable (turn-of-the-century economic crisis is averted when, as a newspaper puts it, "J.P. MORGAN SAVES THE DAY", somebody decides there's got to be a better way to protect the economy from implosion than depending on robber-barons being in a good mood that week), but that doesn't match the 'vibe' from anything I recall hearing about it.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

2 triggers

2 possible triggers to the price/interest snowball.

1. nominal rates on US10Y go negative

2. Zhongnanhai weaponizes its dedollarization program (e.g. by forbidding Chinese companies to offer or accept USD in payment)

I tend to agree with your assessment, but....

I also have respect for viewpoints I find at Naked Capitalism. And it seems they feel quite differently.

https://www.nakedcapitalism.com/2020/07/ilargi-what-default-where-dollar...

I don't want to start a battle here, but could you address what they seem to be missing?

I also find a lot of value in Taibbis work. I think I have heard him state that we are far from a collapse.

You three are at the top of my list regarding economic viewpoints. I wished there was consensus on this issue.

A quick look at NC

The three points at the top are mostly true, but all irrelevant to my points.

#1 is a selective and arbitrary comparison that doesn't mean much.

#2 is totally true, but it only gives two possible scenarios, when there are more options

#3 misses an important point. The point of a reserve currency isn't its availability. It's the stability (i.e. you don't want the value of the currency to change significantly while you are holding it). Exporting jobs is not a necessity. For historical example, see the British Pound during the 19th Century.

However, later in the article is this 100% true statement:

If China wants a reserve currency then they have to let it float. End of story.

There is no getting around it. You can't have a reserve currency that is pegged to another currency, even a loose peg.

That being said, everything I wrote in this essay is real.

The problems of the dollar are both economic AND political. Being a reserve currency involves both economics and politics.

And we are screwing up in both arenas.

Playing hardball with China might very well force them to make up their minds and float the Yuan.

@gjohnsit Thanks for your reply.

Thanks for your reply.

I do feel NC treats "petro dollar" and dollar crash scenarios as CT. My intuition and limited learning/understanding says a major correction and global reorganization are inevitable.

But the US propaganda machine has become wickedly good. Who knows how long they can keep the "American Exceptionalism and Dominance" position as global conventional wisdom. IMHO it cracks apart when and only when that narrative collapses. All other economic truisms aside.

"renminbi"

I have such a hard time conceiving of that as a bread-and-butter word in everyday speech (as the name of a currency must be); it's dumpy and too 'expensive' to say. by contrast, "yuan" is short and elegant, with cultural marketing appeal.

It makes me wonder if that name itself is doing it any damage (i.e. "the Schicklgruber Effect")?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

I always hear it as "RenMan B"

Although your spelling is correct, my ear won't accept it!

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

It sounds like goldfish-speak...

...or Angelina Jolie finally OD'd on lip collagen.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

here in Mainland China

locals don’t refer to it as "renminbi" (人民币, if you were ever curious about how it looks), unless they are specifically talking about foreign currency. It is usually referred to as the yuan (元 or 圆 depending on context), or, colloquially, as "kuai" (块).

This type of discussion always features a strawman

...which can render the discussion pointless. That is not to say that there isn't sound economic thinking on all sides. It's just that they are thinking about very different things.

For example, Yves (and by extension, Ilargi) bases much of her analysis on a 20th century scenario:

.

Although she defeats this Strawman handily, the decline of confidence in the US and the US Dollar has nothing to do with China or its currency. I feel safe in declaring that the Reserve Trading Currency for world trade will never again be the national currency of a powerful state. As we all have seen, this creates a profound "Moral Hazard" in the modern world, resulting in wanton abuses. The 21st century demands a dedicated non-national trading currency — perhaps a block-chain currency with an distributed ledger which would offer all parties protection and transparency.

Even more important, China has no intention of allowing its national currency to be used as a reserve currency for global trade. The Chinese tend to think and plan further in the future than other cultures and they know that path is already obsolete. The financial infrastructure that China has built is for the sole practical purpose of facilitating uninterrupted global trade while the US has a psychotic episode on the World Stage. Rather than stepping down from the end of its Empire fantasies, gracefully, the US has decided to publicly rip itself apart and fail large, while blaming everyone else.

Yves views are focused on a global economic system where a lurching nuclear golem on the World Stage can freely terrorize smaller states, economically, on the whim of whatever "democratically elected" asshole is in charge.

For some, this view will not be abandoned (cognitive bias) until after reality happens. [And, seriously, people are not going to put up with that shit anymore.]

The world has already moved on.

Corporate Dems to the rescue

What Is Your Outlook on the Fraudulent Gold in China and the

potential fraud within gold reserves worldwide?

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

mostly paper gold futures

making money for speculators.

Physical gold is different.

Becomes more rare as the bets come in.

Why does England not want to give

Venezuela back their gold?

Cause it's gone.

Zionism is a social disease

Fraudulent gold in China?

I don't know anything about that.

Propaganda has a life of its own.

I keep looking at China's massive gold buys over the past decade, not to mention all of the gold that it mines internally, which it does not sell or mint, but stockpiles instead.

And I wonder why this is not reflected in China's reported gold holdings.

Where are they putting all that gold?

Wait... Perhaps China expects that gold will become the reserve currency for Global Trade!

It wouldn't be the first time that has happened, and it is always going on in the background. Many nations currently use gold for certain trades, which allows them to trade freely without interference from the US economic terrorists. I think it's a wonderful idea that would tend to benefit People rather than Banksters and war criminals.

Instead of forcing the nations of the world to buy US dollars in order to trade with each other (which conveniently exports the costs of US inflation to them) they could buy gold instead from any of the thousands of brokers in that business. All settlement banks deal with gold.

Gold would make trade truly free of national hegemony. There is still an exchange fee involved. Cost of doing business.

if you are accumulating gold

And you don't want to pay a lot then you don't announce your purchases

Amazingly, China's ongoing gold purchases

Over the past decade never bumped the gold price up (as I know you are aware). They somehow masked the demand from the market. They must have used the US gold shorting racket as cover. My guess.

Russia too has been buying gold

Didn't have this planned when making a little collection of

Walking Libertys a couple of years ago.

Thank you for this essay!

I am concerned about savings accounts. In my family, I have no control over them. Which is OK because they do not originate from my side of the family. However, I would like to do some delicate warning thing. Don't know how.

Marilyn

"Make dirt, not war." eyo

buy silver rounds

hard metals will always retain value

silver rounds are minted without denomination

only weight and purity

.999 pure one ounce silver rounds are now selling at about

$18 apiece. Started buying them when they were $12 couple

years ago. Trading chips for when the dollar dies.

Hedging bets.

Zionism is a social disease

You haven't looked recently

They should be at least $25 a coin now.

About 15 years ago I was giving them as gifts to friends/family @ $6 a piece.

You are right gjohn

not keeping up with the trends.

I buy them whenever there is some leftover money

after paying the bills, which hasn't happened for awhile.

Still think it is better than a savings account.

SD Bullion and JD Bullion were my go to guys.

Zionism is a social disease

If you've been buying silver

You're doing better than you know.

Silver is more volatile than gold, beware.

Gold has cachet and a mystique. Silver is more of an industrial metal and will rise and fall with industrial activity.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Thanks for the warning

in my limited reach, 10 rounds cost about $200

regardless of industrial activity, it has a trade value

on the street for goods and services beyond the dollah

where barter is not yet established, a second choice.

Gold, platinum, plutonium, diamonds, rhodium, etc.

are beyond my reach. Not a get rich scheme for sure.

Zionism is a social disease

Well now on top of everything else....

Congress: you home owners who can’t make your mortgage payment eat shit and die. We have better things to spend unlimited amounts of money on you hosers.

https://www.zerohedge.com/bailout/unprecedented-move-congress-proposes-t...

Congress wants to bailout hotels and shopping centers that can’t pay their mortgages. I don’t know why they need to stay open. Few people will stay at hotels or go shopping at the mall. Why? Because they have no f’cking money!

I wonder if Nancy is still going to give lobbyists money? It’s in the bill. But golly gee we’re getting new jets and ships folks. Always money for killery, but none for livery as Buckminster said.

The message echoes from Gaza back to the US. “Starving people is fine.”

Russia & China speed up de-dollarization

This seems dire:

Bye Bye Benjamin! Russia & China speed up de-dollarization process: most trade no longer conducted in greenbacks

Well who didn't see that coming?

The message echoes from Gaza back to the US. “Starving people is fine.”