The Inequality Crisis in charts

If you are a visual person then this essay is for you.

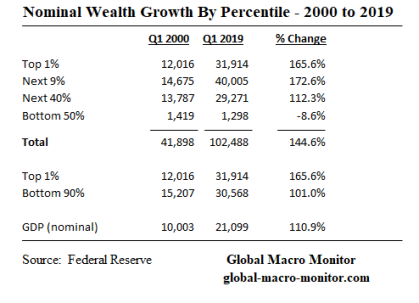

Notice how the 10% did nearly as well as the 1%.

So it's not exactly the 1% vs the 99%.

It's partly the 10% vs the 90%.

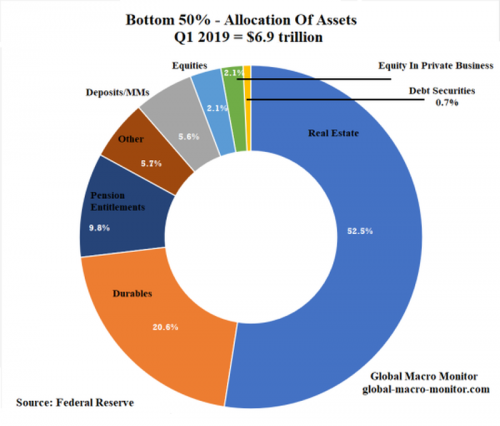

And then the chart that is sure to set everyone off.

For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group. This depressing milestone has two main causes: President Donald Trump’s 2017 tax cut and the long-term rise of tax avoidance by both companies and individuals.

The average tax rate on the richest 400 households last year was only 23%, down from 70% in 1950 and 47% in 1980. Why? In recent decades, the top income-tax rate and the estate tax have both fallen, and corporate taxes — which are effectively paid by shareholders — have plummeted. Middle-class and poor families, on the other hand, haven’t benefited much if at all from the falling corporate tax or estate tax, and they now pay more in payroll taxes than in the past. Overall, their taxes have remained fairly flat.

“Many people have the view that nothing can be done,” Zucman told me. “Our case is, ‘No, that’s wrong. Look at history.’” When the United States has raised tax rates on the wealthy and made rigorous efforts to collect taxes, it has succeeded in doing so.

And it can succeed again.

Saez and Zucman portray tax history as a struggle between people who want to tax the rich and those who want to coddle the rich. The story starts in the 17th century, when Northern colonies created more progressive tax systems — including wealth taxes — than Europe had. The Southern colonies, by contrast, were hostile to taxation, out of a fear that taxes could undermine slavery, as historian Robin Einhorn has explained.

Politicians cut every tax that fell mostly on the wealthy, with the justification that the economy would benefit.

The justification turned out to be wrong. The wealthy, and only the wealthy, have done fantastically well over the last several decades. The American economy just doesn’t function very well when tax rates on the rich are low and inequality is sky high. It was true in the lead-up to the Great Depression, and it’s been true recently. Which means that raising high-end taxes isn’t about punishing the rich (who, by the way, will still be rich). It’s about creating an economy that works better for the vast majority of Americans.

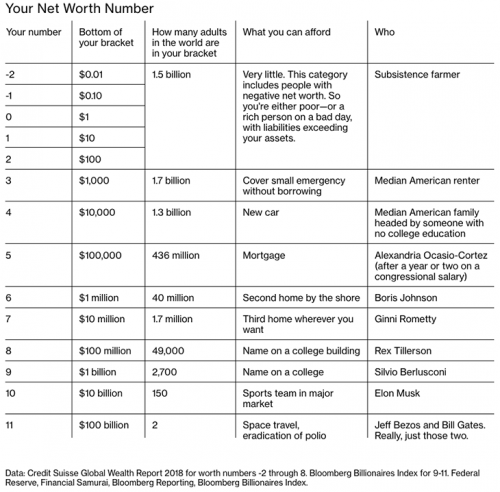

And then for a global view...

Comments

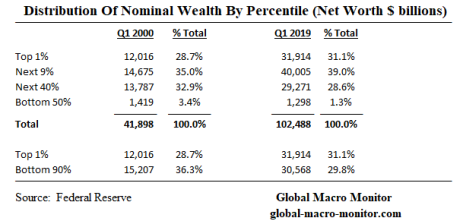

Measured by Purchasing Power, the 90% aren't that much wealthier

than they were before. Those numbers are nominal, rather than what the same amount of income actually purchases. The upper-middles (the 90th percentile) are far more indebted than they were even two decades ago. Things like college educations and buying a house are also far more expensive in real terms, so their real net worth (and standard of living) is down.

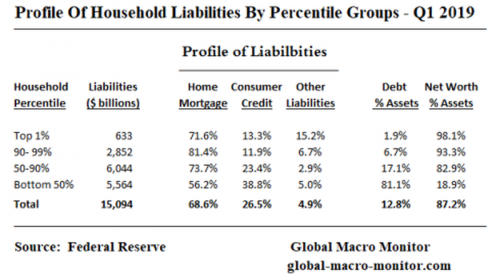

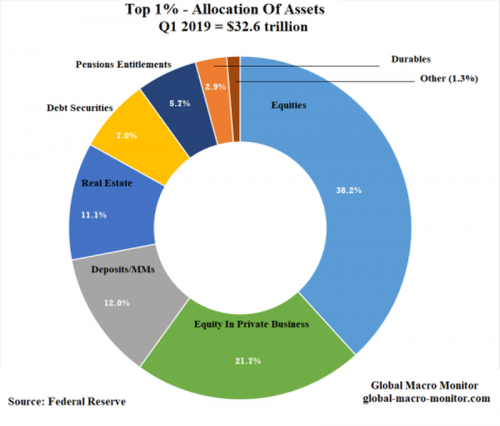

Indeed, it is only wealth (not income) at the 99 percentile, that gives a wealthy person a lot more real loot to stash into fourth and fifth residential investment properties, purchase start-up companies, acquire patent rights, and other things that make real money. Really wealthy people don't pay income tax because they don't need incomes. They have trusts with built-in tax deductions, e.g., foundations. They simply invest, roll over investments, and rarely sell assets outright avoiding capital gains.

When the 1/10 of one percent need cash, they borrow at negative real interest rates (that's tax deductible in nominal terms), from themselves and the companies they own. That's Merchant Banking. Other tax payers pay them to borrow. It's worked this way as long as there's been a Tax Code, that their lawyers (elected officials) wrote a Century ago. In the 1930s-1960s, there were revisions to the Tax Code that made them pay more, but that's been reversed so the wealthy now pay less tax than their grandparents did.

That's what has to change.

A lot of what you say is true

But from my experience the 10% identify with the 1% a lot more than with the bottom 50%.

So when it comes to class war, the 10% are the foot soldiers of the 1%.

Just sayin'.

There come times when the 10% get hurt enough that they turn on

the boss, and say, enough of this shit. It's happened twice. In 1932 with the New Deal and in 1945, when all those vets came home and created the American Middle Class.

But, by 1980, the Democratic Party lost the Middle Class when it ceased being a union-run party and became a party managed by a new class of technocrats beholden to big funders. That happened about the same time that the Middle Class lost its working class awareness that they were being screwed and forgot that they could fight back. That's also when the alliance between the Volvo driving "Limousine Liberals" (the 90-95 percenters) and the rest broke apart, and the Democratic Party fractured into an ethnic identity driven coalition that was easily dominated by Wall Street's agenda.

The fighting back part is what's missing, everywhere except among Bernie and Tulsi people. There are a few Libertarian types who are waking up, as well. I guess when the next crisis and collapse comes, we'll be the only ones who have any shared vision that things can and should be different, and better for the 99%.

Really?

I want to believe that, but I've never seen it even once.

What I've seen from Libertarians is a worship of capitalism and a hatred of taxes above all else.

Plus lip-service to all other rights and a blind/baseless trust that "the markets" will take care of the less unfortunate.

IOW, just another far-right party.

Many have evolved on foreign-policy and see Wall St as corrupt.

There may be more agreement about the 1% being the common enemy and basic rottenness of corporations than we often give them credit for. We identify many of the same basic problems. It's in the preferred solutions that we differ. Perhaps, the Libertarian Right is simply more skeptical that there is any workable solution involving the State. Perhaps, that fatalism about government under capitalism is actually more realistic? I don't know.

From my experience

Libertarians, like most Americans, are generally ignorant of history.

They think they know history but they don't.

For instance, Libertarians will tell you that tyranny = government.

When in fact most tyranny in history was private, not public. It's a rare Libertarian that will even acknowledge that private tyranny exists.

Just to show a fallacy, most Americans believe that during the American Revolution that King George was a tyrant with absolute power.

When in fact more than a century earlier the English had cut off the head of the last king with absolute power.

So who had the power? The aristocrats. Who were the aristocrats? Big private landowners. i.e. the rich

Generally under feudalism, in order to go to war, the king had to ask private landowners to loan him their private armies. So who had the real power?

The misreading of history has led to all sorts of stupid beliefs in America, and it isn't limited to Libertarians (for instance, SJW liberals think that white men have always had it easy, when there are so many exceptions in history that this bizarre assumption has no relationship to reality).

What's evolved in their world view is the corps are globalized

and that capital is largely foreign owned, alien. That is realistic and a vast improvement from the paleo-conservative view that bankers are kindly, native, part of the natural order and benign while labor and unionism, and the Left in general, was once viewed as foreign and dangerous to the traditional order. That's a huge shift, even if the Left is not embraced, it's no longer viewed as the Main Enemy.

Similarly, the Right has lost most of its anti-Russian, anti-communist fervor and the biggest political and economic threat is now seen as a huge, capitalist monolithic China. Along with Arab oil money, always instinctively disliked by most of the public, has morphed and been channeled into a full-blown religious hostility toward Islam since 2001. Even those on the Far Right are tired of forever oil wars while it is the corporate pseudo-Left that most eagerly embraced the manufactured doctrines of humanitarian intervention, regime change and Wilsonian just wars.

Russia! feeds from the same Deep State origins, and it is the conservative media that most accurately identified it as a CIA bureaucratic insurgency and domestic regime change operation being channeled for partisan gain by a hapless, manipulated Democratic Party leadership that desperately needs to blame someone else for its own failures, domestic and foreign.

So, we find a great deal to agree with some of the Right, and find ourselves estranged for largely the same reason from the Democratic Party we once embraced. Maybe we now see it was just our own idealism mirrored back to manipulate us. Our illusion of potential reform of an increasingly corrupt and totalitarian global political apparatus was just self-delusion that we had power enough to set the system right. The illusions of hope and reform of institutions many of us are just now casting off on the Left now seem pathetic, and self-indulgent. Some on the Right just got to a hard cold place before us.

The merchant class

as well, probably. The colonies could only trade/sell what they had to export, like tobacco, with England so it was English merchants who got to set the buying and selling price, undercutting what they paid for it to be able to sell competitively. Same old, same old.

The smaller the mind the greater the conceit. --Aesop

That damn Kennedy

The evisceration of the lower 90% began with John F. Kennedy's misbegotten tax cut for the wealthy (it was pushed thru Congress and signed by LBJ after JFK's assassination). That, followed by Nixonian and Carterian deregulation, coupled with Reagan and Bush the Lesser tax cuts (and Trump's, but his has only a minor effect so far), completed the wet-dream of wealth transfer to the rich.

Ike

Ike kept us out of VietNam. Being a veteran of WW I and WW II, he knew better than to think wars could be won easily.

Having worked in Army procurement, he didn't trust contractors at all.

Part of the 1950's prosperity was the building of the Interstate Highway System, pushed by Eisenhower, modeled on the German Autobahn. Al Gore's father wrote the bill establishing it.

Harry Truman, despised by liberals for nuking Japan and the Korean war, integrated the US ARMY to the loud wailing of Southern officers. He also tried, but failed to establish universal healthcare.

LBJ really screwed up VietNam even more, but gave is Medicare and the Civil Rights Act. Everyone post-LBJ has been worthless.

Which would you rather have, Truman or Trump. LBJ or G.W.Bush? As for Obama, I don't think I have to elucidate people here.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

I assume you've read today's NYT editorial by Saez

and Zucman. If not you should as I believe it captures the inequality better than most ways of looking at it.

They list income by individual not household. I know myself that if a household is making 50K it's a lot different if two people have to work to make that. If it only takes one the other can be doing tons of things that save $, make life more enjoyable, etc. They also concentrate on taxes which used to equal out things much more with 90% top rates and 80% taxes on inheritances.

Saez has helped Warren to come up with economic plans, they are the only reason I can be optimistic of a Warren presidency. I don't like her on guns, at all, nor on immigration, but neither of those are deal breakers, I can always hope for the courts or populism. A reconfiguration of taxes would do more to balance the actual power in the country, allowing things like Citizens United, free education, health care, etc. Shift the power.

I especially like their ideas of how to re figure corporate taxes on all companies, even tax the profits they shift overseas, even the profits foreign companies make on the US market.. https://www.nytimes.com/2019/10/11/opinion/sunday/wealth-income-tax-rate...