Federal Reserve suddenly loses control of it's own market

“This just doesn’t look good. You set your target. You’re the all-powerful Fed. You’re supposed to control it and you can’t on Fed day. It looks bad.”

- Michael Schumacher, director rates at Wells Fargo.

If the Fed ever lost control of the repo market, doing so on the very day of the Fed meeting is not the day to do it.

As the Fed was meeting to consider cutting interest rates, it lost control of the very benchmark rate that it manages.

So what the Hell does this mean? I think this is best described here.

It’s a rule of thumb that if you’re even talking about such geeky fare as long-short market-neutral strategies or overnight repurchase agreements, then something has already gone wrong.

You should not even have to be aware of this stuff, and I wouldn't even mention it except that the market essentially broke yesterday, and that might be important. Especially when the Fed basically sets this market.

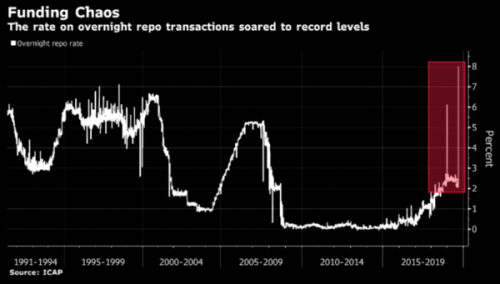

SOFR is a repo rate: It’s a daily index of the interest rate that banks and hedge funds pay to borrow money overnight, secured by Treasury securities. Repo markets have fallen apart a bit this week, as you might have heard. The Fed’s SOFR data shows some repo trades with interest rates as high as 9% yesterday, and SOFR itself—a volume-weighted index of a broad group of trades—settled at 5.25% yesterday. It was 2.43% on Monday, and had spent the previous month in a range of 2.09% to 2.21%. That’s a normal range, consistent with other short-term interest rates. (The Fed Funds rate is 2.25%, one-month Libor is about 2.04%, one-month Treasury bill rates are about 1.96%, etc.) In the entire (brief) history of SOFR, it had gotten above 3% once, clearing at 3.15% on Jan. 2, 2019. A rate of 5.25% is, in some real but hard-to-define sense, definitely the “wrong” interest rate. It was, however, the SOFR rate yesterday.

So what happened? Yesterday there happened to be less supply and more demand for money, so the rate was high.

That's really what it came down to.

"some weird repo bollocks" happens once every now and then, and the correct response is always¹ to just point and go "hahaha nerrrrd" then go back to some proper work while the roughnecks in the repo mines sort it out.

¹except that one time in 2009 obvs.

— Dan Davies (@dsquareddigest) September 17, 2019

Most times this is not a big thing. The Fed had been slowly shrinking it's portfolio for some time. This helped cause a liquidity shortage.

The Fed responded by doing an emergency repo (which was oversubscribed).

The long-term effect is that the Fed might be restarting it's QE program (i.e. buying bonds), which isn't good because the Fed was never able to 'normalize' it's portfolio, but it isn't a reason to panic.

OTOH, this should never have happened.

The macro explanations might worry you a bit, if you are inclined to worry; they seem to point to an inability of the financial system to smoothly move money from those who have it to those who need it—that is, an inability of the financial system to do its basic job. Weird big spikes in fundamental financial numbers can indicate deep trouble; they can also cause deep trouble, as risky levered borrowers lose access to funding.

So just as I was about to post this I took a quick look at Zerohedge and there's an update.

20 minutes after today's repo operation began, it concluded and there was some bad news in it: as we feared, yesterday's take up of the Fed's repo operation which peaked at $53.2 billion has expanded substantially, and according to the Fed, today there was a whopping $80.05BN in bids submitted, an increase of $27 billion, or 50% more than yesterday.It also meant that since the operation - which is capped at $75BN - was oversubscribed by over $5BN, that there was one or more participants who did not get up to €5 billion in the critical liquidity they needed

It's unclear exactly where all this credit demand is coming from, but from what I've read the source is probably from overseas. That's what happens sometimes when you have the world's reserve currency, and everyone borrows in dollars.

Comments

The $54bil question today is who needs the money

and why....

all derivatives suffered a huge hiccup cuz

of this

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Iran destabilizing the dollar /snark

I'll bet that's Pompeo's answer and we will hear that the CIA confirms it but can't tell you how they know. That's classified.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Exactly!

I stubbed my toe this morning. I have no proof and if I did show you proof I'd have to kill you, but I know beyond a speculative doubt that the damn Iranians were responsible.

Crazy shit, ore QE coming

so today another $75Bil and $75bil more tomorrow

someone's in need of QE.....some suspect it's the govt

cuz they need to refi some insane amount.

https://www.zerohedge.com/markets/ny-fed-announces-third-consecutive-rep...

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

There are limits to everything

even to the ability to create a virtual reality of an imaginary commodity (money).

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Albert Bartlett

"A species that is hurtling toward extinction has no business promoting slow incremental change." -- Caitlin Johnstone

Rates should have been raised long ago and the QE ...

would have easily unwound. The rising rates would have dampened P/E and increased demand for bonds.

Throwing the Trump tax cut gasoline on the fire caused the P/E's to shoot higher into the stratosphere than ever before. 40:1 P/E's? Stocks earning 2.5% That's a topsy-turvy world.

We are hitting the limits. ZIRP or negative rates can't drive the S&P to infinity. Especially since consumers are driven to the wall, borrowing just to survive as the vampire 1% suck the blood out of the 99%

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The US owes China $1 trillion that just became due

This "Trade War" being waged by Washington is a failing effort to force China to "reup" on all those 10 Year Treasuries that China bought to refloat the Fed in 2009. They aren't willing to roll over the bonds at a lower rate, so the Treasury has to pay out.

The word's gone out on The Street that the Fed's accounts are about to go into the red. The result is that the Repo Market is locking up again. I wrote here a couple of months ago that this was about to happen. You heard it first, here, at humble little C99.

Am on my phone so will post a link tomorrow. Here's the Link: https://caucus99percent.com/content/active-shooter-capitalism-us-goes-po...

Here's part of what I said:

The renewed roiling of the Repo Markets and the distress of the Federal Reserve and the banking system was inevitable, under the circumstances of conflict with China.

Just a P.S. - after I posted that article in May, someone from the Chicago Federal Reserve accessed my Linked-In page. Linked-In tells you things like that, in case you want to follow-up on a job prospect. Only, I wasn't looking for a job with the Fed, or anything like that. Looks like someone reads C99.

So the Fed justs buys a trillion dollars of bonds from China

with conjured out of the air money. no big deal. happens all the time.

Who pays? Workers pay as wages never meet inflation. Indeed, the Fed thinks inflation is too low.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Worse, China bought $1.1 trillion of U.S. issued debt.

Old saying:

"Borrow a $1000, and the bank owns you. Borrow a million, and you own the bank."

The Federal Reserve and U.S. Treasury are owned, and China is just the biggest single foreign holder of U.S. Treasury issues. And, all that implies.

The whole thing is set up for the 1%

Bonds are not needed. The bonds are never redeemed. The redemptions are paid for with new issue bonds, so we have printing press money which pays interest.

Better we should just print it directly without the intermediary bonds. But then Wall street would not get their cut.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Just before I'd checked in here...

...I'd been browsing stuff about Gnostic theology, including cosmology charts and a spiel on some kinda spiritual website about how one of the characters on the new Westworld TV series (I've never seen it, though I have seen the original Yul Brynner movie) was a rather overt analogy for the Demiurge.

That all made more sense to me than any of this does.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

The all powerful FED isn’t.

The FED tinkers with the value of currencies, which should, and used to be tied to the value of actual assets and commodities, not a manipulated money supply. The ecological corollary is the growing natural imbalance caused by the rapacious over consumption of the age of industry and the unchecked growth in the human population. In both economics and life on this planet the larger forces of actual value (reality based supply and demand) and the natural balance (diversity and reciprocity) will win in the end, and in both cases the reckoning ain’t going to be pretty.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

Funny a bank honcho should call them that to begin with

It's like, "Do you want a FREE-MARKET ECONOMY, or don't you, people???" If the government doesn't control the economy, it can't bloody well be held responsible for what happens to it, now can it?

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

I literally walked by the Federal Reserve

Building two days ago on my way to Zuccotti Pk to celebrate the 8th anniversary of Occupy. I was completely unaware of the situation explained in the essay.

Pushing two kids uphill on the other side of the block I watched a well groomed man in an expensive suit going in. Just being in those narrows, darkened cavernous streets in which Manhattan Island was first settled by conquering Europeans always gives me a mixture of awe about its history and rage at the vile criminality at the center of world’s financial markets.

It’s now forever etched in me that it is the place of the glorious citizens uprising against Wall St.

So ever single time I’m down there I will just start speaking aloud in the presence of anyone wearing a suit. Things like, “credit default swaps? jail time!”

I looked over at that indescribably humongous and gloomy imposing door of doom in front of the Fed and yelled out to that guy, “prosecute the 1%.”

Fuck these people. They don’t fear us at all. We need to start making them.

"If I should ever die, God forbid, let this be my epitaph:

THE ONLY PROOF HE NEEDED

FOR THE EXISTENCE OF GOD

WAS MUSIC"

- Kurt Vonnegut

I've long wondered about that

I frankly don't understand why, at the heart of a vast metropolis dominated by famously belligerent, supposedly Deep-Blue people, it was merely "Occupy Wall Street"...

...and not something more like "Columbine Wall Street".

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!