What the coming end of Dollar Hegemony means

Less than a week ago I posted an essay about the rapidly approaching end of dollar hegemony, but I didn't spend much time talking about its implications. It turns out that I was only a couple days ahead of the curve. Far better writers than I, such as Chris Hedges, have explored the topic in the past couple days.

This reconfiguring of the world’s financial system will be fatal to the American empire, as the historian Alfred McCoy and the economist Michael Hudson have long pointed out. It will trigger an economic death spiral, including high inflation, which will necessitate a massive military contraction overseas and plunge the United States into a prolonged depression.

Hedges quotes McCoy on how bad it will get, and the future he talks about is scarily close.

For the majority of Americans, the 2020s will likely be remembered as a demoralizing decade of rising prices, stagnant wages, and fading international competitiveness. After years of swelling deficits fed by incessant warfare in distant lands, in 2030 the U.S. dollar eventually loses its special status as the world’s dominant reserve currency.Suddenly, there are punitive price increases for American imports ranging from clothing to computers. And the costs for all overseas activity surges as well, making travel for both tourists and troops prohibitive. Unable to pay for swelling deficits by selling now-devalued Treasury notes abroad, Washington is finally forced to slash its bloated military budget. Under pressure at home and abroad, its forces begin to pull back from hundreds of overseas bases to a continental perimeter. Such a desperate move, however, comes too late.

Faced with a fading superpower incapable of paying its bills, China, India, Iran, Russia, and other powers provocatively challenge U.S. dominion over the oceans, space, and cyberspace.

The collapse of the dollar will mean, McCoy writes, “soaring prices, ever-rising unemployment, and a continuing decline in real wages throughout the 2020s, domestic divisions widen into violent clashes and divisive debates, often over symbolic, insubstantial issues.” The deep disillusionment and widespread rage will give an opening to Trump, or a Trump-like demagogue, to lash out, perhaps by inciting violence, against scapegoats at home and abroad. But by then the U.S. empire will be so diminished its threats will be, at least to those outside its borders, largely meaningless.

In other words, we are going to see the ugly side of American politics (even uglier than today), but not a Mad Max Thunderdome dystopia. Just as importantly, we are only a few years away from this future.

It tells you that time is running out to prepare.

For those of you who doubt the danger to dollar hegemony, consider this article from last summer on CNBC by a strong dollar proponent.

All of those actions and others point to one direction: In the coming years the dollar will be facing a barrage of attacks with the goal of eroding its hegemony and the energy trading market will be one of the main battlefields where the future of America's economic dominance will be decided. Any successful attempt to delink commodity trading from the dollar will have a cascading impact not only on the global economic system as we know it but also on America's posture abroad.

...

But ignoring the growing anti-dollar coalition would be to America's detriment. Bull markets eventually come to an end and with a national debt of $21 trillion and growing at a rate of a trillion dollars a year, the awakening could be ruder and sooner than most economists predict.In the midst of America's economic euphoria it is worth remembering that one of every four people on the planet lives today in a country whose government is committed to end the dollar hegemony. Thwarting their effort should be Washington's top national priority.

If you still don't believe in the danger to dollar hegemony, then your denial will be in for a rude awakening in the next few years.

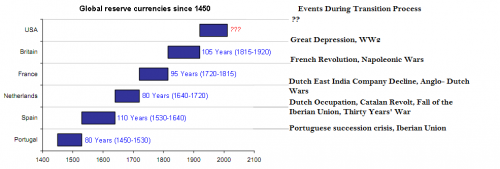

All empires eventually fall, and we are traveling down a well-trodden path.

Finian Cunningham puts our current Venezuela coup policy into context.

Venezuela can thus be best understood as another phase of the US dollar’s historic demise, and the concomitant bigger demise of American global power.

...Again, however, the arrogant Americans are in danger of overplaying their hand. As with Washington’s aggression on so many other fronts – towards Russia, China, Iran, Europe – the American gross misconduct against Venezuela is augmenting the very direction it most fears: a multipolar world where US hegemony no longer prevails.The configuration of chaos and conflict is a very dangerous one. The volatile mix could blow up into a global military confrontation. Washington’s desperation to avert its fate of demise could result in a one reckless aggression too far. A foolhardy invasion of Venezuela could be such a detonator.

Nevertheless, it is crucial to understand the present international precariousness as stemming from inherent American economic problems. That is the key factor that links up all the other seemingly disparate tensions and conflicts. Venezuela is but another demonstration of a wider structural problem centered on American capitalism’s collapse.

Our meddling in Venezuela isn't because of our strength, but because of our weakness.

Venezuela could be America's Suez Canal.

The thing is, unlike when Britain's currency hegemony ended, there is no obvious successor today. China, the 2nd largest economy, has an indebted, underdeveloped financial system, and no overseas military presence.

We would have to go back to the 17th Century to find a similar situation.

Comments

And this was my response as to why it may not be as bad

As predicted:

I don't see Kroger ever taking gold or silver as payment for food. Retailers will stick with fiat currency until it there is no more of it. That is what happens with fiat currencies. Our problem is using federal reserve notes as currency rather than using sovereign bills of credit.

If the shit gets so bad that it all begins to collapse, bills of credit will briefly come back (Lincoln's greenbacks were bills of credit not Treasury notes according to the Supreme Court in the legal tender cases and bills of credit are what preserved the union). The government will issue bills of credit to get over the crisis and then the banks will have Congress take them out of circulation again.

When the shit hits the fan like it did for Lincoln, bills of credit are the answer and they will return, perhaps even suggested by the banks, because even the banks benefit from an economy based on bills of credit when bills of credit prevent total collapse of the monetary system.

When no one has any money

That means less than it implies.

It's why Washington outlawed private ownership of gold in 1933 (not reversed until the 1970's). Can't have competition, doncha know.

When no one has any money retailers will take anything that has liquid value. You'll just have to talk to the manager.

That will include local currencies (that happened in the 1930's).

You are not getting it. YOu have no clue about what a bill

Of credit is. Economists drive me nuts because they are clueless about something so important that it is mentioned in the Constitution. It probably was originally by design. But now it is such ancient history no one knows what happened.

Basics. A coin is a credit instrument not a debt instrument. The government can issue coins without incurring debt and without taxing the people for income. The government has no more cost issuing coins than the cost of minting the metal. A bill of credit is the paper equivalent of a coin. It is not a debt instrument either. In the Constitution, the federal government is granted the right to coin money and states are prohibited from coining money and bills of credit. The Constitution does not prevent the federal government from issuing bills of credit so the Supreme Court reasoned in the legal tender cases that since the federal government was not barred from issuing bills of credit it could do so since they are the paper equivalent of coins.

A couple of years back, Joe Firestone, and MMTer seemed to partly understand this concept and wanted the US government to issue a trillion dollar platinum coin. He understood that coin would be issued debt free and be a credit instrument. He got that right. But of course a trillion dollar coin would cause all kinds of issues when it came to splitting it up. That is where bills of credit come in. The government could issue twenty two billion dollars in bills of credit and pay off the debt tomorrow by fiat. The banks and other US debt holders would have no choice but to swap their debt instruments for the credit instruments.

Once upon a time, coins were a substantial part of our money supply. So credit instruments as currency were plentiful. Not today. They are a fraction of one percent of the currency. And there are no bills of credit in circulation. Lincoln issued $450 million in greenbacks, paid his troops with them, paid the suppliers with them and won the war. The Supreme Court not only said that it was Constitutional to issue bills of credit, since they were the paper equivalent of coins but also part of of the government's war powers. Think about what that means. If a government can't issue its own currency and is forced by private parties to use theirs, it can not defend itself.

But banks hate them. They do not want governments issuing bills of credit. They want governments to borrow. But the citizenry doesn't care whether the government owes them or whether they have with the government. All the citizens care about is whether they can buy something with the paper or coin.

You underestimate me

I'm aware of the story of the Greenbacks during the Civil War.

Reissuing Greenbacks today would be a great idea.

Reissuing Greenbacks after the dollar is no longer a reserve currency would be a disaster, because global demand of the dollar would already be collapsing. It would essentially be what happened to Venezuela and Zimbabwe all over again.

I think you should investigate the history of local currencies during the Great Depression.

@gjohnsit Local currencies

Local currencies would have been illegal as they are bills of credit and only the federal government can issue them. I have thought about this often: whether a local government could get away with issuing bills of credit, and the answer always seems to be no. However, I do think it is possible that local governments could get away with it for awhile. But ultimately since they violate the Constitution, they would be shut down, and likely there would be people who get burned.

As for the dollar issue, greenbacks were dollars and bills of credit at the same time. You would not wait till dollars became worthless to issue bills of credit as dollars. Also the government would most likely begin by issuing bills of credit to its employees, it's contractors, social security recipients and so on. I would damn sure take my social security payments in bills of credit.

Most of us know how Germany was saddled with war debt after WWI and hos its money was worthless and how Hitler created some kind of economic miracle but we don't know who he did it. He did what Lincoln did. Kaiser Wilheim thought Lincoln hung the moon and wanted to do the same thing but was afraid of the bankers. But his desires to do that became part of the German understanding of money. So what Hitler did was issue the equivalent of bills of credit, paid his military and paid its suppliers and presto, you have the Third Reich. An economic miracle, even though it turned out nefarious. Lincoln and Hitler were different men and economic miracles can be good or bad depending on who is the beneficiary of them.

In addition

If we started issuing bills of credit now, I think we would have a much better shot at keeping the dollar as the reserve currency if that is the goal.

I don't think that would save the dollar

The move away from the dollar really started in 2009, when the BRICS created an alternative to the IMF/WB.

This was in response to Wall Street mishandling of the global financial system.

Then the trend sped up in 2014, when we started slamming Russia with sanctions, while attempting to isolate China politically.

The trend went into overdrive when Trump pulled out of the Iran treaty and started trade wars and sanctioning everyone.

Plus, the world is sick of us bombing everyone.

None of these things would change no matter how many bills of credit we issued.

@gjohnsit Well that is

Well that is true. However, if bills of credit were used to build up our infrastructure, get our people health care, get them good educations, get them good infrastructure jobs and get a 21st century economy working, the world might decide to make the dollar the reserve currency once again, if that is the goal. I do not know whether that should be the goal. I don't know whether the benefits of being the reserve currency outweigh the negatives.

@davidgmillsatty It seems

It seems like something that we should earn not be demanded of the rest of the world, and if earned it will be respected and more valuable.

@davidgmillsatty You can't

You can't do these things as long as you borrow and tax. You will always be hit with the austerity argument and the argument that the federal government needs to budget itself. The federal government does not need to budget when it can issue bills of credit as currency. Only states and local governments who are prohibited from coining money or issuing bills of credit have to budget like a household.

Wtf is HE

talking about:

And where TF has he been?!? Did this assWhole MISS the '80s, '90s, and '00s? He predicts we'll see this Now!?! In the next few years?

I've LIVED this fucking reality my Entire Adult Life-all he's saying To Me is Now he's afraid for His future.

Welcome to My World, fuckwad.

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

Isolating Russia, China isn't working

It's undeniable that we are trying to isolate Russia and China. However...:

Russia expects to make free trade zones agreement with Israel, Singapore, India, Egypt and Iran

Saudi Arabia and a group of OPEC members are reportedly trying to commit Russia and other oil-producing nations to continue managing supply

India has signed a memorandum of understanding with Russia for fast-tracking International North South Transport Corridor (INSTC)

And finally:

I have thought about this for years

The last several administrations (notably the Reagan and Clinton administrations) have facilitated movement of industries to other countries. This has created short term profit for Wall St. and some other companies, but it has created the problem that workers in this country do not have enough money to purchase goods manufactured abroad (because of wage stagnation due to offshoring of jobs). To provide purchasing power, debt has increased and bubbles have been inflated (internet and housing). These have created massive problems of themselves, and they have done nothing to address the huge balance of payments deficit that puts downward pressure on the dollar. The downward pressure on the dollar has been dealt with in the short term by debt recycling from countries that sell a lot of stuff to us like Saudi Arabia, China, sometimes Japan and others. e.g. Saudi Arabia sells us oil and uses the proceeds to buy T-bills financing the US government deficit or buys weapons from us. The US maintains hegemony by having a massive military and the leaders of many countries that we owe are happy to keep the system going because it works for them personally. As long as oil is bought and sold in dollars and our debtors keep playing along, the dollar is much stronger than it would be if unfettered capitalism applied. If unrestrained capitalism really applied, the balance of payments deficit would drive the value of the dollar down until the balance of payments stabilized (my guess would be a 40% devaluation, but the devaluation could be quick and messy since we have destroyed much of our industrial infrastructure). This is why any threat to the petrodollar is met with military force. The problem is that other countries like China don't really want to be subject to US hegemony so they are working to gradually erode US hegemony in many ways. The Belt and Road initiative, for example, will link China to various countries in ways that will be beneficial to China and their partners and will bypass the dollar in many cases. Chinese investments in Africa and Latin America will also weaken dollar hegemony. If the dollar falls to a value that gives a roughly even balance of payments, there will be lots of dislocations. People will suddenly be poorer because of inflation (i.e the cell phone manufactured and assembled in Asia will suddenly cost much more). It could be ugly. How will the military deep state respond? Will groups be demonized as in post WWI Germany? What will the disaster capitalists dream up?

I'm not H.G.Wells

but I can play him on C99.

The 2020 election will decide the decade.

If a Republican wins (especially if he is NOT Trump, who is a wild card) the coming depression will be more like a deflation scenario, where sellers bleed themselves white chasing an ever declining pool of available money. Expect scapegoating, violence, and a lot of unnecessary death as things like the safety net and health care are sacrificed.

If a corruptocrat is elected expect the Thucydides Trap scenario. America will respond to increased poverty and scapegoating with identity politics more and more violently enforced (violence is the ultimate goal of identity politics) The safety net (especially health care) will be sacrificed to prop up donor class profits, and when that fails official scapegoating of Russia and China and Venezuela and Iran and who can predict who next will result in ever increasing regional wars and ultimately war with China - the Thucydides Trap. (I originally thought that the declining livability of the Chinese ecology would make them the aggressors, but that was pre Hillary and her violent obsession with Russia, though Theresa May could make a Russia scenario come out)

Our only hope, not for avoidance but at least a relatively quick recovery, is a progressive, the more visionary the better. It will not be just the loss of dollar hegemony but that doubled with massive unemployment from automation and the refusal of our owner class to share the benefits. A progressive President will at first certainly be blocked by a status quo congress, so he will be forced to try the hopeless strategy of jobs programs and safety net expansions, ultimately switching to a UBI - which cannot keep up with the inflation it will create. (UBIs are designed to create inflation) But eventually military downsizing and a GMI will stabilize things. I hope.

On to Biden since 1973

Wow, two thumbs up

to you guys. I am almost getting it. Still, what do us serfs do? I seems that the institutions, banks, stock market will be trashed. What can we do, or count on? We all know the first place the government and politicians will go to grab cash to prop things up will be us, the ones that can't fight back.

Bretton Woods

In 1944 countries met in NH to create a global trading system. It was decided that gold would back up trading in currencies. But since the dollar was backed by gold, it was decided that countries would create reserves of dollars to back up their currencies. Fine enough, but highly tilted towards the dollar. A nation with a trading surplus could always trade it for US gold. Then Richard (tricky Dick) Nixon reneged on US responsibility because of high demand for US gold. This behavior has never been a problem for the US. That's the point where a huge assymetry was created. The US could now run huge trade deficits and just print money or issue debt. No other country could get away with this. The US holds almost no other currency in reserve. There are trillions of dollars held by other nations. That has been essentially theft. The US does not pay in full for the giant flow of goods from China to the US. And the US dollar does not get into trouble and the gold sits in Ft. Knox. Wow, screw job on the world.

Fast forward to today. If other major countries get their act together and dump the dollar the US is screwed. The US will not be able to trade only on the fiat dollar, it will have to offer real interest rates to finance its debt and the dollar will be devalued, as it has been with every other currency on the planet. All of our consumer goods will inflate like a large weather balloon. The standard of living in the US will plummet.

The US has two options, back the dollar with gold, or try to act nice to the rest of the world and beg for a soft landing. Naaah!

The domino effect of losing the position of reserve currency is mind boggling. We will be reduced to the real productivity of our economy, which is zilch. Everyone here is essentially living on hegemonic wealfare. We will really have to pay back our enormous international debt with devalued dollars.

The irony is that the US played nasty with other major trading countries, when it was making off like a bandit and the consequences of doing that will be extreme.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Interview with Michael Hudson today

…on "The Saker" website, about the dollar hegemony & Venezuela:

http://thesaker.is/saker-interview-with-michael-hudson-on-venezuela-febr...

As noted by others above, we've done this to ourselves.

Start a garden, now, if you can.

“We may not be able to change the system, but we can make the system irrelevant in our lives and in the lives of those around us.”—John Beckett