Why this wasn't a one-day thing

The stock market got routed today.

The broad selloff took the S&P 500 to the lowest in three months, the Dow Jones Industrial Average plunged as much as 836 points and the Nasdaq 100 Index tumbled more than 4 percent. All 30 members of the blue-chip index retreated, with Boeing and Caterpillar dropping at least 3.8 percent. Computer companies led the S&P 500 to a fifth straight loss, the longest slide since Donald Trump’s election win.

Despite the big number, the sell-off doesn't mean much taken by itself.

In fact, it wouldn't surprise me at all if stocks bounced higher tomorrow.

There's just one little thing...

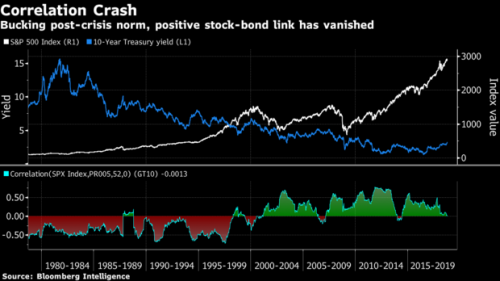

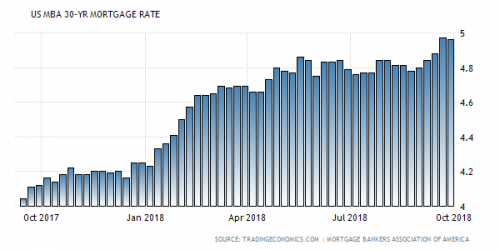

Normally, a stock market sell-off sets off a buying spree in Treasurys, as investors look for security in the more steady government debt market.But that's not the case now, since Wednesday's sharp plunge in stocks is actually happening because investors have been selling longer-dated Treasurys. As Treasurys are sold, yields, which move opposite price, rise, and that drives up interest rates for a whole range of consumer and business loans.

"There's no flight to safety in bonds. That's a sea change," said Peter Boockvar, chief investment officer at Bleakley Advisory Group.

To say that this is unusual is an understatement.

This is a near two-decade old trend that made a lot of people a whole lot of money. If it suddenly ends (which it eventually must), it could cause a lot of wealthy people to get very upset.

The dynamic has entered center stage in the past few days, after the yield on the 10-year benchmark raced to a seven-year peak while the S&P 500 Index fell four straight days to the lowest in a month. Those moves could be just a taste of what’s to come.“Don’t be lulled by how well the stock market has weathered rising yields and creeping inflation thus far,” Leuthold Group’s James Paulsen wrote in a research note this week.

To make things even more unusual, a specific class of stocks is acting strange as well.

Market observers have been puzzled by a recent phenomenon. As bond yields rose last week, tech stocks underperformed. But some stocks that act like bond proxies have done the opposite of what might be expected: They are rising.Since Wednesday's close, the yield on the 10-year Treasury bond is up about 16 basis points. The S&P 500 is down 1.9 percent and the tech-heavy Nasdaq 100 is down about 4 percent.

But not bond proxies. Bond prices move opposite yields, but for these stocks, prices are on the rise.

Old, boring stocks, like Pfizer and Coca-Cola, are performing better than bonds and tech stocks.

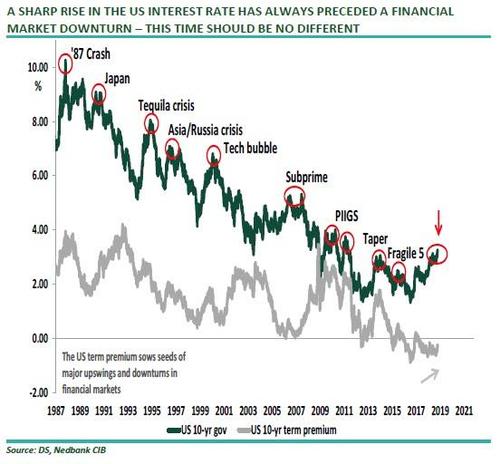

To put this into perspective, this should have happened months ago.

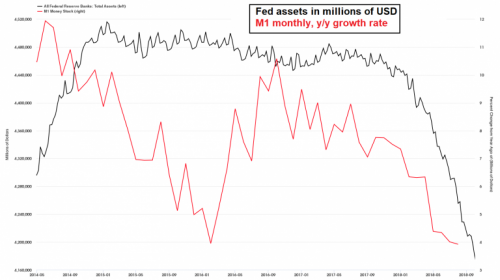

Fed raising interest rates = bad for stocks

Fed shrinking portfolio = bad for stocks

Trade wars = bad for stocks and bonds

Exploding federal deficit = not good

The markets have ignored all of these trends all year long.

As I pointed out a few days ago, a 37-year long bull market in bonds has come to an end.

Let's not forget who really, really hates higher interest rates: real estate.

Comments

Stock futures keep falling after-hours

link

Never fear, stock buybacks will return

I wonder how much money of those

buybacks was lost in the markit today

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

@gjohnsit

Prior to 1982, stock buybacks were generally considered a blatant form of market manipulation.

Per 1982's SEC Rule 10b-18, companies receive a “safe harbor” from market manipulation liability for stock buybacks.

If you, like me, are bored and/or anal enough to read through to the "disclosures" section of your retirement and/or investment accounts and see that peaceful-sounding term -- now you know what those "Safe Harbor" bits are all about. Protecting corporations from stakeholders.

Saw a sign today, a new one on the high wood fence of our local

right wing conspiracy crackpot and obvious gun fetishist. Among the Hillary For Prison 2016, black fully automatic weapon silhouettes, and Trump signs, a new sign: "Hippies use side door" with an arrow to the end of the fence. Who the hell, I mused, uses the word hippie any more? Got a feeling he doesn't look a bit like me today with black fingernails, manure packed boots and sweat everywhere. But now, if you'll forgive me, I'll let you in on a "hippie" secret. Venus is retrograde. Has been since 10/5 and will be until 11/16. So all us "hippies" cashed out already. Check it out. Has nothing to do with this world event or that, just keep an eye on Venus. And eat your phytonutrients.

I do like the " Hillary For Prison 2016"

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Understandable

Bonds don't have protection from inflation, stocks do. Coca-Cola can raise prices. Your bonds can't. So bonds pay 2% but inflation is running 2-3%, so bonds are at best paying zero. at worst they are guaranteed money losers. Dividend stocks have inflation protect and a return greater than zero.

Massive tax cuts and tariffs (no, I'm not against the tariffs) are sure inflation producers. Despite 40 years of Republican nonsense, tax cuts do NOT pay for themselves. They are stimulatory, but inflation is the price that is paid for the stimulus.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

emotional basket case

I am not proficient in monetary or fiscal policy but I do pay some attention. Since the most common advice is “don’t invest emotionally” I figure most people do; that’s why they keep repeating the same advice.

For the last 18 months of the Obama administration I was invested in low risk (securities/bonds) stable value accounts with no regrets. I was all in during the quantitative easing party and never did so well.

The day of Trumps election I increased my risk (S&P) for 22 months, no regrets.

I’ve been in stable value for a month now believing the market will drop for the midterm elections.

Increasing risk on the Trump election was a good bet. I can’t help but think a democratic house and maybe senate, worries investors and most of them will lower their risk.

There are a lot of 401K’s out there, the owners of which aren’t stock gurus but are probably the more emotional type of investors.

I’m way to risk averse (something I learned about myself when I started paying attention) but if correct, a bet the republicans hold the house and senate could prove to be a “huge win.”

I can not see that happening. I’ll wait and buy the dip but not this one; too risky with November right around the corner.

If power doesn’t shift to the democrats, I’ll be in November 7th (since I’m an emotional basket case when it comes to these things).

The one thing I’ve grown sure of is “It’s a crazy world.”

Good Luck!

I sold off most today.

Except the stuff that has already dropped like a stone. Might as well ride the roller coaster. Planning on buying back in maybe January. After the election for sure. Looking at the MACD on the S&P 500.

Dumped FAANG heavy mutual finds a few weeks ago. Trash like Facebook reminds me too much of the tech bubble.

Shouldn't HAVE to do this to avoid eating from garbage cans in retirement.

Damn Obama and the Catfood Commision!

Edit: Kept the dividend ETF's too. Will ride them up and down too. Meanwhile I get dividends to finance the MRD's.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

So if there's a sell-off in stocks

and also one in bonds, where is the money going, cash equivalents? Real estate?

"Obama promised transparency, but Assange is the one who brought it."

Another question...

Why do these sell-offs happen so frequently in October? Does it have to do with taxes and end-of-year stuff, or is it something else?

"Obama promised transparency, but Assange is the one who brought it."

China?

The Indian stock market is melting down too. Also Turkey & Italy. No surprise. Those two have huge fiscal problems.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.