Corporate America is in real trouble

Stocks have been on a record run. The S&P 500 is near all-time highs, while NASDAQ is doing even better.

But appearances are deceiving.

Six stocks account for 98% of the S&P 500 Index’s advance from the July low, according to Bloomberg. That’s right, 98%!

Those six stocks are (no big surprise here): Facebook FB, -1.55% Amazon AMZN, -0.64% Apple AAPL, -0.30% Netflix NFLX, -1.00% Google GOOG, -0.92% GOOGL, -0.95% and Microsoft MSFT, -0.61% Let’s call them FAANG+M.

The recent gains in the general stock market hide two glaring weaknesses, both of those weaknesses involve concentration.

The American stock market has been shrinking. It’s been happening in slow motion — so slow you may not even have noticed. But by now the change is unmistakable: The market is half the size of its mid-1990s peak, and 25 percent smaller than it was in 1976.

...When I say “shrinking,” I’m using a specific definition: the reduction in the number of publicly traded companies on exchanges in the United States. In the mid-1990s, there were more than 8,000 of them. By 2016, there were only 3,627, according to data from the Center for Research in Security Prices at the University of Chicago Booth School of Business.Because the population of the United States has grown nearly 50 percent since 1976, the drop is even starker on a per-capita basis: There were 23 publicly listed companies for every million people in 1975, but only 11 in 2016, according to Professor Stulz.

Fewer and fewer companies makes it harder for investors to diversify. It also means there are fewer and fewer small companies, leaving the economy more and more dominated by behemoths.

However, there is another hidden weakness here that is even more alarming.

Profits are increasingly concentrated in the cluster of giants — with Apple at the forefront — that dominate the market. For a far larger assortment of smaller companies, though, profit is often out of reach. In 2015, for example, the top 200 companies by earnings accounted for all of the profits in the stock market, according to calculations by Kathleen Kahle, a professor of finance at the University of Arizona, and Professor Stulz. In aggregate, the remaining 3,281 publicly listed companies lost money.In theory, as a shareholder, you are entitled to a piece of a company’s future earnings. That’s one of the main arguments for buying stock in the first place. But the reality is that you often are buying a piece of a money-losing proposition. Aside from the top 200 companies, the rest of the market, as a whole, is burning, not earning, money.

I think that is mind-blowing. Even a majority of the S&P 500 are money losers.

Netflix, for example, loses money constantly despite being a member of the elite FAANG.

So when the media talks about record earnings, keep in mind that the corporate world has even more inequality than society in general.

All of those corporations losing money means that they must cover expenses with borrowing, and that leads us to a looming crisis.

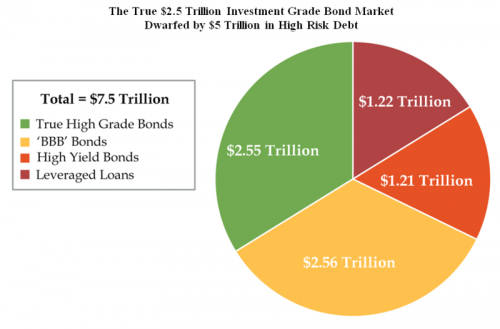

Much has been made of the degradation of the $7.5 trillion U.S. corporate debt market. High yield offers too little, well, yield. And “high grade” now requires air quotes to account for the growing dominance of bonds rated BBB, which is the lowest rung on the investment-grade ladder before dropping into “junk” status. And then there’s the massive market for leveraged loans, where covenants protecting investors have all but disappeared.How does that break down? Corporate bonds rated BBB now total $2.56 trillion, having surpassed in size the sum of higher-rated debentures, which total $2.55 trillion, according to Morgan Stanley. Put another way, BBB bonds outstanding exceed by 50 percent the size of the entire investment grade market at the peak of the last credit boom, in 2007.

But aren’t they still investment grade? At little to no risk of default? In 2000, when BBB bonds were a mere third of the market, net leverage (total debt minus cash and short term investments divided by earnings before interest, taxes, depreciation and amortization) was 1.7 times. By the end of last year, the ratio had ballooned to 2.9 times.

Yield for these "investment grade" corporate bonds is extremely low, which means prices are extremely high, even while these companies lose money hand over fist.

I believe there is a name for that.

Even the few money-making companies are borrowing because interest rates have been so cheap.

The problem is what they are doing with that cash.

Welcome to the Buyback Economy. Today’s economic boom is driven not by any great burst of innovation or growth in productivity. Rather, it is driven by another round of financial engineering that converts equity into debt. It sacrifices future growth for present consumption. And it redistributes even more of the nation’s wealth to corporate executives, wealthy investors and Wall Street financiers

Corporate executives and directors are apparently bereft of ideas and the confidence to make long-term investments. Rather than using record profits, and record amounts of borrowed money, to invest in new plants and equipment, develop new products, improve service, lower prices or raise the wages and skills of their employees, they are “returning” that money to shareholders. Corporate America, in effect, has transformed itself into one giant leveraged buyout.

Last year, public companies spent more than $800 billion buying back their own shares and, thanks to all the cash freed up by the recent tax bill, Goldman Sachs estimates that share buybacks will surge to $1.2 trillion this year. That comes at a time when share prices are at an all-time high — so companies are buying at the top — and when a growing global economy offers the best opportunity to expand into new products and new markets. This is nothing short of corporate malpractice.

It amazes me how no one is talking about reforming Corporate America.

It seems obvious that corporate culture is toxic, predatory, and working against the interests of the country.

Have people forgotten that we can change the rules on how corporations function?

There is simply no good reason why we can't make corporations more democratic and more responsive to the people of this nation.

Finally, there is the inevitable outcome for all of this money burning.

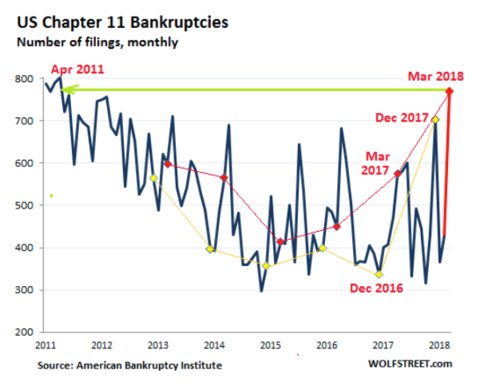

New Chapter 11 bankruptcies in the US spiked 63% year-over-year in March to 770 filings, the highest number of filings for any month since April 2011 (when there had been 789 filings as companies were still trying to emerge from the Great Recession).

Comments

No surprise. The tax scams have made this worse, no doubt.

The pigs will keep this one going for as long as they can get away with it.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

Nice write-up and links, as usual - thanks (n/t)

we can change the rules on how corporations function

sounds good, sign me up. What tools do I need to fix this thing? I've woodworking, metal smithing, electrical, plumbing, landscaping, trench warfare, roofing, brain numb chucks, plows, psychic voodoo and a few special chemicals. I'll meet you at the source. I'm the lady with a big back pack and passion in her eyes.

Zionism is a social disease

Reforming Corporate America--Ha! Ha!

The mainstream media used to report the outrageous salaries and lavish lifestyles of CEOs. How long has it been since we've heard about a $6000 shower curtain or $30 million yearly compensation? (spoiler alert--Aug. 2002) When financial regulations were weakened during the Clinton and Bush administrations, the banks were bailed out in 2008, Obama supported the status quo, and Trump and the Republicans are gutting Frank-Dodd, there's little incentive for Corporate America to change. The best predictor of future behavior is past behavior.

That could be a mistake

No trend lasts forever. The most common investor mistake is to believe recent trends will also be long-term trends.

Comment restated

I should have said:

Can't argue with that

When, exactly, did 'we' suddenly

become "The Country

That Couldn't?"

Growing up, all I heard was, "Yes We Can!"

And did!

These days? Too expensive. And, "No We Can't."

Think of the Deficit! Well, we've always had a deficit.

Never let that stop us.

Third World we've become.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

I recall jaw-dropping articles about lavish bat mitzvah parties

http://duckduckgo.com/?q=bat+mitzvah+million+dollar

2010:

https://nypost.com/2010/04/18/1-million-parties-have-nyc-bar-mitzvahs-go...

2013:

http://www.dailymail.co.uk/news/article-2265390/Shamed-fraudster-Peter-M...

Your bat or bar mitzvah son or daughter can be a rock star for a day!

http://www.rockmitzvah.com

Heroic assumption

link

Who will baby boomers have to sell to?

China. The one thing they really need from us is space. The developed coast of China is incredibly crowded.

And, indeed, Chinese investors are recycling dollars buying real estate.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

They own the media...

People are talking about it but their voices don't carry very far...

https://www.truthdig.com/articles/trillions-and-trillions-speculation-fu...

Tesla comes to mind as well. They lose money on every car they sell.

I thought this piece expressed much of the problem pretty well... as did yours. Economies falter as empires collapse don't they?

“Until justice rolls down like water and righteousness like a mighty stream.”

Apple is not a particularly egregious example

Apple has a huge valuation, but also huge earnings. Estimated P/E for 2018 is between 17 and 18. I agree that there is probably more downside risk than upside potential, but they at least make huge profits so you can argue that the capitalization is reasonable. Some of these other companies (Tesla being perhaps the most extreme example) make huge losses and it's not clear how they will become profitable.

Heh. This part is snark, right?

"It amazes me how no one is talking about reforming Corporate America.

It seems obvious that corporate culture is toxic, predatory, and working against the interests of the country.

Have people forgotten that we can change the rules on how corporations function?"

There has been plenty of talk of change. As long as congress remais a wholly owned subsidiary, options will be few.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

May i scream one word ... oligarchy, thank you.

I read an article that layed out

what several companies could do instead of buying the stock back.

Supposedly, McDonalds could give each of their employees $4,000.00, and other companies could pay up to $22,000 per employee! It may have even been higher, but I can't recall the details.

These corporate pigs simply refuse to pay employees. I'm all for making that form of company illegal. They depend on financial engineering, their products frequently suck, and they now have monopolistic powers.

dfarrah

Stock buybacks should be outlawed.

If stock prices are too low, a reverse split is the answer.

However, stock buybacks are used to produce artificial results to boost bonuses.

If a company has too much money and nothing to do with it, it should issue taxable dividends.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Many stocks are simply a con game

Google (Alphabet), for example, has three types of stock. Google type C confers no voting rights and pays no dividends. So you are buying part of a company when you buy Google C, but the only way you get your money back or make a profit is if someone buys it from you and you have no say in what the company does. The stock really has no intrinsic value. At least with dividend paying stocks, you get cash and if the company grows you get more cash.

speculation-only stocks: they are a con!

That doesn't sound like a Google C share represents anything whatsoever at all.

And all speculation-only stocks (like Google C) are cons......

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Here's a different kind of approach.

According to Critical Thinking at the Free School in London, there are three structural flaws that must be fixed before any new approach can work. (More on that below.) Every year they publish an ever more refined roadmap to restructuring the global monetary system and transforming the political economy.

This is their latest paper and I think it is very good with novel ideas that we never talk about:

Reform Proposals in the Monetary System for Attaining Global Economic Stability

They are an evidence-based think tank, which is unusual in a world filled with ideological-based think tanks. Critical Thinking offers a free education in monetary policy. They believe that it is essential for the People to understand the context in which money operates; who controls money, and who controls the levers of power. When people are able to see it for what it does, they will have the power to transform it.

Excerpt from the article, inked above:

To find out how they put it into action, read on.

Spot on and thanks, Pluto ...

Were i to draft a simple essay tomorrow proposing a contest in which the winner is the person or person's combined who creatively replace the word oligarch in all its meaning, either by another word--unknown to be at this writing--or a short phrase that could transform the meaning of oligarch to language that everyone could and would immediately understand; comprehend?

Suggest leaving a thread open for a week so many c99ers could have fun and participate.

Best phrase or word wins tickets to the hearts of mankind's "in need of help production."

Silly or go for it?

Think ... what would Edward Bernays come up with?

Perhaps something very politically incorrect — lice? ticks?

fungus? — involving the concept of parasites or parasitical behavior, combined with deep-seated, instinctive disgust.

“U.S. invaded by savage tick that sucks animals dry and spawns without mating”

https://arstechnica.com/science/2018/08/us-invaded-by-savage-tick-that-s...

Anything too effective would be prosecuted as “hate speech” (or especially in Germany, “Volksverhetzung”) for sure.

Sith Lords. The Dark Side.

The Force is our only tool.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

very interesting, thanks for the info ;)

Kirtimukha

(Joseph Campbell mucked this all up in retelling it)

The word mukha in Sanskrit refers to the face while kīrti means "fame, glory". The story of Kirtimukha begins when a great king Jalandhara, who "by virtue of extraordinary austerities ... accumulated to himself irresistible powers."[2] In a burst of pride, he sent forth his messenger, the monster Rahu, whose main task is eclipsing the moon, to challenge Shiva. "The challenge ... was that Shiva should give up his shining jewel of a bride [Parvati]."[3] Shiva's immediate answer was to explode a tremendous burst of power from his third eye, which created a horrendous, emaciated, ravenous lion. A terrified Rahu sought Shiva's mercy, which Shiva agreed to. But how then were they to feed the ravenous demon lion? "Shiva suggested that the monster should feed on the flesh of its own feet and hands."[4] So Kirtimukha willingly ate his body starting with its tail as per Lord Shiva's order, stopping only when his face remained. Shiva, who was pleased with the result gave it the name Face of Glory and declared that it should always be at the door of his temples. Thus Kirtimukha is a symbol of Shiva himself.

The point, of course, is that consuming yourself to feed yourself is self-defeating.

There is no justice. There can be no peace.