Trump tax cuts are working out exactly as expected

A heavily-biased poll says voters love the big GOP tax cut.

The poll from the Job Creators Network (JCN) found that 90 percent of Republican voters, 61 percent of swing voters and 36 percent of Democratic voters think the tax law will have a positive effect on the economy.

The poll, conducted by Luntz Global, includes an over-sampling of Trump voters, Republicans and small business owners.

And what's not to love? The results of the tax cut are exactly what Trump promised they would be.

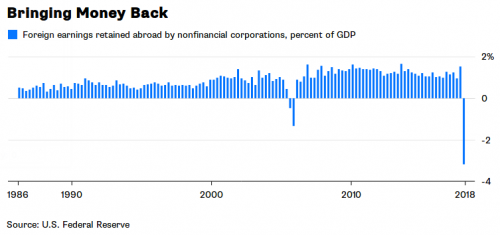

In terms of bringing money back home, the new tax law is proving some of its critics wrong.

Yes, companies are bringing their cash home. But was that ever in doubt?

The question is if the tax cuts would turn into jobs, and that's another story.

In September 2017, House Speaker Paul Ryan traveled to a Harley-Davidson plant in Menomonee Falls, Wisconsin, to tout the Republican tax bill, which President Trump would sign later that year. “Tax reform can put American manufacturers and American companies like Harley-Davidson on a much better footing to compete in the global economy and keep jobs here in America,” Ryan told workers and company leaders.Four months later and 500 miles away in Kansas City, Missouri, 800 workers at a Harley-Davidson factory were told they would lose their jobs when the plant closed its doors and shifted operations to a facility in York, Pennsylvania — a net loss of 350 jobs. Workers and union representatives say they didn’t see it coming.

Just days later, the company announced a dividend increase and a stock buyback plan to repurchase 15 million of its shares, valued at about $696 million.

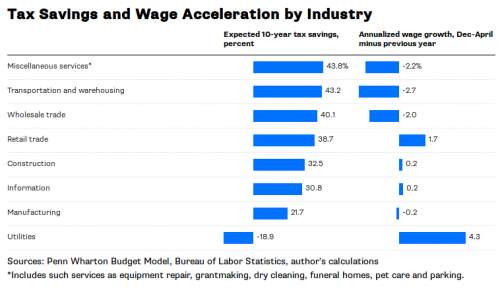

The corporate tax cuts aren't turning into wage hikes either.

Two months ago, there was no correlation between the size of tax cuts and wage gains across sectors. Now it’s strongly negative. Companies engaged in wholesale trade reduced wages, even though they’re supposed to save 40 percent during the next decade (according to the Penn Wharton Budget Model).

In fact, if you listen to what CEO's are actually saying, pay cuts and layoffs are in store.

So where is all that money going? Companies announced a record $201 Billion in stock buybacks in May alone.

That's just the tip of the iceberg.

If current conditions persist, corporations are likely this year to inject more than $2.5 trillion into what UBS strategists term "flow" — the combination of share buybacks, dividends, and mergers and acquisitions activity.

When all is said and done for 2018, UBS expects dividend issuance to top $500 billion, buybacks to range from $700 billion to $800 billion, and M&A to constitute about $1.3 trillion. If the numbers pan out, they would equate to about 10 percent of the S&P 500's market cap and 12.5 percent of GDP.

That's a whole lot of money not doing anything for the bottom 90%.

Comments

Too bad we aren't all one of them.

"Religion is what keeps the poor from murdering the rich."--Napoleon

Trump may yet win the next election...

He certainly is bribing the right people.

[video:https://www.youtube.com/watch?v=JkhX5W7JoWI]

I do not pretend I know what I do not know.

Any time people see more money

in their pay check, they are inclined to believe that it is a good thing. This is just human nature. The problem is the long term effects of the Trump tax cuts and those are not so good for the individual or the country. I have yet to find a good explanation of how this works in words that I can easily understand. But it appears that the cuts are front end loaded with the negative impacts occurring later on including some tax payers seeing a rise in taxes and the increase in the deficit.

Edit to add: Tax cuts for corporations or wealthy individuals never end up in creating more jobs. We have seen this play before starting with Reagan and we know how it ends. Corporations do stock buy backs, and both corporations and wealthy individuals end up hoarding their excess income, often in off shore tax sheltered accounts.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

People might be getting more money now, but just wait

"The problem is the long term effects of the Trump tax cuts and those are not so good for the individual or the country. I have yet to find a good explanation of how this works in words that I can easily understand."

What is going to happen is the tax breaks people are receiving now are going to sunset in a few years and then their taxes will go back up. Probably even more than they paid before because I don't think that the republicans are done screwing us.

But before that happens the republicans are going to gut the social programs that the happy people's parents, other family members and friends rely on. This will put an extra burden on them if they care enough to take care of their parents.

BTW, whatever happened to the 30,000 people who were kicked out of a nursing home? I haven't heard anything about this since the original story ran. But that's what is going to happen to many, many people if the republicans get the rest of their wet dreams of hurting as many people as they can.

I have never understood this.

There were problems with running a campaign of Joy while committing a genocide? Who could have guessed?

Harris is unburdened of speaking going forward.

Right. The Tax Cuts Were Stage One

85% of the Tax Cuts went to the morbidly wealthy and corporations. We got the crumbs from the plate.

Stage Two (already being set up) will be the Wall St Whores In Congress saying, Geez we can't afford SocSec and Medicare anymore. Gonna have to cut (gut) those.

The working class frogs are being slow boiled in the Oligarchs Pot.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

bing. n/t

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

A corporation

is tasked with raising its stock price. A stock buyback is guaranteed to work. In a very few cases expanding its business will also do that, but there's always risk. Why take a risk?

I suppose a simple legislative solution would be to outlaw stock buybacks -- a publicly held company can't purchase or own its own stock, directly or indirectly. It can issue options that can be used as incentives, to be redeemed as newly issued shares on demand but not held by the company (or maybe created at the same time as the options and held in escrow by a trust). Once public a company can't take itself private. I'm sure there are some games that could be played with shell companies, you would have to do something about that, or maybe "indirectly" would be enough to let the whole mess be settled in court.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Albert Bartlett

"A species that is hurtling toward extinction has no business promoting slow incremental change." -- Caitlin Johnstone

Actually, . . .

. . . if you mean that that is the purpose of the corporation, that's a myth. It's a convenient myth for the 0.01%, but it's a myth, made up not all that long ago.

A corporation exists to provide a product or service. That's all. There's nothing in there about increasing shareholder value, no matter how much the shareholders want it to be there. So they, or their bought-and-paid-for propagandists, just made it up out of thin air, and corporate media nodded most eagerly and made sure everyone heard this myth over and over. And now the public believes it.

Indeed, there was such a regulation largely outlawing stock buybacks, right up to 1982 when the SEC decided to loosen the definition of stock manipulation.

But anyone purchasing a majority of the stocks of a company can take it private if they acquire the remaining stocks. I seem to recall that Bain Capital (you may remember the name from the Mitt Romney c.v.) has been one of the players in that game.

Jimmy Dore slams Bernie

Just as in 2016...

... a vote for Democrats is a vote for nothing.

Nice.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Albert Bartlett

"A species that is hurtling toward extinction has no business promoting slow incremental change." -- Caitlin Johnstone

This is down right EVIL

and Pelosi knows it. This is how the social safety net will finally be dismantled and the Democrats will cry foul all the well knowing that they enabled it.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

(No subject)

There are many stories about companies giving raises and bonuses

to employees because of the tax cuts. This is supposed to prove that trickle down works and the benevolence of corporations.

But CEO's, executives, and managers are employees. How much did non-supervisory employees get?

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The tax law obviously gave

The tax law obviously gave huge tax breaks to the wealthy, that was only one of it's purposes. It creates a small bump in the economy, the rich feel richer, not as good as giving it to people who will spend it, but still, when people see they are another couple hundred thousand or half a million richer (the 9.9%ers) they spend money, I know, they hire me.

There were two more parts of it that are even more important politically. Many working people pay income tax, even if they end up getting back more than they pay, there it is on their checks, a noticeable, quantifiable difference. Yes it's small, better than nothing.

The second part is the small business, sole proprietors are pass through businesses. There are restrictions, you can't have too large a business or too many employees, but joe six pack who has a lawn mowing or handyman or plumbing or whatever business gets to write off 20%. Of profit. People notice that too.

Is this a good thing? Hell no. We need to raise taxes substantially. Especially capital gains, and eliminate all the deductions. My wife gets $27K worth of health insurance at her job, tax free, the lawn guy who lives up the street has to pay his entire insurance premium which sucks. Mortgage interest, local taxes, charitable contributions. Our personal incomes get more tax breaks than corporate, and that's saying something.

In two years we went from near poverty to bumping into the highest quintile. I notice taxes and tax free earnings.

Well, people do

pay taxes on their health plans if they exceed a certain level.

Additionally, the new tax code hits some of the wealthy with limits on some deductions.

I'm all for higher taxes on the 1%, though, since they mostly got their wealth by exploiting and underpaying labor or pirating companies like Toys-r-us.

dfarrah

"... exactly as

intended..." in your lede might be nearer the mark, gjohnsit. Every repugnant (and most of the demonrats, as well) who voted for this abomination knew exactly what it was supposed to do --

When Cicero had finished speaking, the people said “How well he spoke”.

When Demosthenes had finished speaking, the people said “Let us march”.

Demosthenes

"When Demosthenes had finished speaking, the people said “Let us march”."

Replying to your tag-line, it may or may not interest you to learn that Demosthenes spent most of his public career campaigning for a military alliance against Philip of Macedon, but the Athenian people did NOT march, Philip divided and conquered Greece, and Demosthenes eventually committed suicide to avoid assassination by one of Alexander's stooges in 322 BCE.

https://en.wikipedia.org/wiki/Demosthenes