The very long stock bull market in three charts

Submitted by gjohnsit on Wed, 03/09/2016 - 12:56pm

This bull market in stock is getting very long in the tooth.

This is happening despite a collapse in corporate earnings

While bulls cling to predictions that profit growth will resume for Standard & Poor’s 500 Index companies in 2016, analysts just reduced income estimates for the first quarter at a rate that more than doubled the average pace of deterioration in the last five years. Forecasts plunged by 9.6 percentage points in the last three months, with profits now seen dropping the most since the global financial crisis, data compiled by Bloomberg show.

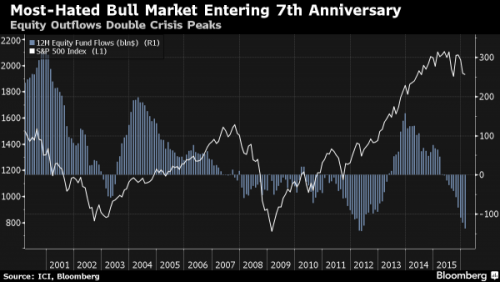

Is the stock market going up because regular people are buying stocks? No. Regular people are selling stocks. A lot of stocks.

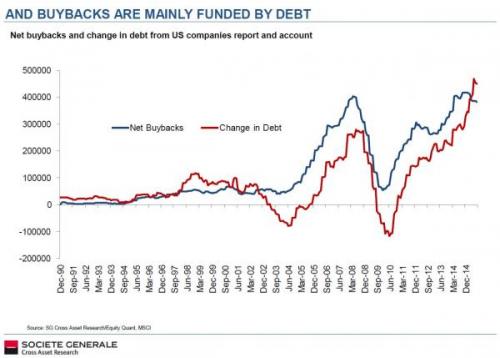

Then who is buying stocks? Companies are buying their own stocks, and going into debt to do so.

So are stock buybacks a good investment? No. Stock buybacks are not a good investment

The companies losing money on these bets are down a collective $126 billion over the past three years, a decline of 15 percent.

Many corporations would have been better off investing that cash in an index fund instead of their own stock. The overall market rose 39 percent over the same period.

So if you put all this info together, what logical conclusions would you draw from this?

Comments

Well, when you build your foundation out of wet cardboard...

I'm honestly glad that there are way smarter people than me out there that have the ability to explain this in layman's terms. Thank you for posting this. It was an education in and of itself. Cheers

“I'll show you politics in America. Here it is, right here. 'I think the puppet on the right shares my beliefs.' 'I think the puppet on the left is more to my liking.' 'Hey, wait a minute, there's one guy holding out both puppets!'”- Bill Hicks

Cue Bailouts...

Expect the rhetoric to be different from "Too Big To Fail" , but otherwise, the American citizen will be on the hook for corporate welfare, again.

Unless of course we get somebody in office who will wield his veto like a sword.

I do not pretend I know what I do not know.

Thanks for the diary

How do you find out if a certain company is buying back a lot of their stock? I'm curious about the one I work for because it seems like we may be in bigger trouble than they seem to be letting on in public.

There is nothing which I dread so much as a division of the republic into two great parties.. This...is to be dreaded as the greatest political evil under our Constitution.--John Adams

Someone tried to convince me

to invest in the stock market the other day.

I laughed, and laughed, and laughed, and laughed, then I got morose.

Great diary, thank-you.

Progressive to the bone.

That we have leverage over them.

This idea here shows that income inequality and economic leverage are just magical ideas that have no resemblance to natural or scientific laws.

Who will be left holding the bag when the market tanks? I mean, who will hold the bag before passing it on to taxpayers?

Man, I'd love to see a 401K run or something leveraging this reality to smash them up a bit -- I'd love to see them shorted while holding the bag.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu