GOP Tax Reform Bill Wants Me Bankrupt and Dead - Eliminates Deductions for Medical Costs

We itemize our medical expenses on our income taxes because our medical costs consistently exceed $20,000 a year. Last year it was $26,000. But the GOP bill will eliminate that deduction which means we will have to dip further into our limited savings.

Source: NY Times

“This bill helps Americans keep more of the money they earn for expenses that arise throughout their lives — such as medical bills — rather than providing a myriad of provisions that many Americans may only use once in their lifetimes, and only if they go through the hassle and frustration of itemizing,” said Lauren Aronson, a spokeswoman for the House Ways and Means committee.

I call bullshit. We have itemized taxes for years. Now our income is limited to what disability pays for my wife. Our income is fixed, but every year medical costs rise, and will get worse should my wife's cancer return. Or if the cost of her cognitive rehab for her brain injury from chemo increases. Or if my autoimmune disorder worsens. I've also had heart problems. But to siphon more money to the One percent, whatever costs we incur will no longer be deductible. We and millions like us will have to pay more to health insurance companies, pharmaceutical companies and health care providers, while also paying more in taxes.

According to an analysis in January from the Joint Committee on Taxation, most taxpayers who claim the deduction have incomes below $100,000, with about 40 percent below $75,000. More than half of those who claim it are older than 65, according to AARP, the lobby for older Americans. They often face staggering medical and long-term care costs.

The deduction also helps younger families struggling to pay the enormous cost of caring for children with chronic conditions or disabilities, and couples going through costly fertility treatments like in vitro fertilization. In interviews, some who claimed it said the deduction is the difference allowing them to afford mental health care, new chemotherapy drugs, or cancer surgeries by doctors who fall outside insurance networks. [...]

[E]liminating the deduction could hasten the speed at which some older Americans spend down their savings and have to go on Medicaid, a far greater expense for the federal government.

“Already I’m having to dip severely into whatever I’ve saved,” said Jennifer Clark, 76, of Falls Church, Va. She has multiple sclerosis and a form of blood cancer, and while insurance covers her chemotherapy and other medications, she pays out of pocket for part-time aides, dental care, a portion of her physical therapy, some of her medications and the continuing care retirement community she lives in.

Of course, the GOP plan is to eliminate Medicaid as well.

And how much does eliminating the right to itemize medical costs on income taxes save the government? Ten billion dollars, less than the one fifth of the increase to the military/defense budget of $54 Billion. That tells you all you need to know about our government's priorities. They would rather spend money on massively expensive killing machines than help people suffering from chronic or life threatening illnesses.

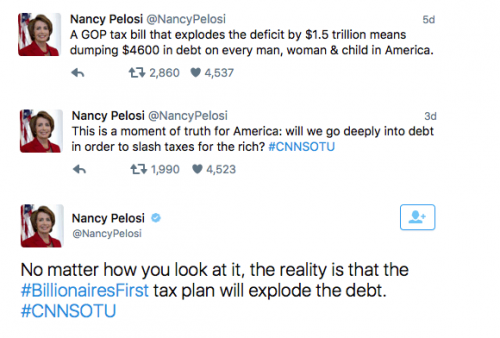

And what are Democrats talking about? #Russiagate. When they do talk about the Tax reform bill they rarely mention the damage it will do to disabled and sick people already crippled by medical debts. Mostly the rant about how the tax plan will explode the deficit. Nothing about how it will harm people. Check out Pelosi's tweets:

Really Nancy? That's the only thing you worried about considering this tax bill? Increasing our deficits? Not the pain and suffering it will cause the people who you claim must turn out and vote for Dems or else. No wonder no one looks to Dems for leadership. No wonder more and more people are turning Independent and opting out of both parties. They are both in bed with Oligarchs who want to profit off our misery.

Thanks for nothing.

Comments

They're coming for the middle class

at the same time they're going after the poor. What really chaps my ass, and I know I've said it before and I will say it again - anyone who's voted Repugnant for the last 30 godamned years should see that this is exactly what they've asked for. I know, it should NOT be partisan and it no longer is, if it ever really was, but damnit, while the rest of us have been screaming about just this for decades, these assholes keep on voting for this shit. I know my own stupid family is swallowing this bullshit whole and I really could just kick a few of them for being so idiotically and supremely selfish, willfully and proudly ignorant all while wrapping themselves in the flag and howling about that damned Bible.

End rant.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

And the effing Democrats enabled them

and when in power, instead of passing sigle payer as Obama promised, they passed a shitty neoliberal health care bill that benefited insurance companies and BigPharma while doing little to stop the rising costs of health care.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Yes, and sadly, look at how all that

right wing nut job screaming about "death panels" helped them do it too. I know, they'd have done it anyway, but the play off between factions helped them immensely. I remember defending Obamacare over and over and over again until reading Matt Taibbi and there it all was - an unsustainable system that would indeed bankrupt the government for private profit, while I on the supposed "left" thought it was the solution. I was sick to my stomach the day I read that Taibbi piece, because I knew then that I had been fooled as badly as any rabid Tea Bagger. I'm still coming to terms with my resentment of a Repugnant family, so I do get partisan at times. But when I listened to my own mother say that social programs "must be cut, but not now" that just solidified my resentment. She stood there and looked me in the face while telling me she would vote my damned retirement down the chute. I coulda kicked her that day, but to what end? It wouldn't get through even if I did really physically kick her.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

It seems everyone fell for one of the oldest tricks in the book

TV Tropes calls it Briar Patching.

GOP: “Oh please, oh please, don’t fling insurance and drug companies into that Romneycare!”

what would Jesus do?

Tough being the only member of a family with a brain or a heart, isn't it?

And what would Jesus do in your shoes? I suspect the answer would have more to do with a "cat o' nine tails" than agreement or support!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Is there some sickness in the goper human DNA

Over and over again, the gop and right wingers profess a profound hatred of medical care based on essentially class and race boundaries. It is one thing to be against Obamacare as system of health care based on cost, efficiencies, etc, but the gop does not argue that--they argue that some people should not be allowed medical care period. Forgot who said it, but gop health care plan was for sick people to simply die. It is like this sick death wish projected on other people.

Fuck, even look one of Clinton's most emotional speeches was made attacking Sanders plan for universal health care.

[VIDEO: https://www.youtube.com/watch?v=BG7w3Oey3xs]

Alan Grayson. "Their Plan

is, if you get sick, hurry up and die."

They're getting ever closer to that even as many more sign up for ObamaCare.

It's a lesser of two evils thing. Yes, my ObamaCare sucks but their plan sucks even more.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

I believe the exact quote was

"If you get sick, die quickly".

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

This is a huge tax increase for the 99% & gets worse over time

It's sad that there has been no spotlight thrown on the truly damaging provisions of this tax increase act.

The total value of medical expenses, property taxes, mortgage deductions and state and local taxes for a two-person household is usually considerably greater than $15,900. Why that number? The new "standard deduction" is accompanied by removing the personal exemption. For 2017 that's $4050 per person. So in a household of 2, the standard deduction amount of $24,000 is now essentially lowered to $15,900. In a family of 4 it's down to $7800.

Who doesn't have medical expenses and state, local and property taxes higher than these ridiculous levels?

But more importantly, the touted $24,000 standard deduction will not grow at the same rate as medical expenses or other taxes -- especially after Trump has totally destabilized the healthcare market.

With itemized deductions when medical costs rose (as they have so much in recent years) or when state and local taxes take a bigger bit out of pay, their total values were included in the itemization (subject to certain limits such as on medical expenses). So we are being suckered into a flat amount of deduction and loss of the personal exemption, as well as all meaningful deductions that ordinary folks use. Even if they retain the mortgage exemption it will be meaningless unless property values are >$500,000.

The tax rate for the poor and elderly will increase from 10% to 12%.

And don't count on any COLA adjustments to that meager flat standard deduction to help anyone. Just ask folks on Social Security about that.

The business tax deductions will remain intact. 95% of the tax code is about businesses and their privileges. There is no simplification in removing itemized deductions that ordinary folks use. But you can report how much you now owe the govt. on a postcard while businesses continue to rely on the big accounting firms to pay nothing.

But the MSM is reporting this in simple-minded ways, as always, as if most folks won't lose. The fact is we will all lose, so that the uber wealthy can keep their wealth intact, continue to buy the legislators and pass more rape and plunder laws like this one.

But perhaps the reason the Republicans "tolerated" Trump is because he's expendable. He can come in, dismantle the government, do a money grab for the rich and then disappear. He's a stooge, but not stupid. We are all stooges if anyone believes for a minute that this tax plan is anything less than stealing from those who need their incomes the most in order to further fatten Trump and the 1%. Their greed has no end.

Don't forget the mortgage interest

this too is going the way of the dodo. I'm seeing too many people agreeing with republicans that they are going to come out ahead with this tax reform bullshit. What people aren't being told is that any benefit they get is going to sunset on them in a few years.

Republicans are not going to do anything that will help anyone besides their donors. I can't believe that some are telling us that the reason that they are doing this is because their donors threatened them if they didn't.

And you are absolutely correct to say that this is why they are excepting Trump even though he is a total asshole. They know that he is going to do just that. Dismantling our regulatory agencies and let corporations do whatever the Hell they want. They approved his entire cabinet.

He is their wet dream.

The message echoes from Gaza back to the US. “Starving people is fine.”

This is why we need a general strike.

Stop working, stop paying taxes, until our taxes start going to things we actually NEED instead of stupid bullshit. If only we could convince enough people to do it to actually make a difference. I'm only one person. Why get a job when nobody wants to pay you enough to survive on? I work, I just don't have a job. At least I look at it this way; if I don't have a job they aren't getting my tax money.

There should be mass rioting in the streets over this bill.

This shit is bananas.

The GOP is scum, and the Dems aren't any different.

I hear this is going nowhere. Let's hope so.

"Religion is what keeps the poor from murdering the rich."--Napoleon

This sucks

I have no idea how it will affect me. It's all Greek to me. I own nothing, but will eventually be accruing medical debt, because those prices are only going to increase.

I had no idea people doing in vitro fertilization were given a deduction. Do people who adopt? I've never approved of in vitro. If there were no kids aging out of foster care, I might have a different opinion. Don't see that ever happening.

Lastly, what will they do when they kill us all off?

They'll get themselves some robots

to clean their toilets and floors or whatever else they need to have done FOR them.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

I believe people who adopt do get a deduction

However I also believe that the adoption deduction is up on the chopping block.

People who adopt should get a huge deduction

Imo. After all, foster parents are actually paid to foster. The ones who adopt aren't. So, they should receive deductions until the child(ren) are at least 18. Maybe more if they live at home while in college.

People who adopt take pressure off the over-burdened foster care system, and save the system lots of money.

And Jesus, those who adopt special needs children should receive even more!

Of course, it's all going away soon, I suppose. :/

The foster care system is absolutely disgusting.

I have many opinions on that, many of which are not suitable for those who would like to keep their lunch down.

Suffice to say, Foster Care in this country, and in California in particular, is one of the most corrupt, lazy, and cruel entities that exists. I consider dealing with them to be less preferable than strapping on body armor and driving around Iraq again.

I do not pretend I know what I do not know.

Just saw they kept the Adoption deduction but not

But not the local and state tax deduction.

What my local ABC station did not mention was the medical deduction.

Interesting omission, not.

Edit add: wrong reply placement and combo?

DTMW, I completely agree about the foster care system. It's horrible. Absolutely horrible.

Both parties want 'class-based' health care, IMO. If

this weren't true, the ACA would have contained one universal plan, with progressive premiums based upon ability to pay.

Instead, the Dem Party PtB fashioned a highly tiered structure, in which the coverage and care one receives is clearly based upon one's ability to pay--or not.

This practice has also become prevalent among employer-sponsored group health care plans. No longer are the same plans offered to all employees--including those in the Executive Suite. Instead, various plans are offered to employees within specific 'categories'--with the lowest paid/skilled employees often offered only high deductible plans.

Of course, employers don't point this out; if anything, most of them successfully conceal this practice.

[Edited: Added 's' and 'group health care.']

Mollie

“I believe in the redemptive powers of a dog’s love. It is in recognition of each dog’s potential to lift the human spirit, and therefore, to change society for the better, that I fight to make sure every street dog has its day.”

--Stasha Wong, Secretary, Save Our Street Dogs (SOSD)

SOSD - A volunteer-run organisation dedicated to the welfare of Singapore’s street dogs. We rescue, rehabilitate, and rehome strays to give them a second chance.

SOSD Rescue 'Barabas The Brave'

Everyone thinks they have the best dog, and none of them are wrong.

The full adoption tax credit is a 'one-time'

credit of $13,570 per child. I believe it's meant to offset adoption expenses such as attorney's fees, etc.

After a child is adopted, a parent/parents would be entitled to take 'regular' child tax credits.

I'm glad that it was restored.

Regarding the medical expense tax credit, it's been a target for quite a while. 'O' increased the AGI (adjusted gross income) threshold several years ago, so that fewer folks would be able to take the tax credit. I'll repost a blurb about it, over at EB.

Today, the allowable medical expenses you incur must exceed 10.0 percent of your adjusted gross income, before you can claim the medical/dental expense deduction. It was 7.5 percent before 'O' raised it.

Mollie

"I think dogs are the most amazing creatures--they give unconditional love. For me, they are the role model for being alive."--Gilda Radner

"If there are no dogs in Heaven, then when I die I want to go where they went."--Will Rogers

Everyone thinks they have the best dog, and none of them are wrong.

Yeats is running through my head right now...

The best lack all conviction, while the worst

Are full of passionate intensity.

I keep seeing the worst elevated to the highest positions, and not brought low, just embarrassed by their actions. Those actions which continue to plague those who entrusted the villains with the ability to inflict said misery.

This is how the empire ends, I think. Not by action, but by neglect. Piece by piece, the services and things we take for granted fall away, and we do without. Until all that remains is a broken husk of a country, in debt to the small gated communities which can't understand why the poor keep defaulting on their debts.

I do not pretend I know what I do not know.

I hear you, Steven,

medical bills took my saving years ago. I'm 54, disabled with an autoimmune disorder as well and will soon have to live on $350 a week. Good times.

The real SparkyGump has passed. It was an honor being your human.

Very, very

Sorry to hear that. This is what a rigged election gets you though.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Yep They Do

their throwing in the huge cuts to Medicaid proves this. They know what cutting all the deductions will do to people and they don't care. They are even telling us that they have to do this because their donors have told them that if they don't, they will be cut off themselves.

It convenient isn't it that any funding for wars, surveillance and the TSA type security programs that their phony explanations say are to keep us safe never have to be budget neutral?

They aren't going to kill all of us of, Deja, just a couple billion and the ones who are left alive will do jobs that keep their profits up and others will be made to join the military to keep their global hegemony going.

Every one has made excellent comments on this new transfer of wealth from different angles. Well done.

I'm sorry for what this is doing to you Steven. It's not right that we have to fear the next thing that might happen to us when so many are already living on the edge.

I'm going through this and worrying how much of my safety net they are going to fuck with .

Screw you, Pelosi!! I don't give a shit about the debt because it's a phony number and you know it. How about you at least express some concern about how this is going to effect us. Never mind, it wouldn't be true.

BTW, how are you enjoying your tax cut that you voted to make permanent?

The message echoes from Gaza back to the US. “Starving people is fine.”

I wish it were just happening to me and my family

But this effects millions of people, and as always the most vulnerable.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

And the added stress of having to worry

about this when one is already suffering illness is despicable. Stress can do lots of ugly things to the body, as I'm sure you're well aware. And all this so that some rotten greedy bastard/bitch can get a nice fat bonus and a second yacht.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

they think they have it wired.

but they are not that smart, and do not run the world.

The Republican Party is a terrorist organization.

And the Democratic Party enables them.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

@The Aspie Corner Which one is the Peoples'

Which one is the Peoples' Front of Judea and which is the Judean People's Front?

Yes.

This shit is bananas.

Not quite......

This is yes:

[video:https://youtu.be/ZmgIQXSRfdE]

The People's Front of Judea and the Judean Peoples' Front are something else.....

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

The folks who may benefit from the higher standard

deduction are mostly single peeps (individual filers) and couples (joint filers) without dependents. Now, that obviously applies to folks who don't have enough deductibles to itemize.

It's by no means a major increase. One Business Insider piece estimates a 15% increase in the overall deduction for individuals under age 65; only 3% for folks age 65 and older, since they lose the additional 'senior' deduction, in addition to the standard deduction and personal exemption that MsDidi mentioned.

Mollie

"Being deeply loved by someone gives you strength, while loving someone deeply gives you courage."--Lao Tzu

"I think dogs are the most amazing creatures--they give unconditional love. For me, they are the role model for being alive."--Gilda Radner

Everyone thinks they have the best dog, and none of them are wrong.

Hey M

Have you seen this?

....

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Hi, DO--no, hadn't seen the Tweet. I'll reply at EB. ;-) EOM

Mollie

"Being deeply loved by someone gives you strength, while loving someone deeply gives you courage."--Lao Tzu

"I think dogs are the most amazing creatures--they give unconditional love. For me, they are the role model for being alive."--Gilda Radner

Everyone thinks they have the best dog, and none of them are wrong.

The Duopoly is consistent -- on taxes, Obamacare, etc., etc.

The policies of the Duopoly are totally consistent. Trump just has different color hair and a different style of rhetoric than his predecessor. Not much difference in substance. It's unfortunate that Obama is so charming -- it makes people think he somehow has their interests at heart.

Obama's tax reform proposal -- a part of his attempt at a Grand Bargain -- was summarized by

Americans for Tax Fairness as:

"President Obama’s plan would lower the overall corporate income tax rate from 35 percent to 28 percent and lower the effective corporate tax rate for manufacturers to 25 percent.[1] He wants to fund those lower rates by eliminating loopholes, including ones that encourage sending jobs overseas. He also proposes a minimum tax on corporate foreign earnings – almost like a Buffett Rule for multinational corporations. He has provided no details about how this proposal would work, what the tax rate would be or how much revenue it would raise."

Have you noticed any similarities between this and Trump's bill?

Were any of you surprised -- as I was -- that during Obama's term, MoveOn had decided that tax bills Obama was recommending should be the cornerstone of their national priorities? When I told them, at a national call-in, that taxes were the Republican way of governing I was essentially told to leave -- and I haven't wasted a minute since with the neolibs after hearing local Dems get so enthusiastic about Obama's tax and health care policies.

Likewise Obama's health care plan was simply a rewrite of Romney's -- and actually put the breaks on any further changes -- such as single payer or public option for 7 years -- long enough to give all the health reform advocacy groups a chance to break down.

The Hillary Bots and neolibs want us to be confused about all this, because they are the architects of combining 'conservative' fiscal policy (read: consolidation of economic power with the few) and "liberal" social policy (read: using identity politics to give folks the illusion that we're 'with her' and with them). I mean, how many white outfits did Hillary have to symbolically drape herself in the uniform of the suffragettes - even with arms extended to the heavens in her righteousness (read: self-righteousness)?

Van Jones sounded a bit silly the other night when he said that the Dems had erred in getting to invested in identity politics and forgotten to consider the issues of white people. What a neolib, identity politics way of framing what is truly a class issue. Economic inequality is the heart of the matter.

We would not need to worry about deductible medical expenses if we had single payer. There is nothing progressive about tax reform proposals, no matter what their terms.