Our Dystopian Economic Future

Everyone knows that minority ethnic groups will make up a majority of the population by 2043.

What most people don't know is the economic disaster happening to these minority groups.

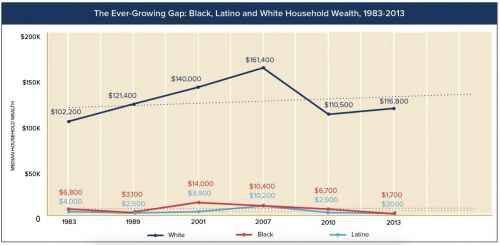

A new report calculates that median wealth for black Americans will fall to $0 by 2053, if current trends continue. Latino-Americans, who are also experiencing a sustained downward wealth slide, will hit $0 about two decades later, according to the study by Prosperity Now and the Institute for Policy Studies.

“By 2020, median black and Latino households stand to lose nearly 18% and 12% of the wealth they held in 2013 respectively, while median white household wealth increases by 3%,” the report states. “At that point – just three years from now – white households are projected to own 86 times more wealth than black households, and 68 times more wealth than Latino households.”

Minority wealth was obliterated in the housing bust, even more than white wealth.

Between 1983 and 2013, median black household wealth decreased by 75% to $1,700 and Latino household wealth fell 50% to $2,000. At the same time, median white household wealth rose 14% to $116,800.

The home ownership rate for blacks was just 41.7 percent, a lower home ownership rate than during the Great Depression of the 1930s.

This problem has been compounded during the unbalanced housing recovery under Obama, and it was all about house prices.

According to analysis from Nationwide, the average price of a lowest-tier home nationally has increased by 56 percent over the last five years. By comparison, the value of a home in the highest tier has increased by 33 percent over the same period.

This has priced out many first-time homebuyers, while home prices are 'overpriced' in half of U.S. markets.

This has left the housing market, our economy in general, and our society, unhealthy.

At the same time, sales are falling, again, because there are too few homes on the low end, and the homes that are available are very expensive.

...Supply on the low end is tight because during the housing crash investors large and small bought hundreds of thousands of foreclosed properties and turned them into rentals. There are currently 8 million more renter-occupied homes than there were in 2007, the peak of the housing boom, according to the U.S. Census.

Investors could take the opportunity of high prices and high demand to sell these properties, but today's high rents offer them better returns.

...The homes are there, they're just not selling, and it's not hard to figure out why.

Just 2 percent of newly built homes sold in August were priced under $150,000, and just 14 percent priced under $200,000. Compare that with the existing home market, where more than half of homes sold in August were priced under $250,000.

The current housing market, with all its tax breaks for wealthy landowners, is the largest contributor to wealth inequality and the destruction of the middle class.

Comments

Forget about income inequality

WEALTH inequality is the bigger story, and only Berniecrats are talking about it.

What's the difference?

There is always Music amongst the trees in the Garden, but our hearts must be very quiet to hear it. ~ Minnie Aumonier

Income is what you earn each year.

Wealth (or assets) is what you have after expenses at the end of the year, and it grows with each year's surplus or asset appreciation.

My explanation

I am on disability and have some investments. I make about $17,000 a year. That is my income.

But I own (outright - no mortgage) a $400,000 condo and have about $400,000 in the bank. My total wealth is therefore a little over $800,000.

2 points:

1. Much of my "wealth" is an illusion. It is tied up in real estate and IRA, I cannot easily access it, and because of my low income if I have to access it I cannot replace it.

2. OTOH, the more wealth the more of it can be used, to buy a house, to send a kid to college, to help that kid buy his own home. This cannot be done with income - cosign a mortgage for your kid then get laid off. Get it? And then if I can pass that wealth on to an heir (and the larger the total wealth the more someone can pass on to an heir) the easier and quicker that heir can build "his own" wealth. (I was 40 when I bought my condo, and I had to take out a $57,000 mortgage. If I had rich parents I would not have taken out a mortgage or would have paid it off faster or would have bought a "better" home or would have bought earlier)

Wealth is an advantage, income is not. An advantage compounds.

On to Biden since 1973

Thanks for the explanation

I assumed that's what it was but wasn't completely sure

There is always Music amongst the trees in the Garden, but our hearts must be very quiet to hear it. ~ Minnie Aumonier

Home Mortgage Tax Deduction

There has been a long standing effort to cap the home mortgage tax deduction that goes nowhere. IIRC Congress even refused a very reasonable $500 thousand dollar cap or excluding "second vacation homes".

The result is that $10-20 million estates are subsidized by all taxpayers. The entire real estate market is skewed towards high priced housing instead of moderate and low income housing.

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

$1 Million Limit - My Mistake

The GOP and Trump are trying to lower it to $500K along with eliminating the deduction for state and local taxes:

If GOP scales back the mortgage interest deduction, Californians would be hit hardest

http://www.latimes.com/business/la-fi-mortgage-tax-deduction-20170828-ht...

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

The GOP and Trump are on the side of a more level playing field?

At least on this one issue? Do I understand that correctly?

I'm not sure I agree with the identity politics

Yes, blacks were harder hit. But they weren't harder hit because they were blacks. They were harder hit because they were already more vulnerable. The problem cannot be addressed by solving it for "black" or any other identity subgroup. The battle is class-based not racially based.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

Why can't it be both?

It is actually both.

It probably is both

But not all the tiki-torch-carrying, pizza joint employees in the world could cause this.

This comes from the donor class.

I'm certainly not denying the racism in the US

Yet I don't think that's the appropriate target in this battle. In the end, it serves to divide us just as the Democratic party hopes with their identity politics. In the mean time, that black guy that got screwed... yeah, I got screwed too. Sure, I wasn't screwed as badly but that's only this round. My turn will come up.

My argument against "both" is two-fold:

a) It plays into the Democratic party's strategy

b) It works against unity among "we the people".

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

OT: Wall Street to police itself

good graphic

from a more recent study that also illustrates the point

“Until justice rolls down like water and righteousness like a mighty stream.”

A graph that lumps

all white people into the same line tells you nothing about class. Put a randomly selected group of a hundred white people in a room. Calculate their mean income and wealth. Then assume Bill Gates walks into the room and repeat the calculations. Income and wealth will go up several times. Those newly calculated means have no more to do with the lives of any of the other white people in the room than they do with the lives of people of color.