What real tax reform looks like

President Trump needs help from Democrats.

A group of six senators is expected to dine tonight with President Trump at the White House in what's being touted as a "bipartisan working dinner" to address tax reform, multiple Congressional aides have confirmed to ABC News.The Democrats expected to attend will be Sens. Joe Manchin (W. Virginia), Joe Donnelly (Indiana) and Heidi Heitkamp (North Dakota) and the Republicans are Sens. Orrin Hatch (Utah), Pat Toomey (Pennsylvania) and John Thune (South Dakota).

...

Donnelly, Heitkamp, and Manchin are also more likely to lend their support to a GOP tax package that includes widespread cuts and reforms because they are vulnerable heading into a risky midterm election.Notably, the senators were the only three Democrats who did not sign a letter addressed to leadership that said the Democratic caucus would not support a tax overhaul that cuts taxes for the "top 1 percent" or adds to the government's $20 trillion debt.

Massive tax cuts for the 1% and Wall Street is the very highest priority of both Trump and the GOP.

Everything else is secondary.

Like the Repubs health care plan, the best defense is a good offense.

There are two of them readily available.

One of them by Bernie Sanders.

In fact, Sanders had detailed (and quite realistic) plans outlining how he would pay for his proposals on his website, and they were extremely popular with the majority of voters. He proposed a financial transactions tax on securities (supported by more than 60% of Americans); eliminating various tax loopholes for the rich and corporations (supported by an overwhelming majority of Americans); eliminating the cap on the payroll tax so that the rich don’t get the majority of their income sheltered from the tax (supported by more than 60% of Americans and by 80% if phased in); and sponsoring a modest increase in payroll taxes (it would add about $1.61 a week to the average household) to help pay for his expansive social programs.

The most controversial proposal in Sanders’ platform involved his plan to pay for universal single payer health care. He proposed a 2.2 percent increase on payroll taxes for households, and a 6.2 percent match by employers. This would have raised taxes, but it would have also substantially reduced the net amount Americans paid for health care, saving American families thousands of dollars. The average family of four paid $24,671 on health care in 2015.

And one of them by Ro Khanna.

Rep. Ro Khanna, D-Santa Clara, will introduce a bill Wednesday that would give low-income and working-class taxpayers a big tax credit — and have a massive price tag.The plan would drastically expand the Earned Income Tax Credit, which helps people at the bottom end of the salary range. Low-income taxpayers without dependent children would see their credit rise from a maximum of $510 to $3,000, and families would see their maximum credit rise from $6,318 to $12,131, depending on their income and number of children. Economists say the increased credit would help compensate for the fact that working-class salaries have stagnated in recent decades even as the U.S. economy has continued to grow.

While the proposal isn’t likely to gain traction in the Republican-dominated Congress, Khanna hopes it will become a Democratic rallying cry.

“I think it’s going to be our party’s answer to Donald Trump on taxes,” Khanna said. “While he’s proposing tax cuts for the investor class, we’re proposing support for the working and middle class.”

Before you can know what tax reform needs to pass, you have to understand what needs to be fixed.

This Bloomberg article spells it out.

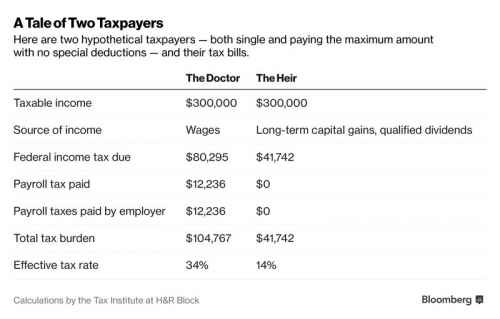

Let’s say you and I are neighbors. You’re an emergency room doctor, and I don’t work, thanks to a pile of money my grandparents left me.You spend your days and nights stitching up gunshot wounds and helping children survive asthma attacks. I’ve gotten really good at World of Warcraft, winning EBay auctions, and frying shishito peppers to just the right crispiness.

Let’s also say we both report $300,000 in income to the Internal Revenue Service this year. Who pays more in taxes?

You do, by a lot. You owe the IRS about $38,500 more, assuming each of us pays the maximum with no special deductions. I also have more flexibility to lower my burden with tax planning strategies and other tricks, and I get to skip about $24,000 in payroll taxes that you and your employer must fork over each year.

Taxing labor at a higher rate than unearned income gives the economy the wrong incentives and contributes directly to wealth inequality.

Comments

Let's look at the players.

Sens. Joe Manchin (W. Virginia), Joe Donnelly (Indiana) and Heidi Heitkamp (North Dakota.

Demonrats/Repugnants. They're in play only because they're vulnerable. They'll go where the money does. More of those "More and better".

How the fuck does anybody gain traction when those who supposedly stand for us stand down?

Game over man.

[video:https://youtu.be/dsx2vdn7gpY]

Regardless of the path in life I chose, I realize it's always forward, never straight.

When you hear "reform"

In connection with government, it means average people end up with less actual money and/or fewer rights. This will be no different I'd expect.

Orwell: Where's the omelette?

The Three Little Piggies & the Big Bad Wolf

If Heitkamp, Manchin, & Donnelly side with Trumpster and the Republicans by supporting tax cuts for the wealthy, they will only decrease their chances of re-election next year. How many times do Democrats from Red States have to learn this lesson? Where are recent Senators such as Mary Lou Landrieu (D-Louisiana), Mark Pryor (D-Arkansas), and Kay Hagan (D-North Carolina) today? I'm sure this list is not complete either.

Right!

“If a voter has a choice between a Republican and a Democrat who acts like a Republican, he’ll vote for the Republican every time.”

--Harry S. Truman, former U.S. President (may be apocryphal)

Have a little empathy for the 1%

They shouldn't have to pay as much as you....they are privileged. And let's cut the estate tax so they can pass it on and have more entitled heirs. Oh my we are so screwed!

Sadly they have done a great job from Reagan on to brainwash the people that taxes (all taxes) are bad. The sheeple are easily herded, and the corporate dems do as their puppet masters demand.

“Until justice rolls down like water and righteousness like a mighty stream.”

That is the message they always tell us

but according to this amerikans ain't so dumb, they even want

MFA, but the 546 in DC just don't have our back, they concetrate

on their own checkbook.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Banquets For The Moneyed Class

Crumbs For The Working Class.

Of course, Trump's loyal schmucks will hail his tax plan as like he is Moses descending from Mount Sinai.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Off the top of my head

I have problems with either plan.

Bernie's plan is dependent on a payroll tax. So he is going to tax jobs, bet he doesn't tax robots. Half of all jobs will be automated in about a decade. (and those that remain will be lower and lower paying) Why accelerate the process, while progressively underfunding health care at the same time?

Khanna's plan is in some important ways even worse, though better in some. His plan is centered on the EIC, and thus disproportionately benefits low income families. (this is not exactly true, but fairly - and perceptually) It does resemble my idea, to raise the personal deduction and make it refundable. (thus creating a guaranteed minimum income) but it is still tied to employment and is therefore vulnerable to the future workerless economy. It also provides a phantom benefit for large families. (phantom because the cost of raising a child is far greater than the benefit) There is also a bigotry issue. "Only colored people and poor white trash (and the religious right) have large families". Khanna's plan would be even more -and more effectively - attacked by the right than Bernie's.

Both plans point out the need to retire 2 sacred cows - the veneration of employment and the nuclear family. Fewer and fewer people are going to have jobs, and fewer and fewer people are getting married. We are dehumanizing millions.

On to Biden since 1973

I wouldn't even mind the 1% tax cuts if they were paid for

by "defense" spending cuts. But that's another sacred cow the D's (Bernie!) won't touch.

chuck utzman

TULSI 2020