Regarding that "Important Asset Class"

Economists at the NY Federal Reserve recently made an interesting observation.

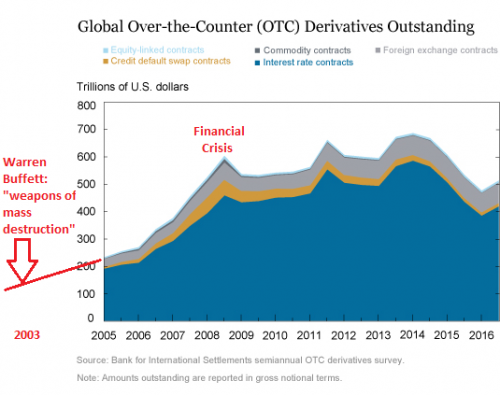

Though the notional amount [of derivatives] outstanding has declined in recent years, at more than $500 trillion outstanding, OTC derivatives remain an important asset class.

So $500 Trillion, that's Trillion with a 'T', is an Important Asset Class, huh?

Gosh, who would have guessed that an asset seven times larger than the global GDP would be considered important?

What I want to draw your attention to is the composition of those derivatives.

You see that thin sliver of greenish color in that chart? Those are default credit swaps.

That thin slice of derivatives nearly brought down the global financial system.

Now look at that mountain of bluish color that dominates the chart.

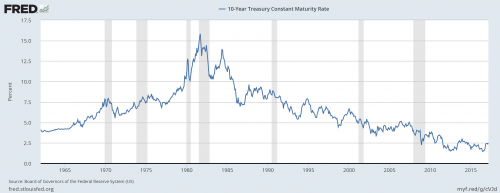

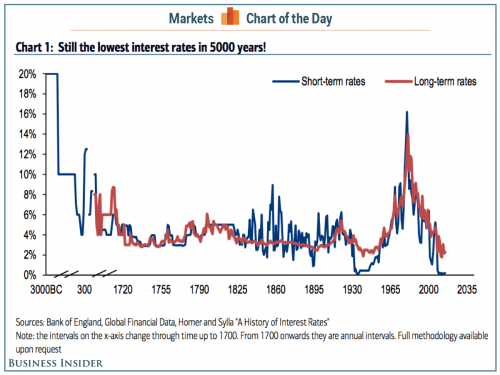

Those are interest rate swaps. They act as insurance against any unforseen rise in interest rates.

For those financial institutions that sell that insurance, it's been easy money for more than a generation.

Simply put, the people selling the insurance haven't had to pay out since the 1970's, before interest rate swaps were popular.

There's just one thing: It's almost impossible for interest rates to go any lower.

If something can't go down any more then eventually it will go up.

This would cause those financial institutions to have to pay up on those trillions of dollars of contracts.

The vast majority of the derivatives are interest rate and credit contracts (dark blue). Banks specialize in that. For example, according to the OCC’s Q4 2016 Report on Derivatives, JPMorgan Chase holds $47.5 trillion of derivatives at notional value and Citibank $43.9 trillion. The top 25 US banks hold $164.7 trillion, or 8.5 times US GDP. So even a minor squiggle could trigger some serious heartburn.

There is simply no possibility at all of the banks making good on all that debt.

Even a public bailout isn't an option.

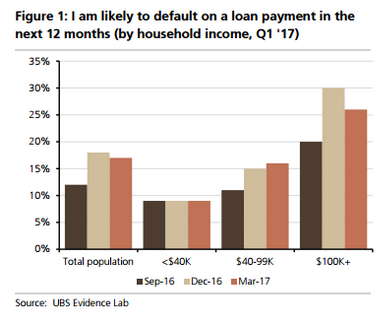

What would drive up interest rates is risk, and that risk usually comes in the form of defaults.

The most recent survey, conducted during the first quarter of 2017, contains yet more troubling data. According to the responses (from 2,100 individuals across the age and wealth spectrum), 17% of all consumers are likely to default on a loan payment over the next year, down slightly from the fourth quarter reading of 18% but up from the third quarter 2016 reading of 12%.

Why this is happening is an unstable labor market, unaffordable college, and consumers living beyond their means.

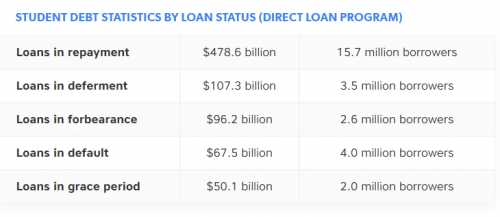

American consumers are once again spending beyond their means. Just a few months ago there was a startling headline reporting that US consumers now had over $1 trillion in credit card debt outstanding. That seemed astonishing in itself but now looking at debt levels in other sectors we find that auto loans outstanding are also over $1 trillion. Keep in mind this is for an item that will lose value once it is taken off the lot. You also have student debt over $1.4 trillion which is amazing given many young Americans are working in jobs that really don’t require a college degree. The debt apocalypse is once again upon us and we better hope the economy keeps on running on fumes or we will be confronted with another solvency crisis shortly.

There is one other possible catalyst that few people are looking at - commercial real estate.

Comments

What can I say?

Now look at them yo-yo's that's the way you do it

You play the politician on the TV

That ain't workin' that's the way you do it

Money for nothin' and chicks for free

Now that ain't workin' that's the way you do it

Lemme tell ya them guys ain't dumb

Maybe get a blister on your little finger

Maybe get a blister on your thumb

More on consumer debt:

This is the Debt Deflation that Michael Hudson talks about. A family spending half their monthly income servicing debt has less left over to spend into the economy. Not healthy.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

How can debts (paper, by banks) be assets?

I am missing something. This is all virtual money? I never took an econ class; it shows.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Banks consider debt as an asset

because for them money is loaned into existence ...they create it ex nihilo ( out of thin air in the common parlance and further double entry bookkeeping factors also. It's kind of counter intuitive. I understand the principle but know virtually nothing about accounting.

Debt-based assets

It might be more accurate to call it "debt-based" assets. Simple example, let's say you've loaned someone money. Their obligation to pay you back constitutes an asset for you. You can sell to a third party your right to receive the loan repayment.

This kind of debt trading (buying and selling debt instruments) currently plays a significant part in the global economy. It all seems very arcane and convoluted, and I don't pretend to understand much of the technicalities. It's a game the high-flyers (financial institutions and 1%ers) have set up.

"Don't go back to sleep ... Don't go back to sleep ... Don't go back to sleep."

~Rumi

"If you want revolution, be it."

~Caitlin Johnstone

Regulate ALL derivatives! (And BAN most of them.)

All of this crapola grew out of the Clinton-era deregulation of financial derivatives.

The Commodity Futures Modernization Act of 2000 (CFMA) needs to be repealed immediately (actually, it needed to be repealed when W first moved into the White House). The repeal needs to explicitly impose all restrictions which were in place before CFMA was passed. (And I, for one, wouldn't mind seeing nearly all derivatives issues, and all third party trading in them, completely banned!)

Derivatives have repeatedly proven themselves to be very bad juju. They need to be treated accordingly.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Your comment and this essay in general

reinforce the need for someone, anyone, to write A People's Economic History of The United States that could pick up in a more specific area where Howard Zinn's seminal tome left off.

APHOTUS made it clear that economics and skirmishes between the Haves and Have Nots are the underpinning of our (and the entire world's) history. But people need to have the lessons codified as to how over the long term, the same people (the 1%) have attempted to screw us through the same means (transfers of the common wealth to private enterprise).

Anyone paying attention during the 2007-2008 meltdown learned about the horrors and dangers of credit default swaps which Warren Buffet called the "weapons of mass destruction" in the financial sector. And yet, they still exist and they still have the ability to crash the system.

If you don't know what a credit default swap is - briefly, it allows outside observers to bet on the outcomes of deals they are not involved in. It literally transform the financial sector into a gambling den. The best definition I ever heard was that it was akin to allowing your neighbors to buy fire insurance on your house in hopes that it burns down. Outside investors basically bet on whether a bond will survive or fail without being required to have "skin in the game" or being actual investors in the bond.

Okay, I learned that back then and so did many others, but others did not or they have forgotten, and we have a whole bunch of newbies who are eligible to vote who weren't old enough to care about issues of two Presidential terms ago.

The newbies are still susceptible to fear mongering about "deficits" vs entitlements and may not be sophisticated enough to wonder how we can take trillions from entitlements (legislated or earned benefits) in order to award tax cuts and still pretend that we care about deficits. Denial of benefits/services to the populace = tax cuts to wealthy = Austerity = good. Does not compute.

But we have to teach this stuff over and over. It's not hard to learn or remember, because it's truth, but we can't ever forget that we have to continually harp on these points. Every day, new voters are created and the messaging techniques of TPTB have proven to be far more effective than that of the 99%. Perhaps because they own all the megaphones and the megaphone factory?

" “Human kindness has never weakened the stamina or softened the fiber of a free people. A nation does not have to be cruel to be tough.” FDR "

involuntary life insurance

Or even better -- allowing someone to take out gazillions of dollars of life insurance out on your life, with him as the beneficiary, without your knowledge or consent. (Fortunately, that one is still illegal!)

Gak.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Employers take out life insurance on employees

How's this for ghoulish?

New York Times

@Phoebe Loosinhouse The illogic persists

The illogic persists because there's an underlying moral narrative. The underlying moral narrative is: You Are Bad Because You Want Too Much. Things are going wrong because the little people's expectations are too high. They are too demanding. They want luxuries they can't afford (owning your own home is now in that category; the most ridiculous forms of this argument talk about how the poor have dishwashers and refrigerators and microwaves, ignoring the fact that the renters don't actually own any of those things; the landlords do).

When the rich want tax cuts that's not wanting too much; it's preventing someone else--the people who want too much--from taking THEIR money away from them.

The only reason any dent has been put in this ideological shitshow is that the whole world saw the richest people in the world running to the government with their hand out because they had behaved so recklessly that they'd nearly sunk their own boats. They stood there, in front of God and everybody, being showered by money they hadn't earned, because they had fucked up their businesses badly and weren't willing to pay the price. That put a dent in it--a serious one. The obvious ways in which they buy up the referees, aka the "government" also bothers some people and puts another dent in the narrative. But it's a powerful narrative, which rests on the notion of a fair competition, which rests on the worse notion that a meritorious individual will overcome any odds, which means that any competition not absolutely and obviously rigged will be considered a fair competition. Under these ideological terms, the system can never be changed in any way that does not benefit those who have already succeeded.

I believe this narrative is also at play in discussions of election fraud, but there are other stories at work there too, complicating the matter.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Our current debt bubble. Yowsa!

In theory many of these derivatives are hedged out so as to be debt neutral. Like a push in blackjack. This is true as long as the status quo reigns. But in practice and in crisis, hedging doesn't work very well.. because often everything goes fey at once. Even more-so once ice nine [credit freeze up] hits the market trust and deep pockets becomes the only thing that counts and as we all know trust is a fickle beast. Its coming, perhaps it will start in Greece or Italy and spread to some of the other PIIGS. But Mario and that debt shill Lagarde have been propping up Athens or I should say France and German banks since all the money never gets to Greece but is merely passed through to the debt holders.

And so across the ocean it is penury and austerity for free spending Puerto Rico and some kind of eventual haircut and bailout for all parties. Islands don't do very well in Collapse. Lack of oil and natural gas "actual real wealth" which runs all global economies is scarce.

Petroleum

About four-fifths of the energy used in Puerto Rico comes from petroleum.22,23 The islands neither produce nor refine crude oil. All petroleum products consumed in Puerto Rico are imported,24,25

Puerto Rico does not produce natural gas.41 All natural gas is imported as liquefied natural gas (LNG) [source EIA]

Importing all your energy is problematic and a key reason PR is bankrupt. Italy and Greece also have this problem.

Energy and Debt are intimately co joined like the beast with two backs. No escaping the eventual rosemary's baby…bankruptcy!

I won't go into China and Japan but when their debt goes sour as is already in progress they will probably drink the coffin liquor of austerity, intervention and jubilee and man up to a dead economy walking.

As for us here in MAGA country, we are led by the bankruptcy king, what could more fortuitous. What a bonfire it will be!

Are there no forms of renewable energy suitable for Puerto Rico?

Is it that windmills and solar panels aren’t robust enough in the hurricane-swept Caribbean? Or are they just too expensive?

Is it political? Colonial captivity to fossil fuel and other corporations of the Empire?

Is Cuba, target of a half-century-long U.S. embargo, also “bankrupt”? Why or why not?

I hate that phrase "living beyond their means"

It has the blame built right into it.

And it ignores the people whose "means" don't extend to being able to buy the basic necessities of life.

The other day I went to CVS and bought three boxes of bandaids, two bottles of sunscreen, and a greeting card. It cost $54.45.

Now, none of these things are "necessary" in the sense that food, water, shelter, and medical care are necessary. People bandaged their wounds before Bandaids were invented, I can stay out of the sun, I can just tell my mother "Happy Mother's Day" instead of giving her a card. But exactly how far do we let the incredible shrinking wage and the incredible rising cost of products go before we blame someone other than the end-user/consumer/little guy?

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver