Sunday's referendum in Italy

What does it mean? Potentially it could dwarf Brexit.

Up to eight of Italy’s troubled banks risk failing if prime minister Matteo Renzi loses a constitutional referendum next weekend and ensuing market turbulence deters investors from recapitalising them, officials and senior bankers say.

Mr Renzi, who says he will quit if he loses the referendum, had championed a market solution to solve the problems of Italy’s €4tn banking system and avoid a vote-losing “resolution” of Italian banks under new EU rules.

Resolution, a new regulatory mechanism, restructures and, if necessary, winds up a bank by imposing losses on both equity and debt investors, particularly controversial in Italy, where millions of individual investors have bought bank bonds.

Italy has eight banks known to be in various stages of distress: its third largest by assets, Monte dei Paschi di Siena, mid-sized banks Popolare di Vicenza, Veneto Banca and Carige, and four small banks rescued last year: Banca Etruria, CariChieti, Banca delle Marche, and CariFerrara.

Italy’s banks have €360bn of problem loans versus €225bn of equity on their books after successive regulators and governments failed to tackle a bloated financial system where profitability was weakened by a stagnant economy and exacerbated by fraudulent lending at several institutions.

In addition to the shock to the financial system, there is the potential political fallout.

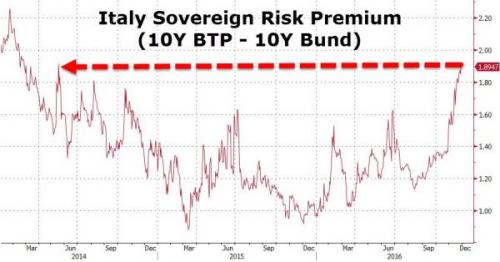

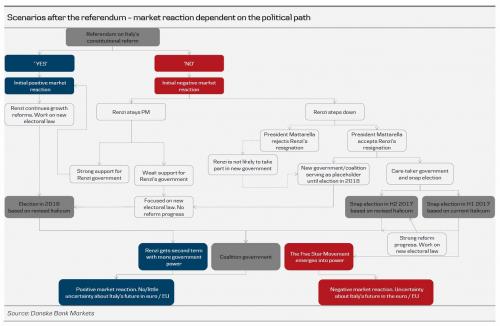

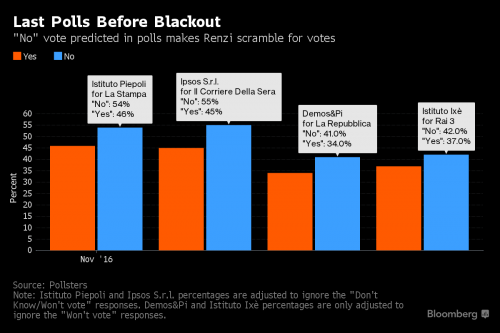

1. Why are markets worried?A defeat for Renzi, who proposed the vote and initially pledged to resign if the result didn’t go his way, could lead to early elections and a rise in support for the populist Five Star Movement. This party has pledged to carry out a referendum on whether Italy should stay in the euro area. Some investors are already predicting the end of the European Union, let alone the single currency. “We think the EU will break and that Italy will leave the euro,” said Jim Smigiel, a U.S.-based money manager at SEI Investments Co. “Until a while ago this was just unthinkable, implausible, but we’re starting to see the wheels in motion, at the very least.”

2. Just how anti-euro is Five Star?

The Eurosceptic party has been actively campaigning for a referendum on exiting the single currency. Five Star’s Luigi Di Maio, vice-president of the lower house, said that if the party achieves power, it would push for an advisory referendum on euro membership. Di Maio hasn’t been clear about what he would want to replace it, saying in an interview with Repubblica that he favors “a euro at two speeds or a national currency.”

3. So why are investors’ fears seen as overdone?

Because a euro exit would take time and complex negotiations. As Britain discovered with the Article 50 court case, leaving the EU -- or part of it -- isn’t as straightforward as might be imagined. “The idea that Italy is going to leave the euro the day after the referendum, or even quite some time after, is really exaggerated,” said Antonio Villafranca, a Europe analyst at the Italian Institute for International Political Studies. Even if early elections were called after a Renzi defeat, Five Star’s chances of getting into power would depend on changes to the electoral system. Winning an election might not be enough because the party “could have a hard time finding enough allies to form a parliamentary majority,” said Villafranca. Finally, there are legal hurdles to quitting the EU.

4. What are the legal hurdles?

The Italian Constitution bans the abrogation of international treaties via a popular vote, so a constitutional amendment might be necessary even before calling a referendum. That amendment would require a two-thirds-majority vote by both houses of parliament, and possibly yet another referendum just to clear the way for the one on euro membership. And even if Italians voted “yes” to quitting, the result could still be blocked by the Constitutional Court, one of the country’s supreme courts.

OTOH, Italians could vote "yes" instead.

Analysts at Exane reckon the market bounce would be much stronger than any downward correction on the expected "no". A rally might facilitate a rapid share placing for Monte Paschi. Unicredit would be able to announce a fundraising for early in the new year, just as it did at the end of 2011.

In turn, these deals would reopen the market for new bank equity. That would be especially good for Deutsche Bank AG.

Comments

Time to call the Euro what it really is...

Neues Deutsche Mark.

Gëzuar!!

from a reasonably stable genius.

All the oligarchy yet only half the purchasing power, though.

Ordinary Germans really lost 50% of their purchasing power in a very short time after the euro replaced the D-Mark.

What the Euro really is

The Euro in effect averages the values of the currencies of the member companies. The euro is stronger, for example, than the Lira but weaker than the Deutschmark. The move from the Mark to the Euro weakened the purchasing power of Germans, but it also made German manufactured goods cheaper to export, strengthening the industrial sectors of Germany and the Netherlands. Germany can rack up balance of trade surpluses without the value of its currency rising significantly because the value of the Euro is determined by the economies of all Euro zone members. The Euro is not as strong as the Mark would have been. On the other hand, vacations in the formerly weak currency countries of southern Europe became more expensive and less competitive with destinations outside of the Euro zone. The Euro is stronger than the Lira or Drachma would have been.

die neue Deutsche Mark n/t

edit for miscapitalization no pun intended.

Prognosis for EU: guarded, possibly terminal

After Brexit the feared market collapse did not happen--at least in the short term. You suspect a market rebound to some degree after Italexit. Not that I understand the banking system very well, but Spain, Greece, and possibly Portugal seem to have their eyes on the exit door. What will happen to Deutschland incorporated then? Merkel's future is murky (pun intended).

How ironic. Italians invented accounting and modern banking

The Father of Accounting and Bookkeeping

History of banking

The political revolution continues

Establishment media has been mocking 5 star for months

Sound familiar?

The current leading party in France, Marine LePens National Front is ahead of all other parties

Facists are winning over millennials! People are pissed.

If you cant deliver some modicum of hope and prosperity you deserve failure. If you are so tied to the creditor class you sacrifice the welfare of your own people, I am not sure losing elections is enough. The economist Mark Blyth often says the low lying beaches of the Hamptons is not a defensible position....