Bond market rout starting to get serious

It isn't just the United States. The entire global bond market was rocked by Trump's victory.

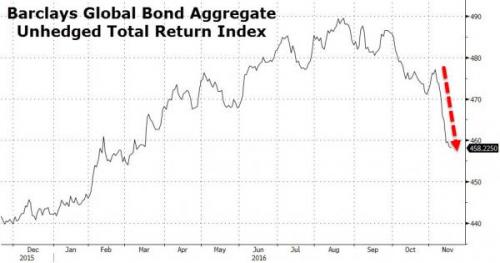

Bonds around the world headed for their steepest two-week loss in at least 26 years as President-elect Donald Trump sends inflation expectations surging.

The Bloomberg Barclays Global Aggregate Index has fallen 4 percent in the period through Thursday. It’s the biggest two-week rout in data going back to 1990.

“Trump is a game changer,” Park Sung-jin, the Seoul-based head of investment at Mirae Asset Securities Co., which oversees $7.6 billion. “I was bearish, but the current level is more than I expected.”

The selloff has gone fast enough that it’ll probably pause before yields press higher in 2017, Park said.

As a result of the Trump victory, the market underwent some staggering asset rotations, leading to trillions in gains (for equities) and losses (for credit).

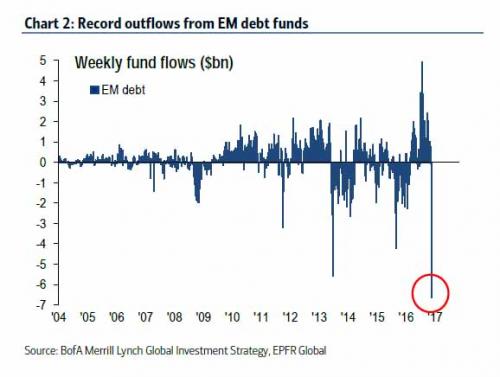

The most brutal example of this was emerging markets.

Investors are fleeing funds that focus on the debt, yanking a record $6.6 billion from emerging-markets bond strategies in the week ended Nov. 16, according to EPFR Global data.

In this case, the debt of developing economies is positioned uniquely for pain, which will most likely intensify in coming weeks. While bonds globally are posting some of the biggest losses on record, debt of U.S., Germany, Japan and other large economies will eventually have natural buyers that can swoop in and support values. That's already happened to some extent with riskier corporate debt in the U.S.

But that's less of the case for emerging markets, which investors flooded into during years of searching for higher yields. Companies in these more-vulnerable economies have $340 billion of debt coming due through 2018, and they are going to have a hard time paying all that back if investors keep withdrawing their cash.

Also, more U.S. growth typically means a stronger dollar, which is a significant problem for emerging-market nonbank borrowers, which have accumulated more than $3 trillion in dollar-denominated debt, according to Bank for International Settlements data. The higher the dollar rises, the more expensive it becomes to pay back the debt.

The sheer scale of leverage in the economy, including "the large increase of emerging-market debt, much of it denominated in dollars," is one of the biggest risks in the financial system right now, Adair Turner, former U.K. Financial Services Authority chairman, said in a Bloomberg Television interview Friday. All that money is owed to somebody, and a failure to pay it back will cause big ripple effects.

Finally, this rise of interest rates has gone hand-in-hand with the rise of the dollar.

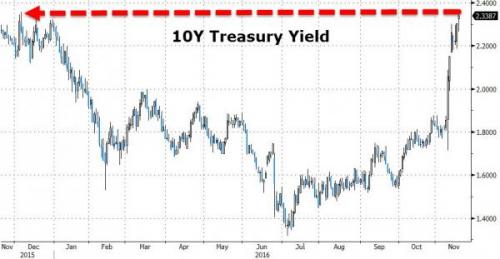

The U.S. dollar spot index (DXY) touched levels not seen since the Clinton administration on Friday morning, and the yield on the 10-year U.S. Treasury has increased by more than 50 basis points since Nov. 9. This rise in the greenback and borrowing costs for the U.S. constitutes a tightening of financial conditions — a potential obstacle to U.S. growth, as servicing new debt has become more expensive and goods produced domestically are now less attractive to foreigners.

Comments

Good information - thanks. Maybe the FED won't raise rates

in December which has been pretty well priced into the bond market. Or, the FED can raise and say that they are just adjusting to the "markets."

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

December hike is locked in

After that...who knows?

I wonder if Trump will be guided by the bond market as the

last three presidents were. I don't know and the bond market doesn't have the experience with this type of crazy. Still, it's hard to see where inflation will come from with the labor market being weak. I don't think Trump will be calling for a minimum wage of $15/hour; he's said he's against any minimum wage set by the federal government.

I think the US bond market is over reacting - I don't know about the international scene.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Meanwhile in China

link

Of course! The Yuan's slide is good for exports!

Of course they are unfazed. A strong dollar is good for them as a net exporter.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Federal Minimum Wage

I understand the opposition to a federal minimum wage. The cost of living varies so much from state to state, county to county, and city to city, that it seems irrational and arbitrary. However, you can't trust every state to do the right thing by their workers by setting an appropriate local minimum wage. Therefore, some minimum level of human decency is appropriate on a national basis. And that's what the federal minimum wage is: an infinitesimal iota of national human decency.

I think a better approach would be a federally mandated pay scale based on percentages of total wages (and other compensation like benefits and stock options) for every employee of every corporation, including officers and directors. Of course, that would have to be coupled with tariff-like protections that make it unprofitable to outsource jobs out of the country or to import products from other countries, as well as very high corporate taxes that incentivize corporations to pay larger portions of their profits in wages.

Or worker co-ops.

Just spit-balling and dreaming, I guess.

Fed only controls overnight rates. The fed gets too much credit.

It's the bonds that set interest on mortgages and long term credit. Obviously the bond market is already doing it's thing. They could care less about the Fed.

"Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies." - Groucho

The FED is the bond market

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Biggest souffle ever.

Will we get to eat it or will we end up with egg on our face. Quite the food fight between stocks and bonds.

Time to hoard food

WWIII is forming, and it will be damned harsh.

Vowing To Oppose Everything Trump Attempts.

Inverse

If u in d USA, it time to hoard food, WW III is ending, d revolution is going to wipe these money vultures off the hyena snot nest dey sucking old boners from. Middle class going to lose der bonds? Har de har! Watchin' d middin class pitchforks, and we be trey worlders scarfin popcorn n sayin "bien hecho carajo!" Har de har USAians finally going to get it. UNDERSTAND!!!

From the Light House.

No one in the middle class owns bonds

Top 10% and above. Everyone else is lucky if they have a savings account.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

I was once given a Savings Bond. Does that count?

Pension funds are large buyers of bonds

Local and state workers, teachers, union workers etc. Bur you are right much of the middle class has lost their taste and fortunes for/to stocks and bonds.

Well, I'm middle class.

Income just about on the median. I own 5 TIPS in my IRA that I bought in 2009.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Or better yet, grow some!

Sure hope the resilience group gets more posts and comments now.

A Great Time To Buy Bonds Soon

Bonds are when investment money goes to hide from loss. Right now, Hair Drumpf is making noises that only greedy investors can love. They want to get their money loose to play in the profit stream. But as soon as it looks like it's going to flood, all the savvy investors will pull out and run for the bond markets lest they lose a penny.

Vowing To Oppose Everything Trump Attempts.

Sounds like sound advice.

But sadly, I ain't got nothing but debt.

"Just call me Hillbilly Dem(exit)."

-H/T to Wavey Davey

If only we could find a way

to securitize all our own debts?

Because if we came up with the right plan you just know some Goldman Sach's deal maker would put it together (as long as thy got their money up front as fees, naturally).

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Don't have to securitize it

Consider.

If corporations are people , my friend, then conversely people are corporations.

It's simple. Every deduction available to a corporation, should be available to people.

Rent you pay for your apartment ( place of business) would be deducted from your profit ( income ). Food ( maintenance supplies ) would also be deducted. So to with gym memberships and any recreational activity, as they are actual maintenance.

I could continue but you get my drift.

Of course, the revenue stream of the country would plummet and we would have to sacrifice something to keep the country functioning.

How about shift the entire expense of the military on the one tenth of one percenters since they hold more wealth than the bottom 90%?

It's their money the military protects, not the tiny bit we have.

What say you, Steven?

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

Absolutely

Let's file a class action! People are fictions too!

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Entirely possible

except most of us aren't good credit risks.

Nevre stopped them before

All those junk mortgages they conned people into taking and then they conned investors like pensions funds and insurance companies into buying, remember that?

Never underestimate the greed and evil and nefarious outside the "legal" box strategies an Investment Banker will employ to keep their big casino in the black.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

That is exactly what a bond is debt.

Fiat currency also. But we live in a crazy world where debt is considered an asset for banks. All paper assets/debt will vaporize in due course.

Gold too.

In your scenario there will be no demand for jewelry. Lead will be much more valuable.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Too, a great time to wish I had

enough money to treat myself to one good Thai dinner.

Orwell: Where's the omelette?

I think it's foreigners that are selling bonds

the wealthy as in real wealthy don't buy bonds, they sell us corporate bonds.

Although this all has to be a fly by, knee jerk algo gone wild reaction to trumps victory.

The stock markit is a different story, that was always set to fly regardless who won the election.

And one way or another this economy is pretty much on life support, all the spin of low unemployment and everything being peachy creamy was

another story on the Obamas legacy tour.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Chinese investors

They are selling bonds and buying real estate. Stage II in the colonization of America.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

China is selling dollars to by yuans to prop up their currency.

It's widely believed China is manipulating their currency to make their exports more attractive. While this may be true in the long term, right now they are widely believed to be buying their currency and paying dollars for them because they don't want the yuan to be seen as junk currency - China wants the yuan to be one of the world's reserve currencies.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

They've been doing this for some time

Vancouver for example is Chinese owned, shacks are going for $2mil+. All the gateway cities of the world now have huge Chinese ownership.

It's the Chines govt. that buys the bonds, Chines investors buy property, stock, Gold and businesses.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

I'm wondering how much the

I'm wondering how much the delay/(please, FSM!) dumping of the traitorous TPP et al corporate coup(s) and unrestrained global corporate/billionaire looting might potentially have to do with this? With complete lack of regulation on markets under these, wouldn't perpetual market/bank crashes have been expected, and wouldn't bonds have been safer in such case? (Speaking As One Who Knows Nothing, of course.)

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Good question EN, but IMO

this had nothing to do with TPP, although I can see it being used as spin if it were to benefit anyone politically, but I really do believe that ship has sailed.

We've had unregulated markits since the 08 crash, Dodd/Frank and bonds have been on quite a run since the crash. With interest rates where they are, bonds are priced at historic highs (low interest rates) and so they've been the "safe investment" until now.

I hope that helps??? If not PM me, maybe i can explain it better.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Thanks, ggersh, your response

Thanks, ggersh, your response is appreciated, especially by One Who Knows Nothing, lol.

And I hope to FSM that any such 'trade bill' won't simply be quietly passed after claims made to take eyes off that area, perhaps in some other guise, especially as the off-shoring of domestic law into the corporate grasp might not be immediately noticeable in the effects, apart from yet more huge sums of public money mysteriously vanishing and typical Republican corporate/billionaire-serving legislation being passed... almost no politicians can be trusted and there are gag orders for the others.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Agree EN

all the trade deals are nothing but giveaways to the corps and kickbacks to the pols, that's the trade and it's free.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

If you buy a treasury bond and hold it until it matures you will

get your money back and have the interest it paid for the life of the bond. If you buy an inflation protected treasury bond, you will not lose any value due to inflation undermining its value plus receive the interest.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Does that mean when stocks

Does that mean when stocks start to go down, one should buy bonds?

I've been told that as retirement approaches, I need to think about moving my 401k from stocks to bonds. Is that true? And if so, when? Or do I just move from higher yield to less risky mutual funds?

I'm No Expert

But as I understand things, there is a very basic rule which states that when times are profitable, the major money is in stocks for the potential gains. But when the threat of losses appears on the horizons, the money flees to bond safe havens to minimize any losses and lock in profits.

I'm very sure this explanation is quite simplistic, but if one watches the markets long enough, there is a visible justification of this aphorism in a very general sense. There are those who make money being contrary to the trends.

Vowing To Oppose Everything Trump Attempts.

thanks.

I'm no pro, but

when the big collapse came in 2008, my 401 was in bonds and I, unbelievably, earned

a half percent that year.

It did grow during the Great Bush Recession.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

To add to the hard choices one has to make, high yield bonds

behave more like stocks than investment grade corporate and muni bonds. The sweet spot for many for the past few years has been the highest rated junk bonds and the lowest rated investment grade corporate and muni bonds. Closed end muni bonds that use leverage have done quite well in this odd interest rate environment. Who knows what the future will bring?

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

A proper reply is more complicated.

In general, as you age, financial advisors encourage you to take fewer risks, as you'll have less time to make up for any investment mistakes. Safety is key for those approaching retirement, and bonds are safety . . . generally speaking. The rule of thumb is that the percentage of your nest egg you place in bonds should be roughly the same number as your age.

There is also a pattern across investing history that bonds and stocks move in opposite directions, depending on whether you are in a golden risk-on environment of a bull market in stocks (which makes stocks more appealing to invest in than bonds, so bonds go down as money is reallocated to stocks) or a risk-off retrenchment of a bear market in equities. That pattern was obliterated by Quantitative Easing. The stock market in the past several years has gone up at the same time as the bond market rose. Investors just didn't have enough places to put all that cash that the central banks were creating out of thin air. Today, both markets are in bubbles, engineered by the central banks to serve their buddies in the 1%. Though bonds have fallen rapidly in the days since the election, as investors fear that Trump's promise to fund a major reinvestment in infrastructure will bring inflation back, that fall in bond prices is a teensy-tiny percentage of what they had risen. There is more room to fall in bonds, and much more room to fall in stocks. That would affect mutual funds as well as individual stock or bond positions, though index funds are more stable and can be had for very small fees.

Having said all that, the markets can rise despite their being bubblicious. We've seen it for seven years. So I cannot offer any advice to help you. It's anyone's guess what will happen. It's a casino. There is absolutely nothing meritorious about investing in stocks anymore.

That is the conventional wisdom - but

interest rates are so low that it makes no sense to take ANY risk. Keep your bond money in cash. Buy bonds only when yields are historically high, not when the FED is holding them artificially low.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Thank goodness for continuity.

I checked the advertized CD returns at my Credit Union

$10K 1year gets back 0.25%. Pretty stinky.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Maybe Trump is just theconvenient

Explanation. Lots of us have noted that the debt is fundamentally insupportable, and that the real economy never really exited recession and lately has been dismal in all details for months now.

And I think we've all expected the bubbles to burst, the unmaskability of the deterioration become plain, immediately after the election.

Orwell: Where's the omelette?

You may be right...

Trump may be something of a trigger but it has been widely agreed upon (including you gjohsit, if I remember correctly) that a recession is imminent; to occur in 2017. The banks don't have enough fingers to keep the holes in the dikes plugged. The head of the IMF has said for some months now that they are on "alert".

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

Why should they bother keeping it plugged.

They KNOW their bought and paid for Congress will bail them out. Prepare for TARP III.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Oh shit! just had a scary thought, Trump is a scapegoat...

for the shadow government/TPTB...

What if he was not just encouraged to run, but allowed to "win" and do such a horrible, clown show job that it would give them ammunition to defeat real populist challengers to the duopoly for at least a decade or two and buy them time to further establish their complete control?

It sounds like the goddamn premise of a Grisham novel, but given some of the crap we have been made privy to over the years I wouldn't find it the least bit surprising if some whistle blower provided evidence to exactly this scenario...

Man, maybe they are right and I am turning into a CT nut job, but it would seem like the pieces fit the current situation nicely.

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

Best fit I can see.

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

Oh Shit part two....

After posting that I had another thought...

Well, lets just say if I end up

deadsuicided tomorrow I want all my fellow C99P peeps know I am not the least bit depressed and actually despite world events my life is actually starting to finally show some small signs of improvement so I am at the least somewhat optimistic for the future, or at least for my personal future. (Globally? Not so much).Just wanted to toss that out there in the event I end up on the Clinton body count website for being right on that theory.

(What is incredibly fucking sad though is that this post is only about 40 percent snark...)

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

Clinton "Suicide" or "Up in Smoke"

IF I all of a sudden end up in prison for selling "drugs" please know that I wasn't a drug dealer but a budtender at a licensed medical marijuana dispensary.

Came home to find both my kids scared to death that Mom will end up in Gitmo over Trumps "Up in Smoke" comments about marijuana.

Free & Brave my ass. This country is full of scared little shits too afraid to make a stand or waves.

"Love One Another" ~ George Harrison

It's occurred to me too

I think Trump's window to do good (if any) is very short.

He'll soon be overwhelmed by global economic events.

Can someone explain why his election caused this reaction?

People were worried that the stock market was going to take a big hit if he won and it didn't. So why is this different than the stock market?

Thanks

The message echoes from Gaza back to the US. “Starving people is fine.”

Fear

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

Investors fear that inflation will return, . . .

. . . which would hurt bond returns.

Trump has indicated a willingness to rebuild the nation's infrastructure that has been ignored by multiple presidents before him. That would mean hiring workers to do the rebuilding, which would put pressure on wages to rise, sparking inflation. If the dollars you invest in bonds are worth less a year from now, due to inflation, your income from that investment is diminished. Investors are looking to better potential returns elsewhere.

Mind you, bonds were already in a dramatically overextended bubble before this, so some of the drop, much of it in fact, is unwinding of positions, with the threat of construction workers' maybe making a few extra bucks being merely a catalyst.

Thanks, dance for the explanation

The message echoes from Gaza back to the US. “Starving people is fine.”

Trump is just a trigger

Risky junk and EM bonds were in a bubble.

Trump is just a reason to sell overpriced assets

I wonder if this will buy ECB more time

I wonder if this will buy ECB more time, by allowing them to buy even more of the fixed income market!. Of course I also wonder if this will push stretch-flation even worse, currency deflation combined with large increases in food/medical/fuel inflation. The Euro is truly a weird situation, removal of oil from the inflation index, and large decreases in the cost of less essentail/non-essentail goods costs, drives deflation, whilest inflation in core essential goods burns the candle on the other end.

I still tend to think the next crash will start in Europe, But Asia would be a fair enough bet as well, Of course any number of things upend the market atm, Some nations might even be in a position to intentionally push things over if they dont get their way. I imagine that OPEC certainly could push things over if they wanted.

Media-Induced Fear

They're pushing the Clinton Supporter narrative, which is, since Her couldn't win, then nobody else can, either.

Speaking of bonds, Trump, and China

What is Trump going to do if China decides to cash in all of its US govt bonds?

Life is strong. I'm weak, but Life is strong.

They can't simply just cash them all in--

First of all they could only cash in mature bonds without significant loss. More importantly, Chinese exports rely heavily on the United States' population to be able to buy them. Contributing to a recession by cashing out would be devastating to the Chinese economy. Like it or hate it, the U.S. and Chinese economies are bound by this relationship. The United States goes deeper into debt (much of which is to support the turgid defense budget) while corporate America profits by moving manufacturing there along with selling technology to the Chinese and turn China into a labor colony. Welcome to Globalization -- busily manufacturing wholesale misery.

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

OT After reading here dollar was up went to check prices

in Kruger National Park in South Africa . They raised the prices from this year for next year so even with the dollar up the prices are a bit higher.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Am I the only one who feels these sorts of reactions

to the US presidential election are often childish?

I mean, do they really think that Donald Trump the multimillionaire is going to do something to seriously upset the financial world? What on earth do they think he's going to do? Does spewing racist insults somehow destabilize finance?

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Trump has promised . . .

increased defense spending, a HUGE infrastructure program and large tax cuts, especially for the wealthy. Insofar as he tries to implement this program, increased spending with lower revenue, the deficit will soar. As government borrowing goes up to finance the deficit interest rates go up to entice people to lend the government money. Treasuries are a benchmark for other bonds. When interest rates on treasuries go up, interest rates on other credit go up as well. As interest rates go up, the value of the bond goes down. (Why would someone buy your bond at the old lower rate when they can buy a new one at a higher rate.)

That is a good stimulus!

Maybe my grandsons can get jobs! Obama should have proposed that instead of agreeing to the sequester.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

One more chart

I work in a bond-adjacent field.

This week has been beyond painful; what happened this week will probably be killing us for months. I expect at some point this will reverse a little, but it will take a big event to shake up sentiment (Fed raising rates in December could do it a little since at this point I would say that the rate raise has been over-factored in, but who can ever guess the timing on this things).