Japan invested their Social Security in the stock market. How did that turn out?

Japan's Government Pension Investment Fund, the world's biggest pension fund, began moving hundreds of billions of dollars from conservative and safe government bonds to riskier stocks in 2014.

The market celebrated.

Under the new allocation guidelines, Japanese stocks and foreign stocks will each take up 25% of the fund’s holdings, up from 12% each previously. The fund intends to put 35% of its money in domestic bonds, down from 60%, while the ratio for overseas bonds will rise to 15% from 11%.

Economists, politicians, and most of all financial analysts, gushed like school girls over how brilliant of a move this was. Japan was going to set the standard that hopefully the United States would finally follow.

Three Japanese public pension funds quickly followed the GPIF into the stock market. The future was bright.

So how did that work out?

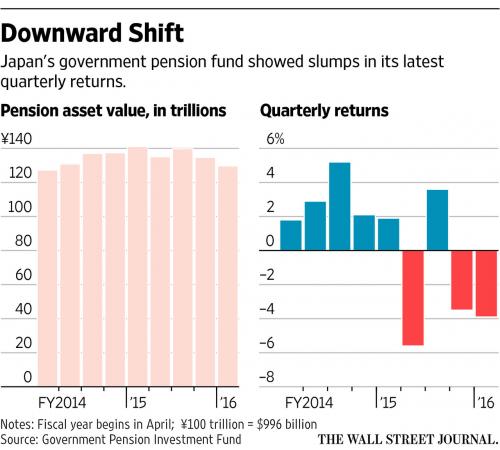

The world's biggest pension fund posted a $52 billion loss last quarter as stocks tumbled and the yen surged, wiping out all investment gains since it overhauled its strategy by boosting shares and cutting bonds....

The quarterly decline follows a 5.3 trillion yen loss in the fiscal year through March, the worst annual performance since the global financial crisis.

In fact, no matter how bad this sounds, the reality is actually worse.

It did work for a while. It worked during the hype stage. And it worked when the GPIF began selling its government bonds to the Bank of Japan and started buying stocks. The GPIF became the biggest buyer of equities in Japan. Stocks soared. Other pension funds followed the model. In June 2015, the Nikkei hit its recent peak of 20,868 (still 47% below its all-time peak in 1989).

But since then, the GPIF has met the goals for its “policy asset mix.” And so the GPIF stopped its purchases. Hedge funds lost interest and bailed out. And the Nikkei has since plunged 22%!

... In just five quarters, the fund’s new focus on stocks, risk, and foreign-currency-denominated assets annihilated 31.5% of the total gains accumulated over ten years!

So this strategy only works as long as the pension funds keeps buying more stocks forever and ever. Like a ponzi scheme.

However, the GPIF did have one asset class holding that went up in value.

Bitter irony: The only asset class that made money was “domestic bonds,” largely JGBs that the BOJ has been gobbling up.

Remember the JGBs that GPIF sold hundred of billions of dollars of to buy stocks? Those went up.

What makes this scary is this is a far cry from being all the public money going to prop up the stock market, and still they can't keep from losing money.

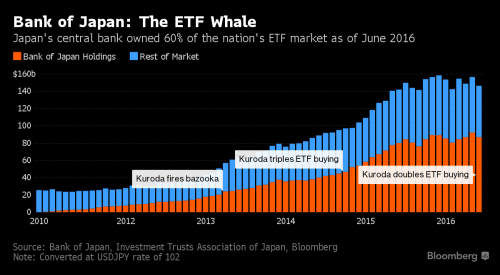

The Bank of Japan’s controversial march to the top of shareholder rankings in the world’s third-largest equity market is picking up pace.

Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings.

For those of you keeping score at home, even massive intervention by the central bank couldn't keep the government pension fund from losing it's shirt on its stock purchases.

If that wasn't enough, the BoJ announced last month it is doubling it equity purchasing program.

And yet, The Nikkei figured that “the two together are the largest shareholders for 474 of about 1,970 stocks” on the Tokyo Stock Exchange’s first section (the section for large companies), “based on public information.”

...“We hope they will hold the shares over the long term,” fretted an official of Yokogawa Electric. Because if they ever tried to sell those shares, all heck would break loose.

I'm not sure what this is, but it ain't capitalism. That's for damn sure.

On a side note, China saw how great things turned out in Japan and decided to follow in their footsteps.

Beijing can invest nearly $100 billion of China’s state pension funds, about a third of the total available for investment, into the country’s volatile stock markets this year, state media reported, bringing a “wave of liquidity” to the moribund markets.

Comments

Gambling with your retirement money?

What could go wrong?

The real SparkyGump has passed. It was an honor being your human.

And likely,

a handful of the chosen, aka the .01%, made billions off of this scam....

They are sharpening their steely knives here.

but we should continue to fight for raising the benefits.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Safety net, not. Old age and disability insurance, not.

This BOJ maneuver seems on par with the geniuses who

proposed negative interest rates. Tell me why all the smart Banksters can thing up such stupid things and get away with obvious fraud--and at the 99%'s expense.