Central banking have the money taps wide open and why this is more important than any election

Chairman Lord Jacob Rothschild of Rothschild Investment Trust recently made an interesting announcement.

The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30% of global government debt at negative yields, combined with quantitative easing on a massive scale

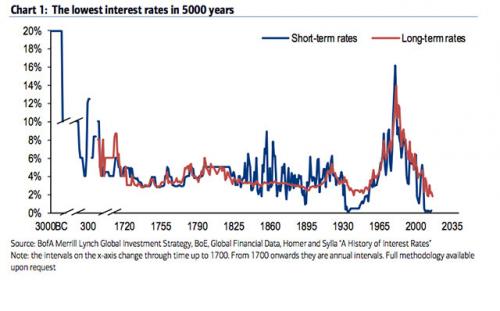

Bonds are trading at record highs. Meaning yields are at historic lows. Long-term interest rates are at the lowest levels in the 227-year history of rates in the United States.

That would normally signal an economy on the brink of ruin and investors panicking into government bonds.

But that isn't what is happening.

How big of a monetary policy experiment is this?

One so big that it is a challenge to even describe in a way that a non-econogeek can understand.

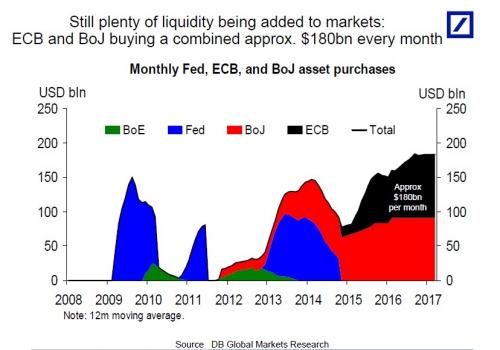

For instance when I say that global quantitative easing is running at a record $180 Billion every month, what does that mean to you?

It's like saying the Andromeda Galaxy is approximately 2.5 million light-years from Earth.

You know it's a lot, but without a point of reference $180 Billion a month is just a meaningless big number.

That is my challenge in this essay.

First of all, let's make a short-term comparison.

The current pace of purchases is higher than ever before, even during the depths of the financial crisis in 2009....

What was supposed to bolster economies temporarily during times of crisis has become a routine tool for policymakers, who long ago cut interest rates to zero

Actually, below zero. In some cases, well below zero.

“They won’t ever say they’re out of ammunition, but central bankers are starting to look like naked emperors,” Gallo wrote in an article for the World Economic Forum.

With rates at zero, QE became the central bank's main interest rate enforcement tool. With it they have managed to push a mind-boggling amount of bonds into negative yield.

The value of negative-yielding bonds swelled to $13.4tn this week, as negative interest rates and central bank bond buying ripple through the debt market.

The universe of sub-zero yielding debt — primarily government bonds in Europe and Japan but also a mounting number of highly-rated corporate bonds — has grown from $13.1tn last week, according to figures compiled by Tradeweb for the Financial Times.

“It’s surreal,” said Gregory Peters, senior investment officer at Prudential Fixed Income. “It’s clear that central banks are dominating markets. There’s a race to the bottom. Central banks are the main drivers of this, it’s not fundamental.”

The lack of fundamentals is the most alarming point, that I will circle back to later, but let's consider for a moment the $13.4 Trillion number.

Once again we have Just Another Big Number (JABN). Meaningless unless put into context.

Already a third of all sovereign debt yields a negative interest rate. That means that investors are effectively paying borrowers to lend to them. The Bank of Ireland and Royal Bank of Scotland already charge depositors interest, as opposed to paying depositors interest.

That's bizarre. Not to mention unsustainable.

How unsustainable? Short-term unsustainable.

At the current rate of decline, the entire global market will be in subzero land by the end of the year.

Why is this happening? Because this.

Bank of America's Barnaby Martin calculates, following the BOE relaunch of QE, "around 45% of the global fixed income market is now “compromised” by central bank buying."

Consider that nearly half of the bond buyers in the world don't care about price, because they print money out of nothing.

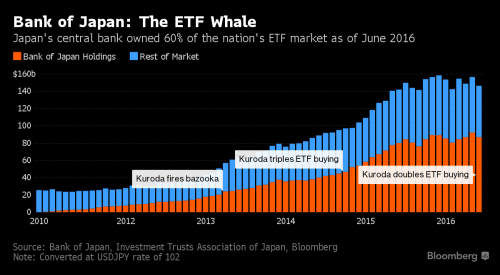

So what does that look like? Take Japan, for example.

Japan’s biggest banks are running out of room to sell their government bond holdings, pushing the central bank closer to the limits of its record monetary easing.

Finding willing sellers is a headache for Governor Haruhiko Kuroda as the central bank prepares to review policy at next month’s board meeting, amid growing concern among economists that he has few tools left to revive the economy. Record bond buying has already saddled the BOJ with more than a third of outstanding sovereign notes, draining liquidity from the market and making it more volatile.

Put simply, the Bank of Japan has bought up nearly every sovereign bond for sale.

Don't underestimate what is happening here, the BoJ is buying a lot more than just sovereign bonds.

The Bank of Japan’s controversial march to the top of shareholder rankings in the world’s third-largest equity market is picking up pace.

Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings.

Forget the economic questions of this move. Has anyone considered the moral and political consequences of having a central bank control basically all the financial assets of a major nation?

How can this situation NOT lead to a government-corporate partnership in both the economy and the political system? How can so-called capitalists refrain from denouncing this obviously non-capitalist situation to the economy, that they just happen to be profiting from?

Let's circle back to those questions later and remember how globalized the world is, and how all of this eventually washes up on our shores.

Last month, yields on U.S. 10-year notes turned negative for Japanese buyers who pay to eliminate currency fluctuations from their returns, something that hasn’t happened since the financial crisis. It’s even worse for euro-based investors, who are locking in sub-zero returns on Treasuries for the first time in history.

Japan may be the extreme example, but they are hardly alone.

The Swiss National Bank has gone and directly purchased American stocks to the tune of $61.8 billion.

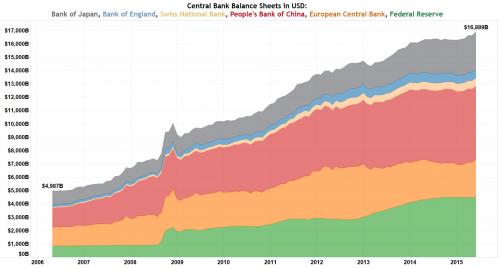

Central banks have been at DefCon1 for eight years now.

The balance sheet assets of the world's six major central banks hit a new all-time record, increasing to $16.9 trillion from $4.9 trillion 10 years ago, a 239 percent increase.

The balance sheet asset of the Fed, which has been leading the monetary policies of America, the world's largest economy, reached $4.495 trillion, equal to 25.41 percent of the country's combined GDP. This proportion was 6.17 percent in 2006.

All the major global central banks are buying up financial assets to the point that global liquidity is drying up. In other words, the central banks are becoming the markets.

Which means that it is unlikely that the central banks will ever be able to sell those assets.

Meanwhile, the Fed is preparing for negative rates to come to America.

It also means, that the markets lack economic fundamentals by definition. It's a condition that prompted the WSJ to say, "One answer to these disparities is that the markets have become so distorted by central bank activity that they are no longer transmitting very useful information about the economy at all."

Say goodbye to "market efficiency".

As I mentioned above, central bankers are starting to look like naked emperors. All this money printing has failed to stimulate growth or inflation.

Which is why, belatedly, they are finally starting to question their own monetary policies. Central bankers appear to be caught in a trap of their own making.

The global economy may now be trapped in a QE-forever cycle. A weak economy forces policymakers to implement expansionary fiscal measures and QE.

If the economy responds, then increased economic activity and the side-effects of QE encourage a withdrawal of the stimulus. Higher interest rates slow the economy and trigger financial crises, setting off a new round of the cycle.

If the economy does not respond or external shocks occur, then there is pressure for additional stimuli, as policymakers seek to maintain control. All the while, debt levels continue to increase, making the position ever more intractable as the Japanese experience illustrates.

However, this can't go on forever. Eventually the QE system will end in tears. The elements of it's demise are already being created.

“The combination of near-record credit flows and significant spread compression means that this year is unlike anything ever seen in the history of finance.”

- Brian Reynolds, chief market strategist at New Albion Partners

The epic bubble in sovereign bonds is doing what all bubbles do - make other normally risky investments look cheap in comparison.

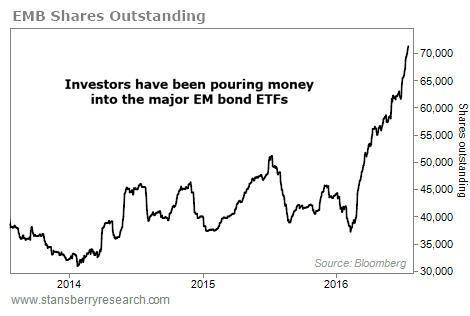

Investors are piling into emerging market bond funds at the fastest pace on record as pension funds, sovereign wealth funds, and other big institutions follow more seasoned specialists into riskier asset classes in search of yield....

“An individual investor might not realize it – but by buying these funds, he’s risking his life’s earnings on the governments of Brazil and Russia, among others,” wrote Steve Sjuggerud, at Daily Wealth:

The benefit is dubious. The largest emerging market bond ETF pays less than 5% interest. Five percent! Meanwhile, the price of this ETF could easily fall 5% in less than a week – wiping out a whole year’s worth of interest.

Well, it's not like Brazil or Russia have ever defaulted before.

And 5% seems like a "totally reasonable" compensation for that sort of risk, amirite? ROTFL

Emerging markets are just one example.

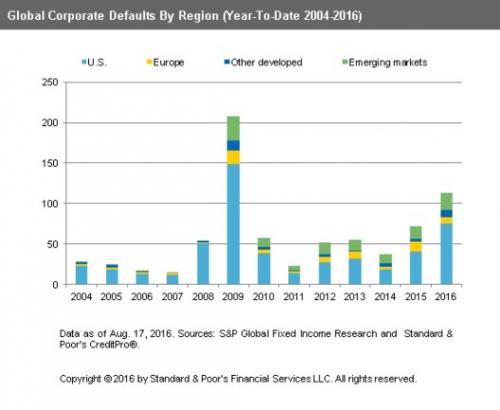

The search for yield has predictably led to junk bonds, which have rallied 48% this year, even while junk bond defaults have hit five year highs.

Corporations are issuing record amounts of debt, and investors are gobbling it up.

Companies worldwide are poised to raise more than $100 billion so far this month, the most for the period in Bloomberg data going back to 1999....

The average yield on sterling-denominated corporate bonds has fallen to a record-low 2.19 percent, according to Bank of America Merrill Lynch index data. Globally, the average is near the lowest ever at 2.3 percent, the data show.

More than $2.3tn of dollar-denominated debt has already been issued by companies and banks since the year began, including three of the ten largest corporate bond sales on record, Dealogic data show.

Which makes perfect sense...until you factor in that corporations are defaulting on debts at a near crisis level.

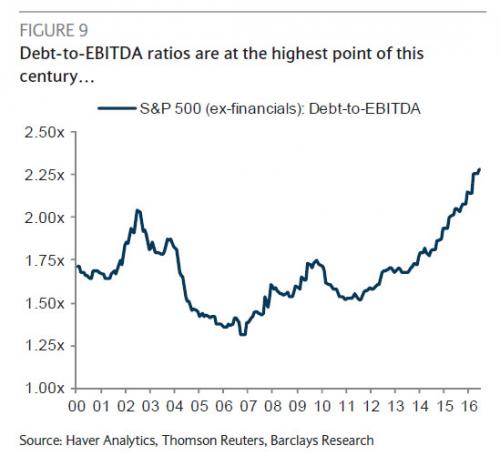

And that corporations are already saturated with too much debt.

According to a new report from Standard & Poor's Global Ratings, corporate debt around the world is massively on the rise and could skyrocket to $75 trillion from the $51 trillion it's at now....

What's more – S&P estimates that two out of five corporations are highly leveraged (meaning they've taken on too much debt). About 43% to 47% of corporations globally are at a financial risk level.

Here's the kicker: why are companies borrowing so much?

Because operating cash flow doesn’t cover it. In Q2, companies generated $425 billion in operating cash flows. Only $151 billion was invested in fixed assets. The lack of investment is the bane of the US economy. And:$110 billion went into dividend payments.

$61 billion was used for takeovers (OK, that’s down from last year)

$137 billion was blown on financially engineering their earnings via share buybacks.So operating cash flows were $35 billion short. That happened quarter after quarter. Hence debt ballooned to 32% of total assets at non-financial firms, the highest since 2008, another propitious year.

Kind of makes you want to go out and buy some heavily-indebted, probably-about-to-default, corporate stocks, right? No.

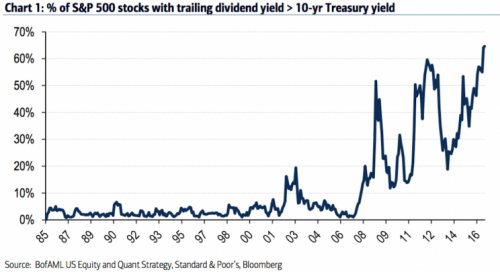

Well, it doesn't seem to bother investors, because stock markets all over are at all-time highs.

And why not, once you compare corporate dividends to bond yields.

You see, stock prices make sense if only you compare them to an historic bond bubble.

It doesn't take a genius to see that some market, somewhere, whether it be junk bonds, emerging market bonds, corporate bonds, equities, or subprime car loan bonds, is eventually going to blow up.

Especially when prices no longer account for risk anywhere in the world. The scale of this future crisis is difficult to imagine.

The World Bank estimates the ratio of non-performing loans to total gross loans in 2015 reached 4.3 percent. Before the 2009 global financial crisis, they stood at 4.2 percent.

If anything, the problem is starker now than then: There are more than $3 trillion in stressed loan assets worldwide, compared to the roughly $1 trillion of U.S. subprime loans that triggered the 2009 crisis.

When disaster finally happens there will be a rush for the exits everywhere, and that is where the fatal flaw in the system will be exposed: there is no liquidity in the markets.

No buyers will stand up in a crisis. Markets will simply hit an air-pocket, and do a Wile E. Coyote impression.

At this point central banks will have an important choice to make.

They could allow interest rates to normalize.

The situation with low-yielding debt has gotten so extreme that Fitch Ratings warned Tuesday that a simple normalization of yields to 2011 levels could cause investor losses of $3.8 trillion. The losses would come in the form of principal plunges, as prices fall when rates rise. The low-yielding debt is held almost exclusively by institutional investors, meaning it poses systemic risks.

Of course $3.8 Trillion in losses means a deflationary depression, something no one wants.

In addition, central banks hold many of those assets and those kinds of losses would make many of them insolvent.

Lastly, 2011 interest rates were still abnormally low historically. Real normalization would be much higher.

The alternative is to go 'all in' - Helicopter Money.

Normally when we say that a central bank like the Federal Reserve or European Central Bank creates money from thin air, it does so by buying up bonds or other assets from banks using money that is just an electronic accounting entry. Banks then spread money through the economy.

But what if those mechanisms aren’t effective for some reason (the banking system isn’t working well, for example), and the central bank wants to get money circulating through the economy anyway?

That was the thought experiment that Mr. Friedman dealt with in a 1969 paper titled “The Optimum Quantity of Money.” He offered this intentionally absurd hypothetical: “Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.”

Helicopter money is what happens if your rich uncle makes you a “loan,” but says that you don’t have to pay any interest and never have to pay it back.

Of course it's only a thought experiment. No central banker would ever consider doing something so reckless because it could easily end in the destruction of the currency. The whole reason for the existence of a central bank is to protect the currency. Right?

As the country gears up for yet more stimulus, financial market speculation has swirled that the Bank of Japan may now go one step further and, by introducing direct funding of government with newly-minted notes, cross into the realm of 'helicopter money'...

"You could argue that there is some kind of soft form of helicopter money going on anyway," says Halpenny. "There's a very fine line between monetary policy for policy purposes and for impacting the debt levels."

To sustainably weaken its currency, then, a country may have to enter what Pictet Asset Management strategists have dubbed "credible irresponsibility"

Wow. "Credible irresponsibility"

Who makes up these terms?

Etsuro Honda, an advisers to Japan's prime minister, noted that Bernanke at an earlier meeting in April, had mentioned the option of "perpetual bonds." Which is really no different than the rich uncle scenario.

Comments

This essay is my 2016 Tour De Force

I hope you like it.

Told one of my inlaws about your previous essay on

the bond market, and she wouldn't buy my explanation. Had told her I would send it, but think I will send this one instead. Good work.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

So bonds are not the place to be?

It usually takes me a while to digest these, and this one scares hell out of me to be blunt. Since they're "safer" than the stock market, I guess money market really is the only supposedly safe place? And even that's an illusion, right?

Thanks so much for writing these and pulling all this information into them.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

If it's not tangible and you don't hold it in your possession,

it's not safe in these times. Real assets, real property. Not in your safe deposit box in a bank that can close its doors without notice. (And, btw, fairly recent changes in law make all depositors in US banks unsecured creditors; once you put your money in a US bank, it literally belongs to the bank--you no longer have final say over when, or whether, you can access or remove any of those funds.) Not in a money market fund controlled by someone else. Not in any asset that requires someone to answer a phone to sell (or buy) for you, or that depends on activity on a market floor that may not respond when things go south in seconds. As they can, and as they have.

Read history. Ask the Greek people. Look at the insanity that constitutes global financial markets.

Oh, and cash, too, can be rendered worthless overnight by government edict that revalues it or makes the use of cash illegal for certain purchases or certain amounts and forces you to feed the banksters their fractional share of everything via credit and debit transactions, unless you are 100% self-reliant and self-sustaining or have an evolved (and quiet) barter system in your community.

Not exactly reassuring, eh?

Apologies for being a downer, but these be parlous times, and the "it can't happen now, here, or to us" attitude so many seem to have is willful blindness and creates even greater vulnerability to forces we truly don't control.

Big thanks, gjohnsit, for another important essay.

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

I don't think that real assets are safe either.

Possession is determined by power relations. In this dystopian future, the nation state military forces will be in charge and democracy will be put on hold if not terminated.

So, maybe we need to think about massive reduction of the MIC in order to protect democracy from the guise of MICs serving faux democracy.

Not Just Real Assets Are Unsafe

So are people.

Under Obama's National Defense Resources Preparedness Executive Order of March 16, 2012, if the government decides that you are valuable to a certain effort, you can be compelled against your will to "serve".

But Wait! There's More!

I strongly urge reading the rest of the article for more horrors from that lying corporatist lackey, Obama.

The ACLU weighed in with more details on this tool, which now appears to me to be the tool to kill any domestic protests against the TPP and the other "trade" bills which that corporatist traitor is determined to push on us

Vowing To Oppose Everything Trump Attempts.

Here's the link to and a quote from the executive order

https://www.whitehouse.gov/the-press-office/2012/03/16/executive-order-n...

The Republican critics of Obama on this are themselves lovers of the MIC, and they often use unfair rhetoric to induce paranoia about the PoC in the White House. And Obama was elected after a Republican president created the fascistic DoHS and got reelected on drum beating terrorism 24/7. And no doubt a President Trump could also find inhumane uses for the unbridled powers under the order such as to round up brown people that don't look like his wife to deport. But given that the ACLU has voiced concerns as you point out, we all should be concerned that the MIC has the power to effectively take over our society at any moment, to the extent it has not done so already.

Nothing is "Safe" around a Bankster...

They don't adhere to the "Honor Among Thieves Code" even...

Anything they do is a scam or rework of an old scam...

Designed to steal your money and property...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

Whoa!

Thanks for posting this, (I think. ..).

Bet this will Not be on the PBS "Nightly Business Report ".

Great work, I feel enlightened, and a little frightened, actually.

Have a great weekend.

Peace -

Murph

They will be writing books and teaching college courses

About the 2016 financial system 20 years from now.

It'll probably be cautionary stories

It will be a tutorial

Capitalism loves boom/bust cycles. People are making money either way.

Unless of course this one wipes us all out.

Thanks for the essay! Scary stuff.

... good job. Now,

if you could predict when the crash comes, you could short some of the more "long-term stable" investment options, and make a bundle.

When Cicero had finished speaking, the people said “How well he spoke”.

When Demosthenes had finished speaking, the people said “Let us march”.

It's not possible to time this

because it'll be a political decision in the end.

But who - including Wall St.

But who - including Wall St. - controls politics?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

I've been wondering for some

I've been wondering for some time about planned crashes intended to concentrate even more wealth into the hands if the very few. Why else fight to have an easily-manipulated-by-insiders unregulated Wild West stock market - while certain corporations have been for quite some time even going into debt to buy back their own stock, this increasing as the finalization of the 'trade deal' global corporate coup approaches?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Good work, gjohnsit.

An essay so nice I might read it twice. Meanwhile, bonddad is back at TOP touting the good news from the Conference Board. An alternative reality ?

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Then I guess I'll just have to share this essay

at TOP.

reply

would love it if you would also post at theprogressivewing.com. :O)

So I posted this on TOP yesterday

Surprisingly it made the rec list.

Not surprising were the comments.

I was accused by Hillbots of being both a BernieBro and a Trump fan. On an essay that had nothing to do with domestic politics.

It was a twofer.

Haha. Bondad Is Back At TOP.

He's a Dem Koolaid drinker to the max.

1) He used to get 100s of comments on his diaries. The one he posted got 6 comments.

2) His diary is typical. Everything is all Angels Riding Unicorns -- and by inference, Obama is an economic gawd. Stawks are up so all is good. Haaha.

3) I still remember the first month into Obama's first term, Bondad was predicting a full jobs recovery by June 2009. And he kept doubling down month after month until he got laughed off the site.

I wonder if Kos summoned Bondad to come back and talk up the Dem economic recovery for the coronation. Kos got rid of all the free thinkers, so it should be a walk in the park.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

thinkers

Well played!

And the word "free" in this passage is redundant!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Hell yes!

I've been thinking about Jill's QE purchase of student debt and trying to find a hole in it, but I simply don't see how it could be worse than the crazy stuff you have described.

Maybe the goldbugs are right this time. Buy a valuable commodity and bury in the basement. And get some guns.

Why are these people in charge?

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Just makes me want to

Go out and buy some corporate stock!

The Rothschilds control of the U.S.

Watch this mini-summary of U.S. History and (Rothschilds) private Central Bank Cartels control over it.

[video:https://www.youtube.com/watch?v=_y53ytyEOUA width:640 height:480]

President Kennedy's last words at the end (which were cutoff) were: "....free and Independent"

---

I never celebrate the 4th of July. For we never really won any independence over the evil British Empire's systems of control (The Rothschilds corrupt Bank of England & its debt-based currency enslavement, and the global Imperialism & Militarism that we never separated ourselves from). These British systems of enslavement were just simply brought in and then indoctrinated right here ... in the so-called "land of the free, home of the brave".

Ever notice that all throughout early United States History, for over 120 years, that England was our sworn Enemy (never our "friend"). Then in 1913, the Rothschilds newest for-profit Central Bank (intentionally misnamed the "Federal Reserve" in order to fool people thinking that it was a government agency) took total control of our monetary system, and our Economy.

And ever since then, England suddenly was "our best friend" -- and we were forever then condemned into fighting all of Europe's Wars and Imperial designs for them (and the Global Banksters).

So we had to fight WWI (strongly opposed by the American people), which of course led directly to WWII, which then led to the creation of the permanent global National Security Warfare State -- which is today what we're stuck with: Permanent Global War and no Independent currency (Rothschild controlled).

That's why "Wall Street" and Warfare run everything (to the detriment of the people).

This never really was a "free Nation", as the Video shows.

---

I only owe, no investments now.

But I don't know whether to be hair-on-fire, or laughing?

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Call me stupid, but how can interest rates be below zero?

The longer they hold the money, the less it will be worth, even in the absence of inflation? And if so, why won't they give us money to take it off their hands, where we could spend it and boost the economy with it?

Pay me to spend money, I could get on board with that!

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

If the "nominal" interest rate is near (just above) zero,

and the rate of overall inflation is greater than zero (currently running around 2 percent per annum) then the "actual" interest rate (nominal minus inflation) can fall below zero. This has been happening A LOT lately, in most of the industrialized economies, and appears to to me to be primarily a consequence of too much money in too few hands (the great mass of proletariat consumers can't really afford to purchase anything).

When Cicero had finished speaking, the people said “How well he spoke”.

When Demosthenes had finished speaking, the people said “Let us march”.

I'm thinking that's what is happening too

There is too much money out there ... one example is that all of that money is driving up the price of bonds.

And yet, the banks are stuck in a mode of putting even more money out there. What can't they see that there is too much out there already? Normally I guess a sign of too much money would be inflation right? But that's not happening ... and yeah, maybe it's not happening because all that money isn't in the hands of the proles, as you put.

~OaWN

Tight vs. Loose $$

In the past when there has been inflation, the Federal Reserve raises rates and money becomes "tight" because it's so expensive to borrow. In the late 1970's under Federal Reserve Chairman Paul Volcker, the federal funds rate averaged 11% and reached 20% in 1981. The only thing I can figure is that we are in a deflationary period, because the rates are so low. However, there is inflation is some products like health insurance, medical costs, food, etc.--items people need. The Federal Reserve is trying to keep the economy going by keeping interest rates very low, so people purchase houses and cars--big ticket items. If there were inflation, "items would be flying off the shelf and there would be people fighting to purchase them." I don't see that.

Perhaps the Federal Reserve is just trying to keep things stable because they have over $4.4 Trilllion "on the books" and they have never had such a large amount. I see it as an experiment and who knows what will happen. The Federal Reserve probably doesn't know either. If they do, they're not telling us.

Speaking as One Who Knows

Speaking as One Who Knows Nothing, it smells to me like last-minute wide-range wealth extraction from the bottom up prior to global corporate law kicking in - at which point the 99% will have nothing left to extract.

After that, the 1% will have to exclusively cannibalize each other for those ever-increasing profits to which they're addicted, until the last one dies with the most toys in a devastated and lifeless world. Unless we refuse to accept 'Simon Says' corporate 'law' which is illegal and unconstitutional in any free country, of course.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

gjohnsit, you are making my head hurt

My mind cannot quite grasp all of the important concepts, unfortunately. I feel like I am close, but not quite there. The thing that is really sticking with me is your Wile E. Coyote cartoon, I can speak that language, and it's a great way to "say" that the situation is really, really, really bad.

I also get the part that what is happening is not happening because "investors are being logical", no, what is happening is that these institutional entities are basically following all of the rules that they've always been following, even though the rules are taking them into very strange territory - they seem to be stuck on auto-pilot and not willing to put it back into manual for some reasons that I don't quite grasp. It kind of reminds me of stock market crashes that are caused by computer trading until some human being decides to pull the plug and call a time-out and a reset.

But I'm like ec, I'm having a really hard time understanding the negative interest rate thingy. Apparently that as bad as negative interest rates sound, the other (perceived? real?) alternatives available to these institutions must be worse, and so they are kind of playing a different version of the lesser of two evils game.

Dang it, I really wish I could better understand what you are trying to say. Bonds are really, really high, because so many people are scared and trying "to be safe" by buying them. And because of these high prices, that is driving the yields down very low, which are interest rates, and once those hit zero as the buying of bonds continues, the yields are going negative. Is that right?

If so, it means that institutions are buying these bonds not because of return, but because of the need of these institutions to not hold cash (I guess?) and therefore convert their assets into another form (a safer form?) (the safest form?) which is bonds.

That's where quantitative easing comes in. Q. What is that? A. "A monetary policy in which the central bank increases the money supply in the banking system, as by purchasing bonds from banks."

Okay, so the goal of the banks is to put more cash out there ("increases the money supply") by buying the bonds. That seems to be the hard part to swallow. The goal of the banks is to put more cash out there, and they accomplish that by converting any cash that they have into bonds.

So the banks have such a high need to put cash out there that they are basically making purchases that don't make any logical sense from a return point of view. So then the question becomes why do the banks have such a high need to put the cash out there?

>What was supposed to bolster economies temporarily during times of crisis has become a routine tool for policymakers, who long ago cut interest rates to zero

Having more cash out there ("more liquidity in the markets") was done to "bolster economies". I guess the idea is that by putting more cash out there, it makes it easier for people obtain the money that they need to spend, and having people spend is kindof the holy grail for an economy ... businesses notice increased demand and try to meet it by delivering products and services, which leads to hiring employees, which puts money in the employees pockets, and so they continue to spend the money.

But apparently putting all of this cash out there hasn't been having the desired / a good enough effect at spurring the economy. Is that it? And the bankers are essentially a one-trick pony that really do not know what to do other than to pull this "quantitative easing" lever? Is that it? I'm just going to stop here and check in with you to see if and where I've gotten any or all of this stuff wrong. Would you please reply and give me some feedback? TY!

~OaWN

I could be wrong, but the safest investment for banks is a loan,

made out to a vetted borrower, (us) at some interest rate to repay. The banks are not awarding us for savings accounts now! Interest is a pittance, and will not keep up with inflationary things like taxes on property, education, cable bills, grocery prices, lack of SS COLA increases, etc. My HELOC grabs 3.45% interest, I think. And it's for less than $40K. I have not used it since the re-roofing here.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Tax the rich

If the problem is that too few hold too much of the money supply, and people aren't buying stuff because they have no money but are drowning in debt already, the solution seems obvious, but politically untenable: redistribute the wealth.

Good luck holding onto those convictions ("we can't tax the rich!") as people will come at you with pitchforks.

Some of the rich get it

Billionaire Nick Hanauer wrote a great article in Politico two years ago called The Pitchforks are coming... for us Plutocrats:

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

And guillotines

n/t

Do I want to thank you for this?

Sigh, yes, I do. We need to know this stuff. Your essays educate me one step at a time.I thank you for that. So, what happens when all comes tumbling down? That's what I continually wonder. Will my pension be lost so I have to work the rest of my life? Will I lose my house THIS time? What will happen to us; the ones they don't consider while they play these monetary games?

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

I'm thinking that this is the

I'm thinking that this is the indirect method of grabbing everyone's (invested) pension money - and moving on to doing away with Social Security. Anything anyone else has is somehow depriving the Greeds, who want it ALL...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Scary. Thanks for the informative diary!

I can't claim to understand the economy, because I still can't wrap my head around fiat money. How much faith will any currency hold when there is not enough clean water and food for everyone? My kingdom for a horse will become all my fiat currency for food and water.

It seems capitalism is based on growth, and 7 billion people is too many people and too much growth. Exponential growth only lasts as long as there are plentiful or unlimited resources. I think we are going to discover the hard consequences of resource depletion. A global economy means we will all hit the wall about the same time.

It strikes me that negative interest rates are just the sort of insanity that one should expect just before the shit hits the fan.

Peace out, tmp.

At this rate, the “preppers” will have the last laugh

The “preppers” or “survivalists” are people who anticipate the breakdown of civilization and are preparing to survive it by acquiring land away from cities, planning for self-sufficiency, stockpiling goods, etc.

https://en.wikipedia.org/wiki/Survivalism

Meanwhile, for the small "d" democrats of the world,

withdrawal and isolation into survivalism is not a solution. We need to work together in solidarity, peacefully, and bravely for liberty and justice for all. What is obvious from the economic picture that the author has accurately drawn is that democracy is substantially dead at this time. The global economy is being managed for the antiquated and inhumane perpetuation of the financial sector, and it is being done with little or no understanding much less oversight by the masses.

We must democratize the economy.

Workers' gardens are a way to

combine political and direct action with local sustainability and stewardship: https://gardenvarietydemocraticsocialist.com/workers-gardens/

Raggedy Andy and I are in this group.

We live in rural America, have land, use solar and wind, grow food inside and out, etc. We have had some financial setbacks, mostly due to the sucky economy and some bad decisions, however, we are finally getting our feet out of the quicksand and onto dry land. Now we are desperately trying to pay off our house because I can envision losing it if things go very badly. Luckily, our mortgage only includes a fraction of our property holdings. We are thinking of building an underground home/bunker on land we owe outright, anyway. We'll see how things shake out.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

i'm not the least bit interested in surviving the

breakdown of civilization, and it bemuses me that anybody else is.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

I have no desire to survive beyond

the destruction of civilization, either.

My crazy prepper acquaintances are stockpiling weapons and ammo to kill people who might steal their food. Charity and good will toward your fellow man does not seem to be a part of the post-bust.

When I was a little girl, drilling to keep safe when the atom bomb hit, I always told my teachers I wanted a bull's eye on my head, that I didn't want to be alive in the aftermath. They had no answer.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

How easily we are co-opted by divide and rule fantasies,

such as the idea that we can or should want to survive without each other.

Well, lucky us! With Obama

Well, lucky us! With Obama and Hillary working toward a 'limited' nuclear war with Russia and China, (I strongly suspect because they can and will defend themselves against the hostile corporate take-over in progress,) North America and other involved areas will be toast before whatever remains of the world perishes more slowly and miserably - if the American people do not successfully demand fair elections going back to the Dem 'nomination' parody and the protection of their Constitutional rights.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Wasn't it Khrushchev that said something about the survivors of

the next war would "envy the dead"?

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

He had reason to know

He was getting those reports from Chelyabinsk that showed what incredibly horrendous effects a nuclear fuel holding tank explosion (not even an accidental bomb, just spewage of contaminated materials!) had had, and was having, on millions of (mostly but not entirely uninhabited) hectares.

The CIA may have sussed it out within a couple of years, but the US public got the mushroom treatment for several more decades.

There is no justice. There can be no peace.

All Survived by Gregory Corso

The United States of America

Bombed itself 86 times

In the 40's, the 50's and the early 60's.

It bombed its Utah; its New Mexico; its Nevada

And clouds took it to surrounding states.

All Survived

It took two decades

For the slow bullets of radiation

to strike;

Two decades

When the dead finally died.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Completely agree!!

I've no desire to experience the end of civilization, anarchy, chaos, survival of the fittest.

All that needs to be considered is the amount of war, the loss of human decency as in chaotic conditions experienced in Central African nations over the last 30 years, or in the Stalinist, Maoist , Pol Pot , type purges of the 20th Century.

And then consider that there are more weapons than people in our own country, and that our "Greatest Nation" is the largest exporter of military hardware on the planet; selling instruments of death to both sides because it is goo business.... I'd say we're royally fucked if the bottom comes out of this rat infested ship. I've no desire to experience the worst of mankind, to watch our species become a pack of hyenas, crunching bones to suck out the good stuff from within.

Damn it makes me mad to want to bury my head in the sand to avoid thinking such terrible thoughts.

What good is a garden if it could be ravaged in one hour by animals, or humans? What good is a bunker with a full cache of gold, gasoline, guns,ammo, food, water, if it can be stolen as you watch your wife, your children, your siblings, etc., ravaged, killed, or worse as they try to save a few weeks worth of sustenance/survival?

How long would it take for our nation , our continent to be denuded of wood, our water polluted with feces, and poisons, disease, and famine to spread like wildfire?

Paint a frigging bulls-eye on me, and/or give me a great big bottle of morphine, or heroin.

The other alternative is to have complete and total faith that we as humans would reach out, share, and compassionately care for our brothers and sisters on this planet??????

I'll see you and raise you.

What good is a bunker, if you have to live in a bunker?

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Dilbert's Alice

had a darkly funny take on this.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

fiat money is no more ineffable than "hard" money,

e.g. gold.

what makes gold useful for a currency? who can say? all over the world, there are vaults and vaults full of the stuff, more than anyone can currently conceive a use for -- and all over the world, people continue to extract more of it, using techniques that degrade both the land and the humans, so that what they have extracted can be delivered directly into the vaults where it will sit unused for the duration of our civilization. a few months ago, i asked the question, why bother to extract it? why not simply conduct the geological assays and set aside the mineral rights to the parcels? the gold is already in a vault, so why bother smelting it out and putting it into a different vault?

when you ask the question that way, you begin to comprehend the insanity of confusing a blob of precious metal with "real" wealth.

as Jim Morrison noted, people are strange.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

"My Precious" gold and other precious metals:

are used (1) ornamentally to represent milestones, honor relationships, and adorn/distract ourselves as being somehow more worthwhile than we otherwise are as equal human beings; (2) industrially, to make some useful things we need; and (3) put in vaults to prop up our personal and national egos and avoid our insecurities.

I'm quite attached to the cheap gold ring my partner gave me over 20 years ago. But I'd gladly give it up if we could agree to never take any more of this stuff out of the ground not needed for item (2), which must be managed for the common benefit of all, present and future.

Indeed.

It is not that gold doesn't have its uses. It's a very useful metal -- malleable, ductile, impervious to ordinary corrosion, highly conductive, lustrous, beautiful.

But it's madness to torture it out of the earth only to pile it up in vaults and say, "Look, here! I have gold!" Whoever has the gold, had the gold when it was still sitting in the earth. It's a very strange thing.

I've noted elsewhere and before, that Milton Friedman described an island culture where wealth was arbitrarily associated with enormous stone disks that could only be extracted from an uninhabited island a day's paddle away. Eventually, they got tired of hauling the stones around, so they started simply marking them to indicate who owned what fraction of each. He claimed that one family's substantial wealth was derived primarily from a disk that never made it back from the quarry. The raft carrying it foundered and the stone sank into the sea, beyond sight. Nonetheless, the island's society was fully willing to credit that stone's "value" to the family that had quarried it.

Absolutely bizarre.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Interesting.

Would also be interesting to know the power structure on the island. And, if it was Easter Island ....

not easter island -- the Yap Islanders

wikipedia knows all.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Thank you. Look forward to reading it.

Dog tired from working in the heat outside all day. Kicking back. Will comment later and appreciate the learning opportunity.

I feel dirty doing it, but here's the link to POS

Milton Friedman's paper: http://0055d26.netsolhost.com/friedman/pdfs/other_commentary/Stanford.02...

And here's an NPR story on the stones: http://www.npr.org/sections/money/2011/02/15/131934618/the-island-of-sto...

This is heavy stuff...I found this useful:

Central Bank Follies – QE, Negative Interest Rates And Regulatory Capital

An idea is not responsible for who happens to be carrying it at the time. It stands or it falls on its own merits.

wow, keen perspective man!

Zionism is a social disease

Given global governments unwillingness or inability

to otherwise get money from the wealthy via the legitimate means of taxation, funding Ponzi schemes may well be the only option left. This assumes that there is as much wealth in the system as claimed and that this wealth in and of itself is not just another Ponzi scheme.

Great essay. Thank you very much for your work. n/t

And all because austerity is "virtuous"

If the WSJ is freaking out, how long before they start demanding government spending to stimulate the economy? It's not like anything else is working, and they tend to be pretty hard headed about making money. Or are they just hoping to suck the largest amount of blood before the music stops?

I'm also wondering if the uniparty is actually a response to this mess, but I'm too tired to think it through right now.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Most all of the econobabble proponents such as Forbes

and WSJ are trapped in their own paradigms and can see no way out except to continue down the current course.

Whatever the heck that is.

To be fair to Forbes, it actually came out against the ISDS portions of the current round of trade agreements. So change is possible. Maybe one day Obama will be as liberal as Forbes?

Very Informative Essay

gjohnsit, I look forward to your essays on the economy and appreciate your ability to explain such a complex topic. It is pathetic when bets are made whether the Federal Reserve will raise the rate .25%. It is more pathetic when the Federal Reserve goes into a panic thinking about a rate hike of .25%. Negative interest rates = a failed economy.

banks and monetary game-playing

The main reason behind all the bizarro things you've just described so very well, gjohnsit, is that in "quantitative easing", central banks create yuuuge quantities of money ex azura, ex nihilo and plumb all those trillions of dollars directly into banks, stock markets, bond markets, and other such economic artifacts. Meanwhile, Jane and Joe Ordinary on Main Street, who could and would use those trillions in the real economy, see not a dime of it but must suck up ever more austerity. Their jobs and houses go into the maw of the recipients of the central banks' largesse (large $), and in any realworld terms, the nation grows ever weaker and poorer.

My reaction to all of this is best expressed, c99p style, as follows:

[video:https://youtu.be/bMehSfTmnbY width:480 height:360]

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

ultimately, the important thing to understand is

that our economic and financial system is built on the principle that hoarded wealth (i.e., "capital") must be rewarded, regularly and certainly, at a geometric rate. a geometric reward of 10% per year requires a doubling of apparent wealth every seven years or so. since it is impossible for human activity to generate such real growth, our financial systems are now spiraling out of control on "paper" wealth, or electronic if you prefer -- and the demands of rewarding capital are such that every new dollar so created must go straight into feeding that gluttonous doubling of wealth (as indeed, must every margin of production and/or productivity). much of the new wealth never escapes the financial system. much of it does, e.g. emerging to buy up foreclosed homes en masse and then rent them back to the human beings whom the economy is supposed to be serving, at the ever-increasing rents required to feed that gluttonous doubling of wealth. the financiers will end up exchanging one another's assets at ever-higher prices, thus justifying the ever-increasing rents. etc.

IT CANNOT BE SUSTAINED. THE MATHEMATICS ARE NOT SUBJECT TO IDEOLOGY.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Who is giving 8-10% increase? Rentiers?

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

10% is of course a magical value in human culture,

10 having boatloads of powerful juju because ... because ... well, because we have 10 digits on our fingers.

You are correct to observe that no "ordinary" means of financial return gives 10% these days, or even 8% -- but the superwealthy do not rely on ordinary means in order to win their returns. They rely on elaborate schemes and scams (e.g. credit default swaps) that enable them to extract ever more wealth at the rate to which the system is addicted.

At 7%, the doublings occur roughly every decade, which is similarly satisfying and similarly unsustainable, but it doesn't really matter, because the ultrawealthy generally insist that they won't even bother coming to work if they aren't somehow increasing their wealth by 15 or 20% per year -- or more -- and then where will we sad and hapless proles be?

And even if they settled for a mere 3%, the doublings would occur every 25 years, and the house of cards would still tumble, but in 2 centuries rather than one. Credit Suisse estimates total global wealth at $250 trillion (which actually sounds dubious to me), of which the top 1% own about $125 trillion. At 3% increase, after a century that number becomes a staggering 2.4 quadrillion dollars, and after another century, over 45 quadrillion: $45,000,000,000,000,000.

According to one source, there's about 165 tonnes of mined, refined gold out there, worth about $8 billion -- it's a tiny fraction of society's net wealth, which is what makes it unsuitable for a currency. However, at the current price of gold, $45 quadrillion would buy FORTY FIVE BILLION TONNES of the stuff.

As I said: The mathematics will not submit to ideology.

And if you're curious, at the magical 10% annual return, the $125 trillion currently in the hands of the top 1% would, after 2 centuries, transform into $23,738,159,557 trillion, i.e. approximately $24 sextillion. This would buy 552,050,222 trillion grams of gold, or 550,000,000,000,000,000,000 grams = 550,000,000,000,000 tonnes. Wait two more centuries and we'd owe them all several solid Earths' worth of gold.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Send them, not us, to another planet to mine Au.

Several problems solved there.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Or, in terms easily comprehensible to kindergarteners:

Or, in terms easily comprehensible to kindergarteners:

Infinite growth of any kind cannot be sustained on a finite Planet!

It really is that simple. And it really isn't subject to ideology, either.

It's time to end the idiocy.......

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

True, but infinite growth can be sustained for a VERY long

time on a finite planet.

Geometric wealth growth, on the other hand, cannot be sustained for even another century -- the numbers become rapidly ludicrous.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

The famous "rice on the checkerboard" paradigm

http://www.singularitysymposium.com/exponential-growth.html

Other versions make the sage a mere mortal, whom the king promptly executed (for being a wiseass, one suspects).

There is no justice. There can be no peace.

Wow, things look all ass backwards --- thanks

for sharing this important and disturbing information gjohnsit! I'm afraid I don't understand much of what you've written --- I've just never been a numbers/stock market person. But, what little I do understand, something certainly looks fucked-up!

Q the fuck E --- another fuckin tool to play around with the money risk game --- add it to those other little tiddledee thingamajigs called direvitives (hell, I'm not sure if that's spelled correctly) --- what a huge cluster fuck that's intentionally meant to be a huge cluster fuck --- it's fucking unreal!

I'll never understand it ---- don't particularly fucking care if I ever understand it --- know that I'm in a kinda fucking denial --- believe that the powers that be are happy that there's people like me and they hope we'll stay in our state of fucking denial --- oh well --- ain't much I can do about these fuckers that control the purse strings --- guess I'll just mosey along and continue chewing on my toothpick, picking my nose, and eating my boogers --- lol, Sorry I'm getting a little carried away with my ignorant smart ass self

Why is nobody dead or in jail?

I don't understand why we all let this unbridled capitalistic trainwreck go on and on. It will, because there are virtually no consequences for the people behind this. The mind boggles.

People don’t listen; media misleads by focusing on personalities

Try to tell people NAFTA is bad for them — well, it is, but never mind, it was such fun ridiculing Ross Perot and his followers.

Try to tell people the Fed is bad for them — well, it is, but never mind, it was such fun ridiculing Ron Paul and his followers.

Try to tell people Hillary is bad for them — well, she is, but never mind, it was such fun ridiculing Trump!Bernie and his followers.

The joke’s on us. Somehow we let ourselves get tricked into ridiculing ourselves and our own interests, every single time.

Ross Perot, WJC, & GHWB at the 1992 Presidential Debate

TPTB made Ross Perot sound like the crazy uncle in the attic. Take a listen and see what you think:

WJC and GHWB are looking at Perot like jocks in the cafeteria

looking at the new nerdy kid in school who doesn’t understand how the pecking order works.

Hillary Clinton's Response to Ross Perot

In 2007 when Wolf Blitzer asked Hillary Clinton about Ross Perot's claims, she smugly responded: "All I can remember from that is a bunch of charts."

Today, the MSM wouldn't even ask such a question.

Charts, you mean actual data?

We don't need no stinking data! We create our own reality!!

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Think what Perot could have done with Power Point.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Perot demonstrated that if you treated the electorate

like interested adults, rather than like bored toddlers, they would:

A. Pay attention

and

B. Understand.

If not for his mercurial temperament and his unwise choice of running mate (whose only actually fault was a lack of charisma, incidentally), he might have actually won.

Hillary's infantile dismissal of Perot's charts tells us more than we want to know about who and what she is. It's the kind of response we might've expected from Palin. Appalling.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Just go shopping!

Fugeddaboutit! Nothing to see here!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Cooool!!

Does that mean that we are all going to get a $600 Xmas bonus from TPTB again?

Either that or coal and switches in our stockings.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

You're assuming a government that's not totally controlled

by the wealthy. Not what we have.

Regardless of what the government does

I expect the people to be outraged, and they're not. Some of the reasons have been listed upthread. My question was more or less rethorical.

Global Economic Meltdown

Outstanding post! I visited a couple of economic blogs to get more info.

Here you go:

http://wolfstreet.com/2016/08/18/commercial-industrial-loan-delinquencie...

And

http://wolfstreet.com/2016/08/19/biggest-u-s-mass-layoff-announcements-2...

And Zero Hedge:

http://www.zerohedge.com/news/2016-08-19/fear-economy-it-couldnt-possibl...

And a tutorial on Helicopter Money:

http://voxeu.org/article/primer-helicopter-money

The economic picture is bleak.

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

Scratching my head like crazy

So all this money being "printed" by central banks does not "trickle down" to consumers, right? Consumption is pretty flat unlike in 2008.

Where does this money go?

Is there a bubble about to pop in the rarefied world of central and giant banks?

gjohnsit you are starting to scare me.

The political revolution continues

Pages