Wanted: Post Office Bank

The Inspector general of the US Postal Service has completed a detailed report on something people in many countries take for granted: Banking Services offered by the Post Office. While it may seem a bit strange to us, a few moments thought reveal that there are a number of very exciting benefits to the concept. Moreover, it seems clear that the USPS already has legal authority (under The Postal Accountability and Enhancement Act (PAEA) of 2006) to extend their existing financial services to include consumer banking. Jump below for juicy excerpts from the report, and pithy analysis from yours truly as well as the incomparable Yves from NakedCapitalism.com. Or just spread the word and leave the wonking to us!

Naked Capitalism readers have frequently called for the Post Office to offer basic banking services, as post offices long have in many countries, notably Japan. That idea has gotten an important official endorsement in the form of a detailed, extensively researched concept paper prepared by the Postal Service’s Inspector General. I’ve embedded it and strongly urge you to read and circulate it.

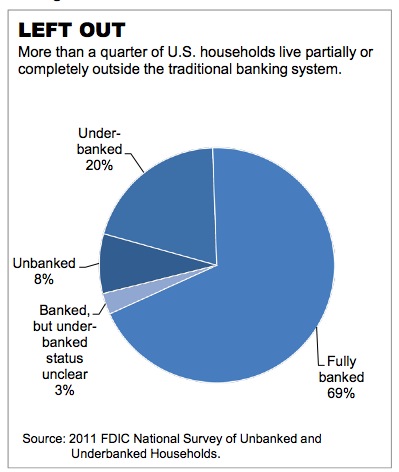

One of the stunning parts in reading the document is to see how wildly successful this program could be, precisely because traditional banks are withdrawing from many of the neighborhoods in which moderate and lower-income people live, and non-banks offer targeted, richly priced services, too often designed to take advantage of desperation or simple lack of alternatives. Even though most of us are aware of this general picture, the USPS IG, dimensions the scale of this problem and the costs to the affected householdsUnderserved Households

There are 34 million un- and underbanked American households, which translates into 28% of the population. And consider what this second-class status translated into in fees and other charges:

The average underserved household has an annual income of about $25,500 and spends about $2,412 of that just on alternative financial services fees and interest. That amounts to 9.5 percent of their income. To put that into perspective, that is about the same portion of income that the average American household spends on food in one year. In 2012 alone, the underserved paid some $89 billion in fees and interest.

In addition to helping the USPS and creating a bank that does not secretly long to be a hedge fund betting with taxpayer dollars, a USPS Bank has the potential to really help those who need it most, and make a concrete step to reduce the income inequality that is strangling the US economy. The USPS IG puts some numbers on this:

For the most vulnerable Americans — including many of the underserved — the difference between making it and not is a small amount of money. Among the 1.1 million people who filed for personal bankruptcy in 2012, their median average income of $2,743 a month was just $26 less than their median average monthly expenses. Put another way, these people were just $26 a month away from making ends meet.

There is no good reason for banks to be private, and many benefits to banks that are controlled by the public, like the Bank of North Dakota, which did not participate in the depravity leading up to the bankster crash, and avoided the bailouts and treasury looting in the aftermath. Credit Unions also show that banks can behave well, when they are not run for the profits of their directors and executives.

Many Americans are economically marginalized, or thrown to the mercy of the most vile usury, just because they lack access to basic electronic payment technology. This trend is only accelerating, despite good intentions of the largely toothless Dodd-Frank legislation. Direct deposit of paychecks, or government disbursements in accounts or pre-paid cards give the most needy a way back into the world of modern commerce, while cutting out a layer of waste and graft from private processors of public funds. A Post Office Bank could immediately help these people:

Postal Loans would be available to people who have their paychecks directly loaded onto their Postal Service prepaid card (this also could be for government payments, such as Social Security or disability benefits) and have received at least two straight payments. For those whose employers do not offer electronic transfer, they could be eligible for a loan if they load at least two consecutive paychecks onto a Postal Service prepaid card.

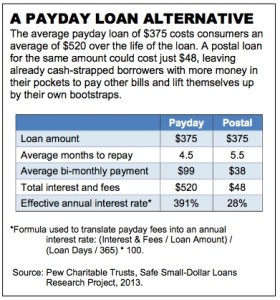

People could borrow up to 50 percent of their gross paycheck. For a person who earns $18,000 per year and gets paid twice a month, that is $375. Every borrower could be required to pay a minimum of 5 percent of their gross pay from each paycheck until the loan is paid off. In this scenario, that would be $38 from each paycheck.47 The Postal Service would automatically withhold loan payments from borrowers’ paychecks before putting the difference on their Postal Card. If the Postal Service charged a $25 upfront loan fee and a 25 percent interest rate, the borrower would pay off the loan in 5 1⁄2 months, paying a total of $48 in interest and fees across the life of the loan.

The above essay was originally published on Thursday Jan 30, 2014 at a faux-progressive blog that was, at that time, pretty well known.

Comments

USA Postal Banking: 1911 to 1966

We have a successful history of postal banking. It worked once and it would work again. We need it.

Postal banking worked especially well during the Great Capitalist Depression of the 1930s when the Federal reserve couldn't handle the strain.

The Post Office needs to be re-federalized and remade into a cabinet secretariat (as per the Constitutin)with postal banking as a part of it.

Big capital wants no part of it because, like Social Security, is shows how a public agency is more efficient than a for-profit business.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Big Capital wants to take over postal services.......

via Fedex and USP. They want to skim the cream and leave the unprofitable routes for the post office to serve. The post office already delivers a good many packages entrusted to Fedex and USP because they go to unprofitable addresses.

I firmly believe the Post Office should be expanding

services in rural areas. Many areas are not served by internet, although that was the promise made when comcast, et al were bidding to set up internet service in the more profitable markets. Post offices in rural communities could create a wi-fi hub for locals either to use their own lap top or to have time on PO owned computers.

That would be a real boon to rural communities - but there's no big money in it for corporations.

We should also be considering state-owned banks like North Dakota. Every state in the union could harness the power of their assets, including state pension plans on payrolls to provide a real service to the people of their state. North Dakota is the one state that has avoided the pitfalls of relying on Wall Street. Several states are considering it and should be supported by the voters.

The Postal Service is denied by law to engage in all manner of

commerce for no economic reasons but only because Big Capital doesn't want a public agency in competition with them.

Capitalism is wasteful: advertising; excessive compensation; failing to serve all the people (red lining by banks is an example); and subverting the legislative process.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

The banks provided banking services until 1966,

it was only because of corporate friendly legislation that they were forced to stop.

Time to push back when 25% of the population is forced into payday loans and check-cashing ripoffs just to keep going. The bottom 25% is losing ground everyday so corporate American can chalk up another profitable quarter.

I moved back to Seattle some years ago, went to work and went to the bank to open an account with my first paycheck. I couldn't believe the crap. I didn't have any credit cards, by choice. They insisted I show them a passport - something I had NEVER had to have in this country. They didn't care what other id I had, after a lot of wrangling, they opened what they called a "limited" account. I was totally amazed at how things had changed over a few years.

There are more payday loan outlets than there are McDonalds

and Starbucks combined. Postal banking would probably have a positive role here.

Major banks make more of their money from fees, including juggling overdrafts to their benefit, than they do from commercial loans.

Things have changed for the worse.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

I would like to see FedEx required to visit every home in the US

six days a week like the USPS does to see if the homeowner has a package to send. They'd go bust in a minute.

I see USPS trucks on Sunday delivering Fedex packages.

You are correct: UPS & Fedex only want to skim the cream and let the USPS have what they don't want.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Most workers at UPS are still unionized . . .

so that at least counts for something. Fed-Ex is another story.

I am on the Leap Manifesto mailing list . . .

and they are currently making a big push for postal banking in Canada. There were (if I remember right) 7000 public comments submitted, so they are hopeful.

Marilyn

"Make dirt, not war." eyo

Considering the federal government mandates...

Direct Deposit for all payments, (THANKS OBAMA) it's only a matter of time before this camel's nose becomes a full fledged attack on all pension and benefit systems maintained in public trust.

A postal bank would be firmly in the common and would help stave off those of us who don't want to do business with the banks, but are forced to. (I'd prefer to get a check, because it's substantial. I know I sound like an old luddite here, but it's far too easy for your payment to be taken electronically, with no paper trail save a log file which is easily altered.)

I do not pretend I know what I do not know.

I would still consider the 25%

rate mentioned in the Inspector General's report to be usurious. No one should be "allowed" to charge more than 15% above the prime lending rate on any loan.

Otherwise, the idea of Postal Banking is a very good one. Screw the banks.

Better than 691%

That 28% is an annual rate for a short-term loan. It is quite a bit better than the 691% offered by the payday lenders.

Postal service in my experience is an oxymoron.

Nowhere do I wait longer and receive poorer service than a visit to the post office. I usually spend more than a half hour in line for the simplest mailing transaction. The branch closest to my home has one window open for every customer need, from passports and mailboxes to certificates of mailing. I use the kiosk when I can to not interface with a human, but not every service can be done at a kiosk and there is often a line for it. The employees offer the same long selling script to every customer for services I will never use and it adds to the long wait times. I watch them throw packages and refuse the simplest requests (like priority mail tape.)

In theory, postal banking sounds like a good idea. In reality, in my experience, it would be a nightmare, way worse than any bank. I cannot imagine a more painful experience- if they take a half hour to locate my certified mail, if they can find it, what would they do with my money?

Austerity in action.

It sounds like you have a severely understaffed post office branch.

Now interviewing signature candidates. Apply within.

So the GOP's long-term attacks on the system are working

They defund and demoralize the system, creating massive problems, then point to the problems as reasons to destroy/privatize the system.

True

I live in a big city suburb and have another house in a very big city. The POs are all awful. The ones near my homes, work, and rent houses are all slow, inefficient, and the employees are often rude. To go to the main post office for the metroplex is a sixty mile round trip- just to get service after five.

28% is better than 691%

That 28% is an annual rate for a short-term loan. It is quite a bit better than the 691% offered by the payday lenders.

ummm yeah, this was supposed to be a reply above... sorry y'all.