‘Sell the house, sell the car, sell the kids’

Submitted by gjohnsit on Mon, 08/01/2016 - 5:55pm

The bull market in stocks is seven years old, which is ancient historically.

The market doesn't seem to care.

“The artist Christopher Wool has a word painting, ‘Sell the house, sell the car, sell the kids.’ That’s exactly how I feel – sell everything. Nothing here looks good,” he said. “The stock markets should be down massively, but investors seem to have been hypnotized that nothing can go wrong.”

But something is going wrong - corporate earnings.

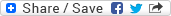

Earnings have been caught in a downward spiral ever since profits peaked a year ago, and Jesse Felder uses this chart to illustrate an ominous trend that traders might want to keep in mind in the coming weeks and months.

“Over the past half-century, we have never seen a decline in earnings of this magnitude without at least a 20% fall in stock prices, a hurdle many use to define a bear market,” he wrote on his Felder Report blog.

That's the Big Picture look.

If you get up close...it still doesn't make any sense.

“We have never had so many client meetings starting with statements such as ‘we are totally lost’,” Credit Suisse equity strategist Andrew Garthwaite said on Thursday.

Indeed, the stock market doesn’t seem to be making a whole lot of sense lately.

...

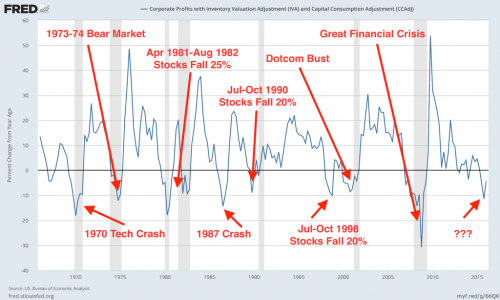

“During the month of July, analysts lowered earnings estimates for companies in the S&P 500 for the quarter,” FactSet’s John Butters observed on Friday. “The Q3 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 0.7% (to $30.44 from $30.66) during this period.”

“As the bottom-up EPS estimate declined during the first month of the quarter, the value of the S&P 500 increased during this same time frame,” Butters continued. “From June 30 through July 28, the value of the index increased by 3.4% (to 2170.06 from 2098.86).”

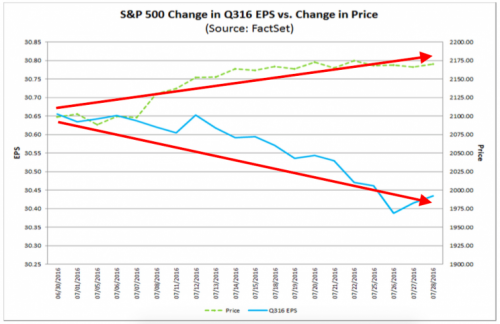

Earnings falling and prices rising means stocks are more expensive now than they were at the 2007 peak, right before the crash.

While median prices are very expensive, they are nothing compared to the energy sector.

But the results haven't been good enough to end the ongoing corporate earnings recession, now in its fifth consecutive quarter. And what's worse, early indications are that blended S&P 500 earnings are now set to decline in the third quarter as well...

The company will report on Friday before the bell. Analysts are looking for earnings of 64 cents per share on revenues of $64 billion. Compared to Exxon's earnings-per-share peak in first-quarter 2014 of $2.10, this would mark a 70 percent decline in profits. Still, the share price has nearly returned to its 2014 high.

Needless to say, this is getting a little nuts.

Comments

Keep the house, you might need it as an investment

when you lose everything else in the inevitable crash, is what it sounds like.

Selling the kids, of course, depends on the kids!

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

I had three (kids that is).

Each one believed that he or she was an only child. I told them that we could get rich if someone would kidnap any one of them as the kidnappers would pay me a fortune to take them back. Never teach you kids to be independent thinkers. It causes too much stress. = )

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

Ha! There's an O Henry story about that, I think it was,

Ransom of Little Red Chief or something like that.

I read it as a kid and kept it in the back of my mind that if I were ever kidnapped, I should act like a complete brat.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

The difference is with my kids,

it wasn't an act. = ) Many people told me at various times, that my children were extremely well behaved and well mannered...when I wasn't around. So nice of them to save all that lovin' just for me. = )

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

It was the same with our family! Our parents were very relieved

to hear what angels we were everywhere else.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

Tulip Bulbs all over again.

And they won't even have pretty stock certificates to show for it this time.

I do not pretend I know what I do not know.

On the one hand,

there is unprecedented poverty in certain areas. And on the other hand, you have this small group of people who have so much money, they throw it at any investment and it causes the value in the stock market to swell.

But if anyone asks for a raise, they will only respond by spending millions to make certain it doesn't happen.

That's the state of the nation.

The longer the wait,

the heavier the weight. This one's really gonna hurt. Bad.

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

The only time there's a relationship between a

stock price and the value of the company is at the initial offering. After that, it's all based on expectations. As long as everyone thinks it's all okay, it will remain okay. Don't worry. Be happy. I know I am.

What me worry?

I have no money in the stock market.

Can't lose what you don't have.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Say what?

IPOs (at least in tech) are all about how much can the investment bank pump up the stock value before unloading. The ability of the banks to maintain stock price in the face of negative press and determined attack can something to behold.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

I don't think the comment specifically meant IPOs

I took it to mean when the company issues new stock, as opposed to that which is traded on the exchanges.

I'd rather learn from one bird how to sing than teach ten thousand stars how not to dance. - e.e.cummings

We're all talking about the same thing,

only at different times (of even one day). An IPO (Initial Public Offering) is done when a company sells a portion of the company to investors. It's a means of bringing in new capital. Typically, the original owners maintain a controlling interest. With an IPO, the owners have a pre-determined amount they need, and that amount is equally divided amongst the shares sold. As soon as shares are sold (in the initial offering), they can be resold. And that may be where the confusion lies. When Facebook went public, we saw major activity on the day it hit the market. Ultimately, by the end of the day, its value had actually dropped.

My grandpa told us about the Great Crash of 1929

One day he left his house and went to work. That evening he came home and told his family about the stock market crash, and added that his job was gone too, the company laid everyone off. His wife said she was glad they had been saving their money, so everything would be alright. Grandpa sadly told her he had gone to his bank to get his savings, but they told him their money was gone, the bank had lost everything. My grandmother then asked him how much money they had, and he pushed his hand into a pocket and pulled out a few coins, and told her that's all the money they had.

FDR pushed through reforms to prevent another such catastrophe. We may see those reform measures tested once again during the next stock market crash. I, for one, own no stocks.

Be a Friend of the Earth, cherish it and protect it.

Close the New York City Casinos!

We definitely need to divorce the core of our private business and capital from gambling operations of any kind. The sole purpose of owning stock in a company should be to participate in its profits via dividends. As long as anyone's able to make more money trading than by holding, we're going to have problems like our Essayist described.

We need to close the New York City Casinos; restrict repeated and fast trading of securities; ban most derivatives trading altogether worldwide; and restructure the tax architecture so that holding for dividends is at least as net-profitable as trading is.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

The Fed

The Fed is using banks to make huge increases in the money supply. Unfortunately for the rest of us, and for consumer demand that would improve earnings, the money remains in the financial sector. Very little is reaching Main Street. I suspect all that money in the finance sector is being used to inflate the value of equity shares. Companies are using low interest rates to borrow to buy back shares, also inflating the price.

Also, investors have no where else to go. Bonds are overpriced with low yields. It can't last forever and the longer it goes on the bigger the crash. I have no idea how long they can sustain the illusion. It's already lasted longer than I thought it could.

^^THIS^^

Gold???

I'd rather learn from one bird how to sing than teach ten thousand stars how not to dance. - e.e.cummings

Gold

I NEVER give investment advice. After the 2008 meltdown gold did poorly too. Paper backed by the full faith and credit of the US government was the only place for ordinary investors to be. Some finance managers I respect point this out. Other managers I respect don't think the full faith and credit of the US government is worth what it was then and see gold as part of a reasonable financial insurance policy.

If you are going to hold gold, there are a lot of things you want to know before you get in. Among them:

There is a cost to storing gold.

Gold doesn't generate interest or dividends. It sits there while you wait for an emergency. It might go up or down.

Precious metals are not easy to sell when prices are falling rapidly. When silver was plummeting I decided it had become a buying opportunity. ( have a very small amount of silver, mostly circulated US coins from when they were silver, in a safe deposit box.) The dealer could not meet my very modest needs--less than a hundred bucks worth. I was surprised. I told him with people unloading I thought he'd be awash in the stuff. He said he always bought silver from people who bought it from him. But he wasn't buying from anybody else. The price was falling so rapidly that he was losing money between the time he bought it and the time he could sell it.

Be very careful of your source of gold. My dealer refused to buy some 1 oz. rounds that had been purchased by mail. They were gold, but not the 99.9% pure gold the man had paid for. If use use a local dealer get a recommendation from a banker or maybe someone with an extensive coin collection.

If I were younger I'd try to talk my brother into buying a small piece of land, above the fall line, where we could practice subsistence farming in an emergency. But we're getting too old to work it.

When the reckoning comes

the overton window will be shattered and the wall it's in will crumble -

politically, everything and nothing, will be possible.

The culture, the economy, the environment, science and the arts will

all be there for those who can seize them from the grasp of the failed oligarchies.

Cinch up fellers, the rodeo is nearly here.

Rivers are horses - and kayaks are their saddles

I hate the fact that I have WS investments

But I admit, I'm scared of NOT buying them. What exactly does one do if they are running out of labor to sell and will depend entirely upon wealth ?

I have been fortunate enough to stay employed most of my life. The exception was short term self employment during the Bush depression, where I spent my meager retirement money trying to start a business. During that time, they pushed back SS retirement to 67. I am 100% positive Hillary will push that back further or make cuts...or both.

So if we have any wealth, we are left to let it ride in the Wall Street casino in hopes it will be enough to get by in our late years. Maybe it will be enough and maybe it won't. If not, we get to depend on the charity of others to survive and we all know how that works out.

Let's tax EVERY stock trasaction - even 1 cent per

With the frequency of computerized algo trading even a one penny tax would increase revenues dramatically as well as slow down trading so a human could have a chance to buy and sell. And while we are at why not put a tax on conditional / limit trades as well because most computerized algos put up stock to buy or sell at a limit just to intimidate or encourage other systems or traders to buy or sell as a ruse. When the algo's trade moves in the correct direction because traders see orders lined up to buy or sell - the computer pulls it's trade order and cashes in a few pennies. But a tax on conditional / limit orders would eliminate this totally. Anyway the market is obviously rigged and with no where else for hot money to go (no money in bonds now) the market will probably continue it's perplexing rise...

Peace

FN

"Democracy is technique and the ability of power not to be understood as oppressor. Capitalism is the boss and democracy is its spokesperson." Peace - FN

Isn't this global money looking for one last safe haven? eom

Just a little expensive

That's interesting