The State of Corporate America

The stock market has hit an all-time high, so things must be great for corporations, right?

That's how its supposed to work in theory.

Wall Street may have set new record highs this week, but the rally is masking an uncomfortable truth: Corporate America is still in the midst of recession.

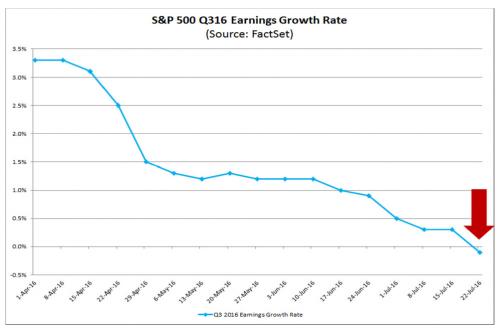

Companies have begun announcing earnings for the second quarter, and the results are not expected to be pretty over the next few weeks. Analytics firm FactSet estimates profits in the Standard & Poor’s 500-stock index will fall 5.6 percent compared with a year ago -- the fifth straight quarter of decline. The contraction has been so prolonged that investors consider it an “earnings recession.”

Corporate earnings are supposed to be the bedrock of stock market value, but at the moment, they appear to be pointing in opposite directions.

This is not what they teach in economics 101. Profits going down while the price of stock going up means equities are getting nose-bleed expensive.

But things are going to turn around in Q3, right? Probably not.

And yet stock prices keep going up. Go figure.

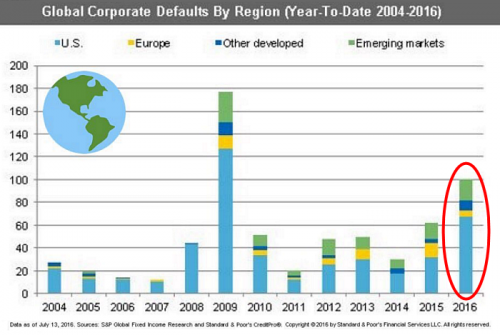

Another milestone happened last week that investors totally dismissed as well.

Fully 100 companies have defaulted on debt, 50 percent more than for the same period in 2015 and the highest level since 2009, according to S&P Global Ratings.

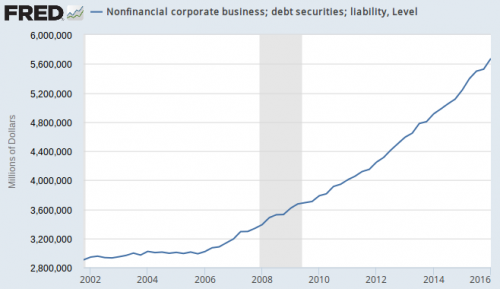

So what happens when corporate credit is deteriorating? Why loan them some more money, of course.

According to a new report from Standard & Poor's Global Ratings, corporate debt around the world is massively on the rise and could skyrocket to $75 trillion from the $51 trillion it's at now....

What's more – S&P estimates that two out of five corporations are highly leveraged (meaning they've taken on too much debt). About 43% to 47% of corporations globally are at a financial risk level.

Or to be more specific.

Close to half of companies outside the financial sector are considered "highly leveraged," which is the lowest category for risk, and up to 5 percent of that group has negative earnings or cash flows.

Profits down and defaults up. What do you do? Buy more stocks, I guess.

I'm going to be honest - I don't understand this, and I don't play games when I don't understand the rules.

Comments

I'm going to be honest - I don't understand this,

Me neither, its inverted, perverted even.

They are borrowing money

and buying their own stock with it driving up the price but they are not making any money (profit) from goods and or services ?

That is at least part of it

just think about your average saver who used to put his money in the bank - if he wants any income from that money, he now has to put that in the stock market. And then all the companies sitting on piles of cash because they aren't investing as much in growing the business are using either that cash or leverage to buy back their own stock, pushing up the price. Yes, they are not really making any real profit, but are juicing the stock price with buy backs which simply HAS to crash at some point, just like the Ponzi scheme it is. Cheap money to feed the bubble, ala Alan Greenspan tactics.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

Planning a global crash?

Then they can jump in and buy all of us at bargain basement prices.

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

Global crash pending--big time

According to gj's graphs were are headed exactly for the same type of crash seen in 2007/08. Except the looming damage is much more widely spread than simply the near-fatal real estate bubble.

The above comment is snark--because we might see a global catastrophe much larger in scale than 2007/08. We are more "interdependent" which means that fewer corporations now control most of the trade. Perhaps many of these megacorporations are amongst the over-leveraged. If there is a global crash, then there won't be corporations to buy at bargain prices--those corporations and those jobs will vanish. I think the Greed Merchants, who are not just confined to Wall Street, have been slowly choking the goose that laid the golden egg. By making the purchasing power off the 99% progressively smaller, there is less disposable income. Hence the falling earnings. Maybe those smart billionaires in their bubbles haven't figured out that hoarding all the money for themselves, will, and has, led to economic downturns. Happened many times--for centuries. Still no lesson remembered from recent or remote past.

As to why stock prices have leapt upward, I haven't a clue.

Yes..

It seems to me that they have given up milking the consumer, because that is no longer profitable. So they are convincing corporations to borrow money cheap in order to buy their own stock and pump up prices. What happens when that bubble bursts? How many corporations will get sucked in? How do you bail them out? And more importantly, how are Fox and the GOP going to blame minorities over that one?

Democrats, we tried to warn you. How is that guilt and shame working out?

Yes, I think that there is going to be a crash soon

Why else did they write in the bail in part in the last omnibus bill? I can't remember where I read it but it's going to happen after the election.

People need to be aware of this bail in shit before it happens or they are going to be in a world of hurt.

Anyone who has money in the big banks need to either move it to a local bank or a credit union. From what I have read, they will be included in this rule.

Many banks are already limiting how many debit transactions they can get a month and how much money they can take out of their accounts each month.

Remember that the banks own congress and they write the agenda for congress to pass.

This is what happened in Greece.

And of course the media isn't telling people about this.

I have no idea about the stock market, but it seems fishy that the Dow is so high when we are still in a recession, imo.

The message echoes from Gaza back to the US. “Starving people is fine.”

How much cash are these companies sitting on?

Apple, for example has $75 billion in cheap debt, but it has $200 billion or so in cash or equivalents parked overseas.

It's entirely possible that corporate debt could be the next shoe to drop. Japan's lost decades, for example, weren't driven by consumer debt -- it was bad corporate and bank debt that has weighed on its economic growth. Households have low levels of debt and cash reserves.

In the U.S. the situation was reversed in the recent past, but that doesn't mean the next bubble won't appear elsewhere.

I think a lot of what is happening now is that the U.S. is still seen as relatively safe, and you have a classic self-fulfilling bubble, where money comes to the U.S. because stock prices are rising, and more money comes to the market simply because the market is rising. It isn't being driven by fundamentals.

Example of how it's being sold to you

Citigroup earnings handily top Wall Street expectations

Sounds great, right?

Here's the actual truth.

Analysts expectations = "our own reality"

This reminds me of the statements made by the neocons before the Iraq invasion that they would create their own reality on the ground. The analysts are similarly living in their own world divorced from physical reality.

This is a problem I've been complaining about for years in the tech sector. Back in the 1990s the mantra was "bits, not atoms". But you can't eat bits...

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

The inevitable death of capitalism

might be what we are witnessing?

Caopitalism requires continual growth, but we are near the end of our non-renewable resources. Most supplies have a natural limitation. Demand must remain high to sustain growth, and the world has been allowed to seriously overpopulate. A once serious issue, it has been squelched for decades - is overpopulation coincidental or has it been allowed primarily to keep demand up? That certainly at least partially explains the big push for globalization and trade treaties. In addition, the greed has gotten so enormous the consumers have less income to spend which has further dampened demand. So perhaps we are witnessing the faltering of capitalism?

I guess my biggest question is how aware are the PTB that capitalism must end/is dying? If aware, are they engineering that end in one way or another? How else can we explain the sudden lurch toward stealing from the public treasury? That can almost be described as a kind of capitalistic cannibalism.

If they are engineering this, is there a way to decipher what they are doing/plan to do in order to best protect ourselves? Because it seems to me the rapaciousness can only increase as capitalism declines. Look at austerity - it is designed to take over public assets and leave we little ones with nothing. I think a natural end to capitalism would be quite chaotic, with the usual sociopaths sucking up everything they can before anyone else can get to it. Is there any kind of engineering/planning that can help a transition? And what would we transition to?

I hope I don't sound too CT here, but the truth is that Marx predicted the inevitable doom of capitalism and if you google "death of capitalism" you will find a lot of articles from credible sources that are saying what I am saying: that we are witnessing the death of capitalism here and now.

But my important questions are repeated here for emphasis: are the PTB aware and if so, are they engineering/choreographing the demise? How can we protect ourselves?

I'm thinking of cashing in my retirement, penalties and taxes be damned. Because otherwise, it might well be stolen. What do you think?

Not what I show above

What I show above is a crisis in the making, but that's all.

This OTOH is a crisis of capitalism.

Overleveraging on cheap money?

Low interest money is not going to us little ones. Lucky to get 1% interest on savings now. Does not matter to me, I am as out of the markets as I can be, all money tied up in real estate, some of which is now un-liquid, I can't sell it. That is going to hurt if I have to walk away from over $200K.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Sounds like the bubble may pop

“Until justice rolls down like water and righteousness like a mighty stream.”

A few factors that I think are involved

Remember the PPT, the Plunge Protection Team? I think that that concept has been systematized, that is the banks are on board with the Administration in supporting a high market cap, as part of the deal of being bailed out. After all, it's one of the metrics that Obama uses to convince us that he has fixed the economy. That and a bogus U1.

Another factor is that Americans have grown used to the concept that the Market is just like a bank, but it produces a higher interest rate, and will not even think about the obvious downside. I was with a group of business colleagues and I asked that question, and every person had the bulk of their retirement savings in the Market, again with the mental crutch of not even thinking about the downside.

This, of course, is an open invitation for the 1% to steal all of our retirement savings, and you can bet that they will. At some point the area under the curve of baby boomer retirees will be so large that the cash-out cash-in model of the Market will cause it to crash. The insiders know this perfectly and will time their exit to steal all of your retirement nest egg.

The current Market values are an aberration, caused by many factors but especially the fact that there are no other good investment alternatives. We are an economy in decline. Except for a few areas, we are not developing much new. Compare our statistics with China, especially in areas that reflect development. China produced 2.5 billion metric tons of cement in 2014, probably the most accurate measurement of development. The US produced .083 billion tons of cement. Russia produced .07 billion tons, but has less than half the population of the US. We have almost completely stagnated in development.

Keeping the stock market at all-time bubble highs is a disaster waiting to happen. If you think like an engineer you quickly come to the conclusion that there is an immense amount of energy stored between a realistic market cap and current values. That energy will be released and will result in an impressive correction, certainly with overshoot.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Got a longer time window for the second chart?

Q3 is often the worst, so some yoy context would be nice.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

It's Q3 consensus expectations

Q3 reporting is still months off. So the chart will get longer as we get closer.

We have our answer!

link