The Great Financial Market Disconnect

The stock market gets all the financial news headlines, but it's the credit markets that hold the real power. Or to put it a more colorful way:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

- James Carville

So what is the bond market saying these days?

The financial media tend to report breathlessly about what the stock market did yesterday. But savvy economic analysts have always known the bond market is the place to look for a real sense of where the economy is going, or at least where the smart money thinks it is going.

And right now, if the bond market is correctly predicting the economic path ahead, we should all be terrified...

The long-term interest rates that currently prevail across all the major advanced economies are consistent with a disastrous economic future.

Bonds are trading at record highs. Meaning yields are at historic lows. Long-term interest rates are at the lowest levels in the 227-year history of rates in the United States.

That would normally signal an economy on the brink of ruin and investors panicking into government bonds.

However, the stock market is telling a very different story.

The stock market is hitting all-time highs, despite declining earnings expectations.

Analysts estimate net income at S&P 500 companies will drop 5.8 percent in the second quarter, which would make it a fifth straight decline, the longest streak since 2009.

Rising stock prices and falling earnings means, much like bonds, stocks have rarely been so expensive.

Valuations are already at historical extremes. The S&P 500 trades at a forward P/E of 17.6x, ranking in the 89th percentile since 1976. At 18.4x, the median constituent ranks in the 99th percentile. Most other metrics such as P/B, EV/EBITDA, and EV/Sales paint a similar picture. These valuations are only justifiable because of the historically low interest rate environment.

The story stocks are telling is: the stock market is more euphoric about future growth ever before.

Bonds are pricing in Armageddon while stocks are pricing in a new Golden Age.

One of them has to be wrong. Maybe both.

But for certain, someone is very, very wrong.

It's a guessing game which one of these markets are the most overvalued, but if I was to guess I would say that bonds are the most overpriced.

Neil Dwayne, global strategist at Allianz Global Investors, is still buying. “Every piece of analysis we do on the bond market tells us they are structurally overvalued,” he said. But he is buying Treasurys anyway. “That’s what you have to do when you have the ludicrous valuations in Europe and Japan.”

...Simply, there is a limit to how negative yields can go before money becomes meaningless.

While stocks can still get more expensive, the mind-boggling amount of bonds with negative yields is rapidly reaching it's physical and logical limits. Not only that, the bond market is picking up speed as it approaches the wall.

In February 2015, the total amount of negative-yielding debt in the world was ‘only’ $3.6 trillion.

A year later in February 2016 it had nearly doubled to $7 trillion.

Now, just five months later, it has nearly doubled again to $13 trillion, up from $11.7 trillion just over two weeks ago.

Think about that: the total sum of negative-yielding debt in the world has increased in the last sixteen days alone by an amount that’s larger than the entire GDP of Russia.

Already a third of all sovereign debt yields a negative interest rate. That means that investors are effectively paying borrowers to lend to them.

That's bizarre. Not to mention unsustainable.

How unsustainable? Short-term unsustainable.

At the current rate of decline, the entire global market will be in subzero land by the end of the year.

"By the end of the year." After that rates stop falling and the bond bull market is over.

Some of you may be thinking, "Well that's only sovereign bonds. There is still the muni bond market and corporate bonds."

It's already too late for munis.

The price of junk-rated Ohio tobacco debt that may never be paid in full has climbed 14 percent since the start of the year. New York City’s Albert Einstein College of Medicine sold $175 million of unrated securities in January at par for a yield of 5.5 percent. Now, they’re worth 122 cents on the dollar and yield 2.8 percent, according to data compiled by Bloomberg. Even those issued by Puerto Rico, which has been defaulting on a growing share of its debt, have returned 8.4 percent.

The same Puerto Rico that just defaulted on $2 Billion in debt.

The same Puerto Rico that just got it's credit rating cut by Fitch to 'D'.

Note that a rating of 'D' is BELOW junk.

If you loaned money to this dead-beat, your return on investment would have been DOUBLE the stock market this year.

Wait a sec. Making money by loaning money to broke dead-beats.

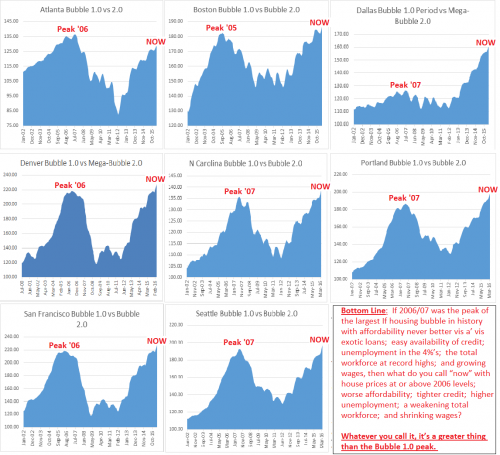

Where have I heard this before? I seem to remember something about this in housing from a decade ago.

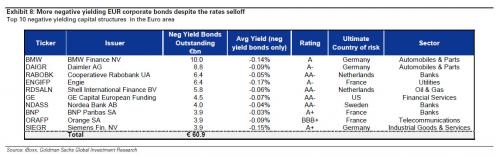

As for corporate bonds, consider what corporations already have negative yielding bonds.

None of these companies are triple-A rated. Several of them are borderline junk. And yet people are still paying money to lend to companies that will likely default.

In what world does that make sense?

It doesn't stop at the financial markets.

It's spilling out into the real estate market.

The share of Americans' total personal income coming from rental profit rose to a record 4.4 percent in the first quarter of 2016, data released in June show. That's at an all-time high in figures dating back to 1947, and is up from just 0.7 percent thirty years ago.

The flip side of this story is that poor renters are paying more money in rent to wealthier landlords than at any time in recorded history.

The cost for renting a home grew by 3.5 percent in the year through June, a post-recession high and above overall price gains excluding shelter, food and energy, of 1.4 percent.

Shelling out high rent payments makes it hard for households to save for a down payment....That means even as homeownership becomes a bigger portion of Americans' total income, it is also increasingly exclusive. The U.S. homeownership rate fell to 63.5 percent in the first quarter, holding near a 48-year low.

Comments

What's worse right now?

Having my hard-earned savings in the stock market? Or the bond market?

Maybe under your pillow? I

Maybe under your pillow? I was recently reading that the TPP President Obama's pushing contains provisions preventing involved countries from using anything to alleviate these sorts of situations, including the ability to shut down runs on banking institutions.

And I'd expect that if people have to continue to bail out financial institutions after soaking up their own losses, the public in each country will eventually wind up indebted to financial institutions, as occurred in Greece. Can any expert please tell me where I'm wrong on this? And, since it doesn't actually vaporize, where the money actually goes when 'everyone' loses his/shirt on the market?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Ellen, you are not wrong on this

In the last omnibus bill and in Dodd Frank they wrote in the rules for a bank bail in instead of a government funded bailout. Just like what happened in Greece.

gj wrote a diary about this a few months ago and maybe you can find it by clicking on his name and essays

Also in addition to the bail in, some countries are going cash free. Banks don't like people not having their money where they can get to it. Neither does the IRS and that's another reason why they changed the $100 bill

I found this article here. http://sandiegofreepress.org/2015/01/the-bail-in-how-you-and-your-money-...

The message echoes from Gaza back to the US. “Starving people is fine.”

Phosphorus Futures

It's an essentia resource that we are running out of.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Great essay!

And creepy, but I know it's true.

Marilyn

"Make dirt, not war." eyo

This is the money quote

I'm not sure what it means because it's never happened in historical memory, but my guess would be to watch the derivatives market.

Sometimes it's good to not have any money.

You can sleep at night.

Life is strong. I'm weak, but Life is strong.

when you ain't got nothin', you got nothin' to lose.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

I'm gonna drop this on TOP

but I know I'm wasting my time.

It's all about "stupid Republicans" and making themselves feel good about their team colors.

Well maybe someone over there will know what it all means

I'm just glad I'm not invested right now.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

The Puerto Rican bonds that are doing well are the insured

municipal bonds. This investment has the determining factor of the insurance companies not Puerto Rico. If someone thinks the particular insurance company can pay the default, then there's safe yield to be had. Maybe.

The most over valued stock sectors are the companies in the consumer sector that can afford to keep paying their dividends like Proctor & Gamble is thought to be capable of doing.

It's possible to imagine a rational government that doesn't allow stock and bond markets so as to avoid the periodic recessions, depressions, and panics.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

45 years ago total debt in the USA

was $! Trillion - that includes the federal government; state governments; municipalities; corporations; and households.

Now it is approximately $50 Trillion.

There's been a 40+ year bull market in bonds and markets tend to overshoot in whatever direction they are going. The bull market is over, in my view, and the overshooting is going on full speed ahead. The smart people, the neoliberals and "free-marketeers", don't know how to stop it. Some of the crazies want the situation to blow up because, you know, Free Markets! The FED wants to

raise rates in the face of economic weakness so they, the FED, can have the ability to lower rates to help a weak economy. We have a weak economy and raising rates will further weaken it. This is what happens when the received economic wisdom is inadequate to explain the situation and propose effective solutions.

The solution is known but cannot be discussed among ruling circles.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

The bond bull market is 35 years old

There is no one one Wall Street old enough to remember how to trade a bond bear market.

The knowledge has been lost in time.

None of their fancy economy models will work.

When it finally hits they won't know what to do, and it will hit soon.

Let's be fair...

even if Wall Street had the right models, the never ending quest for short term profits at the cost of long term stability would still end up causing problems where WS doesn't know what to do!

i'd say the larger problem is the never-ending quest

for profits in recompense for producing nothing

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

OECD told Osborne

(Treasury in the UK) in January to stop deficit reduction and start infrastructure spending.

Whats stunning is the UK has spent .65% of GDP on infrastructure a year, for nearly 20 years. 3-5% is probably normal from 1934 to 1970.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

I figured the bond bull market began under Carter with

Volker throwing people out of work by slamming on the monetary breaks.

35 years works for me if that is what it is. There may be a couple of old timers on Wall Street who remember something about a bond bear market but I agree, most of that knowledge - the practical coping knowledge - is lost and has been replaced by Hayak-type theory.

Bill Gross says it's over and we'll never see the like again.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Hasn't Gross been consistently wrong for the past 8 years?

Paul Krugman may be blind when it comes to Hillary Clinton, but when it comes to his economic calls, he's had a much better track record since 2009, than people like Bill Gross.

http://krugman.blogs.nytimes.com/2014/09/30/the-pimco-perplex/

Gross's misses have continued into 2016. I can understand someone having a bad year, but Gross has been striking out for almost a decade at this point.

Negative interest rates . . .

suggest low to no growth, not necessarily an economic collapse. The flipside is that if governments engaged in coordinated fiscal stimulus you could see much stronger economic growth, and since people are effectively paying them for the privilege of doing exactly that, it's absurd that we aren't.

At least based on P/E ratios and Price to Book Values the market isn't in 2000 or 2008 territory, but stocks definitely look overpriced relative to averages. Price to Sales ratios are well above the average.

What I Don't Get

Wages are being hammered, people have less money to spend even on necessities, and the economic indicators sro due to a lack of economic activity. HOW DO THESE "EXPERTS" NOT UNDERSTAND THE CONNECTION????

Vowing To Oppose Everything Trump Attempts.

The connection

They have no reason to care about the connection. Central banks are creating trillions of dollars in increased money supply. It's going somewhere. How much is getting through to you?

Hold out your hand and make a wish

Now watch for the wish to be fulfilled long before your hand fills. That much.

Vowing To Oppose Everything Trump Attempts.

They are insulated from our reality.

For most people 2008-2009 was a catastrophe -- if things weren't bad before. Things weren't exactly great afterwards.

On the other hand, if a person had money to throw around, 2008-2009 offered a chance to buy up stocks near historic lows. They are likely much better off now than they were in 2008. Think that's a big part of the reason there has been such a disconnect with the political, financial and economic elites. For them, there is no crisis. Many of them are doing better than ever.

When creatures die, vultures feast.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Unfortunately, financial vultures . . .

tend to feast on the living.

Fiscal Policy

In my view the problem is the nearly complete lack of a fiscal policy in countries of the industrial world. Central banks have a limited set of tools and are using them conventionally. They can lower interest rates and they can create money. Unfortunately, their activities are not having results outside the financial sector.

Interest rates are so low that corporations are borrowing to pay dividends and buy back equity shares. Basically, that means the marketplace has no productive use for additional capital. Demand never recovered from the 2008 meltdown.

The money central banks are creating stays inside the financial sector. Those dollars are inflating the price of assets.

If we had sanity, negative interest rates would be the perfect time for government to borrow extensively to build infrastructure. Government spending would have the added benefit of replacing lost demand in the private sector. This prescription should be as straightforward as antibiotics for bacterial infections. Unfortunately, economies in the industrial world are no longer run for the common good. The 1% are making out like the bandits they are.

Well said.

Although, I think the 0.1 percent are being incredibly short-sighted. They are making out like bandits in the short-run, but the prolonged period of slow to no growth isn't healthy for democracies or civilization. There is such a thing as being too greedy. The last time we had this kind of income disparity, within 20 years we had a massive global war that touched rich and poor alike. In an era of nuclear weapons the stakes are even higher.

Agree completely n/t

Wasn't part of Piketty's thesis

in Capital in the 21st Century that low growth means their Capital will have or retain a higher value? If that is the case, then they want low growth ultimately to protect their value. It is their short term greed mindset that's at work, but I no longer think these people are dumb or just not seeing it, I think they not only see it but want it. And a little fascist dictatorship along with it maybe so much the better for the wealthy - it won't do to them what it will do to us and they know it.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

I hope it doesn't blow up before November

It looks like a ticking time bomb.

Some people have figured out how to squeeze the last drop of blood of unsuspecting people.

The political revolution continues

A gentle point of view from the trenches.

I am a teacher; I am also a landlord. Those who watch rents go higher and higher can also watch property taxes go higher and higher, no caps or exemptions. They can watch insurance rates go higher and higher. They can watch the cost of materials go higher. Certainly the cost of legal fees has gone higher and higher. Our rents go up just enough to cover taxes, insurance, repairs and expenses. It is true, our houses don't stay empty long. On the other hand, tenants move out, no notice, not paying the last month's rent, forcing us to pay legal fees for eviction, and trashing the house (incurring expenses and time loss we cannot recoup.) Little guy landlords are not cashing into the rental bonanza. We absorb the financial difficulties of our tenants.

Interesting, thanks for sharing .

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Add Medical Care Costs

The other day, a report came out stating that health care in the USA cost over $10k per person. In Illinois, Obamacare options are drying up and blowing away in the wind. Another report claims that dental care is now beyond the affordability of the majority of the citizenry.

It is now only a matter of time before Obama's legacy is the complete collapse of the medical industry, because he was too chickenshit to take on the insurance companies and get us single payer. Maybe if we were too big to fail banks he'd have done something for us?

Vowing To Oppose Everything Trump Attempts.